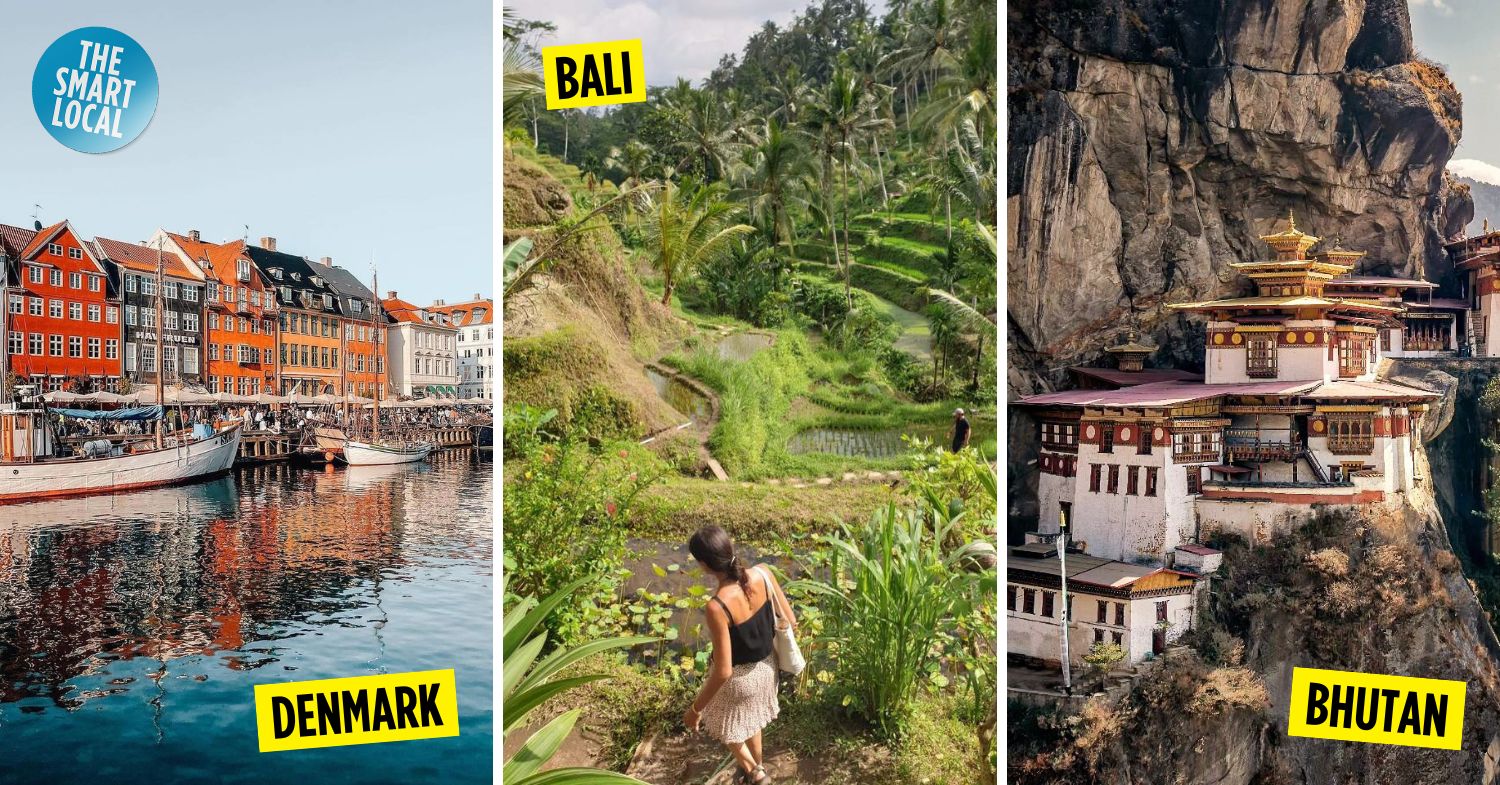

Countries with tourism tax to take note of

Taxes, taxes, and more taxes: we’ve entered the year of 9% GST, and yet one more tax to add to the list is tourism tax, though this won’t necessarily affect all of us. If you’re planning your escapades for the year and beyond, here’s a roundup of countries with tourism tax, so you can factor it into your budgeting.

