How to buy a HDB resale flat

After I got engaged, I had an inkling of what was to follow in the grand Singaporean scheme of things: housing.

New house. New chapter. Yada yada.

The idealist in me thought it was pretty straightforward – it’s like The Sims, no? Pay cash, choose a house, move in. I mean, I’ve heard whispers from friends about long BTO wait times, CPF money, or so-and-so being able to afford a condo at the get-go *gasps*. It all seemed manageable – till I was presented with a plethora of choices and a mountain of administrative detail that threatened to overwhelm my Arts-degree self.

But slowly but surely, with the help of Google, wise friends and multiple online forums, my fiance and I navigated our way through the property buying process, landing ourselves an HDB resale flat under 6 months. Here’s how we sorta figured things out.

Stage 1: HDB BTO vs HDB resale vs ECs vs Condo

First things first, what kind of home did we want to stay in? With our bank account ruling out terrace houses and Manhattan-inspired lofts, we were left with a few options: HDB flats, executive condos (ECs) or condominiums.

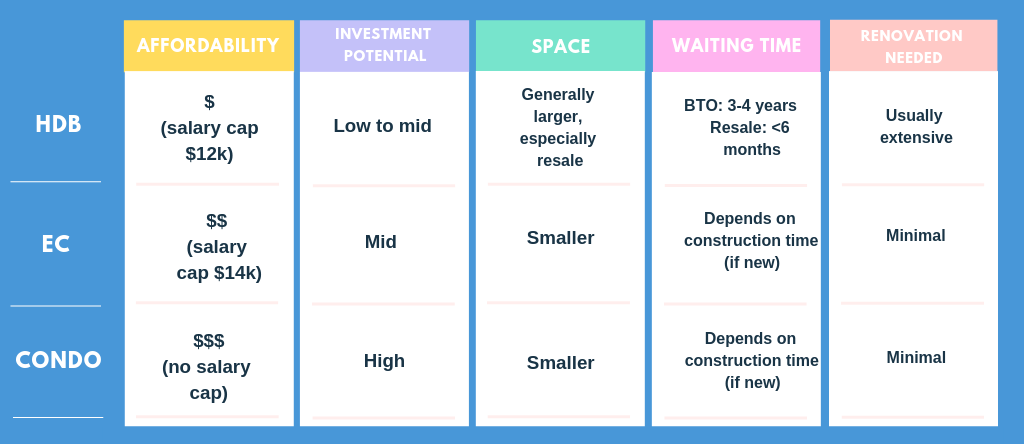

Our decision-making matrix. Note: This was our POV, and might not apply to all.

Our decision-making matrix. Note: This was our POV, and might not apply to all.

Image credit: Jessica Lai

It was easy for us to rule out ECs. It didn’t have the generally larger space of an HDB flat and needed time to mature into private property, yet was pretty expensive.

We also toyed with the idea of a condo, with Riverfront Residences and The Tapestry capturing our imagination with their potential for capital appreciation and a-mah-zing facilities.

Nearly swayed by this condo dream.

Nearly swayed by this condo dream.

Image credit: New Launch 101

But, we didn’t want to spend beyond our means and a HDB was a more practical option. Since we didn’t want to wait years for a house – I would be over 30 by the time the building was ready – resale over BTO was a clear choice with their shorter waiting times and variety of locations.

Note: At this point, you should check if you’re eligible to buy a resale flat and register your Intent To Buy on the HDB Resale Portal to declare to the world you mean business.

Stage 2: Which area?

With what type of housing locked down, the natural next step was where to stay.

It was kinda intimidating to consider the Singapore map is its entirety, so our strategy was to:

- mark down where we stayed currently

- look within a 4km radius around it to be eligible for the Proximity Housing Grant.

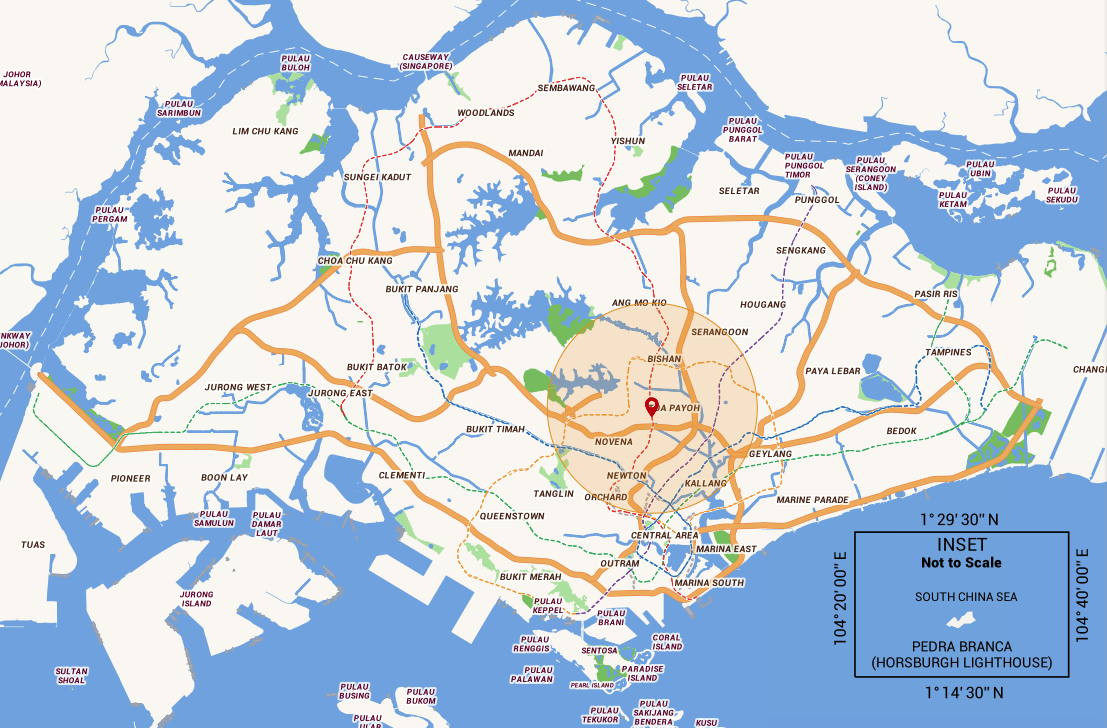

My fiance stayed in Toa Payoh so this was the 4km radius which prompted us to consider neighbourhoods like Serangoon & Bishan. Use the proximity checker tool here.

My fiance stayed in Toa Payoh so this was the 4km radius which prompted us to consider neighbourhoods like Serangoon & Bishan. Use the proximity checker tool here.

But of course, we had to decide which house to stay nearer too, considering our current LDR situation across the island:

Me, a Pasir Ris-ian: “Stay in the East lah. East side, best side. Pasir Ris so near to chalets, airport and it has this quaint seaside resort feel.”

Him, a Toa Payoh-ian: “Toa Payoh is soooo near to town! Like just a few stops. And we have so much cheap, good food around.”

Let’s just say I lost that battle, with the idea of a shorter commute trumping my kampung loyalty.

Stage 3: Which unit?

We zoomed into specific blocks next, and our tech-savvy side kicked in. Unlike our parents’ generation when hunting down property was done via flyers dotted with smiling property agents, our tools were platforms like 99.co, PropertyGuru and iProperty.

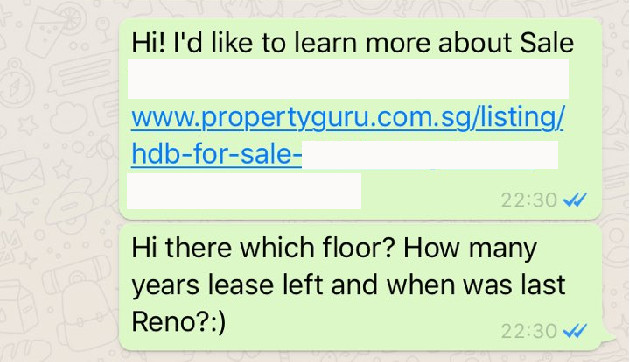

In the spare moments of our busy lives, we shortlisted promising units within Toa Payoh. I remember texting half a dozen messages to agents like:

Rinse and repeat.

Rinse and repeat.

At this point, our filters were:

- Price – not too high

- Distance to MRT – less than 10mins walk

- Level – preferably mid to high floors

- Lease left – at least 70 years left

- Eligibility – no Chinese ratio restrictions

If you’ve ever used online dating apps, you’d know that meeting someone IRL always beats texting constantly. And so, we had to check out the promising units for ourselves.

Being kiasu Singaporeans, my fiance and I inspected each home with the vigour of Sherlock Holmes. Heck, I researched so much that I even wrote a whole article about how to QC your resale flats. *shameless plug*

A diamond among the rough. Image credit: Jessica Lai

A diamond among the rough. Image credit: Jessica Lai

Tip: When viewing resale houses, don’t just look at appearances. After all, surface stuff like tiling or decor can easily be jigged through renovation or redecoration. Instead, we valued attributes like a squarish, large layout as well as the view – things which cannot be changed.

Stage 4: What price?

Folks with “auntie” or “uncle” tendencies, you have an advantage here. Think of the whole HDB price negotiation as a haggling session, but on a larger, thousand dollar scale.

Once you think you’ve found your dream house, offer your seller a price for it. I read on online forums you can ask a good 10-15% below the seller’s asking price, but if you lowball too much, the seller might deem you unworthy or go with someone else’s more attractive offer.

Our strategy here was to check on the last transacted prices of similar units in the area, and use it as a gauge to peg our offer. But just like any negotiation, it’s helpful to know your audience – are the owners eager to sell? Do they need the money readily? Do they already have offers? Did they do extensive renovation which would bump up the price?

Agents are the usually the middleman of price negotiations.

Agents are the usually the middleman of price negotiations.

The seller’s agent can be your “in” too. Another strategy was to ask the agent directly what’s the lowest price the owner would accept. Blunt, but effective if used properly. Also, never offer something you’re not willing to pay, or walk away if the price is too high. Just like how you walked away from overpriced bags at Chatuchak without a second glance.

Stage 5: What admin?

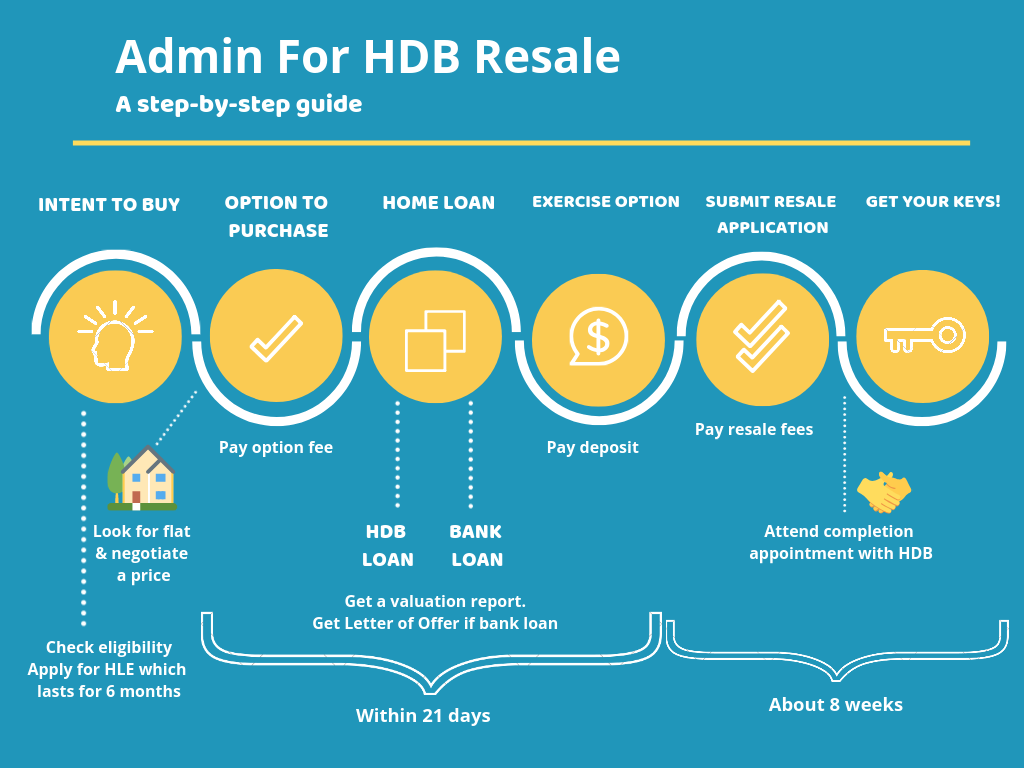

Now comes the not-so-exciting part. After the adrenaline of bargaining, reality sets in that there’s more administrative stuff to be done. Here’s a graph to summarise:

Not to worry, we’ll go step-by-step.

Not to worry, we’ll go step-by-step.

Image credit: Jessica Lai

Option To Purchase & Bank Loans

Remember how you filed for Intent To Buy way early on? Now, it’s time to put that intention into action with obtaining an Option To Purchase. Think of this as choping the seller as he or she cannot give someone else an OTP within a 21-day window. Usually, OTPs range from $1-$1000.

Then, comes the home loan bit. Because ain’t nobody got the $$ to finance the whole house instantly in this day and age. (My parents did – a shocker). Choose between an HDB loan OR bank loan, each with different T&Cs and interest rates. Generally:

- HDB Loan: 2.6% interest rate*. You’ll need an HDB Loan Eligibility letter.

- Bank Loan: Interest rate depends on market conditions and bank. You’ll need a Letter of Offer.

Either document is needed to exercise your Option To Purchase later on.

Pro tip: It’s best to apply for HLEs or LOs earlier on around the Intent To Buy stage so that there won’t be a mad rush later on. Note that HLEs or LOs are valid for 6 months.

*Accurate as of 1st July 2021.

Valuation Report

More nerve-wracking than your PSLE results

More nerve-wracking than your PSLE results

Image credit: HDB Resale Portal

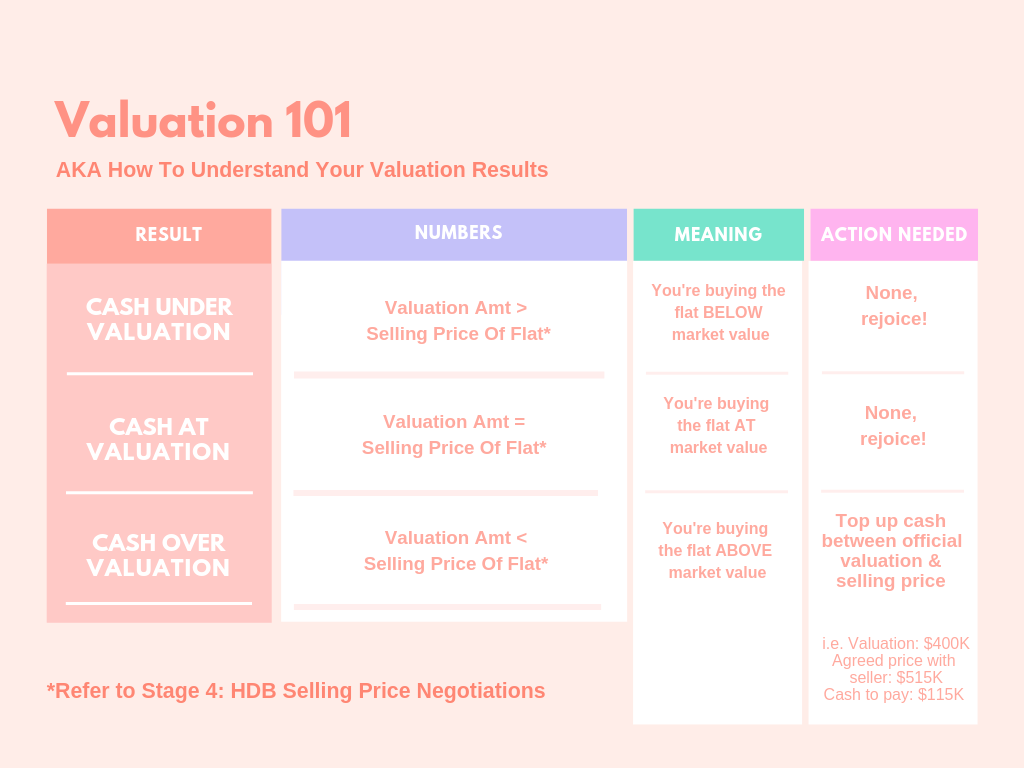

HDB valuation refers to how much your home is worth in the market, as estimated by a professional Valuer. Factors like location, amenities and flat condition are taken into consideration. Currently, HDB has streamlined the process so you can Request For Value directly on the resale portal instead of approaching external vendors. A few possible outcomes:

It’s like playing a game of “The Price Is Right”.

It’s like playing a game of “The Price Is Right”.

Image credit: Jessica Lai

For us, we were glad that our result was Cash At Valuation, where the valuer didn’t even need to go down to the unit. To avoid paying COV, make sure you’re not overpaying at the price negotiation stage by doing your research well.

Do note this isn’t extra cash on top of the price you agreed with the seller – it just means that a larger portion of your agreed price needs to be paid upfront in money.

Exercise Your OTP & Pay Deposit

A.K.A Pay up the rest of the cash you owe the seller. Thank goodness it’s dictated by law that the deposit and your option fee cannot exceed $5,000 in total.

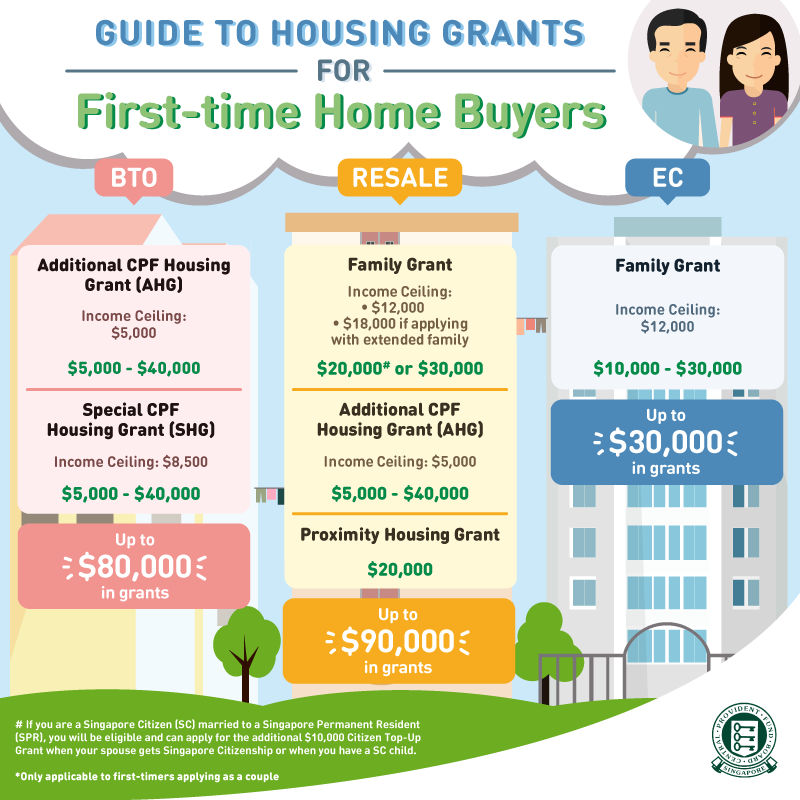

Submit Your Resale Application & Get Grant Money

Nearly there! You or your agent will need to submit the resale application form and book your HDB or bank appointment, depending on the type of loan you opted for.

The point of these appointments are to sign documents, check the grant money you’re entitled to, work out an estimated completion date and also how you’re gonna split up the loan repayment between you and your other half. Touchy, touchy.

FYI, if you’re eligible for one.

FYI, if you’re eligible for one.

Image credit: Are You Ready

Note that you can either use HDB’s panel of lawyers or private ones, usually recommended by banks. Ours was done by Lawhub LLC.

After the law things are done, wait about 8 weeks for the application and key collection.

Stage 6: Mission complete! We now have our own HDB resale flat

After about half a year and 500 internet tabs later, the fiancé and I were finally at the finishing line.

It was an amazing feeling getting the keys for the first time, and absolutely surreal to know we were proud new owners of a real house *fans self*.

Image credit: Jessica Lai

Image credit: Jessica Lai

After this process, I’ve had a newfound appreciation for every homeowner out there – did everyone just figure this out all by themselves or had magical #adulting abilities the moment the rings were exchanged, or even before?

Admittedly, the resale housing process was not an easy one, and my fiance and I were utterly challenged to keep things organised, communicate clearly and take responsibility for our decisions, whatever they were – skills we hope would stand us in good stead for marriage.

Now, all we have to do is HDB renovation. No biggie right – isn’t it just like The Sims? 😉

P.S. If you’re interested in getting a brand new flat, check out our guide to applying for BTO.

Cover image credit: Jessica Lai