How to choose travel insurance

Your bags are packed and you’re ready to go with your plane ticket, transport and accommodation all booked. It’s your first trip out of Singapore in two years – but wait, you’re getting anxious about possible flight cancellations and hiccups amid ever-changing border restrictions.

It’s a good thing that you’ve decided to buy travel insurance just in case your long-awaited travel plans get disrupted. But with so many choices out there, it might be difficult to figure out which one to pick. Here are seven things to consider when choosing travel insurance for your next foray out of Singapore:

1. Why you should always buy travel insurance

You might have a detailed spreadsheet with an itinerary planned down to the minute, but unexpected things can always crop up, even for the most savvy of travellers. Travel insurance will cover you if you encounter common travel problems such as trip cancellations and lost baggage along the way.

Flight tickets, accommodation, and your belongings can add up to thousands of dollars, so you’ll want to make sure you can claim these if anything goes awry.

Travel insurance will also cover you should you ever get into an accident or fall seriously ill overseas. Most packages cover overseas hospital stays and some include general medical expenses as well.

Trip interruptions and delays are also something you’d want to be covered for. For example, you might need to cut your trip short due to an emergency at home; or your flight might be delayed due to a sudden monsoon. You’ll want to be able to get back the money you spend on costly things like additional accommodation and new plane tickets.

2. Don’t always go for the cheapest packages

Insurance companies usually offer both basic travel insurance plans and more comprehensive ones that cost more. Basic plans usually allow claims for fewer items with a lower payout.

Upgraded plans will have larger payouts and include additional coverage, such as compassionate visits from a relative if you’re hospitalised overseas, or medical treatment on your return to Singapore if you get sick or are injured during your trip. They may also cover you for less likely situations such as natural disasters or hijacking.

If you’re renting a vehicle, you might want to pay more for a plan with a lower excess, which is the cost you’ll need to bear on top of an insurance claim. This will provide some cushioning should you – knock on wood – get into a road accident on your trip.

While you’re at it, look for a plan that covers a higher value for lost or stolen luggage if you’re intending to go shopping for luxury goods. That way, you’ll be able to claim back the cost of your spending spree if your stuff gets stolen or your luggage gets lost on the way home.

3. Save time and money by buying insurance packages

It’s 2022 and you’re unleashing all your pent-up wanderlust by planning a series of trips over the coming year. You’ll do well to buy an annual travel insurance package instead of one for single trips. It will be cheaper in the long run and more convenient because you won’t have to remind yourself to buy insurance every time you travel.

For example, an annual worldwide travel insurance plan from FWD costs $345.10, with coverage for a maximum to 90 days per trip. Similar worldwide coverage for a 90-day single trip costs $327.

Buying a family travel insurance plan if you travel with your kids may also help you to save money and make for easier claims. For most insurance providers, family plans cost the same no matter how many kids you’re travelling with.

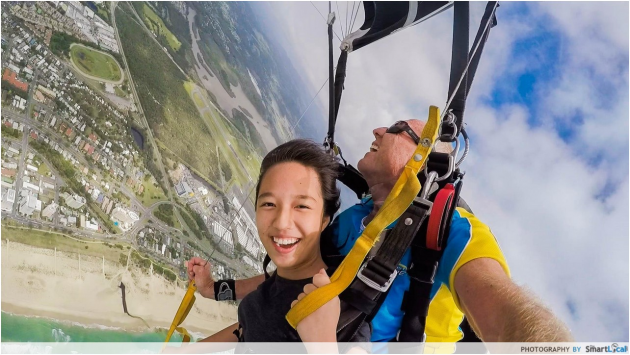

4. If you’re an adventure junkie, ensure that you’re covered

Many of us are adventurers, and it’s not surprising when so many travel destinations offer tempting extreme activities such as skydiving, mountain-climbing, diving and the like.

If those are in your travel plans, be sure to check if your insurance covers medical expenses arising from injuries sustained during high-risk activities. Depending on your plan, you might need to add on a rider or purchase a separate insurance for this.

5. Make sure your travel insurance includes Covid-19 coverage

There’s no doubt that travel these days comes with the big C at the back of our minds. That’s why it’ll be handy to have Covid-19 coverage included in your travel insurance. While medical treatment for Covid-19 in Singapore is free for all vaccinated Singaporeans and PRs, you’ll have to pay your own way if you’re suay enough to catch the bug overseas.

Image credit: Healthway Medical

If you catch Covid-19 overseas, you’ll have to wait at least 14 days before you’re allowed to board your flight back to Singapore. So make sure that your Covid-19 insurance also covers extra accommodation for your extended stay and additional tests needed, and not just medical expenses.

Most VTL countries will require you to have Covid-19 insurance before you travel there anyway.

6. Consider travel insurance that covers pre-existing conditions

A change in season can trigger pre-existing asthma or allergies

Severe eczema, allergies, asthma or diabetes shouldn’t hold you back from living your best life. Instead, get travel insurance that covers unexpected medical treatment if you have a pre-existing chronic condition.

Those with a bun in the oven can also get travel insurance that covers pregnancy-related complications such as severe morning sickness, gestational diabetes or pre-eclampsia. However, there are many exclusions, so read the T&Cs carefully. Most importantly, get the green light from your gynaecologist before you even start planning your trip.

7. Look out for promo codes and credit card discounts

“Discounts” are Singaporeans’ favourite word – and even travel insurance isn’t spared of slashed prices.

Always keep an eye out for discount codes as you’re browsing different travel insurance offerings online. You can also check for credit card perks and discounts, where some companies include free travel insurance when you use it to pay for your plane ticket.

Travel platforms like Klook and Contiki also allow you to package your travel bookings with insurance, so it’s overall more affordable and convenient.

Buying insurance for your next VTL holiday

The last two years have shown us that travel plans can be upended at the last minute. As the saying goes, hope for the best but be prepared for the worst.

While minor inconveniences such as lost or damaged luggage can ruin a trip, accidents and medical emergencies can be financially catastrophic if you don’t have a comprehensive travel insurance plan to cover your expenses.

With travel insurance on hand, you can jet off to satisfy your wanderlust and enjoy yourself knowing that you’ll be well-covered should anything unexpected happen on your long-awaited holiday.

Now that you know what to consider when choosing insurance, check out some of our travel guides: