Tips to grow your savings

Growing up, we’ve always heard the same advice when it came to money: “Save your money for a rainy day! Save your money for retirement!” However, the bad news is that squirrelling away your money into a bank account isn’t wise, because the interest rate that you earn on your savings account will never beat the inflation rate over time.

According to Trading Economics, Singapore’s inflation rate in the last decade averaged 1.5%, between 2011 to 2020. Between March to June in 2021, the inflation rate averaged 2.05%. That’s pretty high considering the interest rates that normal savings accounts are earning.

As such, there are much better ways to make your money work for you, and with better results! Here are five better uses of your savings, rather than leaving it in the bank.

Disclaimer: While we’re suggesting five different avenues for you to park your money to beat inflation, it is important to keep an emergency fund in a bank account that can be accessed readily. A common rule of thumb is to have between three to six months of expenses in cash as an emergency fund.

All investments would naturally carry some form of risk. As such, if you’re unsure on what to invest in, please speak to a financial advisor who would be able to advise you better on various investment products and how to understand them. For this article, we’ll be taking reference to a popular personal finance rule called the 50/30/20 rule. In short, this principle allocates 50% of your take-home income for needs, 30% for wants, and 20% for savings.

Annual earnings if you leave savings in a bank

Looking at basic savings accounts from various banks in Singapore, interest rates vary from a basic 0.01% to 3%. And in order to achieve that higher tier interest rate of 3%, you might have to jump through hoops of criteria. For example, crediting your salary, spending on that bank’s credit card or investment products.

Assumption

To compare if other uses of your savings are better than leaving cash in your bank, we are going to assume an investment of $10,000 in an average savings account.

Taking the rate at an average of 0.8% interest per annum, that means you’ll get a yearly return of $80.

Now, let’s check out alternatives.

1. Invest in the market through individual brokerage accounts

One of the best ways to earn a higher return on your money would be to invest in the broad stock market, through low-cost brokerage accounts. If you invest in the market over a long period of time, you would generally see steady growth in your savings.

According to Goldman Sachs, US stocks have averaged 10-year returns of 9.2% over the past 140 years. Closer to home, the Straits Times Index has also matched an average annualised return of 9.2% ending 2019. That’s way higher than the 3% you could possibly get in a savings account.

If you prefer a low-risk approach, consider investing in an Exchange Traded Fund (ETF), which is basically a broad basket of stocks in a sector. ETFs provide diversification of your investment into many different companies, instead of concentrating your money into one single company.

For example, if you were looking to invest in ETFs listed on the Singapore Exchange, some popular ones include:

- The Straits Times Index (STI) – the top 30 companies listed in Singapore, such as DBS and Capitaland, which has had an annualised return of 6.47% in the last five years

- The SPDR S&P 500 ETF – the top 500 US companies, such as Google and Facebook, which has had annualised return of 17.48% in the last five years

If your risk tolerance is higher, you can consider investing in individual equities instead, but be sure to do your due diligence and research before buying into a company.

Some are great dividend stocks that distribute regular monetary payouts (i.e. dividends) to its shareholders, whereas others are better as growth stocks that do not pay dividends but have immense room to grow in price over time.

Pro-tip: If you open a Supplementary Retirement Scheme (SRS) account with your bank to invest in the market, you can ‘double dip’ with your money. Contributing money to your SRS account also earns you income tax relief (capped at $15,300 per year).

However, note that you can only withdraw your money at 62 years old, and you cannot use your SRS funds on low-cost brokerages (you’ll have to use your bank’s brokerage).

Possible returns: Assuming you invested $10,000 in the SPDR S&P 500 ETF, you would have seen a year-to-date return of a whopping 15.15% this year, earning you a profit of $1,515.

Difficulty level: 4/5

Risk: Moderate

2. Invest through a RoboAdvisor

If you are relatively new to investing or would like to spend minimal effort in picking stocks or ETFs, try investing through a RoboAdvisor, such as Syfe or Stashaway.

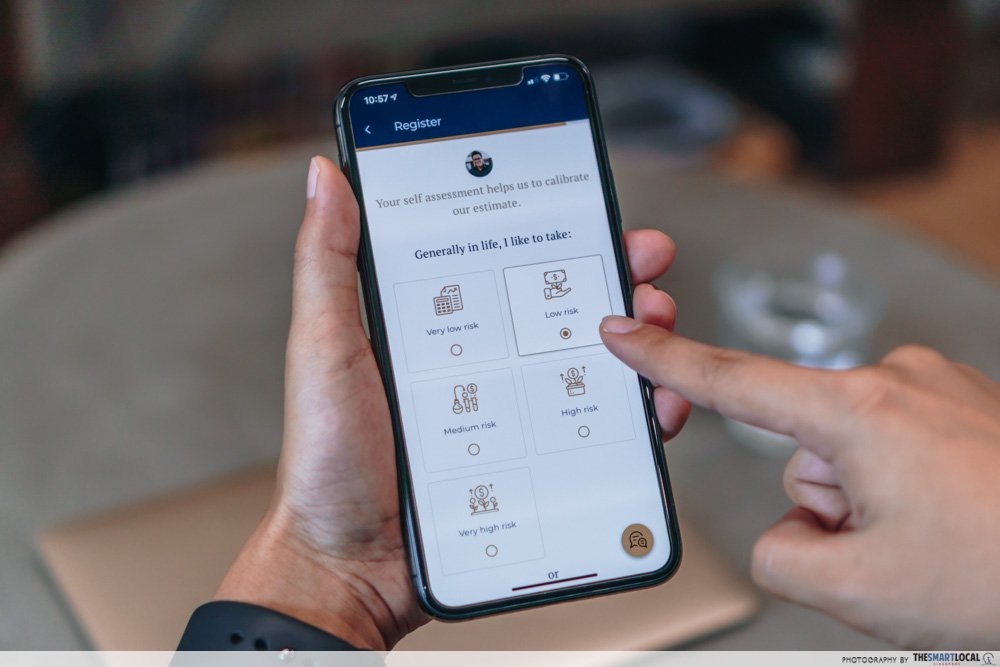

RoboAdvisors are automated accounts that invest in the stock market via predetermined algorithms calibrated based on a client’s risk profile. In addition, they provide access to a team of financial advisors for customers to consult on what is the best option for them, all in exchange for a small management fee.

Investing is relatively straightforward and hassle-free: simply open an account with a RoboAdvisor, fill out an assessment of your risk profile, and then deposit money with them. You can also arrange for automatic regular deposits from your bank account, which is a popular investing approach called Dollar Cost Averaging.

Once you’ve done so, you can actually just forget about it (but be sure to regularly check in every now and then!) and allow the power of regular contributions and compounding interest to grow your money!

Possible returns: Using Syfe as an example, $10,000 invested in their Core Defensive (lowest risk) portfolio will earn you an average annual return of 5.06%, or $506. For their Core Balanced (moderate risk) portfolio, you will earn a return of around 7.5% or $750, and their Core Growth (higher risk) portfolio will earn you a return of 11.37% or $1,137.

N.B. All returns were based on Syfe’s data on average annualised return in the past eight years.

Difficulty level: 3/5

Risk: Low – Moderate (depending on the risk you allocate to your portfolio)

3. Voluntarily top up your CPF Account

Most people may not know that your CPF account is actually a great vehicle to grow your money given its relatively high and fixed interest rates, and that you can voluntarily top up your own account for retirement.

There are three ways to contribute to your CPF with cash:

- Contribute to your Medisave Account only

- Contribute to all three CPF accounts (based on CPF’s distribution rate)

- Contribute to your own (or loved ones’) Special or Retirement Accounts (RA)

Your Ordinary Account (OA) earns you a respectable 2.5%, and your Special (SA) and Medisave (MA) Accounts earn you 4%, all of which are guaranteed fixed returns, unlike the stock market. Thus, having regular contributions into your various CPF accounts can significantly build up your retirement nest egg!

However, it’s important to note that contributing money into your CPF means that you won’t be able to take it out until you hit the CPF withdrawal age of 55, or for special purchases, such as using your OA to purchase a home.

As such, we would recommend thinking through how liquid you need your savings to be for short- to medium-term purchases (e.g. car, or starting a family, etc.) before contributing money to your CPF.

Pro-tip: Similar to the SRS account, you can ‘double dip’ by voluntarily topping up your retirement sum in your CPF. For instance, making contributions to either your SA, MA, or RA will grant you tax relief.

You can also open a CPF Investment Account to utilise your OA funds to invest in the market, although note that you can only invest in Singapore stocks.

It’s also important to carefully assess how your money is used. Given that your OA earns you a guaranteed 2.5%, use that as a target. If your investments cannot return more than 2.5%, then perhaps it would be better for you to just keep your money in your OA.

Possible returns: Taking reference from the lowest interest rate of 2.5% in your OA, a $10,000 contribution would earn you $250. The higher rates in your SA and MA (mainly used for either retirement or medical expenses) would earn you $400 for every $10,000 vested.

Difficulty level: 1/5

Risk: Low

4. Save in a higher-yield fixed deposit account

If you do not need the money in the foreseeable future, one other avenue for you to earn a higher interest rate on your savings would be to park them in a fixed deposit account.

Fixed deposit accounts usually offer higher interest rates based on two factors: (1) the amount in the account; and (2) the length of the lock-in period. The usual minimum initial deposit is $10,000, with a minimum lock-in period of six months.

As the name suggests, you would have to lock your funds in the account for the predetermined period, and you would be unable to withdraw your money until the lock-in period expires. Withdrawing early would usually incur a penalty, such as either forfeiting any returns you’ve made on your money or having to pay a fee.

This is not recommended if you need this amount in the next three to five years for any large purchases.

Possible returns: Assuming you deposited $10,000 for a lock-in period of one year, the average interest rate you will earn is around 1.15%, resulting in a return of $115.

Difficulty level: 1/5

Risk: Low

5. Invest in yourself

Assuming you have additional funds after allocating money for your savings and without many commitments, why not invest in yourself? While the payoffs are not immediate, investing in improving yourself, can arguably lead to better returns in the future.

You could even sign yourself up for a video production course with your SkillsFuture credit

For instance, learn a new skill to complement your working experience. Having additional skills increases your value proposition to employers, which could lead to more responsibilities for a higher salary or better job opportunities.

It doesn’t necessarily have to be in job compatible skills either. Investing in a hobby in order to grow your expertise in the subject can have its returns. You could always monetise your hobbies by turning them into a side hustle.

In line with the government’s initiative to encourage more Singaporeans to upgrade themselves, there are provisions such as SkillsFuture to help Singaporeans offset the cost of courses and programmes to learn new skillsets. Upgrading yourself might generate great returns in the future for you.

Savings tips for investment & wealth growth

Investing your savings isn’t just for the rich. While some do make large profits off investments, that is not all wealth growth is for. It is a way to make your money work for you in order to beat inflation rates and retire comfortably.

With various risk tolerances available in investment options, you don’t have to put all your eggs in one basket either. Again, the 50/30/20 ratio is a recommended rule of thumb to start with, even for those who are risk-averse.

The rewards may not be as immediate but the benefits will be right there waiting for you once you need them.

Check out our other articles on finance: