Best travel e-wallets in Singapore

Suffice to say that we enjoy the e-zy things in life – from e-commerce to travel eSIMS. These digital versions of everyday things and activities make our lives much more convenient and accessible. Adding on to the list of e-somethings are e-wallets, an online solution to those who have the tendency to lose their personal belongings.

These nifty electronic wallets basically provide the same functions as your physical wallet – like storing credit card information and making payments online and physically even when travelling. We’ve rounded up a list of e-wallets available for your consideration, so you no longer have to fumble around with actual cards.

Are digital wallets safe to use?

The digital wallets that are available in Singapore must be regulated under the Payment Service Act, and all e-wallets require a licence from the Monetary Authority of Singapore.

It’s a strict process, and providers are required to submit thorough information regarding consumer protection, cybersecurity, and anti-money laundering policies before they’re awarded a legal licence to offer their services in Singapore. So, long story short, travel e-wallets in Singapore are certified safe to use.

Of course, it doesn’t hurt to be extra wary. You can always check if the e-wallets you use are licensed via the financial institution directory on the MAS website. You can see the licence type and the kinds of services the digital wallets provide.

What do I do if my e-wallet is compromised?

That said, it’s never 100% safe when dealing with digital transactions, so practice keeping track of your own accounts. If you find your e-wallets compromised, freeze or lock your cards, and immediately report all suspicious activities to the customer service team.

Are there hidden fees or charges when using e-wallets?

Most e-wallets do not have hidden fees or charges. Registering for an account is usually free unless stated otherwise or if the e-wallets have multiple plans, like Revolut.

However, you may be subjected to variable charges or transaction fees when sending money or making online foreign purchases. Companies are usually transparent about these rates to customers, and you can find well-detailed information on their websites.

Breakdown of travel e-wallets

| Digital wallet | Best feature | Stored currencies | Transactional fees |

| YouTrip | Free contactless Mastercard | 12, including MYR, JPY, USD, AUD, HKD, EUR | None |

| Wise | Can store & exchange >40 currencies | >40, including MYR, JPY, THB, USD, and AUD | From 0.31% |

| Revolut | Disposable virtual card for one-time online payments | >30; JPY, THB, USD, AUD, EUR | From 0.30% |

| Citibank Global Foreign Currency Account | Can withdraw cash at any Citi ATM overseas | 14; JPY, USD, AUD, HKD, CAD | From 3.25% |

| GrabPay | Earn points with delivery or car rides | SGD & MYR | 2% on foreign transactions |

| FavePay | Get instant cashback | SGD & MYR | From 1% |

| Instarem | Collect miles with every dollar spent | 10; MYR, JPY, THB, AUD, CAD | From 0.4% |

| Apple Wallet | Convenient contactless payment | Depends on your linked cards | None, but depending on the bank or card you’ve linked, charges may apply |

