Singapore Budget 2024 guide

Every year, February brings us the Singapore Budget, which sets the stage for our Government’s strategic fiscal focus for the year ahead. In simpler terms: how they’re going to divvy up spending for the country.

The Singapore Budget 2024 was announced by our Minister for Finance, Lawrence Wong, last Friday. It’s generated quite the buzz, but TL;DR, here’s a dummy’s guide on everything you need to know, and what it means for you.

Cash handouts for everyone

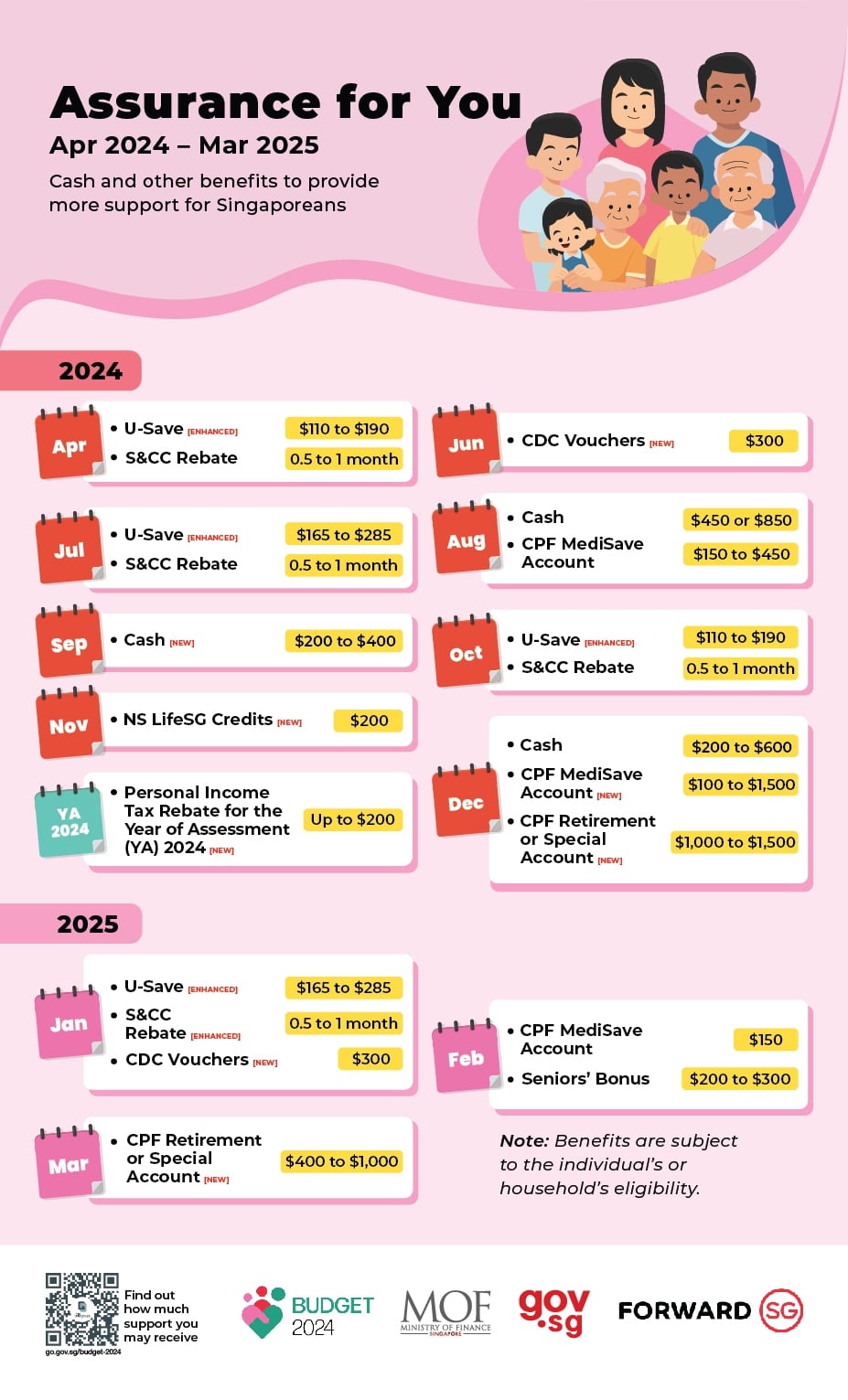

Image credit: Government of Singapore

One of the things most of us look forward to at every Budget announcement are the various cash and in-kind handouts by the Government. After all, who doesn’t love free money?

In the recent Budget 2024, Finance Minister Lawrence Wong announced a whole slew of distributions to various groups of people:

$600 worth of CDC vouchers for all Singaporean households

Image credit: Community Development Council

One of the biggest handouts in this Budget is $600 worth of CDC vouchers that all Singaporean households will receive in 2 tranches: $300 in June, and another $300 in January next year. This is on top of the $500 of CDC vouchers that you would have already received at the start of 2024.

To recap, CDC vouchers can be spent at many hawker stalls, coffeeshops and other heartland merchants like hair salons. A special set of CDC vouchers are specifically meant for supermarkets like FairPrice and Giant; you can check out CDC’s website for a list of all the places you can spend your CDC vouchers at!

$200-$400 Special Cost-of-Living payouts to eligible individuals

If you have an assessable income of up to $100,000, and own no more than one property, you’ll be entitled to a special cost-of-living payout of between $200-$400, which will be credited directly to your bank account.

$200 in LifeSG credits for all NSmen

All NSMen, past and present (including those enlisting this year), will receive $200 worth of LifeSG credits. In case you forgot, we also received $100 back in 2022 to celebrate 55 years of National Service.

Take note that you’ll have to download the LifeSG app in order to be able to access these credits. LifeSG credits can be spent anywhere that accepts NETS QR, or PayNow UEN QR payments.

$300 MediSave bonus for all Singaporeans

To help with rising healthcare costs, all Singaporeans will receive a one-time bonus deposit of $300 into our MediSave accounts, which will be paid out this December.

Rebates for individuals and households to help with rising costs

A big concern in many people’s minds is the rising cost of living, thanks to soaring inflation as well as a 2% increase in GST over the last two years. As such, part of the Budget this year caters to helping individuals and households defray some of these costs, especially since they pertain to inescapable bills like personal income tax and utilities.

Apart from cash handouts, the Budget also introduced various rebates for both individuals and households. Largely, these are meant to help offset the increasing costs of living, as well as those of household expenses and utilities.

Personal Income Tax Rebate of 50%, capped at $200

If you are due to pay income tax, you’ll receive a tax rebate of 50%, capped at $200, for the Year of Assessment 2024 (1 Jan 2023 to 31 Dec 2023). It’ll be tax season again soon, so check out our guide on how to file income tax deductions so you can pay less tax.

Service & Conservancy Charges (S&CC) rebates for those living in HDBs

For those of us living in HDBs, we’ll receive half a month of S&CC rebates in January 2025, which can be used to offset February 2025’s bill. Together with the regular rebates that we received last year, we’ll have saved on 4 months’ worth of S&CC charges.

U-Save rebates for HDB households

ICYMI, U-Save is a quarterly rebate given to HDB home-owners. This sum goes towards offsetting utility bills like water, electricity and gas. Under the Budget 2024, all eligible HDB households will receive a one-off U-Save rebate of up to $950 this year━approximately 4 months of utilities expenses in a 3- or 4-room HDB flat.

Closure of CPF Special Account (SA) for those aged 55

One of the biggest talking points of the Budget was the announced closure of the CPF Special Account (SA) for those who turn 55, coming into effect from 2025.

With this closure, what will happen is that all the funds from your SA will go to your Retirement Account (RA) to fulfil the Full Retirement Sum (FRS) amount. This FRS amount varies, and you can check out the CPF website to find out more. After topping up the FRS, your SA balance will be channelled to your OA.

This move plugs a loophole that some people have been exploiting, called CPF SA Shielding. There’s nothing illegal about it, except that it takes advantage of the CPF mechanism to gain additional interest rates and liquidity on your CPF funds upon hitting 55 years old.

There’s a whole article that we can write on this topic, but in a nutshell (before the new changes):

- When anyone turned 55, an RA will be set up, and money would automatically be transferred from your SA to your RA to achieve the FRS. If you’d not met your FRS, funds would be pulled from your OA.

