Investing terms explained

You know you’ve firmly entered adulthood when conversations with friends revolve around investing, portfolios, and “diamond hands.” But you might need some help if you catch no ball when the jargon starts flowing. The investing glossary can sound like a totally different language to newbies and getting past this hurdle can be a challenge.

Instead of leaving you out to dry with the Wall Street sharks, we break down 10 cheem investing terms so that you can at least nod along and mean it.

1. Appreciation

One term all investors love to hear is “appreciation,” but not because someone is saying that they appreciate them. The term refers to the increase in an asset’s value over time, whether it’s stocks or real estate. So if your bubble tea rose in price from $4 to $6, the appreciation is $2.

2. Candlestick

Image adapted from: moomoo

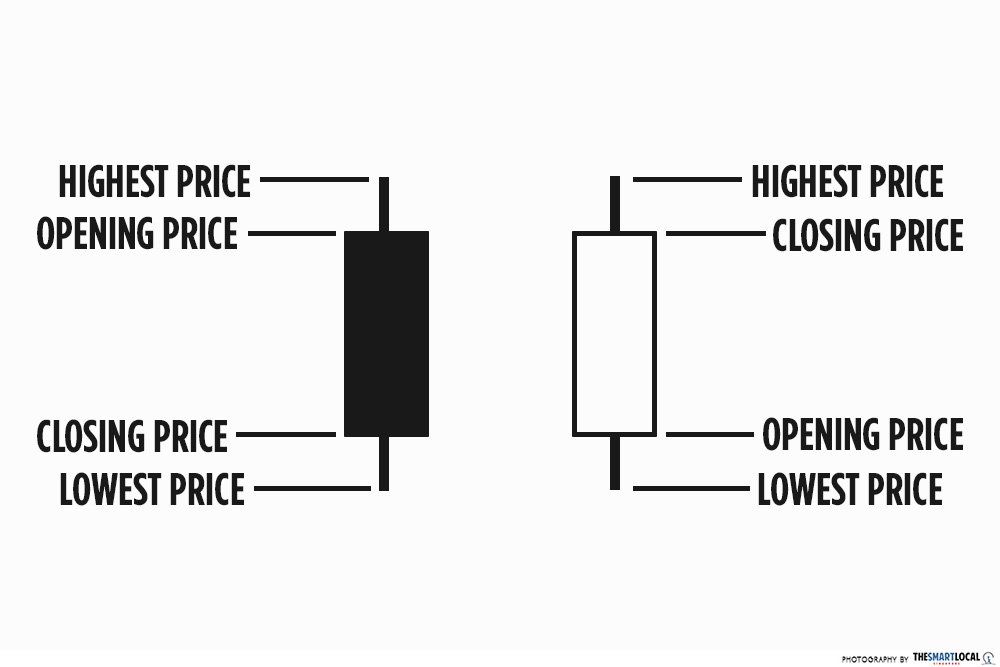

The price of a stock can rise and fall throughout the day, and the candlestick represents its highest and lowest prices, as well as the opening and closing prices during that time period. Here’s how to read it:

The main body indicates the opening and closing prices of the period, while the two wicks at the top and bottom represent the highest and lowest price of the same period. For example, a red candlestick can mean the stock opened at $21, peaked at $25, dropped down to $15, and ended off at $19 for the day.

3. Capital gains & loss

Capital gains are the profit you make when you sell an asset, while capital loss is how much you’ve lost. It’s important to note that gains and losses are not set in stone until you sell your asset

P.S. Singapore doesn’t tax capital gains from the sales of shares, properties, and other assets like cryptocurrency. However, you’re liable to be taxed if you’re a trader whose income comes from making a profit in the market.

4. Index funds

You might have heard of indexes like the Straits Times Index (STI), the Standard & Poor’s 500 Index (S&P 500), or the Dow Jones Industrial Average (DJIA). These indexes are portfolios that track the performance of a group of companies like how the STI follows the top 30 companies in Singapore while the DJIA does the same for American companies.

So rather than buy individual stocks from the companies, you can invest in an index fund that holds all the stocks of a specific index. Since an index’s holdings don’t change often, it requires less management which means less fees for everyone. The S&P500 Index Fund is also recommended by veteran investor Warren Buffett as an easy way to diversify your money.

5. Liquidity

Don’t worry, there’s no water involved when discussing liquidity in investing. It just means how quickly you can get your hands on cash.

Things like your day-to-day savings account can be considered high liquidity, meaning you can withdraw cash from it anytime. Whereas your CPF account is considered low liquidity, as you can only withdraw it under specific circumstances like when you’re buying a home.

6. Margins

Borrowing money from brokers to buy investments is a type of loan called margins. To ensure you’re not going to run off and not pay it back, you have to put down some collateral. Here’s a quick example: I borrowed $300 from my parents to buy a pair of sneakers that cost $600 while giving them my AirPods as collateral.

Ideally, I would sell the sneakers for $700 and repay the loan plus make a little profit. But if the price of the sneakers dropped down to $300, I would have to forfeit my AirPods so my parents can get their money back.

7. Mutual funds

Another type of fund you can invest in are mutual funds. Unlike index funds, they’re more actively managed by professional fund managers and cost more fees to maintain in the long run. Investors usually pick them with the expectation that they’ll outperform index funds since there’s someone actively shopping for investments.

8. Paper trading

It’s okay if you don’t have the means to start day trading like a pro yet. You can still get the hang of things by paper trading. It’s a type of simulated trade that lets you experiment with different strategies with zero risk.

Yep, while you don’t stand to gain anything if your trades do well, you also won’t have to worry about losing your life’s savings on a bad decision.

9. Positions

No, we’re not just talking about the Ariana Grande song. The term position in investing means how much of an asset or property you own.

There are two main types: long and short positions. Long positions are more common and mean that you’re either buying an asset, or you think its value will increase in time. Take for example an investor with 100 $TSLA shares that they own fully – that’s a long position.

Short positions are a little trickier to understand. Using the same example, if the investor is “short” 100 $TSLA shares, it means that they borrowed the shares from a brokerage to sell, and they eventually have to return those 100 shares.

Ideally, they’re hoping that the value of the shares drop after they’ve sold it on the market. This way, they can buy it back at a cheaper price to return to the brokerage with a tiny profit in tow. But this is risky as you’re speculating that the stock price will drop; if it doesn’t, you can end up losing a lot more money than you anticipated.

10. Real estate investment trusts (REITS)

Companies that invest in real estate to make gains are called REITS, or real estate investment trusts. They’re a type of mutual fund that benefits from a growing real estate market and best of all – you don’t have to buy a property just to invest in an REIT. Instead, think of it as chipping in to buy a property and you’ll get to reap the benefits when rent is due.

What these common investing terms mean

It’s easy to get lost in all the jargon especially with a broad topic like investing. That’s why we’re here to help distil these complex investing terms into something easy to understand. But this isn’t an exhaustive list, and the further you get into investing, the more terms you’ll come across.

If you’re feeling less overwhelmed by the lingo, investment trading platform moomoo is a platform where you can kick start your era of financial savviness. As the first full-service digital investment platforms in Singapore with approvals-in-principle (AIP) for all SGX memberships, users can benefit from more features after converting AIPs into full approvals.

The app has various features to make it easy for new traders to understand how trading works. If you want to see how institutions like Soros Holdings or Warren Buffett’s Berkshire Hathaway diversified their portfolio, the Star Institution tab on their mobile app (moomoo for Apple | moomoo for Android) displays their position reports so you know how that’s going for them.

Those interested in index funds in a certain industry can also check out the Heat Map for how each sector is performing. Obviously, you’d want to see more green, since that means the markets are doing well.

New joiners are also privy to a bunch of perks and rewards worth an estimated of $280. Think commission-free trading for 180 days for the US, Hong Kong, and Singapore stock market to an AAPL share (~$240) and a $40 stock cashback coupon when you make a deposit of at least $2,700 and above*.

Once you’ve checked out these features on moomoo, you can also start applying all these terms you’ve learnt today. If there’s a word you come across and you’re unsure of, moomoo even has a Stock Academy where you can go and find out what it means.

Find out more about investing with moomoo here

This post was brought to you by moomoo trading platform.

Photography by Alvin Wong.

Note: *Terms and conditions apply.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

All prices listed in this article are in Singapore Dollars.