Myths about investing in funds

Investing is one of those topics that start to dominate dinner conversations when we reach adulthood. And for all the talk about passive income and planning for retirement, it’s understandable if you have some reservations about the whole process, especially if you’ve heard stories about people losing their life savings due to FOMO.

To help assuage your concerns, we debunk 7 myths about investing that will put your mind at ease so you can get started on the road to financial independence.

1. It requires a lot of capital to start

Unless you were born with a silver spoon in your mouth, chances are you don’t have a large amount of money to start investing with. Requiring a lot of capital to buy your first stock or fund is a common misconception that many people have. Instead, the key is to start early and be consistent with your investments.

Many brokerage platforms like moomoo have no minimum deposit required, which means you can start investing from as low as $10 a week and slowly build it up from there.

2. You need to wait for the right time to get into it

One mindset that plagues many newbies is buying only when the price of the stock is down. “Time in the market beats timing the market,” is a quote often said by industry experts and much of the community on Reddit. After all, the odds of you buying a stock at its lowest is slim – what happens if you think it’s at the bottom and it drops even further?

Rather, this is where you can use the dollar-cost averaging method, a strategy where you invest a fixed amount over regular intervals, regardless of price.

For example, you have a budget of $100 to start with. Every week you buy $10 worth of the same stock whether its price is up or down. In the end, you would still have invested the same amount without worrying about the volatility of the market.

3. The more stocks you own, the more diverse your portfolio is

Don’t put all your eggs in one basket. Or in this case, a bowl.

Whenever someone starts investing, one piece of advice they’ll never stop hearing is to diversify your portfolio. Yes, that should absolutely be the case where you don’t put all your eggs in one basket, and that includes spreading out your investments across various markets and securities, not just one.

Instead, think big and spread your wealth beyond penny stocks into real estate investment trusts (REITs) and other commodities like exchange-traded funds (ETFs) and bonds.

4. You need to closely track your investments all the time

The stereotypical image of a trader is someone staring at 6 monitors displaying an array of graphs and numbers for the whole day. But contrary to popular belief, casual traders like me and you aren’t required to do that at all. Consuming too much information might be detrimental as the slightest dip might make your anxiety spike, especially if you see a sensational headline.

However, as long as you’re in it for the long haul and you’ve invested in a stable ETF like the Straits Times Index, put down your phone and go do something rather than freaking out over a 1% change. It’s perfectly normal for prices of your investments to rise and fall throughout a single day.

5. Popular companies and hype are the trends you should follow

You’re not alone if you started your investing journey searching up the prices for popular companies like $AAPL and $TSLA. But just because these stocks are from popular and successful companies, it doesn’t mean that they’ll perform like you want them to.

Take General Electric for example. The American company’s stock value boomed in the 1990s thanks to trends and the economy. Then its glamour faded and its price started to slump while funds like the S&P500 soared year on year. It performed so badly that it was removed from the Dow Jones Industrial index.

This is a cautionary tale on not jumping on the FOMO bandwagon just because you saw a viral TikTok video on a particular investment. Always do your own research and have an exit strategy in case this goes awry.

6. Investing is a get-rich-quick scheme

There’s no shame in admitting that you want money, and investing is one way to pad your bank account without having to take up a second job. However, the last thing you should do is go into it thinking you’ll be a millionaire by tomorrow. Investing is not a get-rich-quick scheme.

Rather than pump all your savings into a commodity that’s just riding a hype train, practice patience and invest responsibly. Plenty of retirees who invested early will be glad to tell you about the benefits of compounding gains, a concept where your earnings are reinvested to see your principal increase over time.

7. You should invest in your early 20s-30s

If you haven’t already started investing, you might feel as though it’s too late to begin. That couldn’t be further from the truth. All you have to do if you’re only investing your first dollar in your 40s would be to adjust your investment approach.

You’re most likely to have slightly more spending power compared to when you were younger, meaning you can invest a little more every week or month. This might help make up for lost time.

Sure, the earlier you start investing, the better your profits will be at the end of the road. That doesn’t mean you just give up and leave your money in the bank to stay stagnant.

Common myths about investing debunked

Investing can be quite a daunting endeavour, especially if you’re unfamiliar with all the cheem investing terms that the pros throw around coupled with any fears that you might have about it. With these 7 common investing myths debunked, you hopefully are less wary than when you first started reading this article.

And if you’re ready to dip your toes into it, you can get the ball rolling with the investment trading platform moomoo. The platform allows you to invest in funds like the local Singapore Straits Times Index and other global index funds like the S&P 500.

Since you can get them in smaller denominations, the barrier of entry is more accessible compared to more costly stocks like $AAPL. The minimum amount required to invest in money market funds is S$0.01, while the minimum amount required to invest in non-money market funds is S$100.

Some other popular funds you can consider to diversify your portfolio include the BGF World Energy Fund which has seen returns of over 40% over the past year, or the Neuberger Berman US Real Estate Securities Fund which is up over 27% over the past year.

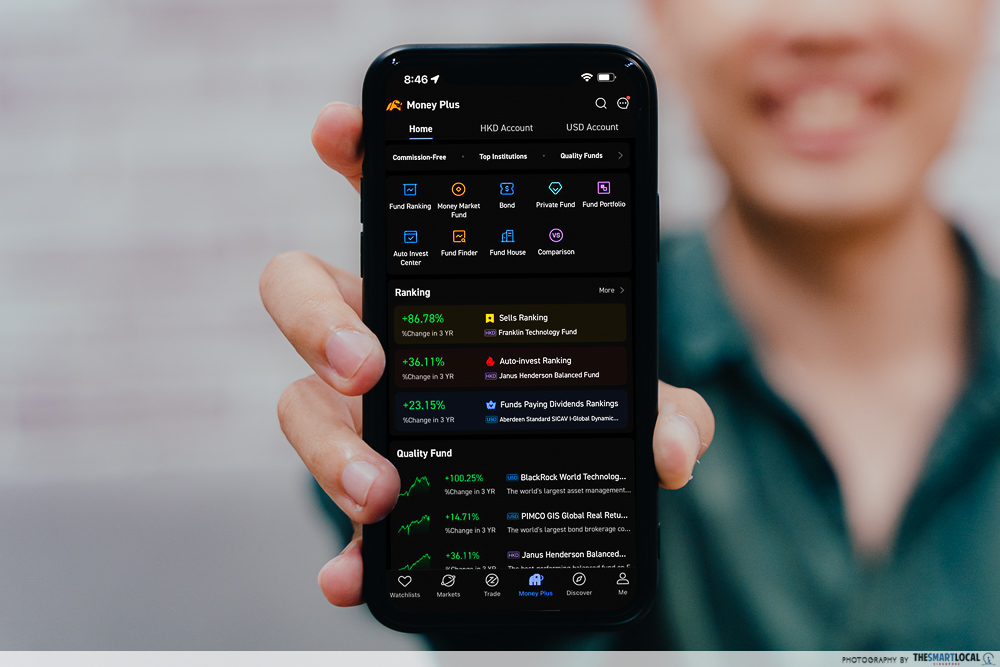

The Money Plus tab on moomoo has all you need to know about investing in funds.

All the funds supported by moomoo can be handily accessed via their app under the Money Plus tab. Here, you can find over 60 equity, bond, dividend, and balanced funds ranging from 20 asset managers.

To sweeten the deal for new retail investors, moomoo is also running a welcome promotion where you pay no fees when investing in funds. From now till 31st May 2022, all the money you can save from the fee-free investments can be turned around into more investments too.

New moomoo users can also complete certain tasks to score rewards like a fund cash coupon worth $8.80 and a stock cash coupon worth $5.80. Once all the tasks are successfully checked off, you’ll also get rewards including 1,500 points to their rewards club and a fund cash coupon worth $18.

And if you decide to take the next step and sign up for a FUTU Singapore securities account, you can stand to enjoy a myriad of perks. Think lifetime commission-free trading and free platform fees for 1 year for the US stock market*, a stock cash coupon worth $10, a fund cash coupon worth $30, and free access to stock market data from select countries.

The promotion for new FUTU Singapore securities account holders is only valid from now till 30th June, so don’t wait till the last second to open your account, otherwise you won’t be able to score this deal.

Find out more about trading & investing with moomoo here

This post was brought to you by moomoo trading platform.

Photography by Loo Jie Ling.

All prices listed in this article are in Singapore Dollars.

*Applicable to eligible clients of FUTU SG. Terms and conditions apply.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The content is provided for entertainment & informational use only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. Investments in stocks, options, ETFs, Funds and other instruments are subject to risks, including possible loss of the amount invested.