Credit card tips

Air miles, discounts, and priority ticket sales to events like music festivals and pop concerts are benefits a credit card holder may enjoy. However, as useful as credit cards may be, you may also inadvertently chalk up debt if you’re not careful with your spending.

So don’t get carried away with swiping your credit card without keeping track of your expenses. With good credit card management habits, you can reap the rewards of owning a credit card while avoiding the debt trap.

1. Use GIRO to pay your credit card bills in full and on time, automatically

If you miss a credit card payment, you may incur interest rates of around 25% per annum, plus late fees. Your late payment will also affect your credit standing. For more peace of mind, set up a GIRO arrangement to automatically pay your credit card bills.

Paying with GIRO is easy and convenient. It means no more late payments and ensures that your credit score remains healthy. It will be less likely for a bank to reject future loan applications due to a poor repayment history.

2. Interest-free instalment plans look affordable…until you look at the total amount

Big ticket items like gym and spa memberships can cost ridiculous amounts of money, often in the range of thousands of dollars. An instalment plan may make the monthly commitments look small, but they still add to your regular expenditure. This is why paying through credit card instalment plans isn’t always the best idea, even if it’s interest-free.

Before committing to an instalment plan, find out the damage it will do to your monthly spending power. Even if it’s marketed as interest-free, you will incur interest charges on the instalment amounts if you’re ever late in making payments.

3. Keep track of recurring payments on your credit card. They all add up!

Avoid signing up for multiple monthly subscription services using your credit card if you don’t have a system to keep track of them. Remember, all your online music and entertainment subscriptions can add up very quickly!

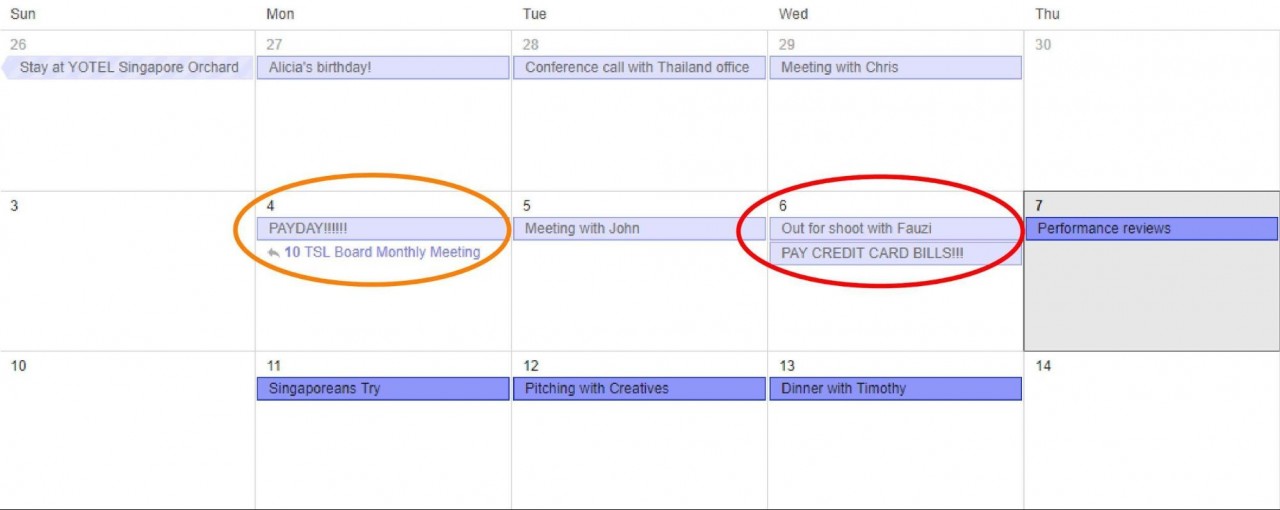

4. Change your payment due date to immediately after payday

This will help you avoid late charges

If your finances are always a little too tight right before paying your credit card bill, you might want to ask your bank to move your payment date to a few days after payday.

Just as you tend to splurge when you’re feeling rich, you’re also more likely to settle your credit card bill in full then too, when it feels much less “painful” than doing it at the end of the month.

This way, you’re setting a fixed day to clear your credit card debt, drastically reducing the chances of being late with payments or not being able to make payments at all. While you’re at it, you can also arrange to have a common payment due date for all your different credit cards to better keep track of your billing cycles, and total monthly expenditure on your cards.

5. Always check your card statements to ensure that you’ve been billed correctly

Credit card fraud isn’t something you need to constantly worry about, but it’s definitely a good idea to review your monthly statements for discrepancies. If you notice an odd transaction or any error, notify the bank immediately to initiate possible remedial actions such as chargeback.

6. Limit the number of credit cards you hold, and ask for a lower credit limit

It’s easy to lose track of your spending when you have multiple cards that you use on different occasions. After all, it’s common to have one card for utilities, another for travel, and yet another for dining out to take full advantage of the deals for each card.

Limiting your number of cards and having a lower credit limit on each of them will help you better monitor your credit card spending, and limit your liability in the event of credit card fraud.

7. Avoid withdrawing cash with your credit card

“If I pay my bills on time, I won’t have to pay interest right?” This, unfortunately, is only true for retail payments.

When you’re short of cash, it can be tempting to take out a cash advance to tide you over until the next payday. But what most people don’t realise is that cash advances are loans with compounding interest on a daily basis from the date of withdrawal. And the interest rates can be as high as 29% per annum. To illustrate, a $500 cash advance will cost you over $650 in a year’s time.

For many cards, you’ll also be charged a cash advance fee that’s the larger of a fixed amount or a percentage of your cash advance amount. So really, you want to do your best to avoid taking out a cash advance.

8. Know all the fees and charges related to credit cards

Besides the usual annual card fees, take note of other fees and charges, especially when you don’t pay your credit card bills in full and on time. Paying just the minimum amount due will also incur interest on the remaining balances. The fine print matters.

If you don’t pay off your credit card bills every month, the late payment charges will accumulate and can be quite costly.

Take charge and stay out of debt

When used well, credit cards offer a host of rewards and benefits. But should you slip up and find yourself debt-trapped, it’s still not too late to take charge. Take steps to work out debt repayment plans or debt consolidation plans with your lenders, reduce your monthly expenditure, and practise the tips above to improve your financial situation.

Find out more about credit card debt management at MoneySENSE (Facebook/Instagram).

If you’re already in debt or know someone who needs help, approach Credit Counselling Singapore for advice and assistance.

This post was brought to you by MoneySENSE.