Ongoing scams in Singapore

Scammers are getting more creative these days. Whether it’s upping their game to appear more “legit” or simply hacking their way through well-oiled systems, these tactics can get to even the most discerning of folks.

Here are some of the ongoing scams in Singapore that you can share in your family WhatsApp chats to help them avoid finding themselves in these pickles:

Table of Contents

- Ongoing scams in Singapore

- 1. Getting concert tickets from scalpers

- 2. “Guess who I am” phone call scam

- 3. Fake food promos & ads on social media like Facebook

- 4. Crypto scams on dating apps

- 5. Delivery of online purchases scam

- 6. Calls or texts from the bank

- 7. Fake giveaways on Facebook with legit-looking comments

- 8. Fake links from IRAS & LTA

- 9. Phony artwork buyers targeting local artists

- 10. Fake job recruiters on Telegram

- 11. Job hiring scams for “Online Marketing Associate”

- 12. Unofficial emails or unauthorised payments from Apple

- 13. Carousell scams

- 14. Instagram ambassador scams

- 15. Identity thief/impersonation on Instagram

- 16. Messages and calls from “royalty” and kidnapping scams

1. Getting concert tickets from scalpers

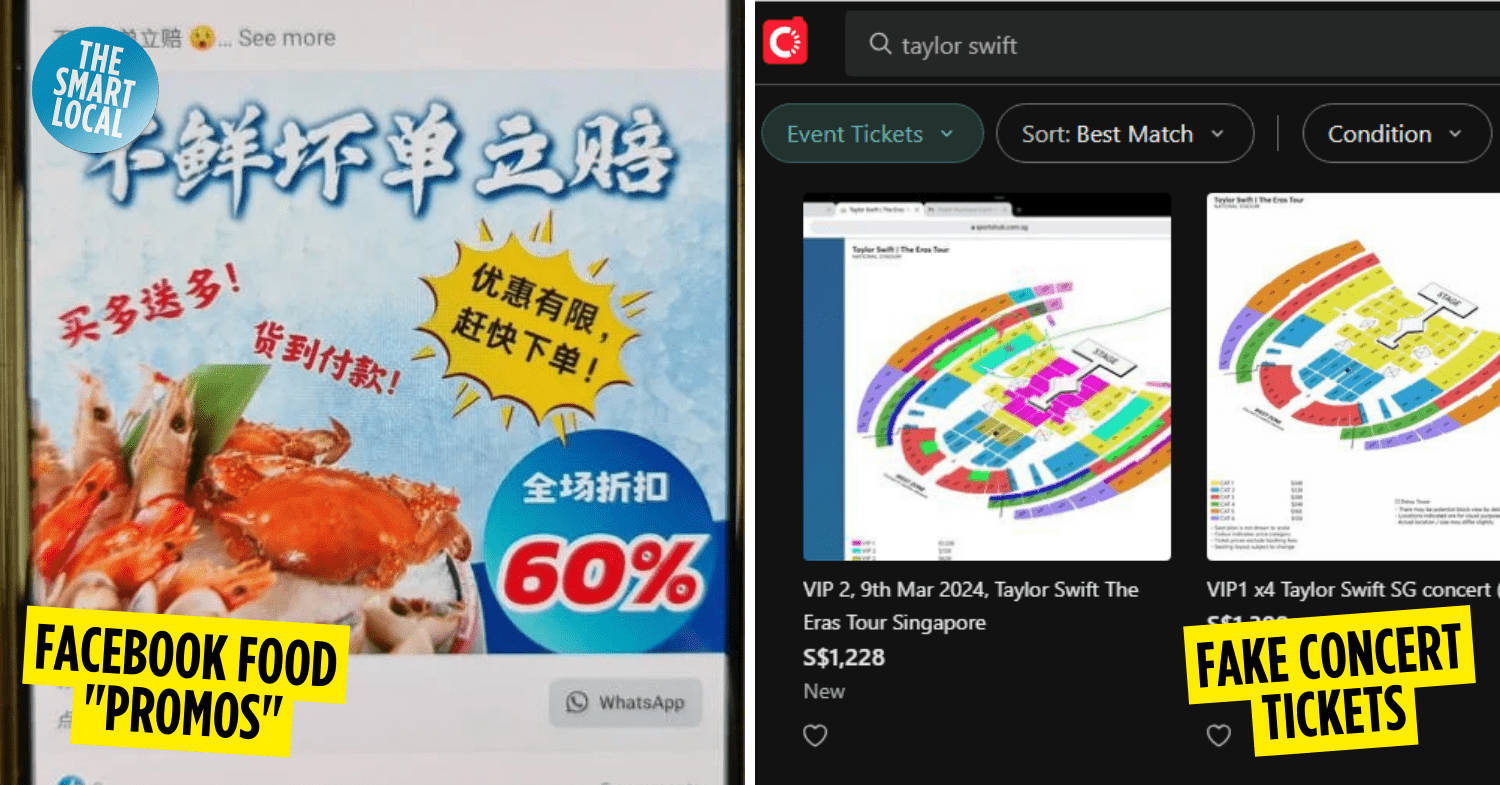

Look, we are one of the many who also did not manage to score Taylor Swift or Coldplay concert tickets. And in times of desperation, you might be tempted to contact ticket scalpers just so you can watch your fave acts in person.

Image adapted from: Carousell

Be warned though. Some ticket scalpers prey on the vulnerable and desperate for a quick cash grab. Just a day after the Taylor Swift pre-sale ended, a Swiftie fell victim to a scammer who took $700 from her and disappeared, along with her hopes of getting a pair of tickets.

Much like other transactions that take place online, the one red flag to look out for is having to pay upfront without ensuring the seller even has the goods. For dealings like this, it’s best to meet in person so you can check that their tickets are legit before paying in cash.

Offers that are too good to be true should also trigger the alarms – no one is willing to part with tickets at half price, be FR.

2. “Guess who I am” phone call scam

By now, people know to decline calls from international numbers, but it’s harder to ignore calls from a local number. Who knows – it could be a callback from a recent job interview or a reminder about an appointment you forgot about.

Just be careful when you pick up the phone and the caller asks “guess who?” In this phone call scam, scammers gaslight callees into thinking they are someone the victim knows, just that they’re calling from a new number.

To make it more convincing, the scammer will usually address the victim by name. They’ll even joke around and tease the victim by saying things like, “You really don’t know who I am? We’ve known each other for so long.”

The folly of the victim is to actually guess who the caller might be. Once given a name, the scammer then uses this piece of information to gain the victim’s trust in order to borrow money. This is definitely where alarms should be sounding off if they weren’t already.

To prevent falling victim to this, contact the person who you thought it was to check that they’ve really changed their number.

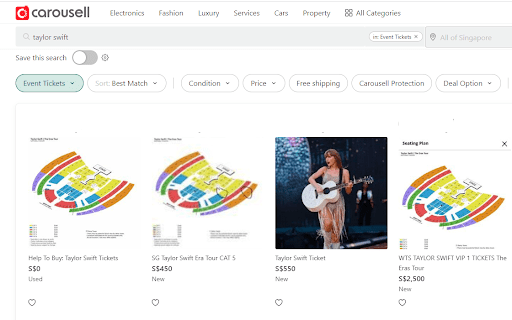

It’s hard to resist a good deal. But like most scams, if it sounds too good to be true, it probably is. This applies especially to food promos and ads that are all over social media like Facebook and Instagram.

Image credit: MSNews

Victims who are tempted by irresistible deals such as $1 for dim sum or 60% off seafood are then directed to a download page for a fake application. This one mostly affects Android users as the operating system allows third party apps to be installed without much verification.

These fake apps then redirect victims to a fake banking site to make payments. There’s usually malware involved that would then capture and store the victim’s banking credentials. The scammers then take over the unsecured bank accounts to make cash transfers to their own accounts.

This scam does have another variation that is just as dangerous. You may be contacted by a bank staff member informing you of unauthorised transactions being made on their account. Scared victims are then sent a link to download a fake version of ScamShield, an app that ironically is meant to help detect scams – the real one at least.

The intent of getting the victims to install this fake version of ScamShield isn’t clear yet. Perhaps it’s to get the victim’s SingPass info. Regardless, it’s safe to say that businesses or banks will not request for you to download an app – especially one from a third-party site.

So, TL;DR, the rule of thumb is to never download unverified third party apps. A good way to check if an app is legit is to download it from Google Play or App Store directly. You can also check the number of downloads each app has for extra security. Those with malware are usually taken down in a matter of days.

4. Crypto scams on dating apps

Dating apps used to be the place where you’d meet your one true bae, but scammers have now infiltrated the platform to plot against unsuspecting romantics.

Even the smartest of folks can fall prey to sweet talk. Coupled with daily updates on branded watches and sports cars – all acquired due to their “success” in crypto – who can blame anyone for buying into this lavish web of deceit?

Scammers will send you a link to join their crypto trading platform. The first few small investments you make will seem like it’s showing success, such as returns being credited into your account. But, subsequent ones will require heavier investments for higher returns.

This is when the ball will drop – withdrawal of your investments is suddenly not allowed, and coincidentally, your “lover” will go MIA. We’re not saying true love doesn’t exist on dating apps, but be wary when your partner starts aggressively pushing you to transfer money to their supposed bank account, especially in the early stages of your relationship.

5. Delivery of online purchases scam

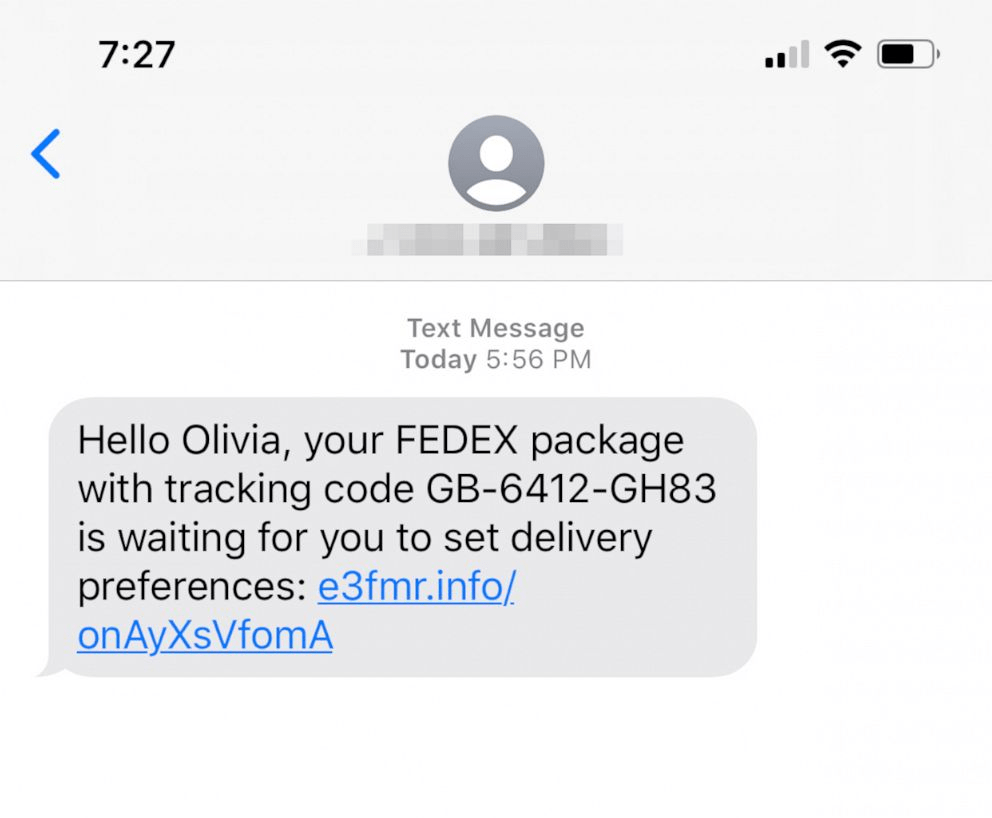

Image credit: Olivia Craig

There’s nary a person who doesn’t shop online anymore. It’s a convenient and easy way to get clothes, food, and everyday essentials delivered to your doorstep in just a matter of minutes, so chances are, you’re always expecting parcels to arrive.

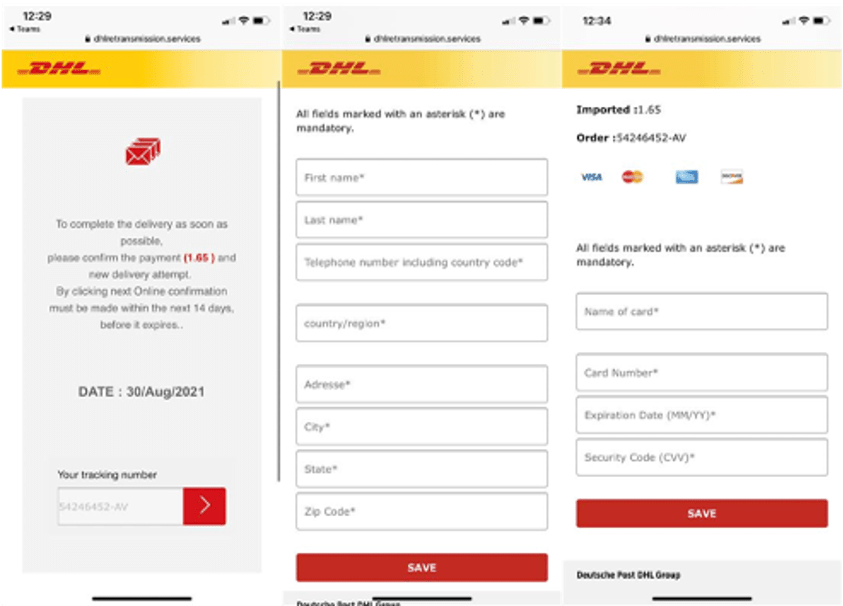

But here’s where you might get scammed. You might get an SMS from a courier service such as DHL, FedEx, or UPS that includes a link for you to check on a package delivery status. This link will then open up to a dummy courier website where you’re asked to key in your personal and credit card details to access your “delivery” updates.

No prizes for guessing what happens next – money is then siphoned out of your account unknowingly.

Image credit: Antivirus.com

Some victims have also reported getting text messages for a failed delivery. These come with a sketchy link also that is meant for you to reschedule the delivery, but will redirect you to the same credit card page to fill in your details.

Another old trick in the book would be receiving a call from these scammers claiming to be from your courier company. They’ll inform you that your parcel is stuck at customs and the only way to release it would be to transfer a certain sum of money to their bank account.

Image adapted from: @tokopedia via Instagram

The easiest way to tell if it’s fake is to check if you’ve ordered anything. If you’ve bought something online and your parcel is genuinely being held up at customs, they won’t actually contact you through call or text and ask for payment for it to be released. So as long as the caller is asking for money, it’s downright shady and you should hang up.

6. Calls or texts from the bank

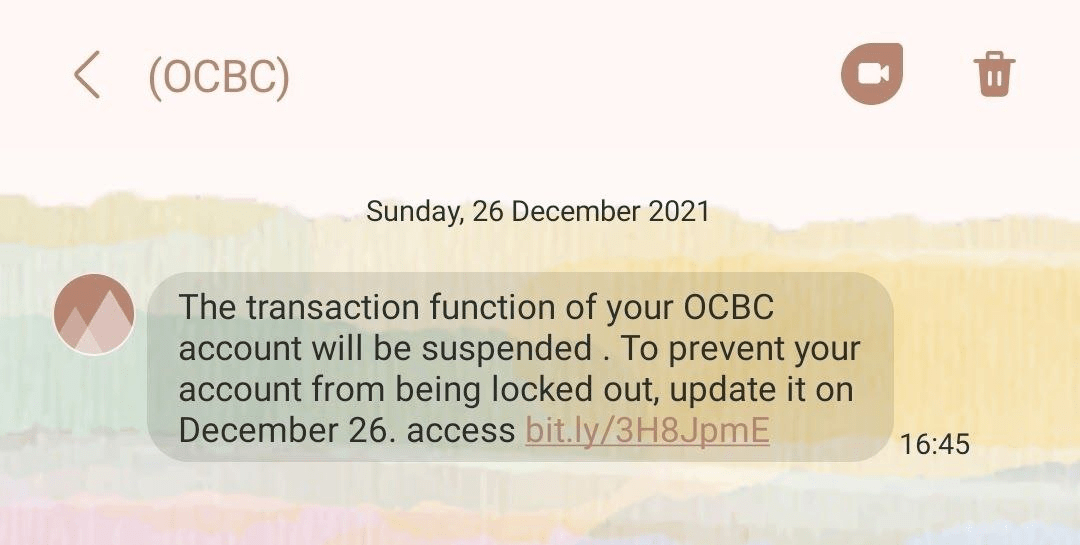

Image credit: Maybelline Tan

We’re always on high alert when receiving notifications relating to our bank account, because well, it’s to do with our hard-earned money. The above screenshot was provided by Maybelline, a 34-year-old marketing manager who almost fell for the scam.

She shared that she was very close to clicking on the link as the sender’s address had seemed legit, and the message was grammatically coherent with no random punctuations to give the scam away.

Upon further inspection of the message, a few warning signs surfaced:

- The sender was “(OCBC)” instead of “OCBC”.

- The message was sent on 26th December 2021 but required immediate action on the same day.

- The Bit.ly link differed from the original OCBC website.

OCBC, along with several other banks, has since stated that their SMSes will not contain any links, in an attempt to help recipients identify scams.

Banks typically give multiple warnings like SMS notifications and physical letters before suspending an account. Messages like these that require prompt actions are highly likely to be scammers requiring your information ASAP before they get discovered by authorities.

Scam callers “from the bank” or “MAS” will usually claim that your account has been locked, you have some debts they can settle for you, or that they can offer you a loan. They’ll then ask for information like your account number, OTPs, or passwords which legitimate banks and MAS will never ask for. Give them any of this info and they might as well have a red carpet to your bank.

It’s important to know actual reasons banks will call you and how they verify that you’re the account or cardholder. Banks will only typically call you for suspicious activity on your account like unusual purchases in another country or if you have any unpaid bills. To verify it’s you, they’ll ask you things they already know like your birthday or how many cards you own.

Calls from the bank requiring you to make a transaction or reveal information like your banking credentials or your OTPs are big red flags. Double-check the number and make sure there isn’t a “+65” in the number as these are overseas calls. If you’re still on the fence whether it’s a scam or not, err on the side of caution and refuse to give any personal information.

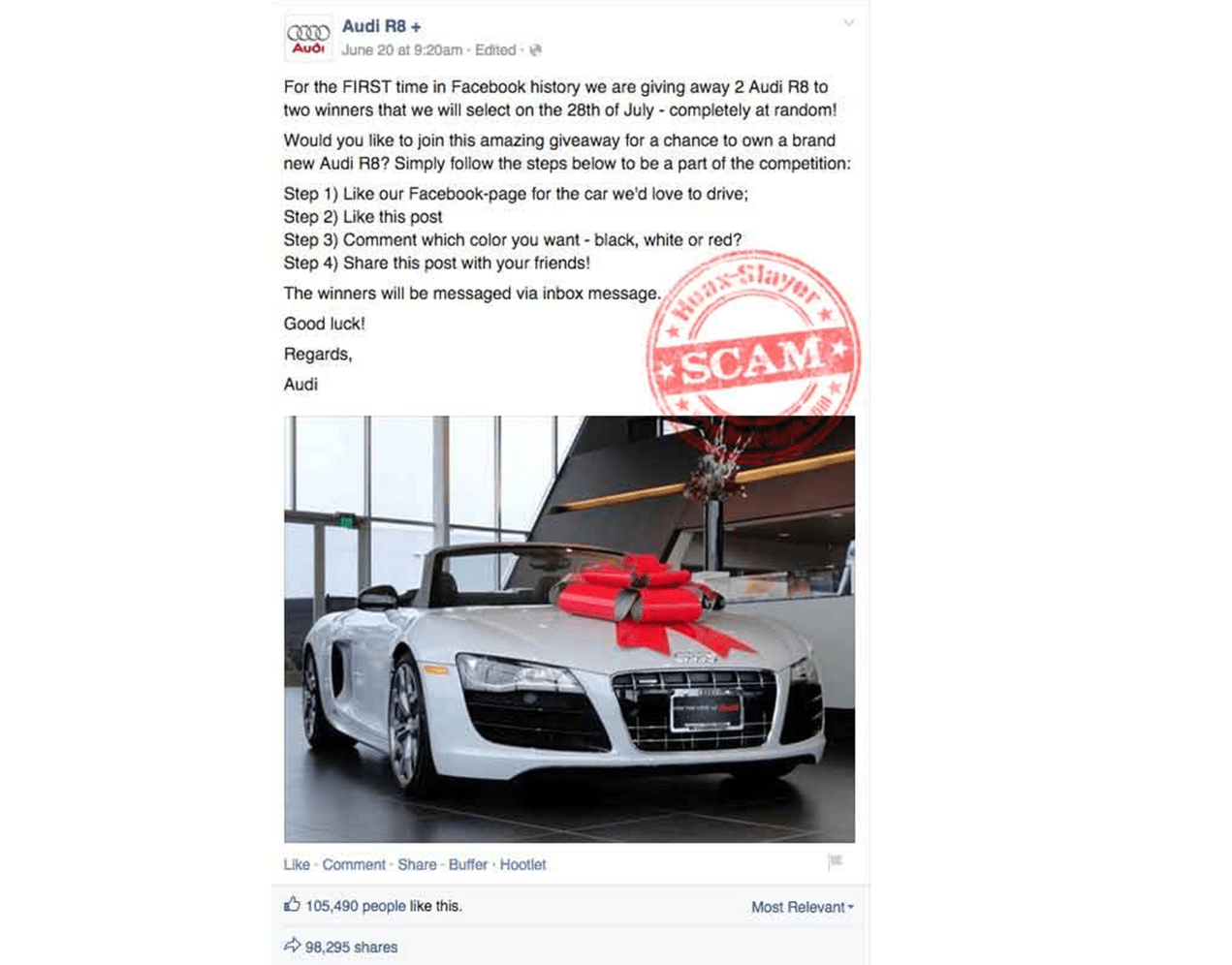

7. Fake giveaways on Facebook with legit-looking comments

Many of us thrive on social media giveaways. After all, if that friend of a friend can win freebies, can’t we win one too? Just be wary if a giveaway seems too good to be true, because scammers also target the hopeful.

It doesn’t help that they impersonate popular brands with big ticket price tags, such as cars and fancy gadgets. Plus, these posts often contain professionally shot images, complete with comments to make the giveaway look legit.

Alongside its well-written captions stating the giveaway requirements, these posts are seemingly harmless as they don’t require your personal details. Yet.

A fake giveaway that promised two lucky participants a “free” Audi R8

Image credit: Zululand Observer

The scammers will then reach out to the unlucky winners to congratulate them on winning the giveaway. Here comes the catch – you’ll have to submit personal information such as your bank account details in order to redeem your prize. Victims have shared that upon submitting their bank account details, the scammer will go MIA and the reward will be left unclaimed.

Always check that the social media page is legit – verified Facebook or Instagram pages of brands, banks or government organisations usually have a blue tick beside its name to prove that it is the official page.

