Assurance Package 2024

Unless you’ve been living under a rock all this while, you should know about one of the biggest things that’s going to happen as we roll into 2024 – yes, we’re talking about the GST increase from the current 8% to 9%.

To help Singaporeans tide through the GST increase as well as the general high inflation that we’ve been experiencing these past few months, the Singapore Government announced a whole slew of measures meant to cushion the impact of the GST increase.

This included things like the Household Support Package, enhancements to the GST Voucher scheme, and an initiative called the Assurance Package for GST. Here are some things you need to know about the Assurance Package, and what it means for you.

What is the Assurance Package?

The Assurance Package was first announced during Budget 2020, with a fund of $6 billion. Working in conjunction with the existing GST Voucher scheme, it’s intended to help defray the higher cost of living associated with a GST increase. There are 5 main components to the Assurance Package:

- Cash payouts. Singaporeans aged 21 years and over will receive cash payouts between $700 and $1,600, depending on their income and property ownership. These payouts will gradually be dispensed over 5 years from 2022 to 2026, in the month of December.

- CDC vouchers. Distributed to every eligible Singaporean household, these vouchers are redeemable at participating heartland shops and hawker centres, as well as major supermarkets and grocery stores, such as NTUC Fairprice, Giant, and Sheng Shiong.

- Senior’s Bonus cash payouts. Additional cash will be disbursed to seniors aged 55 years and above. The amount ranges from $200 to $300, and varies based on age group, income level, and property ownership.

- Additional GST Vouchers (U-Save). Eligible households will receive additional U-Save rebates on top of those in the GST Voucher scheme. Meant to offset utility bills, the rebate amount credited depends on the size of your HDB flat.

- Medisave Top-ups. Singaporeans aged 20 years and below or 55 years and above will receive a Medisave top-up of $150 each year from 2023 to 2025, totalling up to $450.

