Side hustle as a working mum

These days, every man and his dog seem to have a side job on top of their usual 9-to-6. From creating content on social media to selling baked goods, earning extra coin definitely comes in handy to pay off travel expenses, debts and mortgages.

And then there’s me – a new mum also working a full-time job. Searching for a part-time job as a mum is like trying to find a unicorn – nearly impossible. The options were limited and I needed something flexible and realistic.

I also needed something that would secure my and my baby’s futures in the long run. While part-time work got me through week-to-week, I needed a way to grow my income for future expenses, like when he starts school and goes off to college. Here’s how I found a different path to make money on the side:

Life before having a kid

My early twenties were spent roaming the clubs and spending all my money on drink

Image credit: Samantha Nguyen

When I was 23, I was many things – a college graduate, a full-time corporate intern, and a part-time waitress. In my pursuit to be financially independent, I had taken on two jobs just so I could make ends meet. Saving up was an option, but my penchant for avocado toast prevented me from banking anything more than a few dollars a month.

How things changed when I became a working new mum

I was making enough to live comfortably on my own but once I threw a baby into the mix, my finances were all over the place.

I’d heard countless times that raising a child would come with a hefty price tag. Other parents had advised that my husband and I should hit financial milestones before family planning. Having an emergency fund or substantial savings were counted as must-dos before having a kid.

Funds and savings I had none, and I was clearly unprepared for the financial load motherhood would bring. But starting a family was something I’d wanted ever since I was young, and having the resources or not wasn’t going to stop me.

Bills, bills and more bills

Once I left my first prenatal appointment though, it hit me just how expensive this ride was going to be. During the pregnancy itself, we’d spend close to $5,000 already. And this was before the birth, which was estimated to be a whopping $10,000.

The high costs were because my husband and I are foreigners in Singapore. Neither of us qualified for any government subsidies, so we had to reach deep into our pockets for all this. And all of this included everything from the monthly scan down to the last painkiller. By the time the baby arrived, my husband and I thought we had mortgaged our lives.

But it didn’t stop there. The expenses continued when the baby returned home. My husband and I weren’t sure how we were going to pay for any of this – the rocking chair to soothe baby to sleep, matching cot and dresser set for his many onesies, multiple rockers, and various gadgets and gizmos.

This was on top of everything else the baby would actually need, like clothes. Baby clothes alone burned a hole in our wallets. Granted, I made the classic new mum mistake and bought too many onesies – some of which he never stuck a foot in because he grew a size bigger overnight.

Not to mention, as he was growing older, the number of diapers, wipes and formula milk he needed increased at the speed of light. Per month, I’d be spending about $300 for just these, on top of other bits and bobs to make motherhood easier, like diaper rash cream.

Some months were costlier than others too. Additional expenditures came in when my baby had his growth spurts or when he had to take trips to the doctor for his appointments. It seemed like I was stuck in a cycle of never-ending credit card swiping.

Cutting down on expenses

With these bills on hand, I dove into saving mode. I abandoned my Starbucks lattes, cancelled my spin membership, and kissed my regular weekend brunch goodbye. Going out became a foreign term and shopping for literally everything – including food – at the clearance section was the norm.