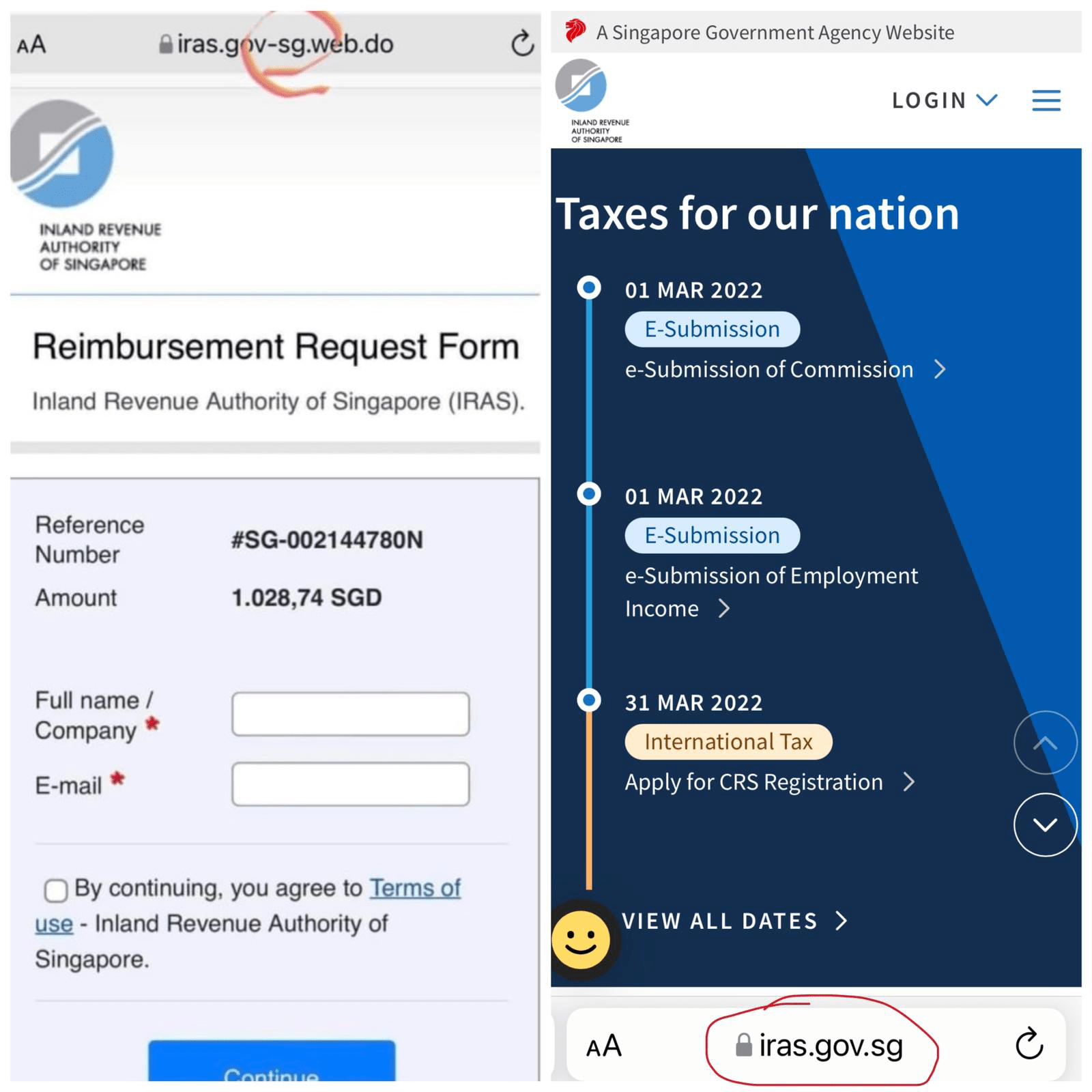

8. Fake links from IRAS & LTA

Left image depicts the fake website while right image is the actual website

Image credit: Oh Qian Yi

Singaporeans are a lawful bunch, and most of us don’t like to be on the wrong side of the law. That’s why it’s easy to fall for scams that involve impersonations of government bodies.

One such scam involves an SMS that includes a link to a reimbursement request form on a fake Inland Revenue Authority of Singapore (IRAS) website.

This promises a refund of around $1,000, but requires the user’s personal information, credit card or bank account details. In some cases, victims were tasked to make payments to a third party’s bank account in order to retrieve the promised sum.

Image credit: Collin Ng via Facebook

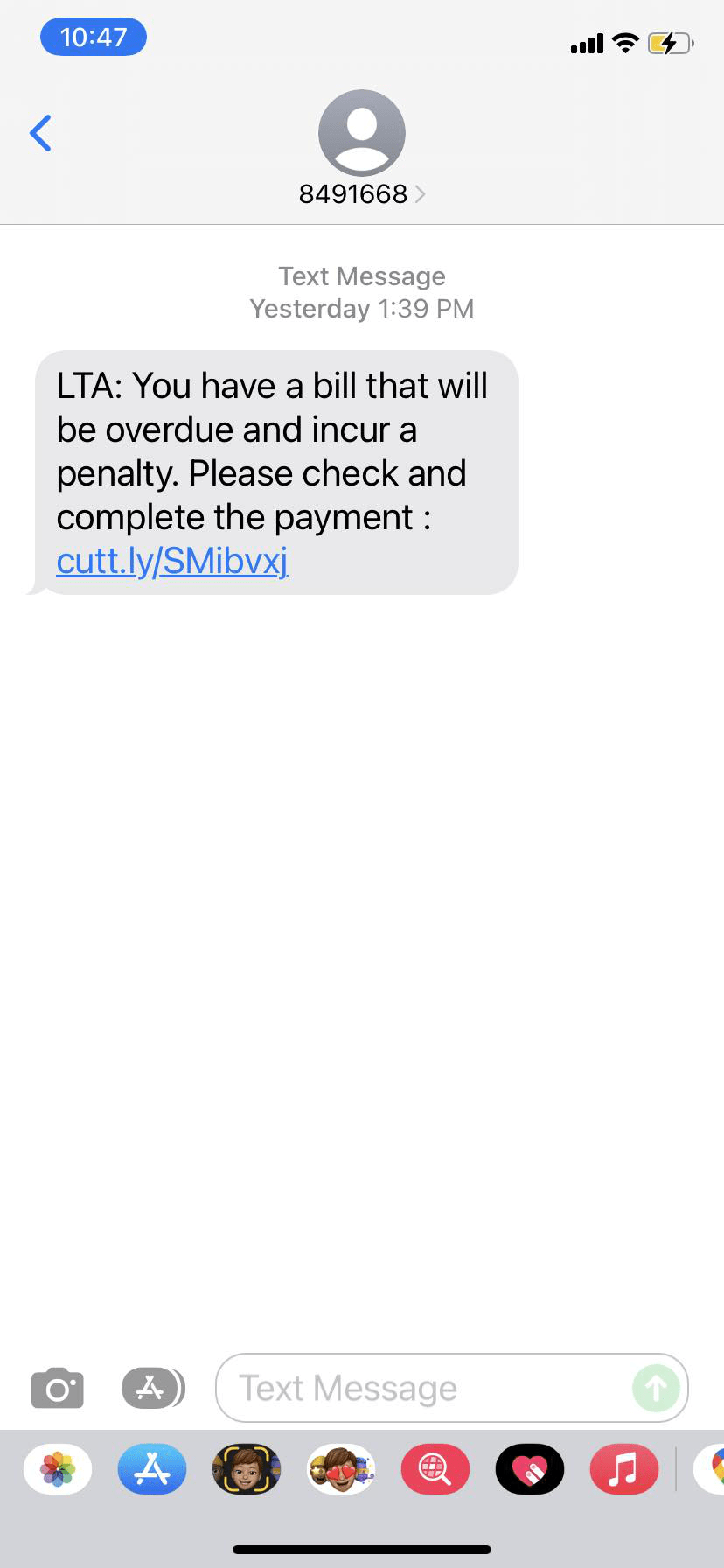

Another example would be a fake message from “LTA” claiming that you have an overdue saman to pay, and you’re likely to be fined more if you don’t pay up. Don’t panic when you receive such a notification. Check first on the LTA portal for any outstanding payments and fines, and only pay through proper channels such as via an AXS machine.

Double-check the website URL even when the user interface appears real. Fake websites usually only have one differing letter or punctuation.

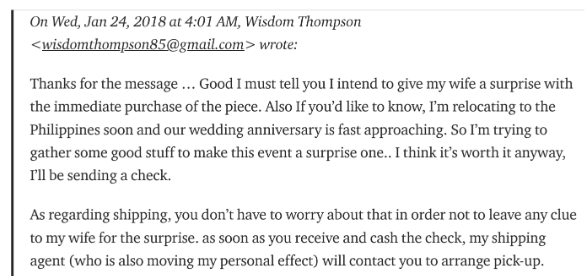

9. Phony artwork buyers targeting local artists

Image credit: Komicer

This one’s for all business owners who sell their products online.

Local illustration studio manager Komicer informed us of an art scam they experienced, where the scammer posed as an interested buyer. The scammer feigned interest in purchasing a highly-priced artwork and shared personal details like how his wife fell in love with the artwork. These background stories paint a believable persona, making it easy to fall prey.

Image credit: Komicer

Scammers will usually suggest less secure forms of payment such as payment by cheque, so that it may bounce and they score a free artwork. They’ll also try to get personal information from you such as your phone number and address.

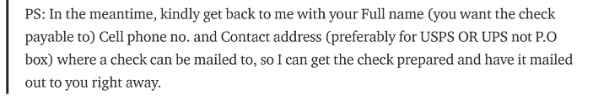

Image credit: Komicer

After suggesting for the fake buyer to use PayPal instead, Komicer realised that this was a quintessential art scam when the scammer requested for their PayPal password. The takeaway here is to never, ever, disclose your banking passwords or OTPs, whether it’s to a stranger or to someone you know.

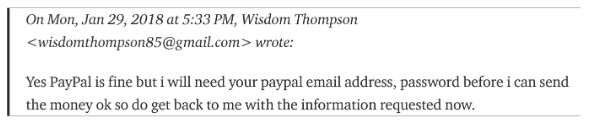

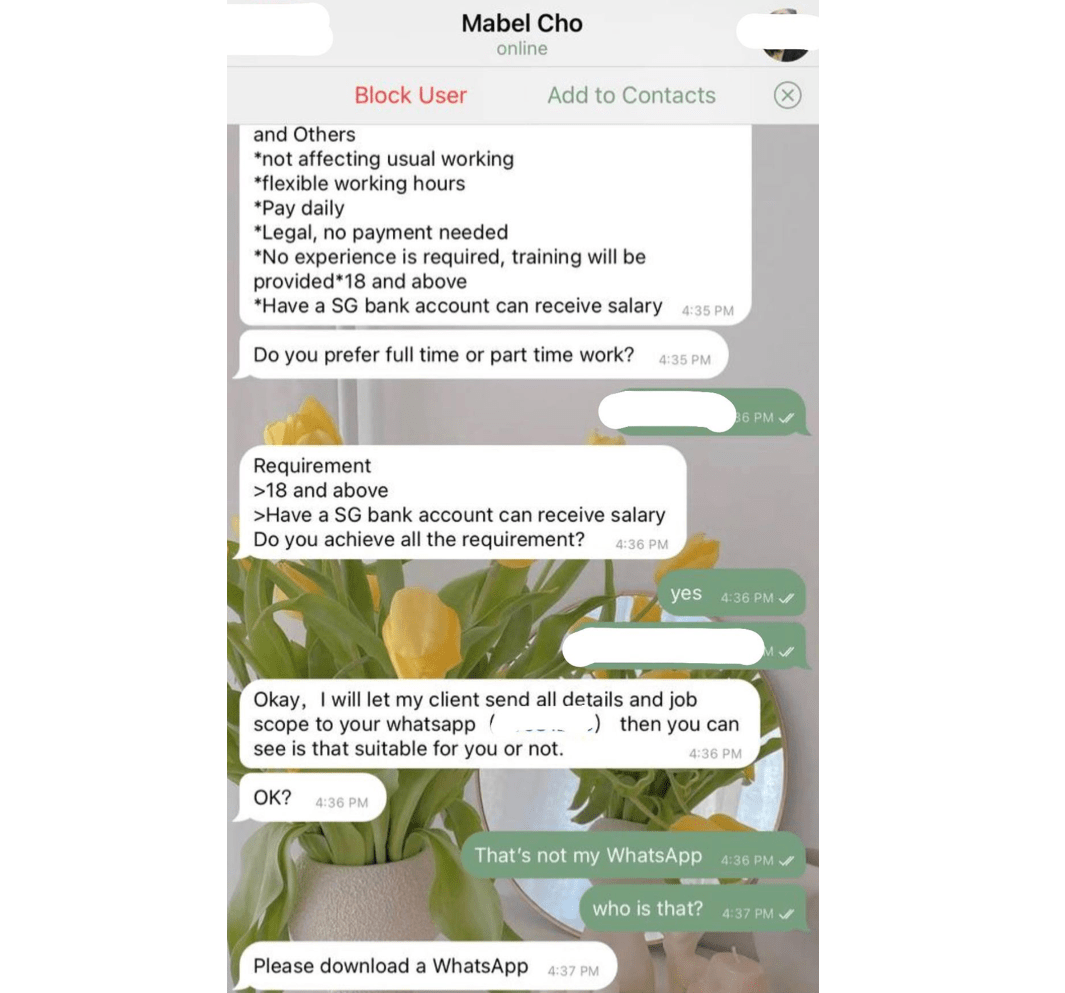

10. Fake job recruiters on Telegram

Image credits: Joycelyn Yeow

There are many legit job-hunting platforms these days, including Telegram channels that share available openings to subscribers. However, there’s been a slew of scammers pretending to be recruiters in the recent months, sharing lobangs for “promising” jobs with good work benefits.

Recipient playing along to call out scammer

Image credit: Liew Wan Ning

Once victims have expressed interest, the scammers will tell you that you’re hired, asking you to provide your phone number and bank account details to “seal the deal”.

Image credit: Joycelyn Yeow

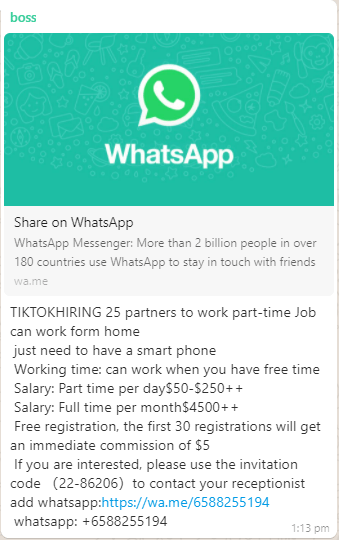

There’s also been a recent spike in fake TikTok job offers. After a “successful” job, scammers will then request that you top up money into the company’s bank account in order to retrieve your salary.

You shouldn’t have to fork out money before you’re able to get your pay. One other red flag to watch out for is when “recruiters” ask specific questions related to your bank account and details right after hiring.

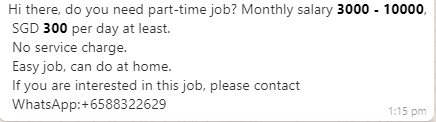

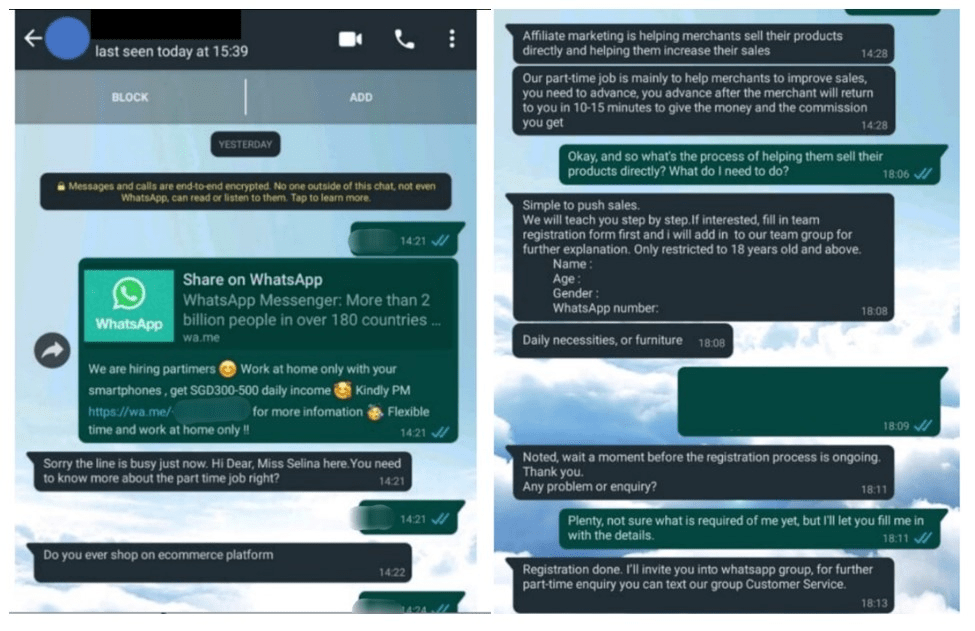

11. Job hiring scams for “Online Marketing Associate”

Image credit: Singapore Police Force

Like the previous scam, fake part-time jobs have been offered via WhatsApp for popular e-commerce websites such as Shopee.

Part-timers are promised $300-$500 daily upon completion of tasks. The main scope of work will require them to help e-commerce platform sellers boost their sales and ratings through advance purchases.

Image credit: Singapore Police Force

These advance purchases of the shop items are made by, you guessed it, the victims. With a promise of “commission”, payment is done by transferring funds to a specific bank account provided by the scammer.

The transferring of funds will start small, with victims paying for items that amount to slightly more than a few hundred dollars. Subsequently, this amount gets higher and scammers will suddenly claim technical issues when attempting refunds, and victims fail to secure their promised refunds.

It’s best to avoid situations where your money has to be spent first in order to receive payment, especially when there is no written guarantee for you to get your money back.

Look out for suspicious-looking email addresses and avoid clicking links on these messages.

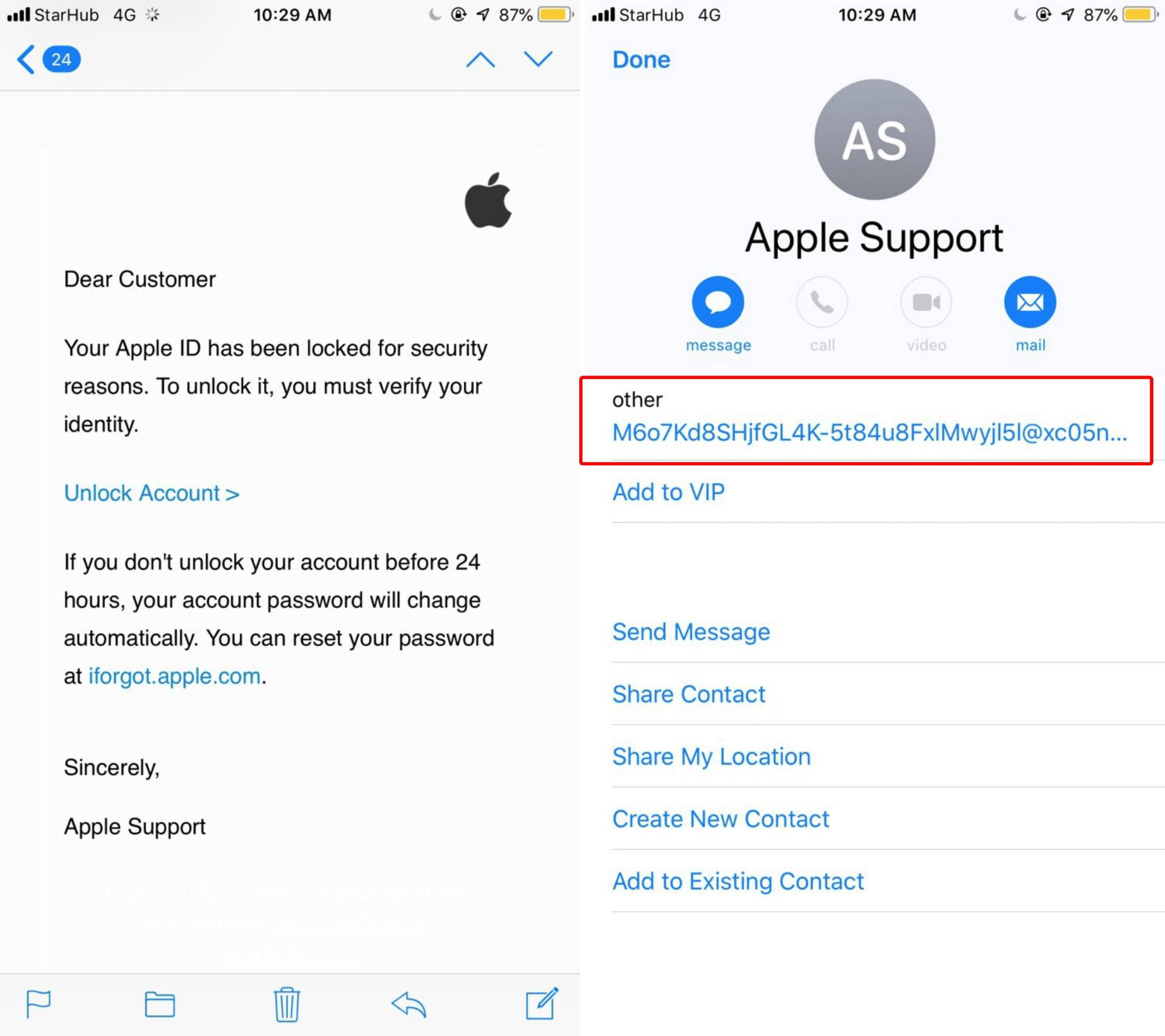

Image credit: Alvy Rose

Although the Apple ecosystem is mostly safe, it doesn’t stop scammers from launching phishing attacks in the form of emails impersonating Apple. These emails usually claim that an account has been locked or compromised, and that you’ll have to reset their account by clicking on a link. But instead of securing your account, you’re actually handing over your login details.

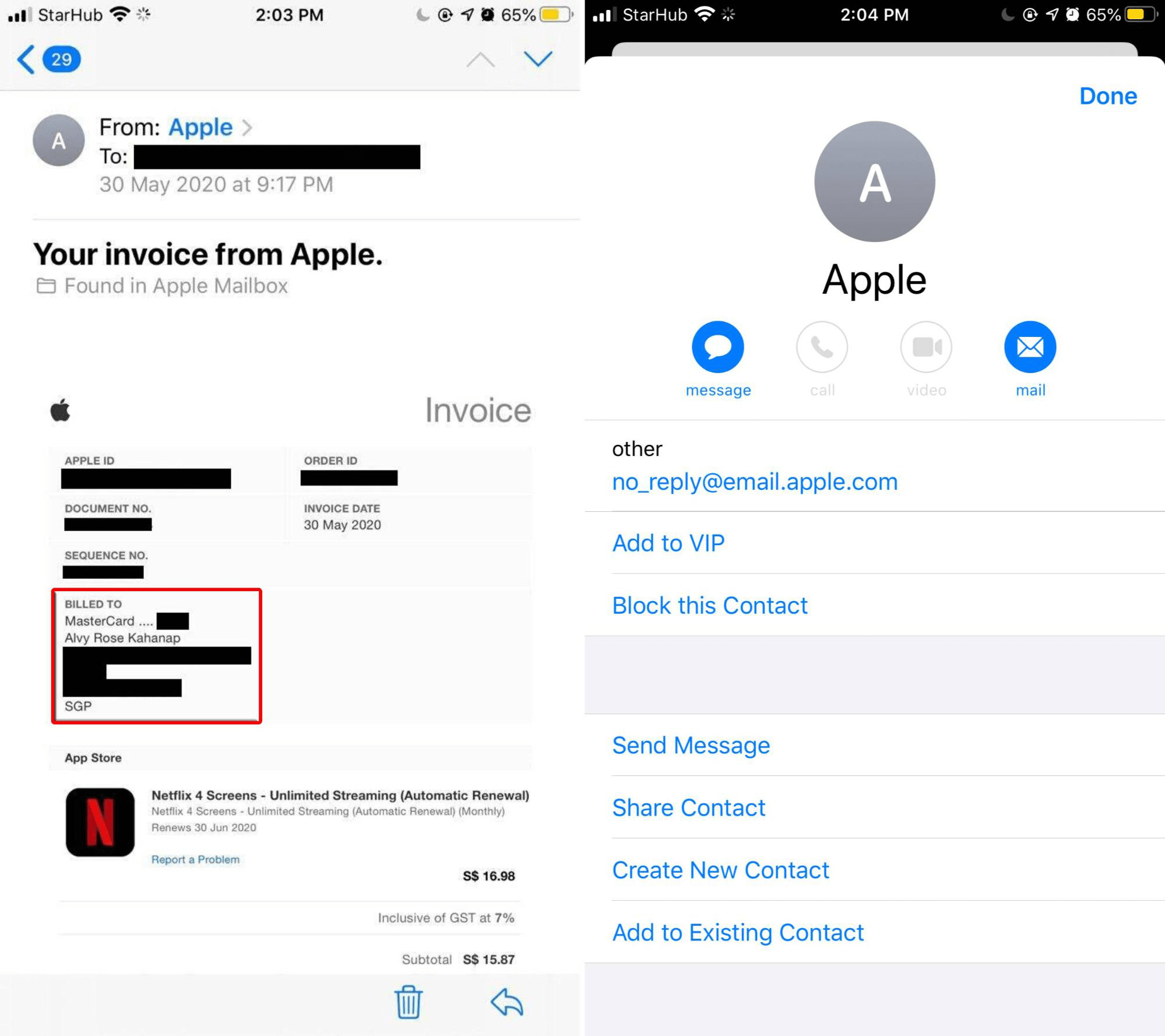

Legitimate emails like this invoice from Apple should already have your information like your billing address and full name. Apple will also not require you to click on any link or give any information.

Image credit: Alvy Rose

Usually, official emails from Apple will be invoices which include information that hackers won’t have like your billing address. For Apple-looking emails that are not invoices, simply double-check the sender’s address. If you want a foolproof way to tell if your account is compromised, drop Apple an enquiry under “Apple ID”.

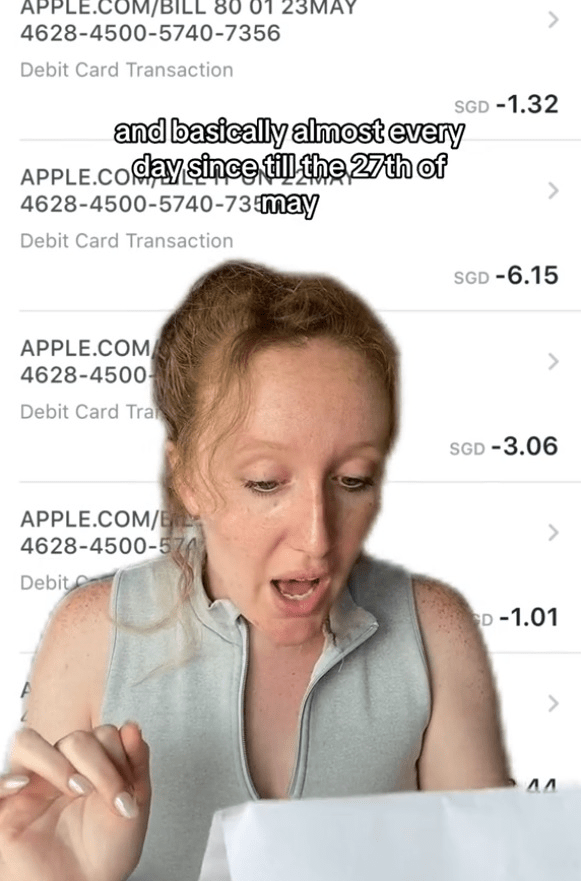

In recent months, this has not been the only way Apple users have been scammed of their money. One victim lost nearly $205 in a week from what she thought were transactions billed to her Apple account.

Image adapted from: daizamazze via TikTok

Every so often, she would be notified of a transaction from “APPLE.COM/BILL” and thought nothing of it, since the deductions from her bank account were small. But these quickly added up. Further inspection also found that these transactions were not authorised by Apple at all.

If you notice these micro-transactions on your bank statement, call up your bank to cancel your cards to prevent anymore siphoning of money from your account.

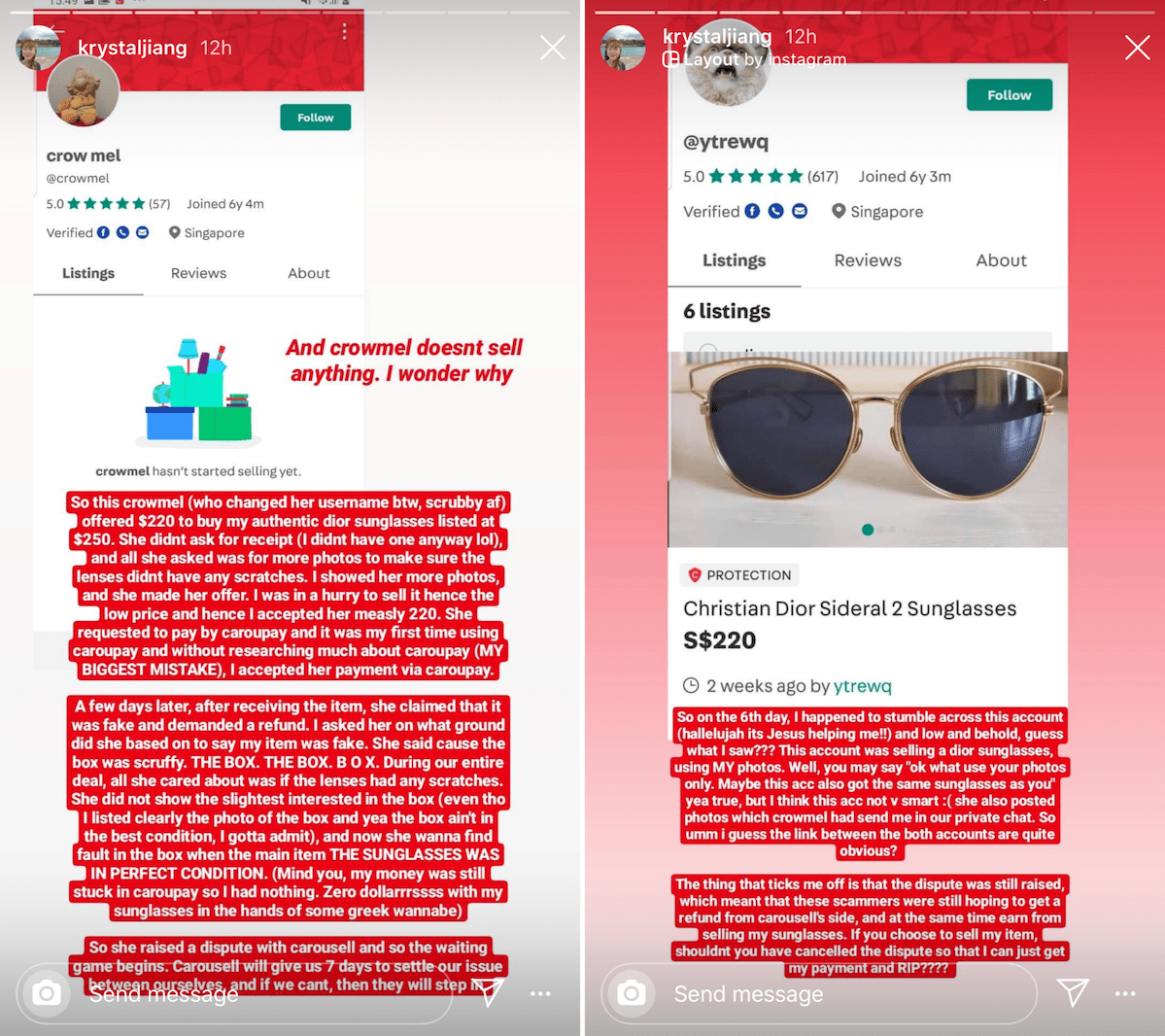

13. Carousell scams

This Carousell seller was scammed of her sunglasses, before she found the item being resold for a profit.

Image credit: Krystal

Carousell is a go-to place for many to find cheap deals on everything from branded bags to Nintendo Switches. The flip side is that there are also many ill-intentioned people posing as sincere buyers and sellers.

Earlier on, most scams usually involved sellers who took payment for items that were fake, spoilt, or goods they never intended to ship. To combat this, Carousell introduced a new payment method – Caroupay. This safeguard withholds payments from sellers until buyers confirm that their purchases have been received in good condition.

This sounds like a foolproof way to get rid of scammers but, alas, people get smarter and find ways to game the system. Now, there are deceitful buyers who request for refunds claiming the items were not as described. Often, they re-list the high-value item on a different account, essentially making money out of thin air.

It’s clear that the nature of scams is constantly evolving. A good rule of thumb: be extra vigilant with high-value transactions and analyse the reviews of sellers and buyers. Bare accounts with no reviews or listings are very shady so steer clear of those.

Additionally, always opt for meet-ups whenever possible. Worst case scenario is being stood up but at least you save money that way.

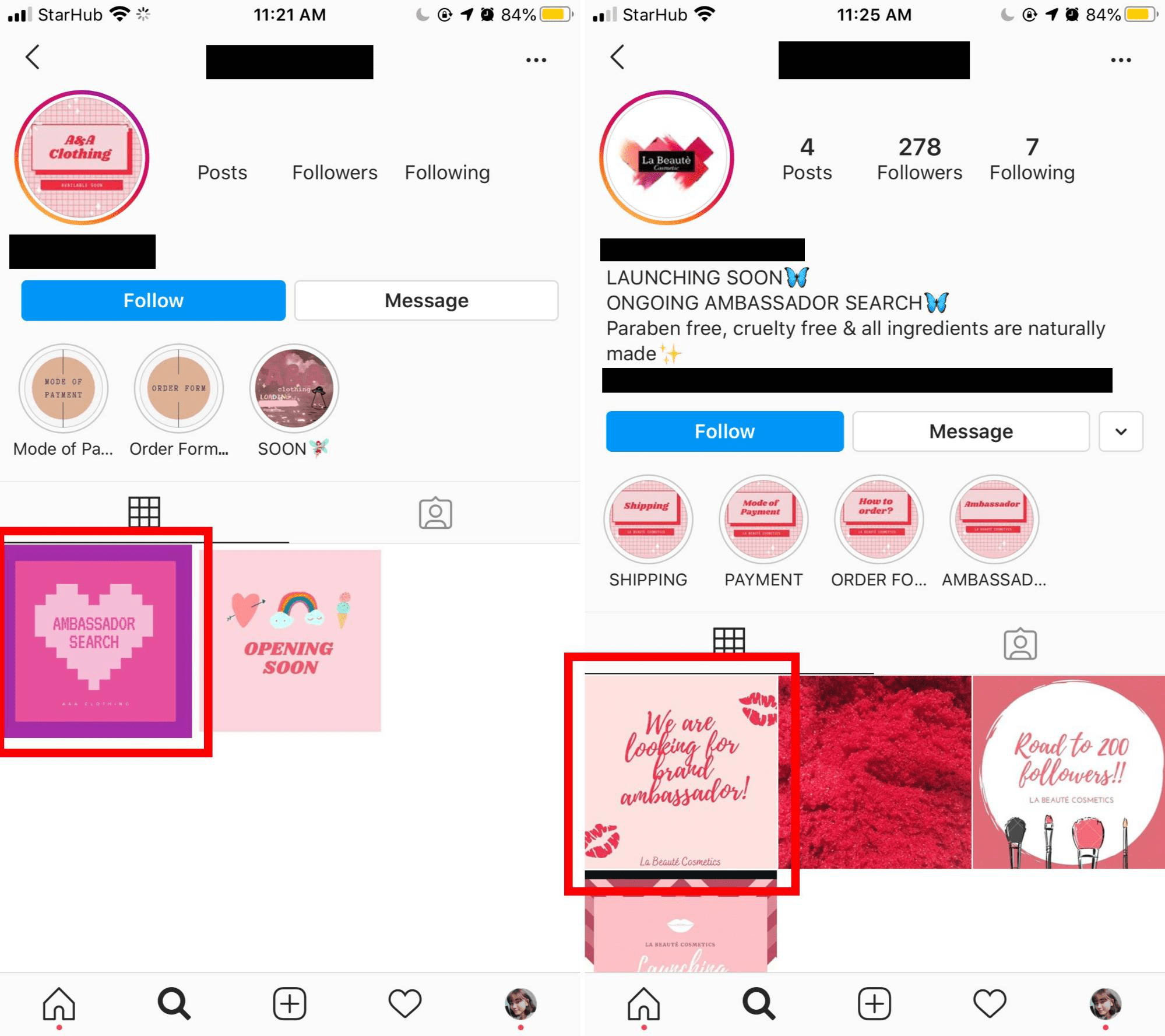

14. Instagram ambassador scams

The glitz and glamour of an influencer’s life can be alluring, and many scammers know that. If you’ve been tapping through your stories, some of your targeted ads might be low-key brands looking for ambassadors. They make it look so simple too – just swipe up for the website and fill in your information and surprise, you’re just who they’re looking for.

According to them, you’ll get a super exclusive promo code for a discount in exchange for a review or feature on your social media. Or even better, they give you the items for free as long as you pay for shipping which could even cost more than the item itself. Then it becomes a waiting game with no guarantee of receiving what you were promised.

Before accepting offers for reviews or features, check the company’s Instagram page thoroughly.

Image credit: @aaclothing.__ and @_labeauteco.ph via Instagram

Before you jump headfirst into a probable scam, do quick Google searches on the company and reviews of their brand. More often than not, other people who have already lost money to this scam would have posted about it online. If their social media pages also look recently made and they’re offering deals that seem too good to be true, they’re likely out to take advantage of you.

All in all, avoid giving any personal information and if you’ve already done so, immediately block them if they contact you.

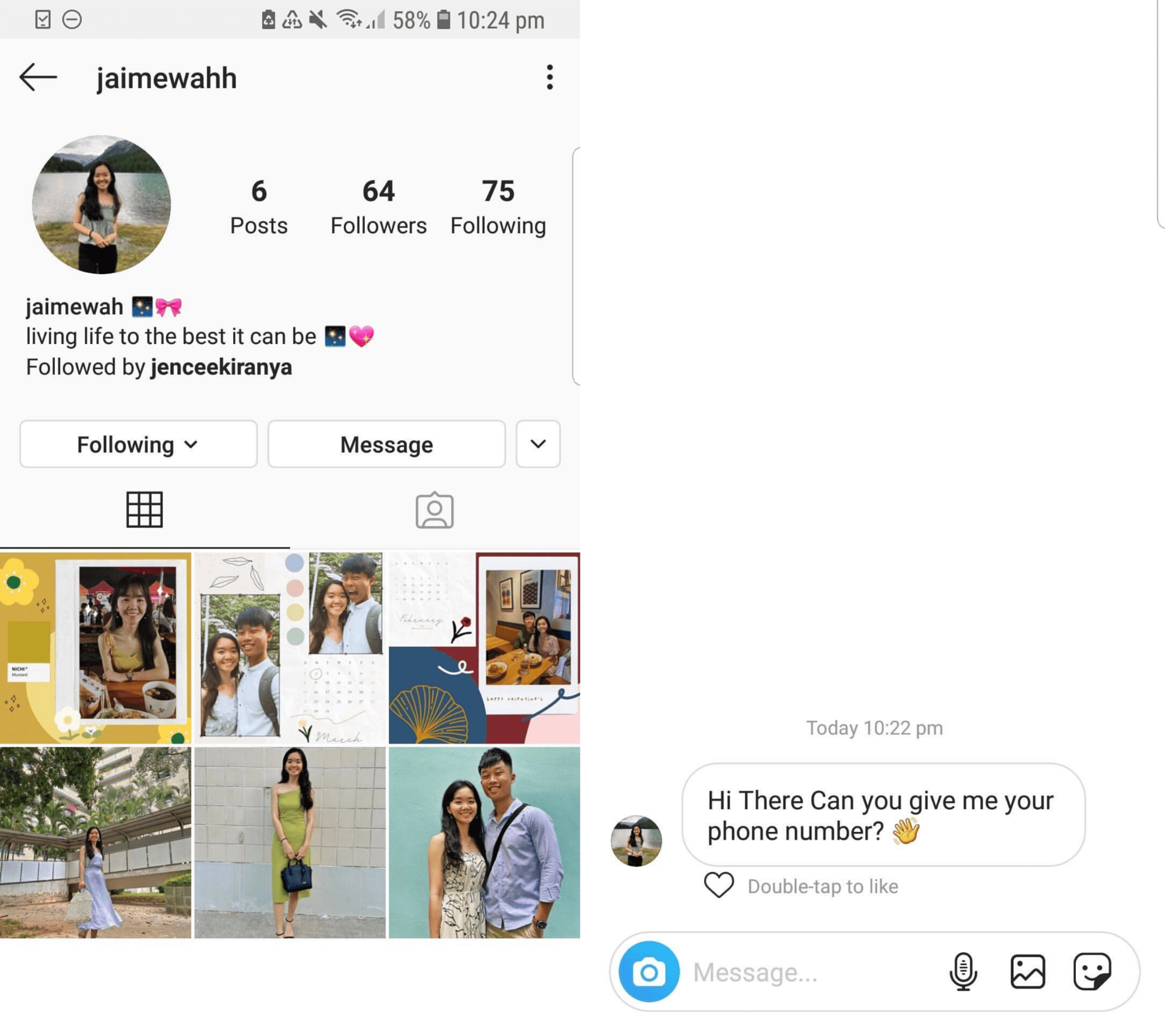

15. Identity thief/impersonation on Instagram

Most of us were taught as kids never to trust strangers, much less give up any personal information. But when it comes to familiar faces, we let our guard down and scammers know this well enough to take advantage of it. We might not even think twice about giving phone numbers or, worse, a few hundred dollars.

A common tactic by these impostors is to ask for pictures of your credit or debit card and your OTPs because they’re trying to “help you sign up for lucky draws” on Lazada or Shopee.

Fake accounts of your friends with stolen photos often have just a few photos posted recently within the same time frame.

Image credit: Alvy Rose

If you have a childhood friend or acquaintance suddenly sliding into your DMs asking for your number after 5 years of no interaction, red flags should already be up. Check that the handles are spelt correctly and that photos have been posted over a period of time.

A quick check if they’re genuinely your friend is to text their mobile number directly and ask if it’s them. If they’re a long lost friend whose number you no longer have, ask them a trick question like how’s (insert fake family member’s name here).

16. Messages and calls from “royalty” and kidnapping scams

The elaborate stories some scammers come up with could be worthy of a soap opera or film. Think millionaire royalty in distress or kidnappers holding your family members hostage. Props to them for originality.

Far-fetched as they are, it’s usually our loving grandparents who fall for these since they’d rather give up their life savings than see their family in harm’s way. These scams are often carried out through email blasts, calls, and online messages.

This scam isn’t exactly difficult to identify. Just treat any far-fetched story from a stranger on the internet with suspicion. For calls, avoid picking up any from foreign numbers. On top of being a scam, you might get slapped with exorbitant overseas call charges too.

Make it a rule to never ever give or lend money to anybody over the internet because you’ll never see that money again. Then after that, check in on the seniors to warn them from unwittingly giving away their retirement money.

Identifying scams in Singapore and ways to avoid them

While some of us luckier ones may not have fallen prey to such situations, it doesn’t mean we should let our guard down. After all, hubris always seems ridiculous – until it’s our own.

Besides the tips shared above, a useful rule of thumb is to stay updated with the latest news to be in the know of scams that may be taking place and to guard your personal details with your life.

For other scams to look out for, check out:

Cover image adapted from: Oh Qian Yi, Joycelyn Yeow

First published by Joycelyn Yeow on 7th February 2022. Last updated by Raiz Redwan on 7th July 2023.