- Any leftover money in the OA and SA could be withdrawn whenever you wanted. If you chose to leave it, you’d continue to earn a respective 2.5% and 4.08% interests on the deposits. Money in your RA can only be accessed in monthly payouts, or larger withdrawals under special circumstances like a critical illness.

- This is where SA Shielding comes in: where people use the funds in their SA to invest in stocks, bonds, or other investment products, leaving the minimum balance of $40,000 in the account. This depletes their SA, so the shortfall to make up the FRS gets taken from their OA instead..

- They then liquidate their investments so the cash goes back into their SA, where they can enjoy risk-free, 4.08% interest rates on this sum━thus successfully shielding their funds from the RA. Plus, they can freely withdraw this money. In essence, this loophole allowed Singaproeans to gain liquid assets, garnering a greater amount of interest.

Back to the latest changes: what the CPF and Government have effectively done is to peg interest rate to its liquidity. The funds that you can withdraw at any time (OA) will earn interest at a lower rate of 2.5%, and funds in the RA, which cannot be withdrawn on demand, will earn the higher 4.08% interest.

Amidst all the hoo-ha surrounding the closure of the SA, some other CPF changes include an additional 1.5% in CPF contribution rates for those aged 55-65, and the raising of the Enhanced Retirement Sum to $426,000.

Increased upskilling funds for those aged 40 and above

As part of the Government’s drive to embrace lifelong learning and continual upskilling, funds have been allocated in Budget 2024 to encourage upskilling in Singaporeans aged 40 and above.

One of these is a $4,000 top-up of SkillsFuture credits for Singaporeans aged 40 and above, which will be credited in May this year. According to Minister Lawrence Wong, this $4,000 will be more “targeted in scope” from the current SkillsFuture credits in our accounts: it can only be spent on selected courses and programmes.

From 2025, Singaporeans aged 40 and above will also enjoy subsidies if they want to pursue another full-time diploma at polytechnics, Institutes of Technical Education and arts institutions. That’s not all: you’ll also be entitled to a training allowance if you enrol in a full-time course, working out to half your average income in the preceding year, capped at $3,000/month, for a maximum cumulative duration of 24 months.

Up to $10,000 for ITE students who pursue further education

Two incentives, primarily aimed at encouraging ITE students to further their studies, were announced.

First off, all ITE graduates aged 30 and below will receive a $5,000 top-up in their Post Secondary Education Account (PSEA). In case you are unfamiliar with it, the PSEA is a continuation of your Edusave account after secondary school, and can be used to offset costs of educational programs. When you’re 30, your PSEA is automatically closed, and the funds channelled to your CPF OA.

Completing a diploma post-ITE would gain the graduate an additional $10,000 that will be deposited in their CPA OA━money that can be used for buying a house, paying for education, and more.

More support for senior citizens

The Budget also introduced some initiatives specially targeted at seniors, to help them age well. We won’t go into too much detail, but these include schemes such as:

- More money being set aside to make public infrastructure more senior-friendly. These enhancements include sheltered linkways, neighbourhood amenities, bus stops with senior-friendly features, Active Ageing Centres, and Community Care Apartments

- An Additional Buyers Stamp Duty (ABSD) refund if they downsize their private property to one of a lower value.

- One-off MediSave bonus of $750 or $1,500 for eligible seniors.

- Between $1,000-$1,500 top-ups for seniors with retirement savings that fall below the Basic Retirement Sum.

- Annual Earn and Save Bonus of up to $1,000 for eligible seniors who earn up to $6,000 a month and are still working.

Budget 2024 at a glance

On the whole, this year’s budget spells out the Government’s commitment to helping Singaporeans. As a Blue Zone 2.0 nation, we have an ageing population amidst rising costs of living, inflation and more━this Budget sets out a direction to protect our seniors and everyone in between, helping to tide us through the various cost increments, while encouraging one and all to continually improve ourselves.

Most, if not all, Singaporeans, will benefit in one way or another from this Budget. More details and more initiatives are set to be announced at the subsequent Committee of Supply debates, where each ministry will unveil its plans and announcements for the year ahead.

Find out more about the new Budget 2024 here

For more budgeting tips, check out: