The Singapore Budget in a nutshell

The Singapore budget is prepared yearly before the start of each financial year. It outlines the government’s planned revenue and expenditure over the year. It’s always a hot issue as most of us are tax payers looking to see what the government’s plans are for the upcoming year.

Fun fact: More than half of Singapore’s revenue comes from Corporate Income Tax (24%), GST (17%) and Personal Income Tax (13%). Betting and motor vehicle taxes just account for 5% and 4% respectively.

Some examples of benefits Singaporeans enjoyed in past budgets include U-Save and GST cash vouchers. Small business would have found the PIC grant (30% > 60% in 2012) very beneficial. The themes are similar throughout the years – to encourage productivity in companies, to somewhat aid healthcare and elderly and provide support to vulnerable groups.

How the Budget 2014 will affect you

The Ministry of Finance (MOF) takes the role of gathering public consultation and a few months later the Minister of Finance makes the Budget Speech in Parliament. You can see the video in Deputy Prime Minister and Minister for Finance, Mr Tharman Shanmugaratnam’s budget speech.

We’ve went through the 1 hour and 40 min video and the various media to put together an easy to understand summary of Budget 2014. (References listed below article)

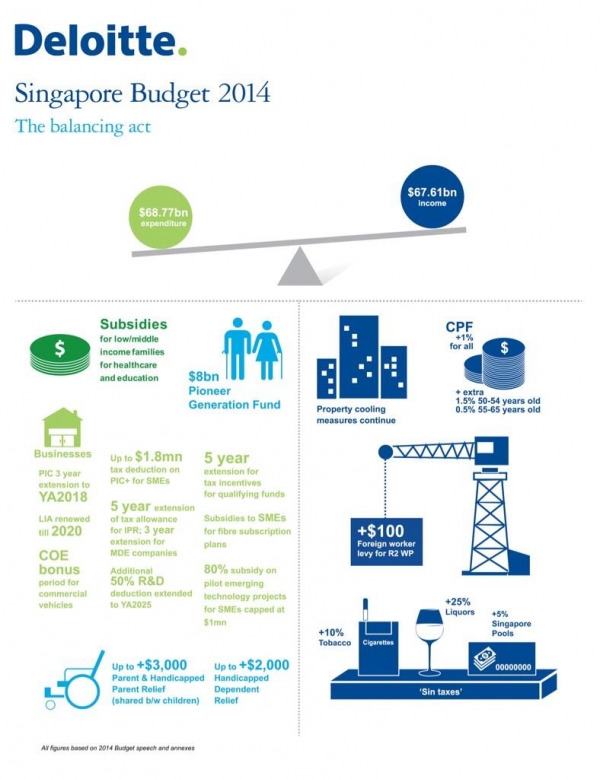

Highlights from this years budget include a strong focus on the “Pioneer Generation”. It also focuses on productivity so companies can continue to restructure and equip themselves with more technology. It has also drawn flak on social media from users commenting on the raising of tobacco tax and alcohol excise duties by 10% and 25% respectively.

The Pioneer Generation wishes to thank the smokers and drinkers of Singapore for financing their benefits. #SGBudget

— mrbrown (@mrbrown) February 21, 2014

The Pioneer Generation:

Key Points:

- Additional 50 per cent off already subsidised bills at specialist outpatient clinics and polyclinics, starting in September. From next January, they will qualify for the Community Health Assist Scheme (CHAS) which provides accessible and affordable medical and dental care.

- Annual Medisave top-ups of $200 to $800 from August. They will also be given more flexibility to use their Medisave for a wide range of outpatient treatments.

- Coverage under MediShield Life. Subsidies will be given according to age to ensure premiums for this scheme are affordable.

- Those or their nominated caregivers with moderate to severe functional disabilities will get $1,200 cash a year.

Why?

The objective is to honour the contributions of the pioneer generation – the first generation of Singaporeans who were living and working in Singapore after we became independent.

If you are over 65 years old, you should qualify under this generation. They will get the benefits regardless of income, for the rest of their lives. There are about 450,000 Singaporeans who fulfil this criteria.

Some like Tan Kin Lian have argued about the arbitrary cut-off date and how it should instead apply to everyone who reaches 65. This would help more elderly in Singapore. Right now, some pioneers will receive more benefits over others who can arguably be considered pioneers too.

Regardless, this is still a good initiative as it not only directly benefits the older generation but helps lessen the financial responsibility of younger Singaporeans who would need to support their parents’ medical bills.

Companies

Key Points:

- The PIC scheme will be extended for another three years to 2018. Firms will continue to be able to get either tax deductions or cash grants when they invest money into boosting productivity. A new PIC+ scheme will be introduced for larger amounts.

- New industrial spaces within the same industry will be created to help small- and medium-enterprises consolidate their operations and pool resources.

- The Lifelong Learning Endowment Fund will be increased by $500 million. (NTUC’s Labour MP, Patrick Tay has been advocating for PMEs to have this they can weather through financial storms. It is encouraging to see that more funds will be pumped in to help support the upgrading of skills of workers through the Lifelong Learning Endowment Fund.)

- An ICT for Productivity and Growth programme will be launched, aimed to subsidise 70 per cent of the cost of ICT products and services for SMEs. The Government will also subsidise SMEs’ fibre broadband subscription plans of at least 100 Mbps.

- The Government will raise the support level for pilot and test-bedding projects for companies who want to venture overseas, from the current 50 per cent to 70 per cent under the Global Company Partnership.

Why?

Increasing productivity in Singapore has always being the key because you cannot increase wages without increasing productivity growth. Otherwise companies will pass on these costs to consumers and so on and the situation will become dire. NTUC has been calling for productivity improvements for sustainable wage growth so wages can grow and workers are able to do their job easier, smarter and safer.

This is why there has always been a lot of support from the government to make firms more productive and competitive. This is actually one of the fundamental pillars behind the Progressive Wage Model (which requires workers to acquire new skills to progress) and that is why it is the preferred choice as compared to the Minimum Wage model which encourages inflation rather than productivity.

Also see “Australian workers suffer lowest annual wage growth for almost two decades” for further reading.

Employees and CPF Contributions

These were the key CPF contribution changes announced in Budget 2014.

Key Points:

- The employer Central Provident Fund (CPF) contribution rate will be increased by 1 percentage point for all workers from January next year. This will go into the Medisave Account.

- The CPF contribution rates for those aged 50 to 55 will increase by 1.5 percentage points, on top of the increase of 1 percentage point on point 1. This consists of 1 percentage point from the employer and 0.5 percentage point from the employee.

- The employer contribution rate for CPF for those aged 55 to 65 will increase by 0.5 percentage point.

Why?

NTUC’s call for an increase in employer’s CPF contribution was answered in Budget 2014.

It helps:

- Young Families – With Singaporeans getting married and starting families later, the increase in Medisave contribution will come in useful for their ageing parents, or in the event of unforeseen circumstances.

- Working ageing parents – Allows them to be more independent in taking care of their medical fees

It was mentioned in the Budget Speech that apart from technology, the Singaporean workforce should learn to change their Social Norms.

- “We need a workplace culture where employees’ views and contributions are valued, up and down the line. When employees are engaged and empowered, productivity goes up.”

- “We also need a culture of mastery of the job. As individuals or companies, and as a society, we have to take pride in developing expertise and flair in every vocation, seeking not just competence but excellence, throughout people’s working lives.”

- “We have to change our habits as consumers. Quality service comes in many forms, and need not mean having service staff constantly waiting on us. We must also feel at ease with self-service technologies, such as at check-out counters in supermarkets.”

While this is good for employees, Lennon Lee from PwC had noted that “…the SMEs and local businesses who employed a significant portion of Singaporeans and PRs are bearing the costs for healthcare through a 1% increase in Employers’ CPF contributions on top of rising industrial rentals and wages due to tightening of foreign labour policy and higher foreign labour levies.”

Smokers & Drinkers

- Excise duties for cigarettes and manufactured tobacco products will be raised by 10% to $388 per kg, compared to the current $352 per kg.

- Excise Duty rate of all liquor types will be raised by 25% to keep pace with inflation. The last effective increase was made in 2004.

These changes are to take immediate effect, which will generate a revenue gain of $70 million and $120 million a year respectively.

This was the most controversial issue in this year’s budget. It was stated that the tobacco increase was to discourage the rising trend of smoking among youths aged 18 – 29 years. Now I am not a smoker or drinker but I find this ruling meant to curb social ills somewhat ironic since Singapore did open up two casinos.

Other Relief for Singaporeans

Vouchers:

- Those aged 55 and above this year who earn $26,000 or less a year will get a one-off Seniors’ Bonus of $100 or $250, depending on the value of their homes.

- Housing Board households will get one-off GST vouchers, ranging from $90 to $260. HDB households, up to 4-rooms, will get one to three months rebate on their conservancy fees.

Education:

- Lower- and middle-income families will get more help with kindergarten fees

- Bursary amounts for students at the Institute of Technical Education, polytechnic and university level will be increased. More students will also be eligible for bursaries which will benefit students from two-thirds of all Singaporean households.

Disabled:

- Families of children with special needs will get more subsidies for the Early Intervention Programme for Infants and Children. This programme includes educational and therapy support services.

- Disabled individuals will get more subsidies for their transport needs. The Government will provide subsidies to cover up to 80% for those who require dedicated transport services to access special education and care services.

- Parent relief and handicapped parent relief will be increased by up to $3,000, with those living with their parents getting a higher relief quantum. Parent relief can now also be shared among family members.

- Individuals caring for a handicapped spouse, sibling or child will see their relief increase by $2,000.

Healthcare:

- Lower- and middle-income groups will get permanent subsidies so that they can fully pay their MediShield Life premiums out of regular Medisave contributions.

- To ease the transition into MediShield Life, the Government will also provide subsidies to offset premium increases in the first few years.

- Subsidies for specialist outpatient clinics for lower- and middle-income Singaporeans will be increased from the current 50 per cent to 70 and 60 per cent respectively.

- Subsidies for medication will be enhanced as well.

- Singaporeans aged 55 and above who are not part of the Pioneer Generation, will receive annual Medisave top-ups of $100 to $200 over the next five years.

Rounding Budget 2014 up

Habitual drinkers and smokers will not be too happy to learn they now have to pay 25% more when businesses pass down their costs from the increased taxes to them. It’s also worth noting this tax revision has taken effect immediately, while mostly of the incentives only start kicking in during Aug to early next year.

But apart from that, the government has handed out a generous amount of incentives and subsidies across the board, strengthening our social safety net especially in the area where some people have been complaining a lot in – our elderly.

The Pioneer generation were the big winners of Budget 2014.

Related Article: 5 Ways the Budget 2014 will affect Singaporeans.

References:

Straits Times – Budget 2014 – Summary of Points

Budget 2014 Singapore – Budget Speech and Past Years Budget

NTUC wants CPF contribution rates for above-50-55 age group to be hiked