How working adults spend their year-end bonus

As we enter the months ending in “-ber”, a few things are certain. Mariah Carey is defrosting as we speak, everybody’s in a jolly mood from the Halloween and Christmas festivities, and we get to count down to not only the new year, but our long-awaited year-end bonus as well.

If you’re feeling a little spoilt for choice on what to spend that spike in moolah on, we’ve rounded up some inspo for you. And as cautionary tales, some year-end bonus splurges Singaporeans have sprung for which weren’t all that worth it. Read till the end for a Citi lobang which will allow you to splurge more on yourself and your loved ones, no matter the time of year.

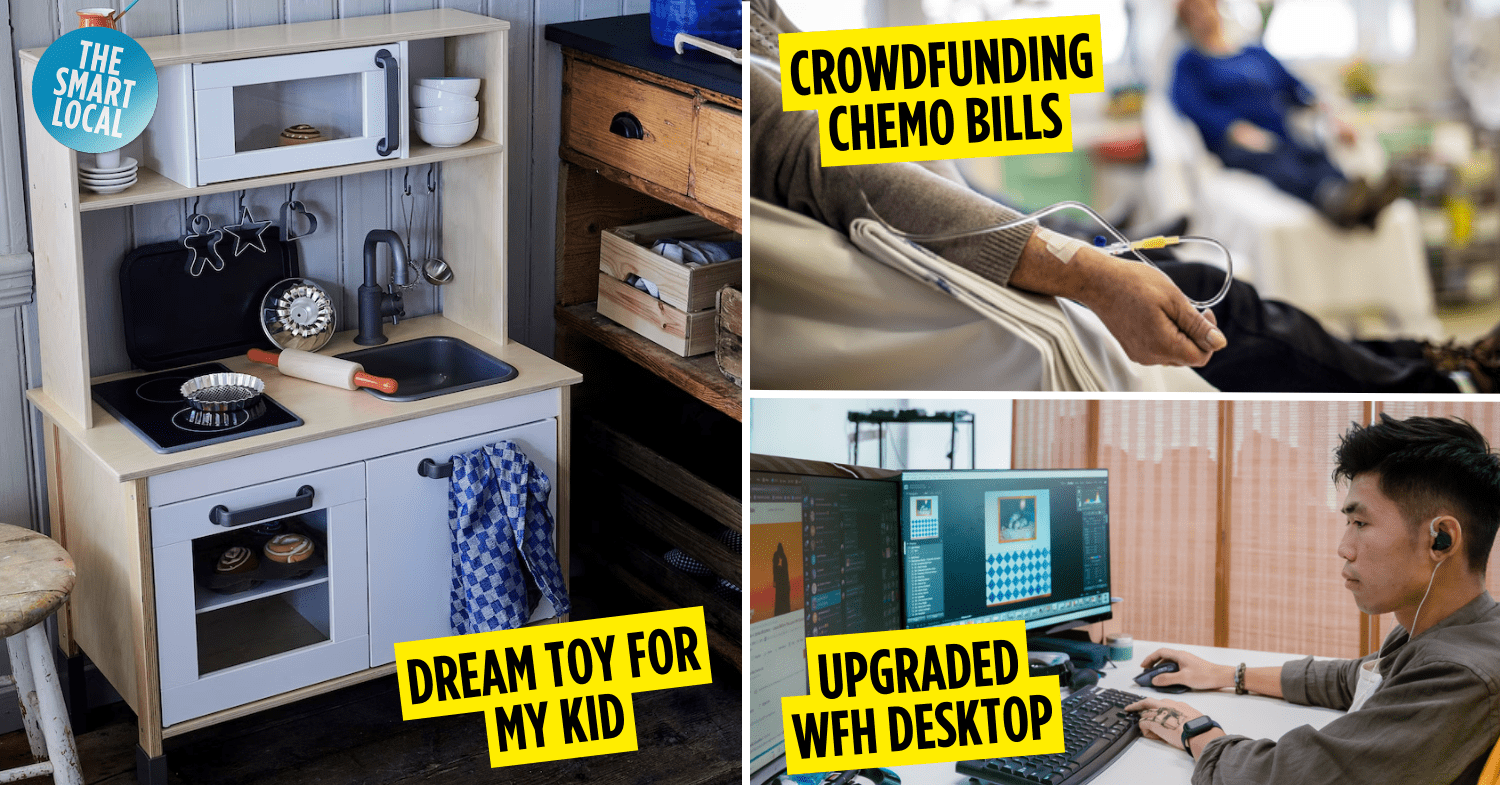

1. Kitchen playset for my toddler

Image credit: IKEA

After putting most of my year-end bonus into savings and household funds, I gifted an IKEA wooden kitchen playset to my daughter. It cost about $150, and the set is quite high-level – by my own standards at least. It was low-key my own dream toy when I was a child, but my parents could not afford to buy one back then.

The toy has provided my kid with countless hours of fun, and we love to play masak-masak with it together. It cracks my husband and I up when my kid takes our order and pretends to cook it on the little stove and microwave, even emulating the way we do dishes afterwards.

Besides the fact that my kid seems to love it, it kind of heals my inner child to be able to treat my little one to things that my kid self yearned to have, but couldn’t experience because of my family’s financial situation.

– Natasha, 34, admin officer

2. Upgraded PC for my remote working setup abroad

Image for illustrative purposes only.

I’ve been remote working in Canada since 2021. When I first moved over, I didn’t want to lug my computer in Singapore all the way over. The need for a new PC coincided with year-end bonus season, so I decided to give my WFH setup an upgrade since my existing desktop was a few years old anyway.

At around $1,500, the new PC was able to power 2 Ultra HD monitors concurrently without any lag at all. It also kept up with the multi-tasking necessary for my job, allowing me to run numerous different tabs and software at the same time without fearing that my computer will overheat or that the system will crash.

– Josiah, 28, sub-editor

3. My first hotel high-tea experience

Image for illustrative purposes only.

Image credit: Roderick Eime via Flickr

I had always wanted to experience living the tai tai life, nibbling on dainty IG-worthy treats while sipping fancy tea. The prices always cause me to be heart pain, so I couldn’t bring myself to splurge on them. I finally decided to take the plunge together with my fiancé, especially since my year-end bonus helped to soften the financial blow.

It was overseas, so it cost around ~S$80/pax. Although the experience in itself was a major bucket list item checked off for me, I couldn’t help but acknowledge that there were many hiccups along the way.

A handful of the petite pastries, although pretty, were lacklustre in quality – stale bread, dry and crumbly cakes, and frosting that was too rich and cloying yet devoid of flavour. When the bill came, my heart sank because the price did not seem justified based on the quality. I take comfort in the fact that I’ve tried it before at least, and the FOMO has been lifted.

– J.C., 28, content executive

4. Pilates package to take care of my mind & body

Image for illustrative purposes only.

I picked up pilates when I was in need of a form of fitness that wasn’t strenuous on my back and knees, lest an old injury of mine acts up. I came to like it a lot, and find that it’s a very good balance of muscle toning and stretching.

I’ve now been doing it on a weekly basis for 2 years and counting. As a little treat for myself and my well-being, part of my year-end bonus went towards a new pilates package, amounting to a few hundred dollars.

I see my pilates sessions as essentially an hour each week where I get to switch my mind off and just focus on strengthening my body. I don’t have to think about all the stress brought on by work or life in general. Plus, I’ve been able to see physical results so that’s really rewarding as well. Even small things like being able to carry heavy bags are a win.

– Joyce, 25, writer

5. Going on a 5D4N cruise

Image for illustrative purposes only.

Image credit: Pexels

I’d never been the type of kid who got to go on cruises with his family during school holidays. Last year, I decided to splurge on a 5D4N cruise for my girlfriend and I ‘cause I saw a promo for it that seemed attractive. Turns out the price underneath all that fine print actually totalled several hundreds more, which was a major pinch on my bank account.

Alas, I tried to make the most of my splurge by partaking in as many of the cruise activities as I could. My girlfriend and I also pigged out in a major way on all the delicious and atas food onboard – I must’ve gained a solid 3kg after the cruise.

Plus, we got to disembark in Malaysia and Thailand which proved to be very fulfilling day trips and a much-needed respite from our fast-paced jobs. So all things considered, maybe the cruise was worth it even though it wasn’t the dirt cheap price that was advertised.

– Wei Liang, 29, retail manager

6. Facial package for my mum who loves to be pampered

Image for illustrative purposes only.

Facials aren’t really for me, as I’m not a big fan of people touching my face. My mum, however, is all about being pampered while getting to step out chio-er as a result. So, a facial package seemed like a no-brainer gift for her.

When my year-end bonus came in, I shelled out $500 for a 3-session facial package for Mummy Dearest. Although she loves facials, she always complains that she doesn’t have the time nor money for it. Hence, I bought her the package to “force” her to go. Seeing how happy it made her is definitely worth it, and I’d gladly buy it for her again.

– Lynn, 25, content executive

7. Nintendo Switch & a bunch of games

A Nintendo Switch was something I’d longed for since I was still a student. Once I entered the working world, I knew it was something that I wanted to save up for. Upon getting my first year-end bonus, I splurged not only on the console but of course, a bunch of games to kickstart it all.

My fave was Stardew Valley, a cosy farming game to offset the stress of my job. I also bought a few couch co-ops and multiplayer games to play with my partner and family, and it brought on many hours of chaotic fun.

Now that it’s been many months since I purchased it, I’m a little paiseh to admit that the console has been collecting dust in my cupboard for a while. In the spirit of girl math, it seems that I really ought to play it more often in order to get the most value and ROI.

– Gregory, 23, hospitality assistant

8. Crowdfunding of chemo bills for my colleague’s mother

Image credit: The Cancer Centre

My colleague’s mum had undergone chemotherapy. In order to cope with the mounting medical bills, he had set up a crowdfund online. Without going into the specific amount, I contributed my entire salary for that month, inclusive of my year-end bonus.

This was a colleague I was decently close to, but not super close. But if I’m being honest, I probably would’ve anyhow spent my year-end bonus anyway. When this came up, I figured he needed the money more than I did.

– John, 32, creative executive

Splurge on yourself & your loved ones with Citi ThankYou Rewards

Whether it’s showering the ones we love with pressies or giving ourselves a well-deserved treat, it’s often reserved for the season of giving. We also tend to wait around for external push factors like receiving a year-end bonus, so it helps to cushion the impact dealt to our bank accounts.

The good news is that you won’t have to save all your splurging till EOY anymore, because Citi ThankYou Rewards allows you to offset your purchases any time, anywhere using the Citi Mobile App. This can be done in 2 ways, using Citi Points/Miles:

- Offset new purchases via Pay with Points/Miles

- Redeem merchant vouchers via the Redemption Catalogue on the Citi Mobile App

To make the season of giving even sweeter, Citi has a promo happening from now till 29th February 2024 where you can get up to 25% off when you make a Pay with Points redemption. In short, you’ll be able to offset your purchases using less Citi Points/Miles.

You can also use your accumulated Citi Points/Miles to redeem vouchers via the Redemption Catalogue on the Citi Mobile App. Denominations range from $10-$50 for popular brands and stores including Starbucks, TWG Tea, Jack’s Place, Swensen’s, ISETAN, Takashimaya, and DFI Retail Group (Cold Storage). Consider your gift-shopping and party-planning needs sorted.

Given all the dashing around that comes with the festive season, you’ll be pleased to know that the Redemption Catalogue also has vouchers for Esso and Shell – so you can save on your petrol.

For the uninitiated, a Citi Rewards Card can bag you up to 10X the Points* on purchases, both online and in-store. These Points can then be used to offset future purchases for savings galore. If you’ve yet to apply for a Citi Rewards Card, do so from now till 31st January 2024 to get a bountiful 40,000 bonus Points* as a welcome gift.

To help make your future splurges a lot less of a damper on the wallet, make sure you take advantage of the Citi ThankYou Rewards range of cardholder perks.

*Terms and conditions apply.

Get up to 25% off your Citi Points or Miles redemptions

This post was brought to you by Citi.

Cover image adapted from: IKEA, The Cancer Centre