Getting a car in Singapore

There are 2 types of people in Singapore. The folks who know how many MRT stops there’re from Somerset to Yishun – 10 – and those who’re familiar with where the cheapest parking spots are in Orchard or places to get free parking in Singapore.

For everyone who has considered getting a car in Singapore, the question remains: is it worth it to jump camp to the latter? After all, there’s rising COE, the increasing connectivity of public transport and many cab or ride-sharing options out there.

Yet, not many can resist the siren call of a sleek Porsche or the convenience of having your own drive on the road. No matter, we’ve done the math to help you evaluate if getting your own car trumps that of taking a cab everywhere.

Note: This is meant to be a general guide only, and is not meant to be representative of all cases.

Table of Contents

Average cost of getting a car in Singapore

With the massive variety of cars in Singapore, how on earth are we gonna come up with an “average”, you might ask?

Seeing how we can’t ask the entire driving population how much they spent on their cars without being as annoying as a CNY relative, we’re projecting for a debatably average Joe scenario. Literally.

COE, purchase fees & monthly costs

Here’s the scenario.

Joe is a mid-20s CBD worker who drives a Honda Civic from Tampines to work in the CBD every day. He also drives out to places twice a weekend – probably cafe-hopping or dates with his family or girlfriend.

We’re choosing a Honda Civic here as it’s one of the most popular cars in Singapore.

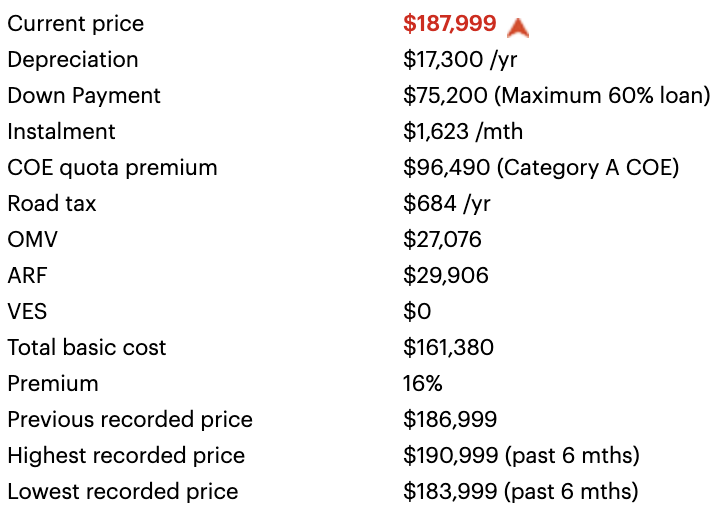

Total cost of the car upfront, including COE for Cat A* (COE: $96,490) will be around $187,999.

This also includes road tax, OMV (Open Market Value), registration fees, and VES (Vehicle Emissions Scheme) among other duties and charges.

But all that is when you first get the car. When comparing, we’ll be looking at a rough estimate of how much it’ll cost Joe monthly to own the car.

Car Loan

Screenshot from: SGCarMart

As the OMV for the Honda Civic is above $20,000, that means you can get a maximum 60% of the price for a car loan. That leaves 40% – or $75,199 – as down payment, and a monthly instalment of $1,380 per month, considering an interest rate of 2.78% over a loan term of 7 years.

Total monthly cost: $1,380

Road tax

Road tax is something you have to pay, regardless of how much you drive your car around. This varies according to the vehicle’s engine capacity, age and fuel scheme. In Joe’s case, this will be $684/year.

Total monthly cost: $57

Parking

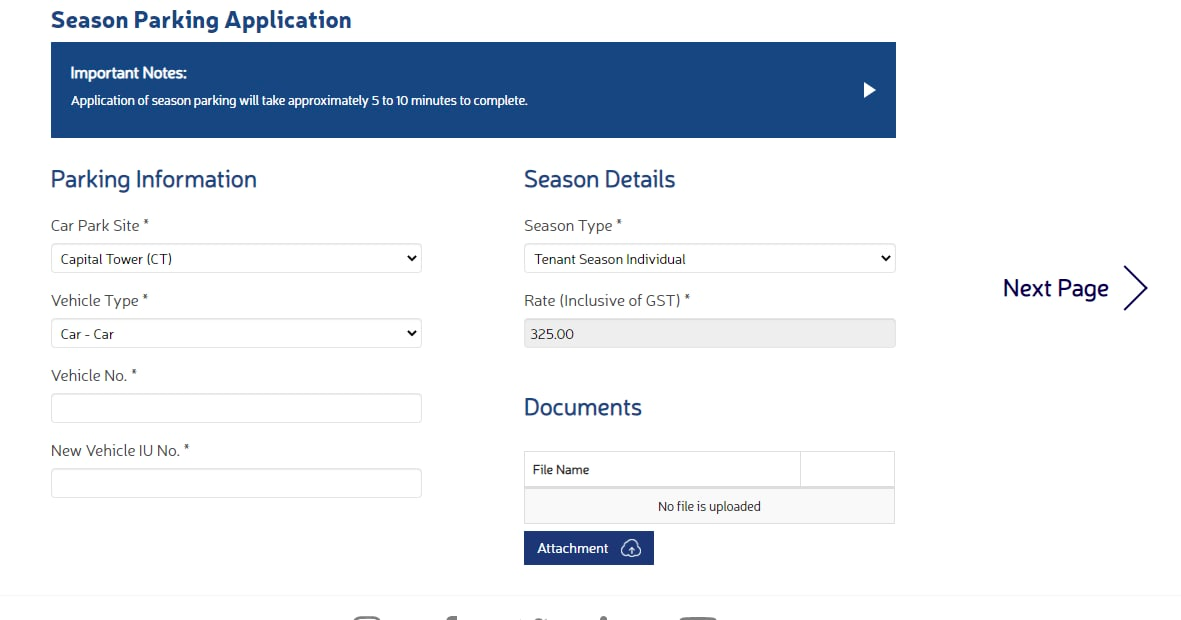

Since our guy stays in Tampines and probably parks his car in a HDB estate, his season parking for that can go up to $110. Let’s assume that his company is covering the cost of office parking (lucky fellow!)

Note: Some offices do not offer free parking, so you have to top up for monthly season parking. This can be a few hundred bucks, but we’re leaving it out of the equation to keep costs as low as possible.

Image credit: HDB

As for the weekends, if he lounges for around 4 hours at a Tiong Bahru cafe on Saturday morning and spends the entire Sunday at Orchard Road, that would cost around $5 and $5.50 each (for Tiong Bahru Market and one-time entry at Orchard Hotel Singapore). We’ll take this as an average cost for his weekends.

Total monthly cost: $110 + 4 x ($5+$5.50) = $152

Petrol

The distance from Tampines MRT to 30 Raffles Place (formerly Chevron House) – Joe’s hypothetical home and workplace – is around 20km. That’s 40km to and fro for each weekday. His weekend jaunts will clock up a total of 76km. That’s about 39.43km/day – around 1182.9km/month.

A Honda Civic’s full tank is around 50 litres, and at a fuel economy listed at 16.6km/L, that theoretically should allow you to travel a good 830km before you hunt down a petrol station.

The current cost of a litre of petrol in Singapore right now is about $2.84. A full tank of 50 litres would thus be $142.

Total monthly cost: (1,182.9/830) x 142 = $203 (rounded up)

ERP

Image credit: Kalleboo

ERP rates were last updated in September 2024. We’ll estimate an average of $3 per entry and exit, leading to around $120 monthly, if we take it as 20 weekdays applicable in a month.

Total monthly cost: $120

Servicing

It costs between $200-$500 to service a car for every 10,000km driven. Seeing as Joe drives 1182.9km/month, he’ll have to service his car roughly every 8 months. Over the course of 10 years, the car would be serviced around 15 times, costing about $5,250 in total. This comes up to be around $43.75/month, but we’ll round it up to $45.

Total monthly cost: $45

Insurance

Looking at car insurance providers like NTUC Income, MSIG , FWD and more, annual premiums for yearly insurance ranges from $800+ to just over $1,000. Averaging it out, that would be around $994 annually.

Total monthly cost: $82.80

This is the total table summary of all the monthly ownership costs:

| Monthly Payment | Regular | Red Plate |

| Parking | $152 | $32 |

| Petrol | $203 | $50 |

| ERP | $120 | $48 |

| Servicing | $45 | $45 |

| Insurance | $82.80 | $70.40 |

| Road Tax | $57 | $15.33 |

| Car Loan | $1,380 | $982 |

| Total | $2,040 | $1,243 |

*As of September 2024. Prices are subject to change.

How prices were deduced:

- Parking: extrapolated from Joe’s lifestyle

- Petrol & ERP: Prorated for 8 days a month

- Insurance: 15% off for red plate

Other scenarios of getting a car in Singapore

Yes, yes, we hear your protests. “You can choose a cheaper car, what?” or on the other spectrum, “I don’t drive around that much, please.”

To clarify, the above is just one scenario. Some other permutations:

What about getting a cheaper car?

If we were to choose the cheapest possible option in the new cars for sale category as of September 2024, that would be the Suzuki Swift Mild Hybrid going for $133,800 including COE. That’s a monthly installment of $982, and assuming the other monthly costs remain generally the same, the lowest you can go will be in the $1,642 range.

What if I don’t drive to work and only use it on the weekends for family or outings?

Ah, the red plate scenario – aka you’ll only drive your car during weekends or off-peaks. That would be:

- 7pm-7am (next day) on weekdays

- Full day on weekends

With off-peak vehicles, you’d pay lesser road tax versus regular vehicles. You would also get a rebate of $17,000 that can be used to offset the initial purchase price.

According to a friend who uses a off-peak Honda Jazz vehicle, his road tax is $184 per year versus the regular $684/year – a discount of $500. You’d probably also save on petrol, ERP and parking costs.

If we’re talking about Joe’s lifestyle habits (weekend only), that pulls down the monthly car owning bill to $1,243.

Note: See table above for calculations.

Hailing a PHV ride everywhere in Singapore

Now that we’ve sorta have a grasp on the monthly costs of getting your own ride in Singapore – what if you took a cab everywhere instead?

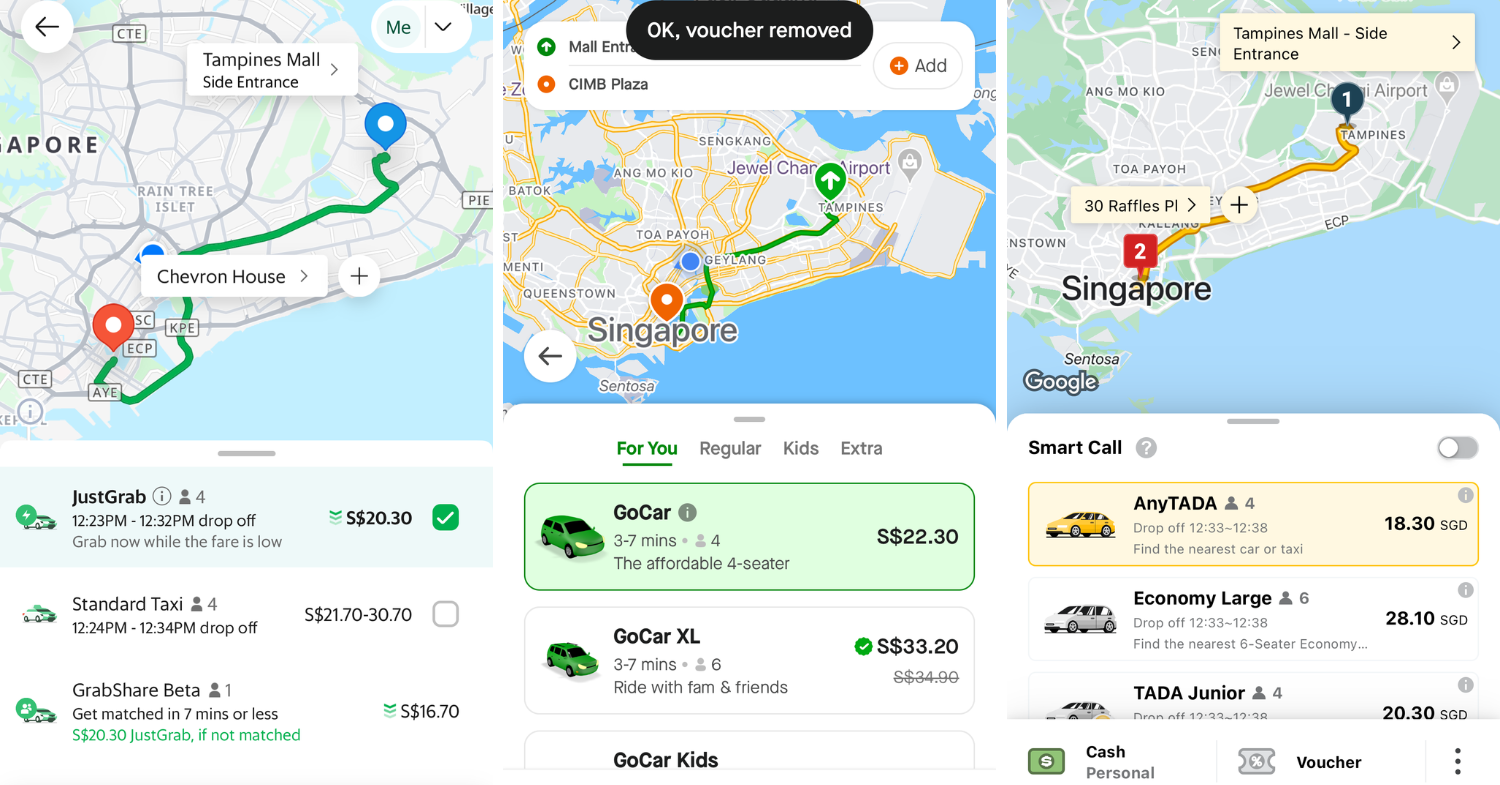

Let’s just go with the ol’ average Joe scenario above. A private hire vehicle (PHV) ride from his home at Tampines Mall to his workplace at 30 Raffles Place would cost an average of $20.30, based on fares shown on Grab, Gojek, and Tada. This also assumes he has a flexible WFO arrangement and manages to book a car during off-peak timing.

Grab, Gojek, and Tada.

To and fro, 5 days a week. That’s $812 per month for weekday commutes. Assuming this guy is a creature of habit and takes a PHV to and from a Tiong Bahru cafe ($21.80 each way) every Saturday, and Orchard ($22.80 each way) every Sunday, it’ll cost him $89.20 every weekend or $356.80 a month in PHV rides.

Total monthly costs:

$812 + $356.80 + = $1,168.80

Verdict

At a glance, here’s how the monthly bill of the various options looks like:

- Regular car ownership (Honda Civic): $2,040

- Cheaper car model: $1,642

- Red plate: $1,243

- PHV rides: $1,168.80

With the same Joe scenario, hailing a PHV is generally cheaper than owning your own car. That’s even taking into account how unlikely it’ll be for you to take Grab cross-island to and fro for every single workday, when there’s a wealth of public transportation options that allow you to skip the jam.

So, TL;DR – no, it generally isn’t worth it to get a car if you’re just basing it on monthly expenses. But getting a car can still be worth it if you’re looking at it in more intangible terms – such as convenience or or as a status symbol.

For instance, you might be willing to pay more for the convenience if you have a family and want to drive them around frequently, or need to drop kids off at school, or if you’ve elderly folks who are less mobile. Some highly mobile jobs such as sales could also necessitate getting a car to meet up with clients all over the island.

However, if you don’t, our public transport system might well suffice – especially considering the extensive MRT developments slated for the future. You might also get in slightly more exercise by walking as opposed to hopping in your ride, say, after a heavy meal.

That doesn’t mean we’re discouraging buying a car, as factors might vary for you. So, if your dream car is still calling out to you, consider getting a ride second-hand from Carousell to shave off the bill slightly or wait it out till COE prices plunge yet again. Some resources here:

Last updated by Raewyn Koh on 18th September 2024.