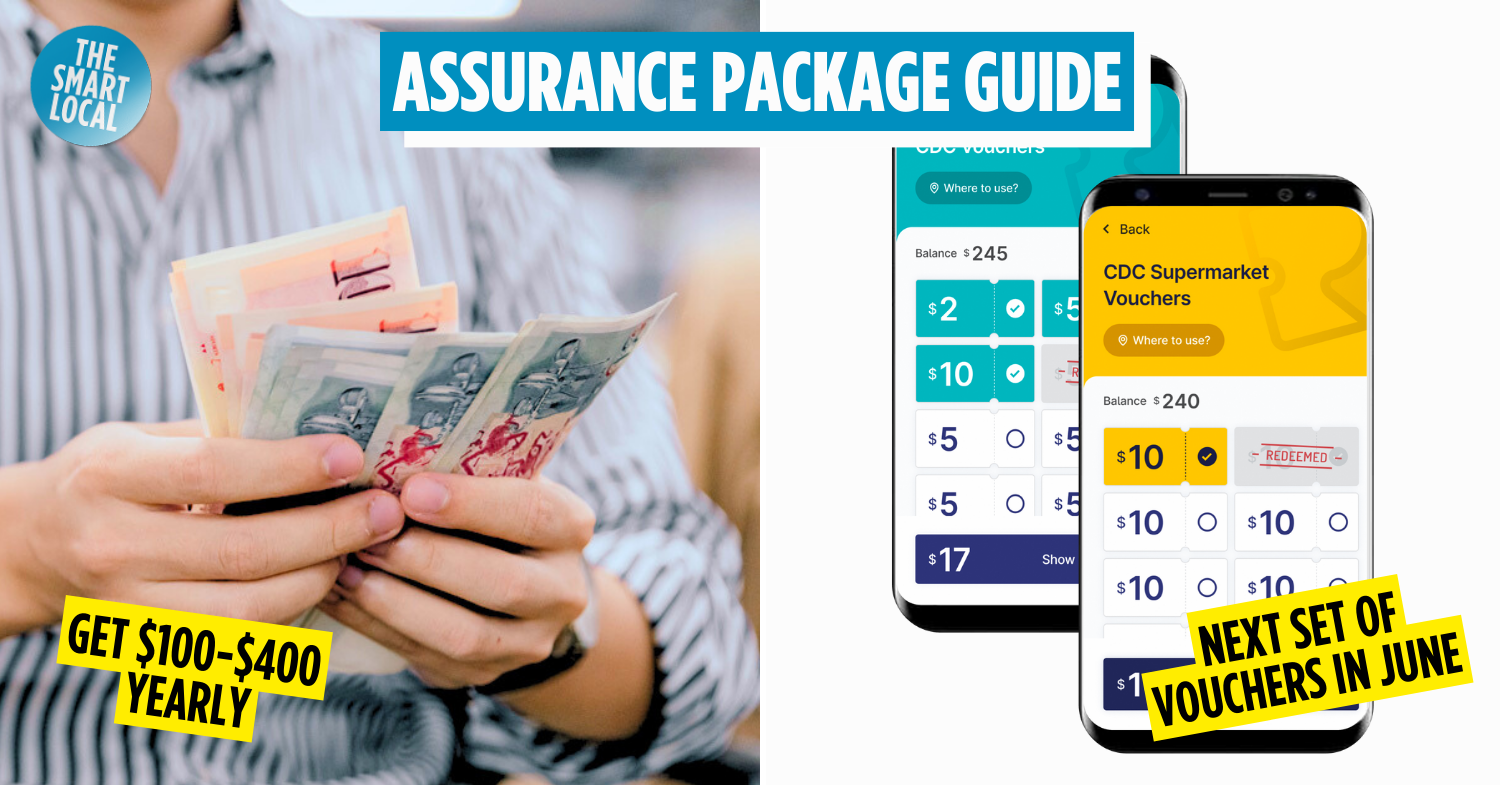

Image credit: Unsplash

Assurance Package 2024 summary

These are the main Assurance Package benefits Singaporeans can expect to receive in 2024, as well as their corresponding eligibility criteria:

| Component | Amount | Payout method | Eligibility | Payout month |

| Cash | – | PayNow-NRIC, Bank crediting, or GovCash | Singapore citizens residing in Singapore, aged 21 and above in 2024 | Dec 2024 |

| $600 | Accessible Income up to $34,000 | |||

| $350 | Accessible Income more than $34,000 and up to $100,000 | |||

| $200 | Accessible Income more than $100,000 | |||

| $100 | Owns more than 1 property | |||

| MediSave top-up | $150 | CPF MediSave account | Singaporean 20 years and below or 55 years and above | Feb 2024 |

| Senior’s bonus | – | PayNow-NRIC, Bank crediting, or GovCash | – Singapore citizen residing in Singapore, aged 55 and above in 2024

– Accessible Income <$34,000 – Annual Value of home <$25,000 – Must not own more than 1 property |

Feb 2024 |

| $300 | 65 years and above, Annual Value of home up to $21,000 | |||

| $250 | 55 to 64 years old, Annual Value of home up to $21,000 | |||

| $200 | Annual Value of home more than $21,000 to $25,000 | |||

| U-Save | – | Directly offsets household’s utilities bills | – Living in HDB flat

– Owners, occupiers, & tenants do not own or have any interest in more than one property – If flat is partially rented or not rented out: have at least one Singaporean owner or occupier in the household – if flat is entirely rented out: have at least one Singaporean tenant |

Jan & Jul 2024 |

| $190 | 1- and 2-room flat | |||

| $170 | 3-room flat | |||

| $150 | 4-room flat | |||

| $130 | 5-room flat | |||

| $110 | Executive/Multi-Generation flat | |||

| CDC vouchers | $800, split into $500 & $300 | Redeem through CDC Voucher website | Every Singaporean household | Jan & end-June 2024 |

Who is eligible for the Assurance Package cash payout?

With more than 3 million Singaporeans qualifying for the Assurance Package cash payout, many of us must be wondering about the eligibility criteria, and how much we’ll be receiving exactly.

For starters, you have to be a Singaporean Citizen residing in Singapore, and aged 21 years and above in the reference year in order to be eligible for payouts in the first place. To give a more concrete example: if you’re only turning 20 in 2023, then you won’t be eligible for the first year, but after that, you’ll be eligible from 2024 to 2026.

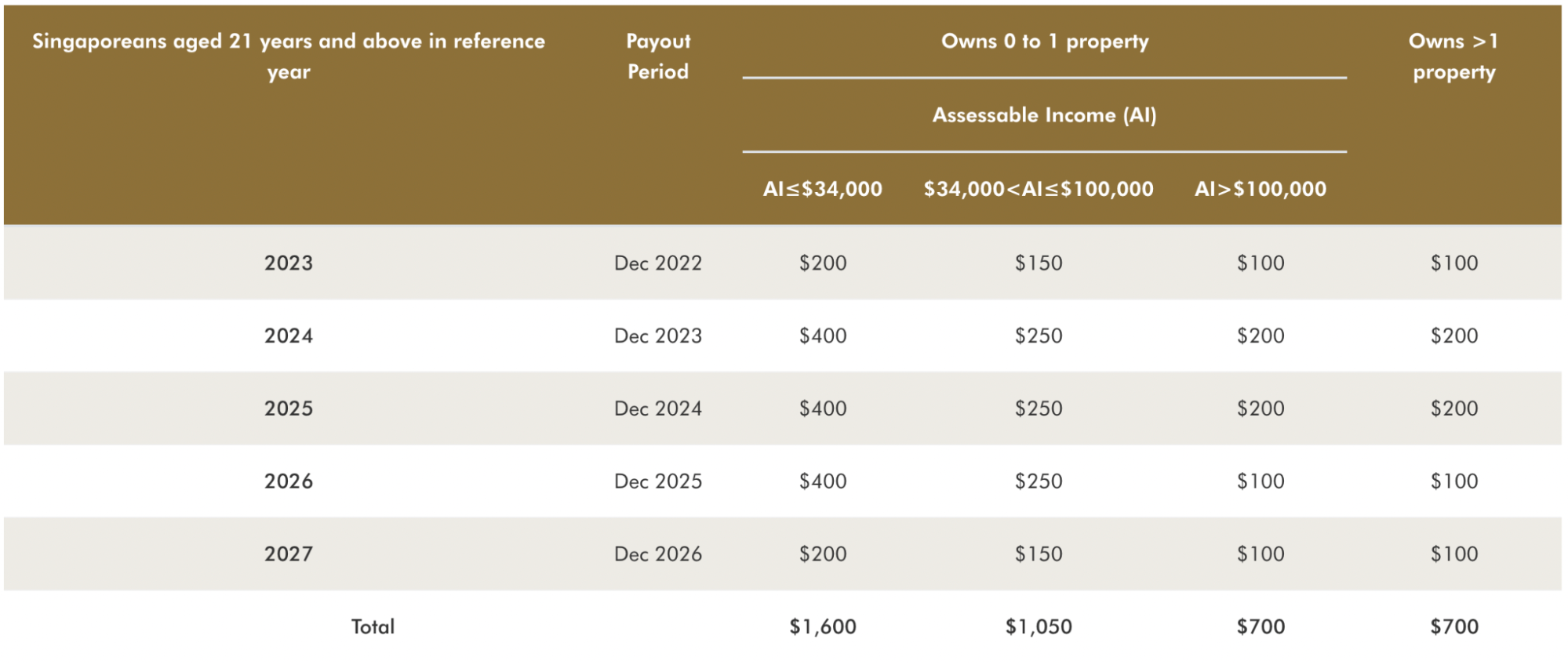

The actual amount that you’ll receive is based on 2 factors: the number of properties you own and your Assessable Income (AI) for the year. The latter basically takes into account all the income you get from sources like your employment and rental income. To find out your AI, you can check your tax bill or Notice of Assessment on the IRAS website.

Screenshot from: Ministry of Finance

If you own more than one property, then you’ll just get either $100 or $200 annually over the 5 years, for a total of $700 for 5 years.

If you own just one property or none at all, then the next criteria to determine your payout amount is your AI.

If your AI is $34,000 and below, then you’ll receive the highest quantum from the Assurance Package, with payouts of $200 or $400 over 5 years, amounting to a total of $1,600. If you have an AI of over $100,000, you’re considered a high income earner and so will naturally receive lower payouts, of $100 or $200 for a total of $700.

Bear in mind that the AI is based on the Year of Assessment for 2022, and doesn’t scale with the years. This means that even if you get a significant pay raise in subsequent years which brings you to a higher AI bracket, you’ll still be eligible for the bracket that you were in for 2022.

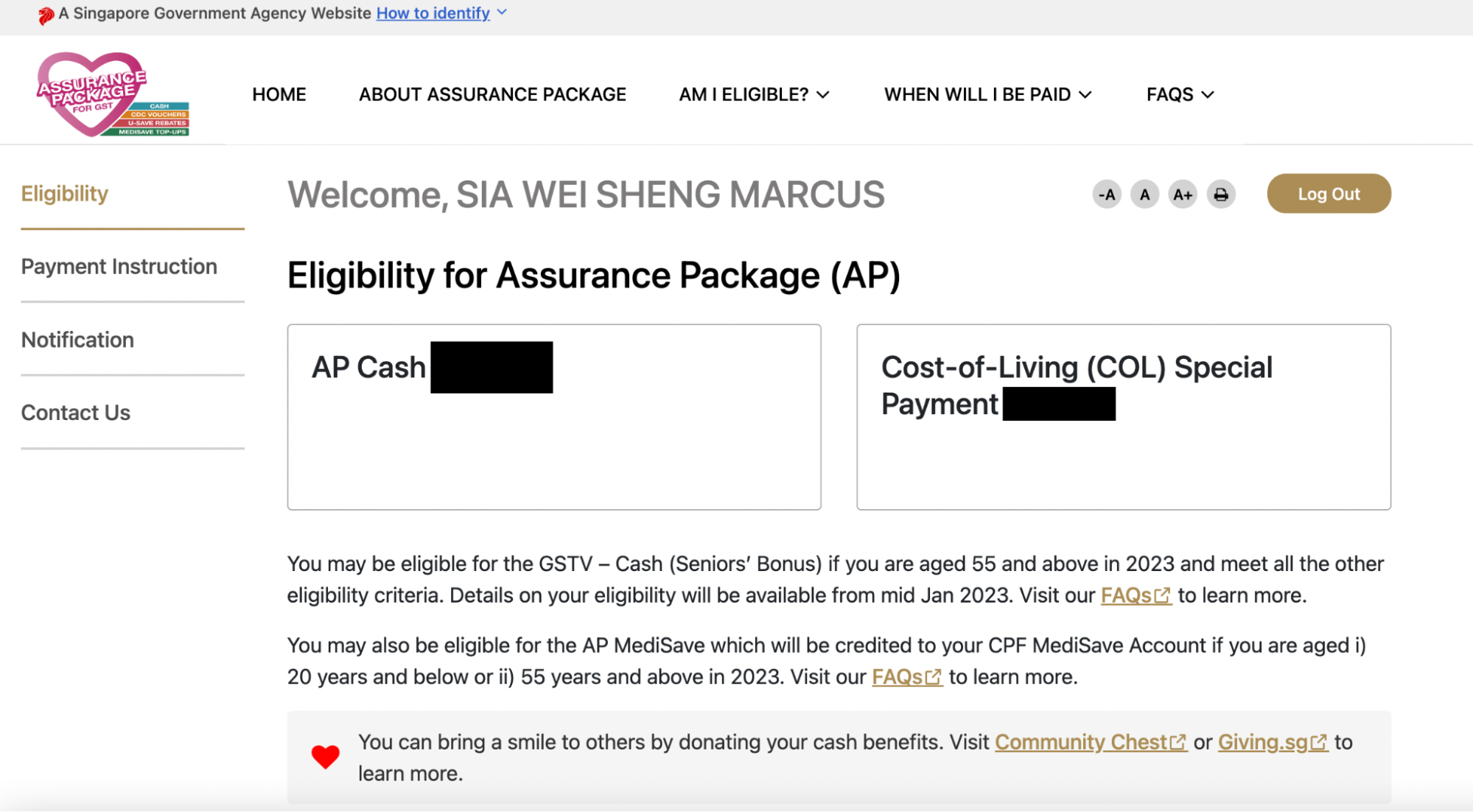

To find out more details about your own eligibility as well as the exact amount you’ll be receiving, you can login to the e-services online portal on the Assurance Package website with your Singpass account.

Image adapted from: GovBenefits

Other payouts to help cushion the impact of the GST increase

As we’ve mentioned before, the Assurance Package is not just the 5-year cash payouts. In fact, there are a whole range of other schemes under the Assurance Package, all of which are essentially disbursing cash to help Singaporeans.

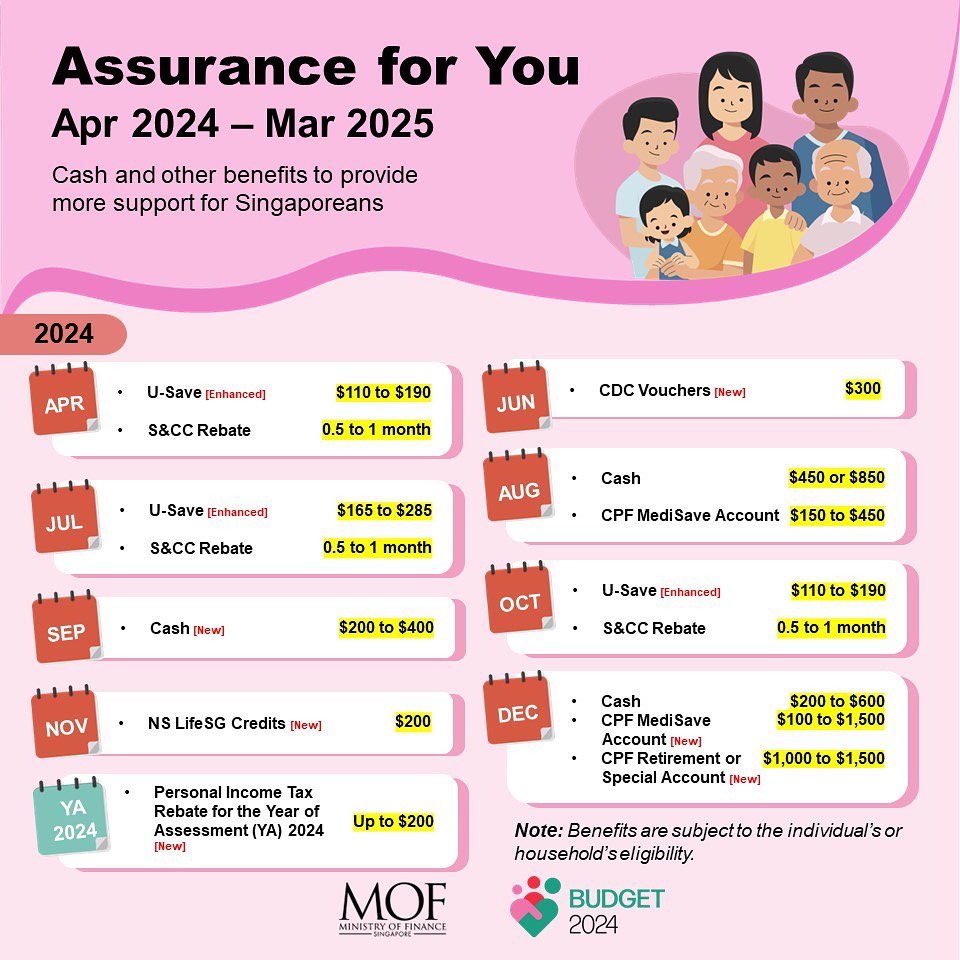

Image credit: Ministry of Finance

For Budget 2024, the government unveiled enhancements made to the Assurance Package, which total up to $1.9 billion. These enhancements include:

- Extra CDC Vouchers. An additional $600 in CDC Vouchers, half of which will be dispensed in end-June 2024, and the other half disbursed in January 2025.

- Cost-of-Living (COL) special payment. A one-off cash payment ranging from $200 to $400, depending on income.

- Additional COL U-Save. A one-off rebate that offsets utility expenses, the amount depends on the size of your flat.

COL and Service and Conservancy Charges (S&CC) Rebate. A one-off rebate for S&CC charges, which is a fee that goes towards the upkeep of common properties on HDB estates.

How can I receive the Assurance Package cash payouts?

Assurance Package Cash payouts will take place every December, until 2026.You can receive the cash in several ways.

The easiest way is to link your NRIC to your PayNow. Once you do, you’ll receive it like any other normal PayNow transfer.

Otherwise, you can provide your bank details to the government through the Assurance Package e-services portal. You can also update your bank details there if they are outdated. Just FYI: although they previously issued payouts in the form of cheques, it’s been phased out as of 2022.

If you somehow bypass both steps for whatever reason, then the “last resort” will be for you to receive it via GovCash. GovCash can be withdrawn through the LifeSG mobile app, or through OCBC ATMs. Find out more about GovCash.

The Assurance Package to help Singaporeans

All in all, the Assurance Package is certainly a welcome initiative by the Government to help assuage the concerns of Singaporeans about the impending GST increase.

While we can only wait and see if there will be additional measures to help us defray some of the increased costs, it’s great to hear that we’ll receive some additional cash from as early as next month, so be sure to link your PayNow to your NRIC to enjoy the earliest payout date!

Find out more about the Assurance Package

More finance for beginners below:

- Singapore Savings Bonds

- Guide to personal loans in Singapore

- Best investment-linked insurance policies

Cover image adapted from: Tampines West Community Club

Article originally published on 20th November 2022 by Marcus Sia. Last updated by Shannon Lee on 5th March 2024.