Top places to retire overseas

It’s always good to plan ahead, and the same thing goes for retirement, especially if you’ve got plans to spend it in a far-flung country away from our clustered city. If you’re already looking for ideas of where to live in your silver years, here are 10 cities you may consider.

And to make it even easier, we’ve broken it down based on the accommodation you can get on average for a 3-room flat in Singapore (SGD $300k ~), plus these cities’ immigration/visa policies and procedures.

1. Bali, Indonesia

Image credit: guoguiyan

There’s hardly a better place to spend your retirement than at Bali, a laid-back paradise featuring imposing mountains, sandy beaches and lush forests. Just imagine: You can spend your days quietly strolling past valleys and paddy fields alike.

The cost of living is much lower compared to Singapore, which means lower transport fees and the ability to indulge in higher-end meals minus the guilt. The locals in Bali are incredibly friendly too, and there are expat communities everywhere so you won’t feel out of place!

What you can get for SGD $300k: a luxury two bedroom villa

Entry: Your application must be done through a licensed Retirement Visa Agency.

Requirements: You have to be 55 years old or older, and in possession of a valid passport with more than 18 months remaining before expiration.

Paperwork: Your passport pages, a copy of your health and life insurance policies, among other things (the full list can be found here)

2. Victoria, B.C, Canada

Image credit: Beth Rand

Toronto or Vancouver comes to mind when you think about Canada, but Victoria, the capital of British Columbia, is one of the country’s top retirement cities. While the northern parts of Canada constantly dips below zero degrees, Victoria’s winters are mild and usually snow-free, with heat in the summer hitting 25 degrees, max.

Image credit: @victoria_city_canada

With the temperate climate comes the flourishing of a great variety of plants. Couple that with the fresh sea breeze, and you’ve got a city with one of the best living environments around. Stroll down the classic colonial buildings and cobblestone alleys, or visit one of their magnificent castles.

As with some other countries on this list, you might want to consider immigrating earlier as a skilled worker if you haven’t already got relatives or children staying there.

What you can get for SGD $300k: a 1 bedroom condominium

Entry: Through the Temporary Resident Visa if you’re staying for less than 6 months a year, or the Permanent Resident Visa if you’re staying for more than 6 months a year.

Requirements: Find out whether you are eligible here.

3. Kuala Lumpur, Malaysia

Image credit: asiatourist

One option is right at our doorstep: Malaysia. Its capital city, Kuala Lumpur, boasts accommodation and delicious food at prices a fraction of Singapore’s, because of that yummy 3:1 exchange rate. The city is so near to Singapore that it’s easy to keep in touch too – your friends and family back home are just across the Causeway.

The city’s extensive network of buses and trains also makes it easy to get around, so you’ll never be bored at home even in your later years.

What you can get for SGD $300k: a condominium, partially furnished, in a prime location

Entry: Only through the Malaysia My Second Home (MM2H) programme

Requirements: All requirements can be found here.

Paperwork: Fill up the application forms available on the MM2H website, and provide the relevant documents.

4. Bangkok, Thailand

Image credit: DrukAir

Besides the wide variety of cheap and delicious Thai food in Bangkok, there’s another draw – you’ll be greeted with friendly faces wherever you go. Truly the “Land of a Thousand Smiles”.

Even the government welcomes retirees to stay in Thailand, providing complimentary return airport transfers and an annual health checkup at a private hospital.

For a brief escapade, apply for the short-term non-immigrant O Visa that will enable a stay in Thailand for just 90 days. For something more long-term, apply for the renewable non-immigrant O-A Visa to stay in Thailand for up to a year.

What you can get for SGD $300k: a 1 bedroom condo

Entry: Submit related documents to the Thai embassy in Singapore

Requirements: You must be at least 50 years old, and have a security deposit of THB 800,000 in a Thai bank account for 2 months prior to application. Further qualifications here.

Paperwork: Submit an updated bank book or passbook and a bank letter stating that the money had been deposited to the account from an oversea source for not less than 2 months.

5. Auckland, New Zealand

Image credit: vacationidea

Mentioning New Zealand brings to mind the countryside, with picturesque green pastures and farm animals. Auckland isn’t too far from that dream, with its abundance of walking trails, farmland and beaches.

You’ll be spoilt for choice with the city’s cuisine, music and art, and even their stellar wines.Temperature doesn’t fluctuate much, either – the hottest and coldest days in Auckland are 20 and 11 degrees respectively, which makes for some pretty comfy living.

What you can get for SGD $300k: a residential apartment

Entry: Either through the Parent Retirement Category or the Temporary Retirement Category.

Requirements: Both categories have different requirements with regards to investment funds, settlement funds and age limits. Find out more here.

6. Taipei, Taiwan

Image credit: internations

One of the most popular tourist destinations for Singaporeans, it’s evident that some of us have fallen in love with Taipei. It’s not a bad place to retire in, too, with its delicious cuisine, good air quality and plentiful attractions, ranging from night markets to Taoist temples.

There’s no dedicated retirement visas in Taiwan, but you can score 30-day visa free entries and a long-term visa that lasts 90 days.

While Singaporeans are automatically entitled to the short-term visas that’s great for ‘mini-retirements’, you can also easily obtain the long-term resident visa with a local job or business commitment in the country.

What you can get for SGD $300k: a 1-bedroom apartment

Entry: Apply for a resident visa. Find out more here.

Requirements: Provide passport-sized photographs, a filled-up health certificate form and a passport with at least 6 month’s validity.

Paperwork: Submit an application for the visa at the Taipei Representative Office in Singapore.

7. Melbourne, Australia

Image credit: acaciatours

Australia’s already a popular place for Singaporeans to migrate to, and top of that list is Melbourne. You’ll never be short of things to do, be it going for coastal drives along the Great Ocean Road, or visiting St Kilda, a beachside suburb with everything from theatres to botanical gardens and museums.

Melbourne is an attractive destination, so be sure to prepare for retirement early – it’s much easier to obtain a retirement visa if you’ve lived in Australia for longer, or have dependents with PR status. If not, you can still opt to work in Australia and apply for residency later on.

What you can get for SGD $300k: a spacious studio apartment

Entry: Through the Investor Retirement visa

Requirements: Be 55 years or older, have no dependents other than a partner, have an income of AUD 65,000 per year and a designated investment of AUD 750,000 in Australia.

Paperwork: Follow these steps

8. Brighton, UK

Image credit: ecenglish

There is more to the UK than the hectic metropolis of London – Brighton is by far more suitable for retirement with its quaint seaside resort feel. Besides chilling by the pier next to crystal waters, you can engage in conversation with friendly, hospitable locals, or relax in one of their cafes or restaurants.

Cost of living is lower here than in London too, so you can get your groceries and rent at a cheaper price.

What you can get for SGD$300k: a well located 1 bedroom flat near the Brighton seafront

Entry: Through the Independent Means visa application, to be made at the British Embassy in Singapore.

Requirements: You must be over 60 years old, have at least a £25,000 income per year, and a connection with the UK – which may mean you have a close relative in the UK, or have business connections in the UK.

More information can be found here.

9. Da Nang, Vietnam

Image credit: Klook

Vietnam is gaining popularity as a retirement city and it’s easy to see why. Just look at coastal city and culturally rich Da Nang, where pagodas stand side by side with cathedrals, mementos from the colonial French.

And you can be sure it’s safe to roam around during the day – it’s got one of the lowest crime rates in Vietnam.

To note: There isn’t a proper retirement visa scheme in Vietnam yet. But you can apply for a one or three-month visa to visit the country, with choice of single or multiple entry.

What you can get for SGD $300k: a 2-bedroom apartment in the city centre

Entry: Enter through applying for a business visa for longer stays, up to three months.

Requirements: None

Paperwork: You’ll need to provide a valid passport, a completed application form, a passport-sized photograph, a criminal record and an authorisation document issued by the Immigration Department.

Note: We recommend contacting the nearest Vietnamese embassy for more details.

10. Kyoto, Japan

Image credit: @furutanimunenobu

If you’re looking for a slower pace of life, skip Tokyo’s bustle and soak in Kyoto’s serene aura instead. Kyoto is the best preserved city in Japan, meaning you’ll find countless traditional Buddhist temples, Shinto shrines, teahouses and geishas here.

Another bonus: the healthcare. The country has a universal healthcare insurance system with affordable prices – so you’ll be in good hands here even in your later years.

Make your plans early if you’re looking to retire here – you’ll have to apply for permanent residency first, which you can do after 3 years of staying in Japan as a spouse of a Japanese citizen, or 10 years if you aren’t.

What you can get for SGD $300k: a 3 bedroom, 2 story house

Entry: Permanent residency is required for a retirement visa in Japan. Visit here for more details on permanent residency.

Plan ahead for your retirement

Retiring overseas might seem like a lofty dream if you’re only in your 20s, with your work life stretching out before you with the end far out of sight. But it’s never too early to start planning for your future financially, and think about the retirement life you want.

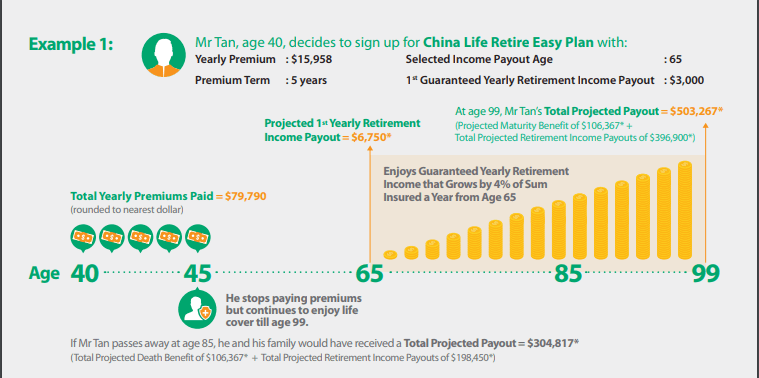

One way to realize that idyllic retirement vision? A solid insurance plan. And that might be in the form of the China Life RetireEasy Plan.

Let’s break it down:

The perks at a glance: no medical check-up needed, increasing guaranteed yearly retirement income and a maturity lump sum payout.

That means you can save the trouble of going for a medical check-up just to start this retirement plan – it’s not required. Also, you can choose whatever suits your lifestyle and finances – choose to pay your premiums over 5, 10 or 15 years and when you want the income payout age to be – 50, 60, 65 or 70 years old.

The insurance covers you till you reach age 99 – after that, you’ll receive a maturity lump sum payout. But if you should pass away before that, there’ll be a guaranteed death benefit which is at least 108% of your total yearly premiums due-to-date.

A more in-depth illustration. Image credit: ChinaLifeInsuranceSingapore * Figures include non-guaranteed values. The non-guaranteed values are derived from the participating fund earning the projected investment rate of return of 4.75% p.a. in the future. Therefore, the actual amounts payable will depend on the future performance of the participating fund.

And finally, you’d be defended against inflation. The plan provides you with increasing guaranteed yearly retirement income that grows by 4% each year from your selected income payout age.

Image credit: Chinese Tourist Agency

Whether your goals are admiring the cherry blossoms in Kyoto or strolling through ample grasslands in Auckland, planning ahead when you’re young will always pay off in the end.

Find out more about China Life RetireEasy Plan here!

This post was brought to you by China Life Insurance (Singapore) Pte. Ltd.