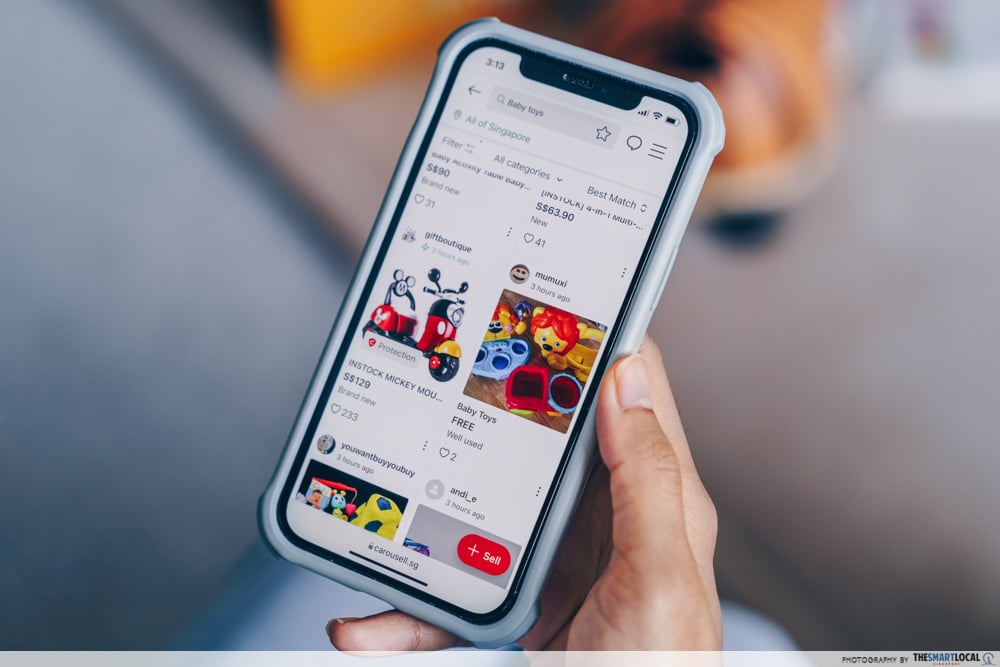

Online markets like Carousell had a great trove of new baby items going for cheap

My baby was not spared by my penny pinching either. I swapped new baby things for second hand ones I found on Carousell and Facebook Marketplace, or even from relatives. But hand-me-downs weren’t that cheap either. Although second hand clothes had a lower price tag, they racked up quickly, and my shopping carts checked out at the hundreds regularly.

Lifestyle changes were also needed. My husband and I moved into a cheaper apartment and kept a hawk’s eye on where our paychecks were going. A spending spreadsheet, which tracked things like how much we made, spent and saved, was very useful. One could say we were living frugally. I’d like to think we were saving money for the baby’s education.

Finding new ways to earn income and revenue

Being a full-time working mum often meant I would have to type with one hand, while holding my tot in the other

When I was single and in my early 20s, I had the energy to hustle hard. Not so with a baby, however. I couldn’t just take off for the weekend to run tables anymore. But increasing expenses necessitated that I earn some extra cash. After all, other mums have been working many odd jobs for decades to bring up their children.

Although the market for side jobs was big, options for me were few. Some lucrative gigs, like selling homemade food, baked goods or crafts online require specific skills – which I didn’t have.

My other option was to actually look for a part-time gig I could do after work. It’s hard enough looking for a job, even without a baby. But with him and my regular 9-to-6, it was practically impossible. Once, I had to juggle carrying a baby with making dinner, while my husband read out loud listings on Jobstreet.

I did dabble in dog walking for a while. It paid $20/hour and I could bring my baby along in a stroller to look after him. But this hustle was short-lived. As my son grew older, I got busier, which meant barely any free time for myself, let alone time to walk a dog.

After exhausting all resources, I turned to one option that I hadn’t thought to consider: investing.

While I knew how to scrimp and save, I didn’t know much about investments. I still considered myself a new-ish adult but this was adulting on another level. I had barely any knowledge but I thought I’d give it a try.

Gaining investment knowledge through online courses

ETFs, REITs and having a diversified portfolio were terms that I’d heard but were foreign to me. But we live in a digital age where information is so readily available.

I first brushed up on my knowledge of finance terms I needed to know, like Dividend and Risk Profile. Then I read up on guides to Exchange-Traded Funds (ETFs) in Singapore and other investment tips.

For further information, I turned to the SGX Academy. There were recorded webinars on the basics of investing, as well as programmes I could sign up for. Although I would consider myself a beginner now, there are courses on the intermediate and advanced levels for topics like understanding fintech and neutral options strategies.

Armed with my newfound grip on investing, I now needed a brokerage platform to start trading. That’s when I stumbled across ProsperUs – a digital investment service.

Making my first investment

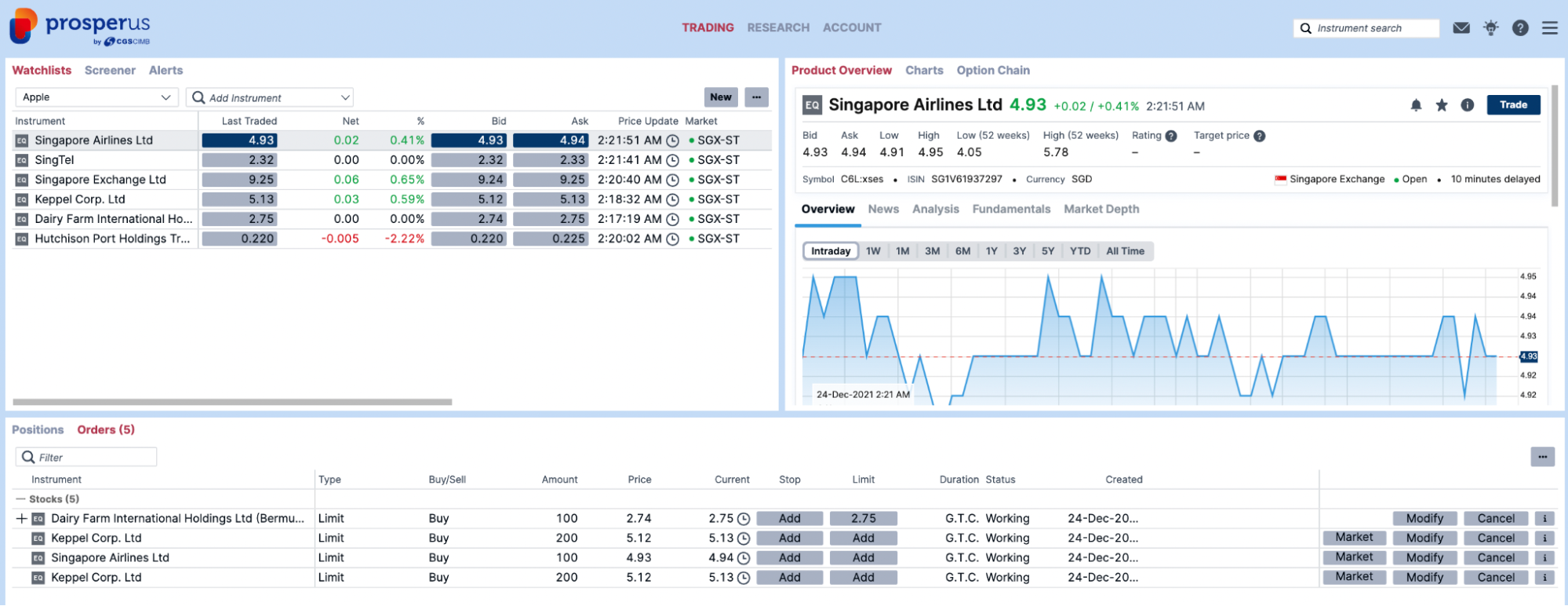

Image adapted from: ProsperUs

I was instantly sold on the fact that ProsperUs is among one of the more user-friendly investment platforms geared towards the younger crowd. Even without prior investing experience, I had no issues navigating around the app.

Within ProsperUs are two different applications: BUILD which caters to the more risk-averse crowd (read: lower risk, lower return) and BOOST which attracts traders who have more time to spend monitoring their investments.

If you’re like me, an entry-level investor, you’ll be glad to know that the platform offers other bite-sized investment articles, insight reports and webinars to help get investment education going. From the fundamentals of investing to advanced analysis, you’ll be able to find everything you need on ProsperUs.

I didn’t know which one I should pick, but after watching ProsperUs’ video on understanding risk and volatility, I could comfortably identify having a lower risk appetite, which meant I could start building my own portfolio with my first investment.

With all this new knowledge, I felt that I was ready to make my first investment. But knowing which companies to invest in was another issue. As a newbie, familiar companies like Keppel and Singtel seemed like safe bets.

Then I read up on ESGs on ProsperUs, companies that were environmentally-friendly, socially responsible and practiced good corporate governance. Ones like Apple and Microsoft were ensuring their operations were as green as possible, in hopes of preserving the environment for much longer.

I felt that sinking my money into these companies were a more worthwhile investment. After all, this wasn’t just about gaining returns. I was investing for my son’s future as well, and there wouldn’t be any point in doing so if there wasn’t going to be a world to live in.

Start investing early with ProsperUs

Once I made my first investment, it’s all about diversification. With ProsperUs, you can invest in multiple assets using just one account – an approach that has been gaining popularity since it’s more affordable, less volatile and provides a stable stream of income.

The platform offers a range of different asset classes – from bonds and equities to options and futures – across over 30 exchanges and 25 markets from APAC to Europe and the US. It also boasts competitive pricing and no platform fees.

If you find yourself always tight on time, the ProsperUs app is available on both iOS and Android, making trading and reading on-the-go convenient and easy as pie for everyone. You can easily manage your portfolio on your phone while pumping milk or running after your tots.

Whether you’re also a new mum looking to secure your children’s future or you’d like to be more financially prepared for greater expenses in adulthood, investing is a passive way to earn that income.

TSL readers looking to start their own investment journey with ProsperUs can sign up with the code <TSL100>. You’ll get SGD$100 in cash credit and be entered into a giveaway. Attractive prizes like an iPhone 13 Pro and an exclusive martini tasting are to be won when you make your first investment on the platform.

Start investing with ProsperUs here

This post was brought to you by ProsperUs.