| Google Wallet | Tracks your total spendings |

1. YouTrip

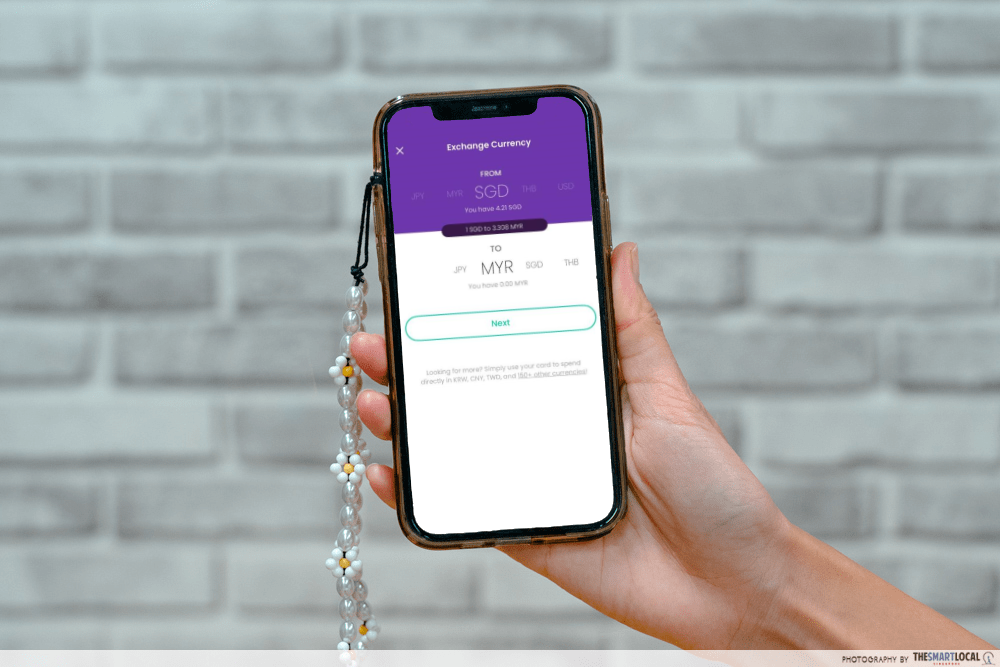

Lock in best exchange rates ahead of time

YouTrip allows you to pay in over 150 countries with competitive rates, zero FX fees, and no hidden charges. You also have the ability to exchange currencies and lock in the best possible rates ahead of time for up to 12 wallet currencies, all conveniently in-app with a few taps on your phone.

Image credit: YouTrip

Singaporeans love this e-wallet for its seamless and convenient modes of payment. Feel free to either tap your physical YouTrip card or add your virtual card via Apple Pay or Google Pay for mobile contactless payments, as well as for online and in-store purchases.

Saving opportunities are also aplenty, as YouTrip has numerous “Perks” partnership deals for its users to enjoy. Their highly anticipated Malaysian Ringgit wallet was recently launched, which means frequent travellers to Malaysia will get to exchange and lock in the best Malaysian Ringgit rates anytime, ahead of their next trip across the Causeway.

In typical YouTrip fashion, you can look forward to exclusive perks to celebrate this launch. For instance, score up to 10% exclusive cashback from now till 17th June 2025 at the likes of JD Sports, Decathlon, CARiNG Pharmacy, and Lotus’s supermarket in Malaysia when you pay using YouTrip.

Full list of countries that support YouTrip.

Sign up for YouTrip.

2. Wise

Store & exchange over 40 currencies including Ringgit

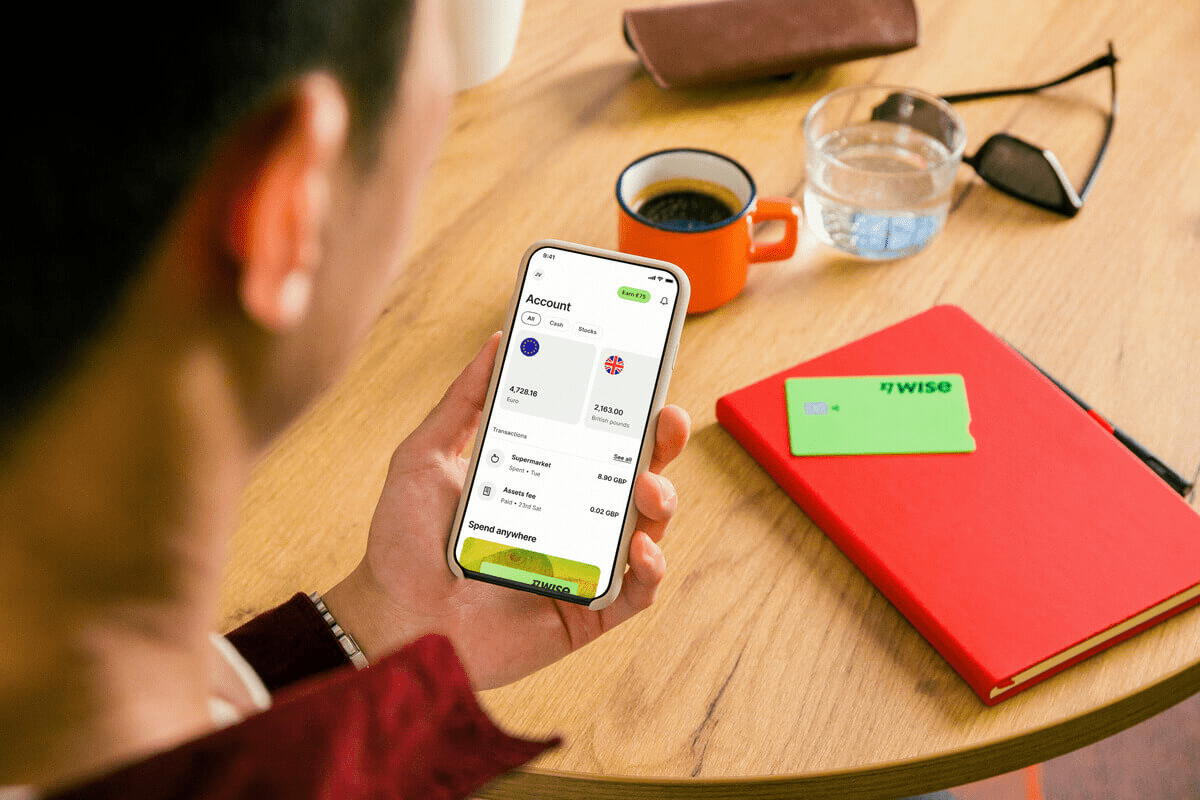

Image credit: Wise

Globetrotters, listen up. Wise allows you to exchange and store over 40 currencies in the e-wallet, including the British Pound, Malaysian Ringgit, Japanese Yen, Canadian Dollar, Thai Baht, and Euro. Aside from these currencies, you can also use Wise to make both online and offline purchases in more than 160 currencies, sans foreign transaction fees.

You’re allowed to make 2 free withdrawals overseas amounting to S$350 each time too. You can also transfer funds to your friends or family overseas in over 80 countries such as Bangladesh, China, India, and Malaysia.

Full list of countries that support Wise.

Download the Wise app.

3. Revolut

Has a disposable virtual card for one-time payments

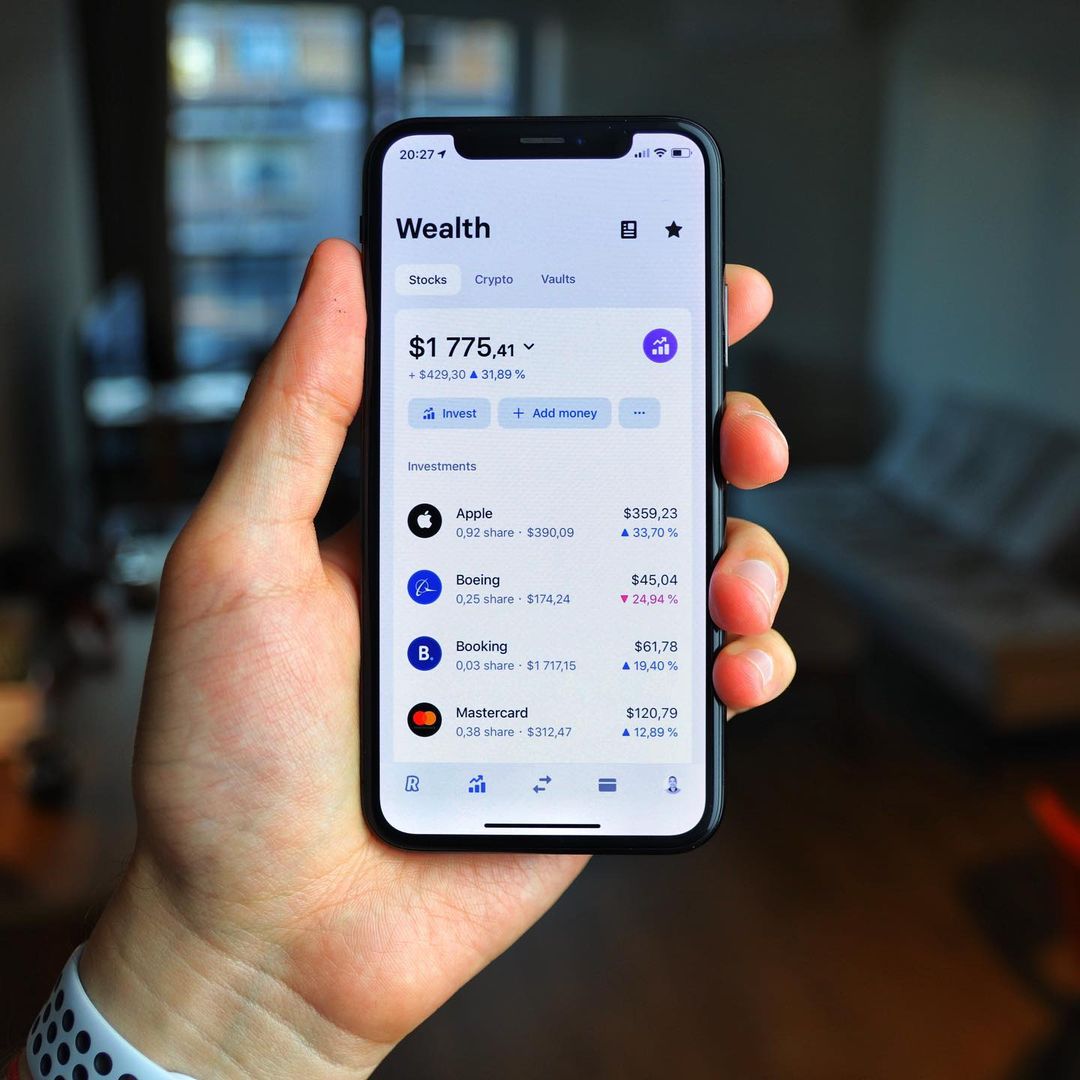

You can also trade stocks and crypto currencies via the app.

Image credit: @benas11 via Instagram

Revolut has 3 tiers – Standard (free), Premium ($9.99/month), and Metal ($19.99/month) – but we’ll focus on Standard. This tier lets you exchange 33 currencies, such as US Dollar, Thai Baht, and Euro, and you can store up to S$5,000/month. The e-wallet also has a budgeting function that helps track and limit your spending, so you don’t go overboard with your shopping.

Speaking of shopping, Revolut has a disposable virtual card which can be safely used when purchasing items online. A unique card number will be randomly generated, and once used, it will be erased from the system forever.

Full list of countries that support Revolut.

Download Revolut.

4. Citibank Global Foreign Currency Account

Insured by government

The Citibank Debit Card.

Image credit: Citi

The Citibank Global Foreign Currency Account is the e-wallet for those who travel a tonne, as you can withdraw cash at any Citi ATM in the world without incurring additional charges. Of course, there’s also the option to transact and exchange 14 different currencies like the Japanese Yen, Australian Dollar, and Euro.

Citibank Debit Card users can also link their card to the e-wallet, and there will be no extra currency conversion costs. The e-wallet is also under the Singapore Deposit Insurance Scheme, in which up to S$75,000 is insured – so rest easy knowing that you’re protected by the Government.

Full list of countries that support Citibank.

Apply for the Citibank Global Foreign Currency Account.

5. GrabPay

Earn points for food delivery & cab rides

If you’re guilty of taking cab rides and getting your food delivered often, GrabPay might help to ease your conscience. When you use the digital or physical card for transactions, you’ll be able to earn reward points which can be redeemed via the app.

Additionally, plenty of hawkers and smaller merchants now accept GrabPay as it has lower merchant fees as compared to credit cards, so this form of payment is always handy to have. If you have other friends using GrabPay, there’s also the option of transferring GrabPay credits to them too.

Full list of countries that support GrabPay.

Download the Grab app.

6. FavePay

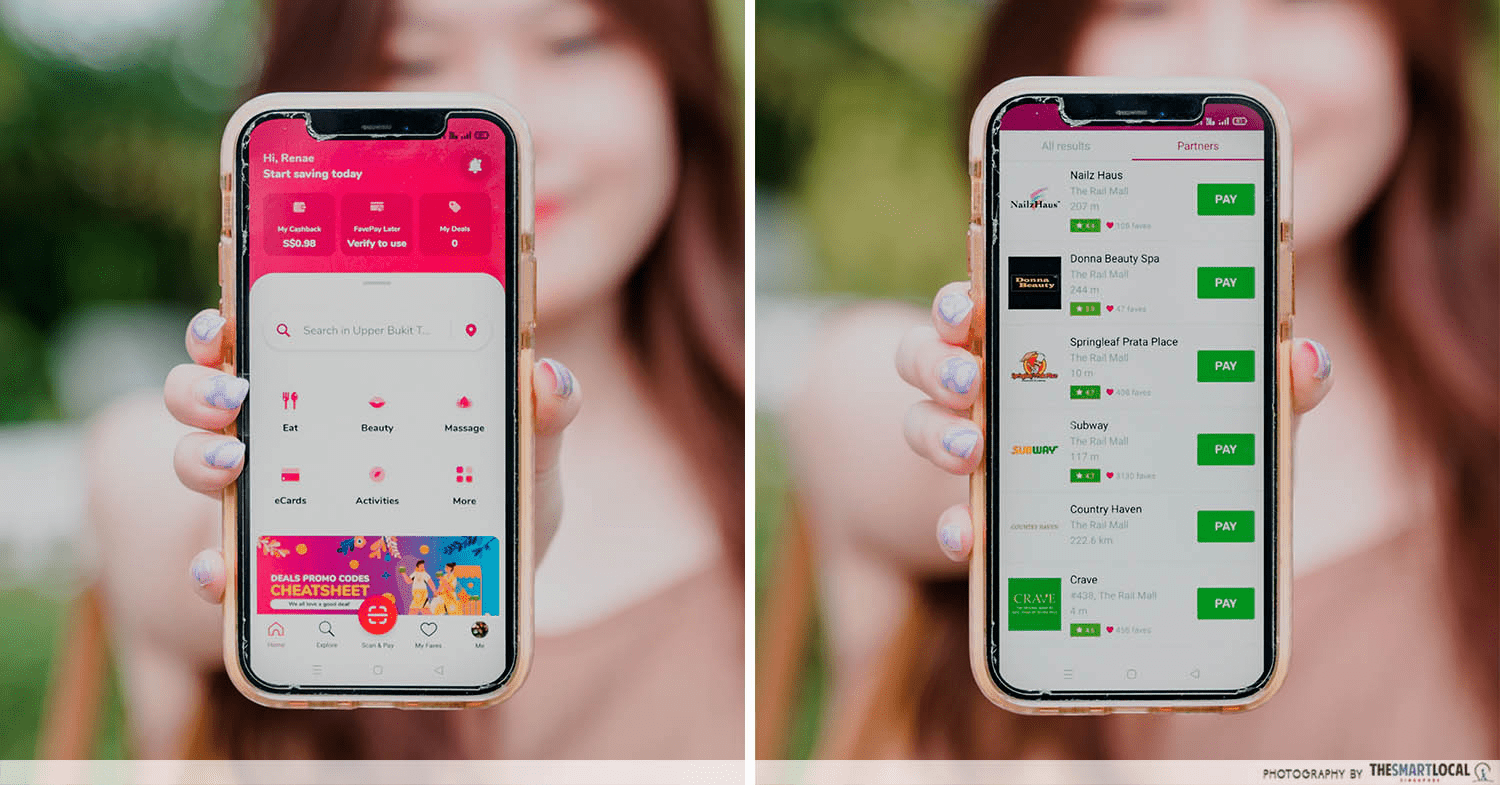

Get instant cashback

FavePay can be used in Singapore and Malaysia.

For those who travel to Malaysia constantly, consider jumping on the FavePay wagon. It’s commonly used in both Singapore and Malaysia, and you can link all debit and credit cards – including GrabPay – to your account. Those based in Malaysia can also receive online transfers from banks such as Maybank2u, OCBC Bank, and RHB Now.

Another reason why FavePay is such a fav is the instant cashback you can earn. Purchases from retail, F&B, and even entertainment merchants gets you up to 20% cashback – yes, 20%. Just think about how many bubble tea drinks you can redeem with that.

Download the Fave app.

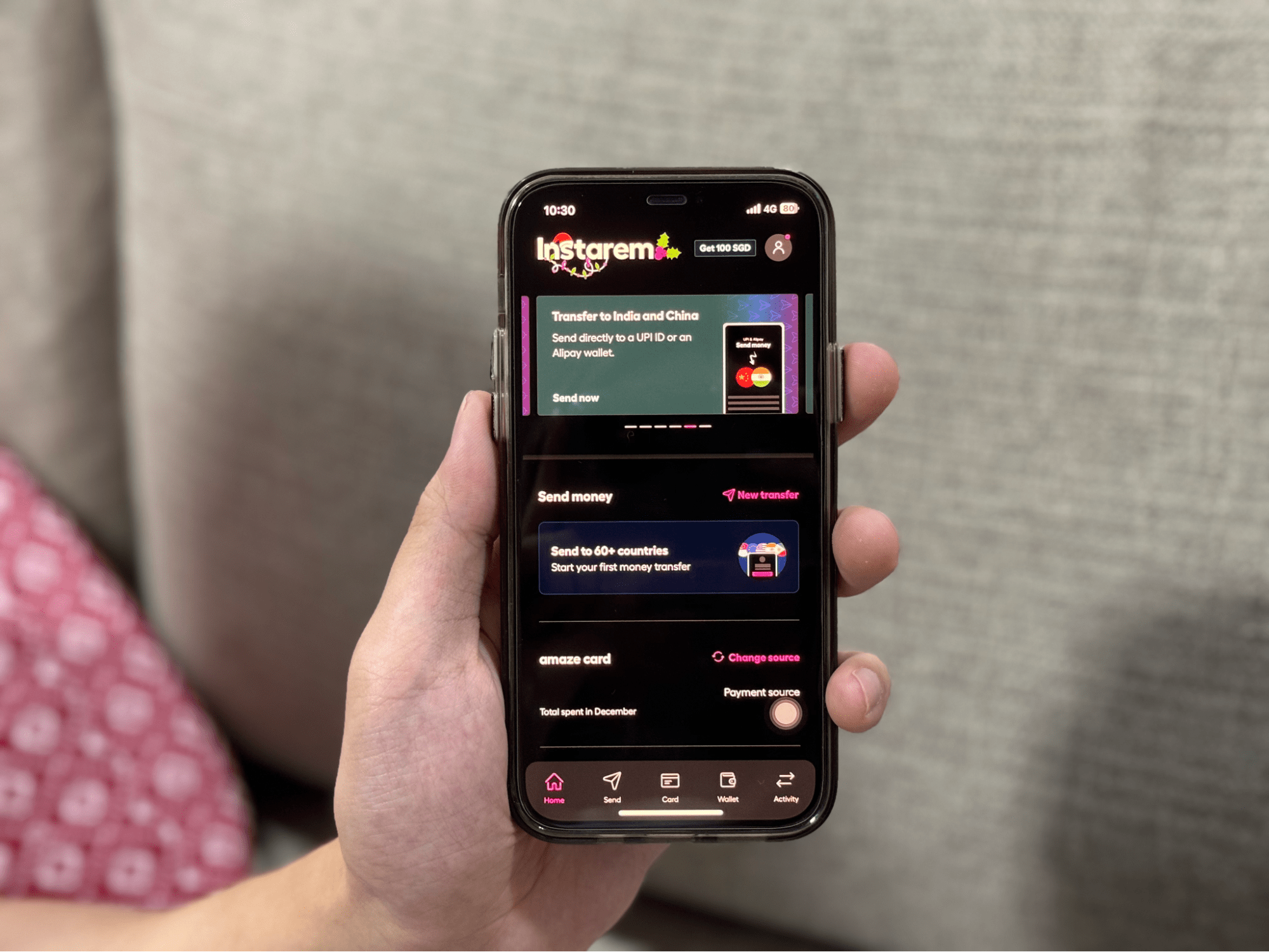

7. Instarem

Collect miles for every dollar spent

Image credit: Joash Khoo

You don’t have to be a frequent flyer to rack up miles. Every dollar spent with Instarem earns you miles, as long as you link an air miles credit cards such as the UOB Lady’s Card or Citi Premier Miles Card.

Otherwise, you’re free to add up to 5 debit and credit Mastercards to this e-wallet. You’ll earn InstaPoints when you make overseas transactions, and these points can be redeemed for cashback. P.S. there isn’t any foreign transaction costs, so feel free to go ham.

Full list of countries that support Instarem.

Sign up for Instarem.

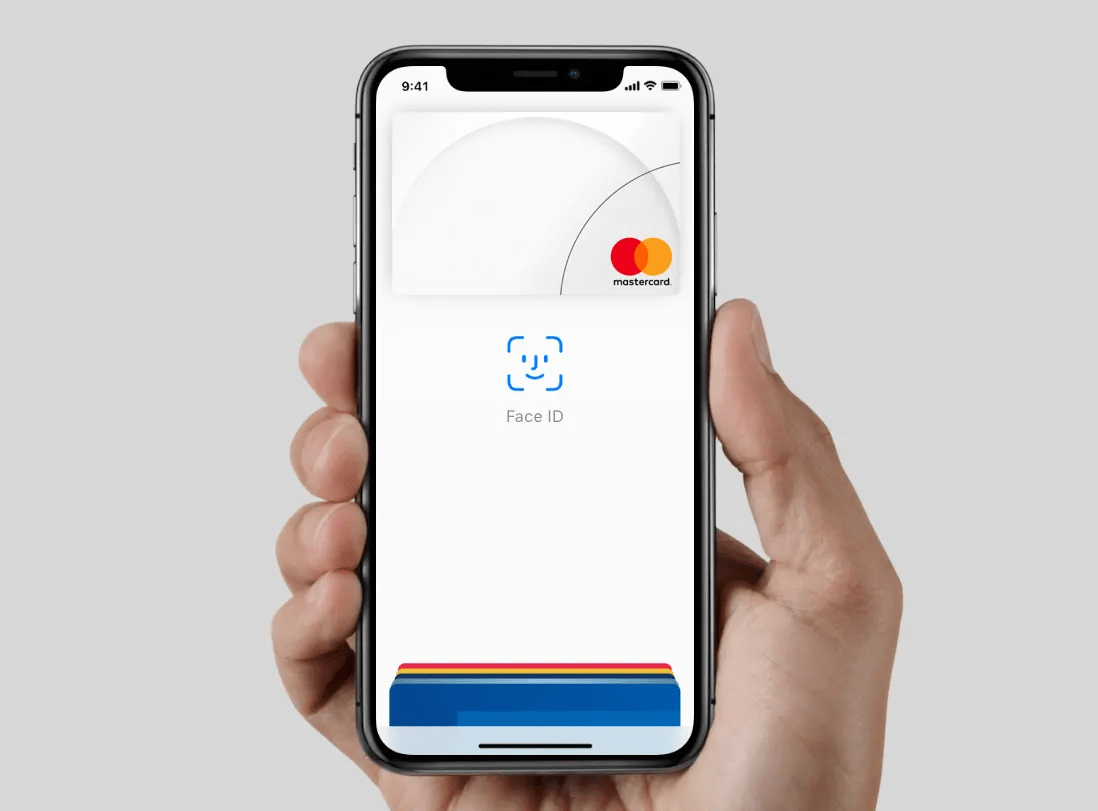

8. Apple Wallet

Convenient sign-in with Face ID

Image credit: Apple

You’re either on team Android or team Apple. For those in the latter group, you’ll probably be familiar with Apple Wallet, the in-built app. You can link up to 8 cards, and it’ll save your details and pre-fill the information when you checkout online. It also stores other items like flight tickets, gift cards, and digital car keys which are defo useful.

For those worried about privacy issues, Apple has explicitly stated that it will not track your transactions – but it’s ultimately on you to protect your personal information. To log in and access your cards, simply use Touch ID or Face ID. No typing of passwords needed which is super convenient for on-the-go purchases.

Full list of countries that support Apple Pay.

9. Google Wallet

Rounds up your total spending

On the other hand, we have Google Wallet. Think of it as the Apple Pay counterpart, with similar functions including the ability to save and pre-fill details when you’re making online transactions. It’s also where you can store plane tickets, e-coupons, and loyalty cards.

Google Pay on iPhone.

Image credit: Joycelyn Yeow

Under Google Wallet is Google Pay – and don’t let its name fool you as this app is available for both Android and IOS users. You can send money to your pals, track your expenditures, and even search for deals on the app.

Full list of countries that support Google Wallet.

Download Google Pay on App Store and Google Play.

Download these e-wallets to make your life e-zier

It’s time to join the digital age, people. If you haven’t already converted to an e-wallet, let this be your sign. The next time you’re out with your friends or travelling with your family, you can conveniently whip out your phone and make payment.

More life hacks:

- What to do in a flood

- Emergency hotlines in Singapore

- Common cooking misconceptions

- Google slides hacks

This article contains partial partnership content. However, all opinions are ours.

Cover image adapted from: Wise

Last updated by Renae Cheng on 2nd May 2025.