What is tourism tax?

But first, what is tourism tax and why do we have to pay it? In the same way that the Singapore Government imposed COE to regulate the number of cars on the road, tourist taxes were implemented in a bid to combat overtourism.

The rise of cheap flights, a growing middle class population worldwide, social media, and popular culture has led to a burgeoning global tourism market. While it seems good for the destinations on paper, it’s a double-edged sword that’s had ripple effects on local populations.

Besides acting as a slight deterrent and crowd control tool, tourism taxes also shift part of the tax burden from locals to tourists: the funds go to conservation, maintenance, and upkeep of the cities and landmarks, alleviating the negative effects of overcrowding and tourism on the local environment.

– Existing tourism taxes –

1. Bali

S$13 tourist tax before arrival

Tegallalang Rice Terrace in Ubud, Bali.

Image credit: @rubyvioletyoga via Instagram

Your next trip to Bali will cost you IDR150,000 (~S$13) more than what it used to, after the Land of the Gods recently imposed a tourist tax. This new rule came into effect on 14th February 2024 and applies to all visitors, big and small, to the mainland as well as its islands.

On the bright side, this levy is a one-off charge per visit that you’ll have to pay ahead of your trip. Payment should be made through the Love Bali website, after which you’ll be sent a tourism levy voucher that you can scan at immigration checkpoints upon arrival.

If you forget to do this before arrival, you’re supposedly able to complete the application at payment booths in Ngurah Rai International Airport. We’d suggest getting it done online, though, for a more fuss-free arrival experience.

According to the website, this fee will go towards preserving Balinese culture and heritage, promoting sustainable green tourism, as well as protecting the Indonesian destination’s natural landscape.

Plan your trip around some of the best things to do in Bali, which we’ve sorted by location.

2. New Zealand

S$29 International Visitor Conservation and Tourism Levy, paid with entry visa

Hawke’s Bay, New Zealand

Image credit: @purenewzealand via Instagram

If New Zealand is on your bucket list, there’s a NZD35 (~S$29) International Visitor Conservation and Tourism Levy (IVL) that you’ll have to factor in when you apply for your visa, also known as NZeTA (New Zealand Electronic Travel Authority).

It’s lumped together with your visa, which is chargeable at NZD17 (~S$14) if you apply through the mobile app, or NZD23 (~S$19) through the Immigration NZ website. Each NZeTA, and hence IVL, is valid for 2 years after approval so you won’t have to pay for it if you visit again during this time.

The IVL needs to be paid for before arrival, and goes towards improving infrastructure and sustainability throughout the tourist attractions in New Zealand. They welcomed 4.9 million visitors in 2023, which is 1.5 million more tourists than the previous year; it’s no wonder some checks and balances need to be put in place.

Psst. here’s an NZ itinerary you can refer to for inspo on your trip.

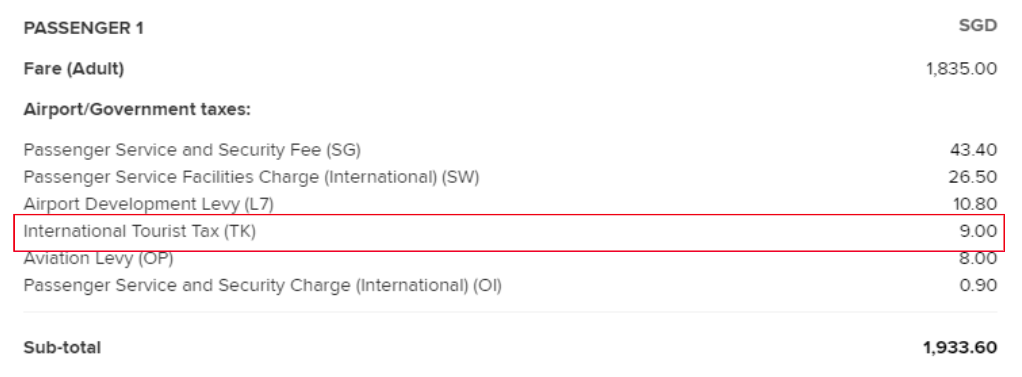

3. Japan

S$9 departure fee, included in ticket prices

Shirakawa-go, Japan.

Image credit: @_progress_in_art_ via Instagram

If you’re surprised to see Japan on this list, that’s okay, because we were too. Unbeknownst to us, we have been paying a departure tax of JPY1,000 (~S$9) on every trip to Japan, ever since their International Tourist Tax was implemented on 7th January 2019.

Image adapted from: Singapore Airlines

Ever since then, this tax has been tagged to all your cruise or airline tickets, and is hidden in the cost breakdown under the broader airport and government taxes. This stealthy addition may be a rude shock to us all, but NGL, not having to go the extra mile to apply and pay for it is a great perk.

If you’re headed to Japan, we’ve got you covered with walking trails in and around Tokyo, onsen towns in Japan to put on your list, and even a week-long Japan itinerary so you don’t have to plan the trip yourself.

4. Italy

S$7 entry fee before arrival, during peak periods in a pilot program

Venice, Italy

Image credit: @veniceforevervenice via Instagram

As of 16th January 2024, all visitors tripping into Venice, Italy, will have had to pay €5 (~S$7) each to enter the historic city━ but only if you’re visiting on weekends, or the last week of April, and first week of May. Check the Venezia Unica website to find out more about the exact dates, and the pilot program.

Travellers to the Old City, as well as some of the minor islands of the Venetian Lagoon will have to pay this entry fee through the Venezia Unica website before their intended visit, and be issued a QR code. There are 7 checkpoints, including at the main train station, where visitors will be asked to show their QR codes.

Exceptions to the rule are if you’re staying overnight in a Venetian hotel, at which point your tourist tax will be included in your nightly rate as a lodging fee, payable up to 5 nights. In this case, you’ll still have to visit the above website to apply for an exemption voucher with a QR code for the days of your stay.

Otherwise, if you’re only entering the city after 4pm to attend an evening event, you won’t have to pay the tourist tax too.

Since they’re still trialling this system, there is no daily limit to the number of visitors that can apply for entry to the city at this point, nor varied charges according to port of entry. It’s hoped that this entry fee will regulate tourist entries, and improve the quality of life for Venetian residents━Venice was almost added onto UNESCO’s list of World Heritage in Danger.

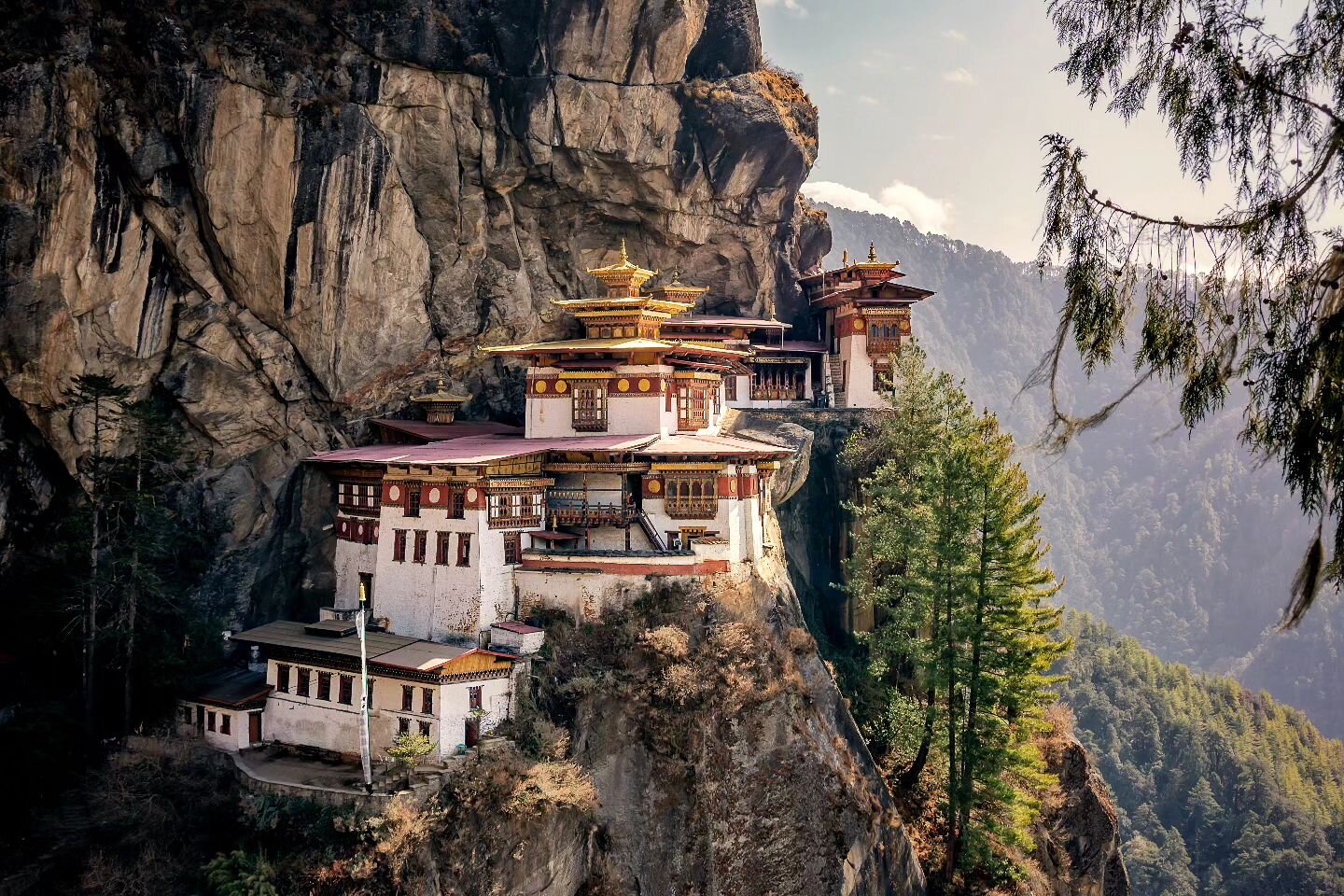

5. Bhutan

S$134 Sustainable Development Fee per night before arrival

Tiger’s Nest in Bhutan.

Image credit: @abhiineet via Instagram

The Kingdom of Bhutan, also known as The Land of Thunder Dragons, perched on the slopes of the eastern Himalayas, has many things going for them. They’re the happiest country in the world, have uber picturesque landscapes, and fun fact: they’re the first carbon negative country on earth.

Getting to Bhutan is not easy, though. There’s only 1 direct flight from Singapore on their national airline, Drukair, and it flies twice a week. You will need to apply for a visa (USD$40, ~S$54), which can either be done through a tour operator, or via an online application portal.

When you apply for your visa, you’ll also encounter a Sustainable Development Fee (SDF), which will cost USD100 (~S$134) per traveller per night of your intended visit.

If you’re travelling with a child aged between 6 and 12, there’s a 50% concession rate applicable. Do note that the child should not have turned 12 at the time of travel. While this SDF fee is refundable should your trip be cancelled, the visa application fee is not.

This SDF fee is exclusive of all travel costs such as accommodation, guide and food, unlike previously, where the USD$250 (S$336) daily fee was all-inclusive. If you’ve got time to spare, consider hiking the Trans Bhutan Trail to fully appreciate everything the kingdom has to offer.

– Upcoming tourism taxes –

6. Thailand

S$11 tourism fee, pending implementation

Wat Arun Temple, Bangkok, Thailand.

Image credit: @lyrar via Instagram

Visiting the Land of Smiles will potentially cost you a teensy bit more, since Thailand has approved a proposal from the National Tourism Board Committee to levy a tourism fee on all incoming visitors.

The controversial tax garnered great dissent from the travel industry, who feared that the THB300 (~S$11) fee would put tourists off visiting Thailand, especially since cruise ship and overland arrivals would also be charged a similar, but cheaper tax of THB150 (~S$6).

As such, you can breathe easy for now because the implementation of this new tax has been postponed. It was meant to be kickstarted last June and was delayed till September, but at this point of writing, the lack of clarity as to how it will be implemented and collected means there’s still no start date in view.

For those of you headed there, here’s a list of things you can do in Bangkok on your trip.

7. Denmark

Green tax on plane tickets, varying by distance

Copenhagen, Denmark.

Image credit: @copenhammer via Instagram

With climate change being a pressing issue, Denmark is doing its part by phasing in a green tax on plane tickets, which will take effect from 2025.

Green taxes will vary depending on where you’re flying into Denmark from: intra-Europe arrivals will be taxed DKR30 (~S$6) in 2025, while medium-distance arrivals and long-distance arrivals will be charged green taxes of DKR250 (~S$49) and DKR300 (~S$59) respectively. These rates will gradually increase to DKR50 (~S$10), DKR310 (~S$61), and DKR410 (~S$80) by the year 2030.

Funds from these green taxes will go towards supporting renewable energy solutions, hydrogen technology, and the development of green jet fuels. It’s hoped that by 2050, Denmark will have achieved carbon neutrality.

– Other taxes for tourists –

Other than entry and exit taxes, tourism taxes can be imposed on travellers under other names: accommodation tax, culture tax, climate tax, and such. These are often added to your bill, and might be payable up front when you check in, or at the end of your stay.

Besides these lodging levies, other taxes that you might encounter on your trips include spa taxes in Wiesbaden, Germany, or a similar onsen tax that you can find at all hot spring accommodations across Japan.

Existing taxes

| Country | How are you charged? | How much? |

| Austria | Overnight accommodation tax, AKA Tourismusgesetz and Beherbergungs Beiträge |

|

| Belgium | Added to room rates |

|

| Croatia | Sojourn tax for all visitors, including arrivals via cruise ships |

|

| Czech Republic | Added to room rates |

|

| France | Added to room rates, AKA taxe de séjour |

To note:

|

| Germany | Added to room rates as culture tax (Kulturförderabgabe) or bed tax (A Bettensteuer) |

|

| Greece | Climate crisis resilience fee, replacing hotel tax, added to room rates |

|

| Hawaii | Transient Accommodation Tax (TAT) added to room rate |

|

| Iceland | Added to room rate, including cruise ship arrivals |

|

| Italy | Added to room rate |

|

| Malaysia | Added to room rate |

|

| Portugal | Added to room rate |

|

| The Netherlands | Added to room rate |

|

| Spain | Added to room rate |

|

| Switzerland | Added to room rate |

|

| UK | Added to room rate |

|

| USA | Occupancy, lodging or hotel tax |

|

Upcoming taxes

| Country | How are you charged? | How much? |

| Hawaii

(TBC) |

Climate tax |

|

| Scotland

(2026 or earlier) |

Visitor levy |

|

| Spain

(2024) |

Valencian Tax on Tourist Stays (IVET) added to room rate |

|

You’ll have to pay a tourism tax to enter these countries

Paying for these tourism taxes may be a pinch on our wallets, but they are all for a good cause. Don’t forget to factor these in when you’re budgeting for your next adventure, or plan your trips so you don’t have to incur peak tourist tax charges.

Use our guides to help you figure out where you’re headed this 2024:

Cover image adapted from: @abhiineet via Instagram, @rubyvioletyoga via Instagram, @copenhammer via Instagram