Convert purchases into investments

‘Investments” and “portfolios” are such grown up terms that can be intimidating for those just stepping into adulthood. Plus if you’ve just started working, we know you’ll be feeling the pinch of putting aside a large chunk of your income just for investing.

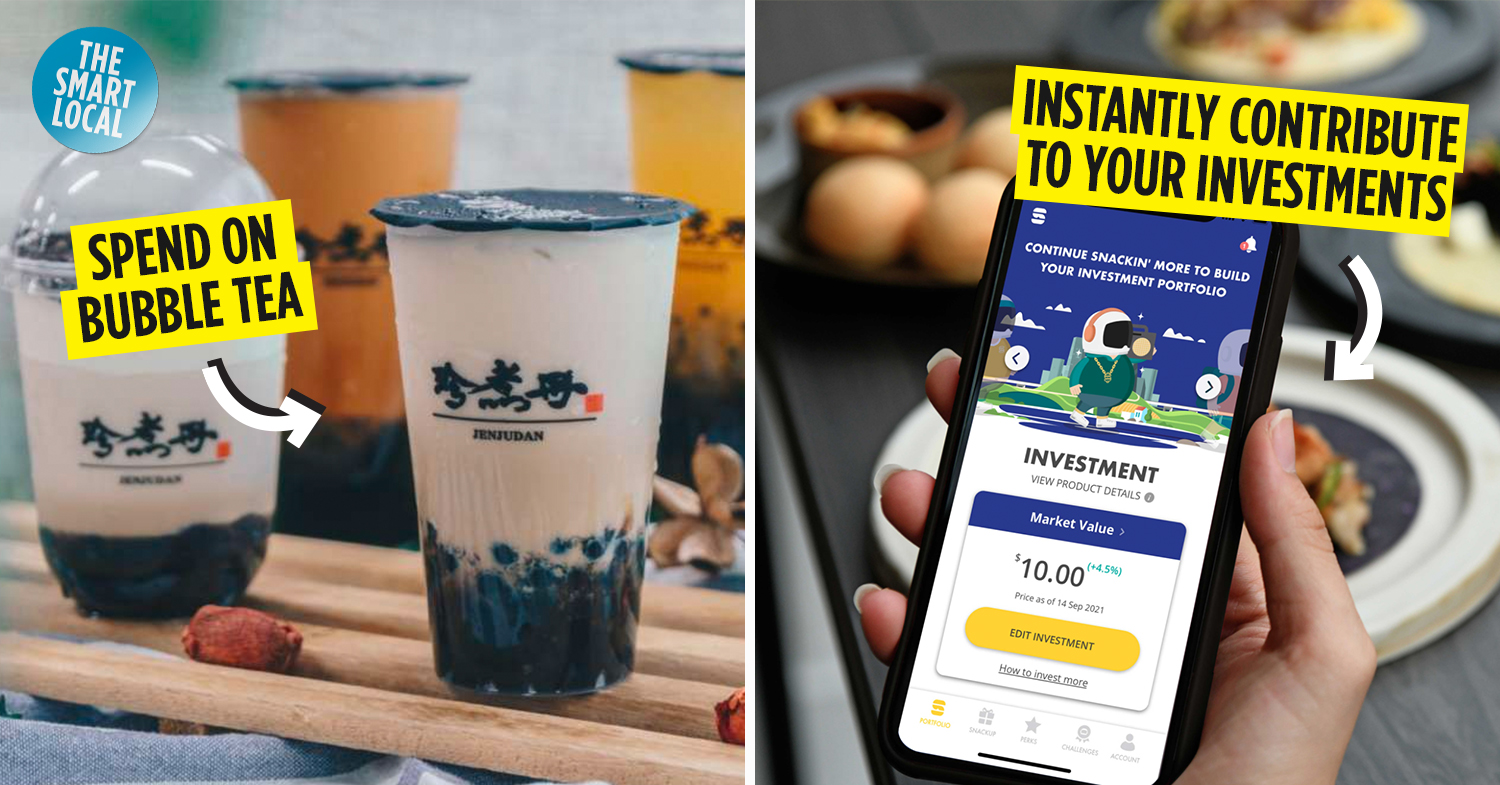

But if you can part with a few bucks a day for your fave bubble tea, you might just be able to start your investment journey now. With SNACK by Income, you can start investing as low as $1 when you buy your bubble tea. Here’s how to do it:

Start investing with just $1

If large monetary commitments are what has kept you away from investing, you can start with just the price of a single plain prata on SNACK by Income. Just $1 is all you need to jump right into the platform to kickstart your investment journey. The money will then go towards purchasing units of the Asian Income Fund for your portfolio.

If you can have prata for supper, you can start investing on SNACK by Income right now

Image credit: Eatbook

Over time, you can continue contributing to your portfolio through bite-sized amounts. With premiums of up to $10 per lifestyle activity, there’s no pressure of having to commit a large part of your paycheck at any time.

Turn public transport and F&B transactions into investments

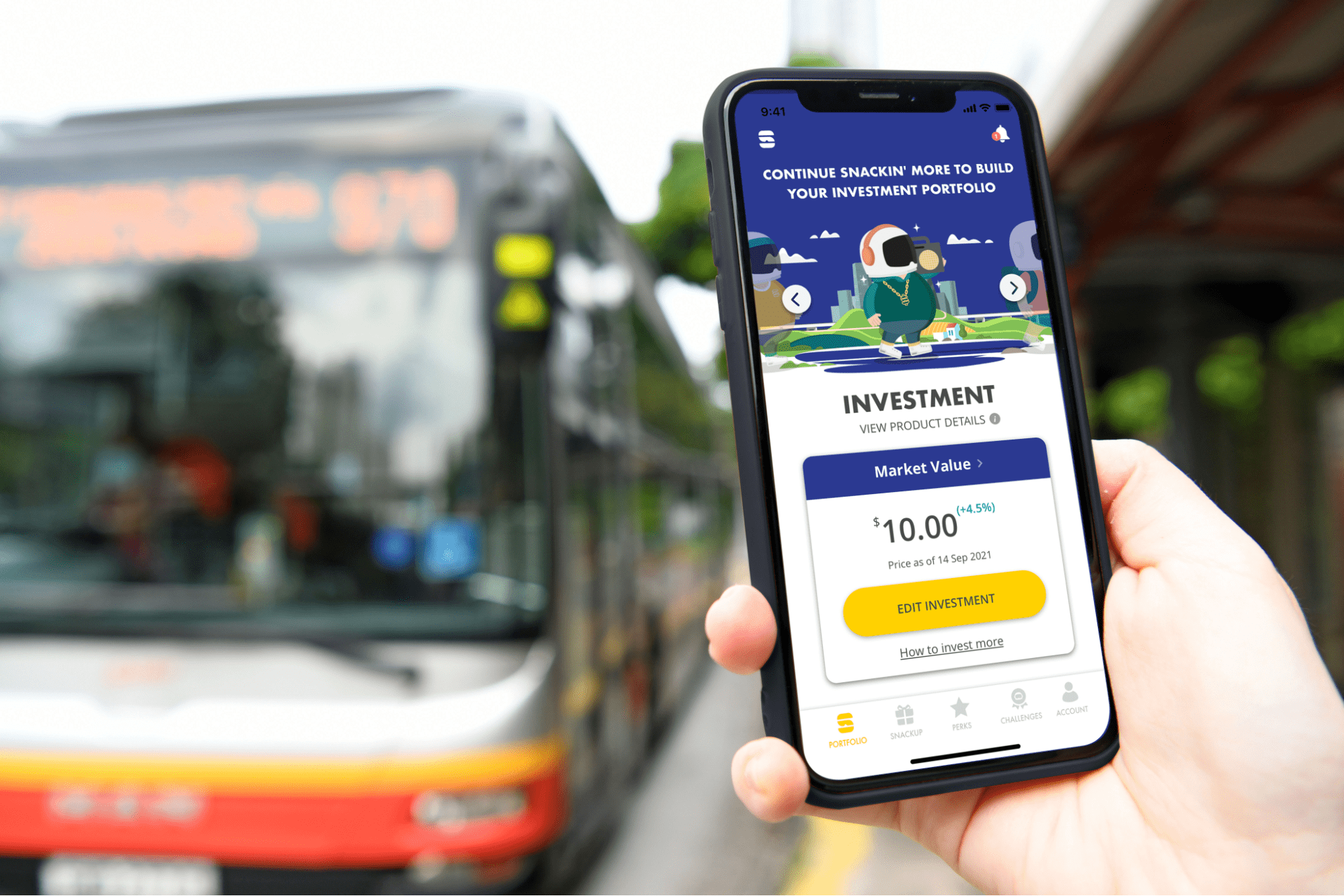

Now that you’ve got a foot in the door, you’ll want to make regular contributions to your portfolio to make use of SNACK’s dollar cost averaging model.

Instead of dumping a load of cash at one go and losing out on good buy-in opportunities, the DCA strategy pumps in smaller amounts over a period of time. This allows you to get steadier returns since you’ll be less affected by volatile market changes.

Image credit: SNACK by Income

Image credit: SNACK by Income

With SNACK by Income, you can link your investments to the activities you do on a daily basis, such as buying groceries or taking the bus – easy for those with a busy schedule.

Link your VISA or EZ-Link card to your SNACK account, then choose from as low as $1 to channel into your investments whenever you use your cards. That means every time you swipe your card to buy a cup of bubble tea or tap out at gantries, you’ll also contribute to your portfolio.

If you set the premium for your F&B activities at $2, buying bubble tea five times will help contribute $10 to your portfolio

Image credit: Eatbook

Here’s where else you can link your activities to SNACK:

- F&B outlets

- Public transport

- Retail

- Groceries

- Entertainment – movies and attractions

- Paying bills

- Petrol stations

If you’ve got a fitness tracker like a Garmin or Fitbit, you can link that to your SNACK account too. Whenever you clock in 5,000 steps on your pedometer, it can trigger your VISA or EZ-Link card to add a contribution to your portfolio. More health trackers like Samsung and Apple Health will be added soon.

Adjust or withdraw your investments at any time

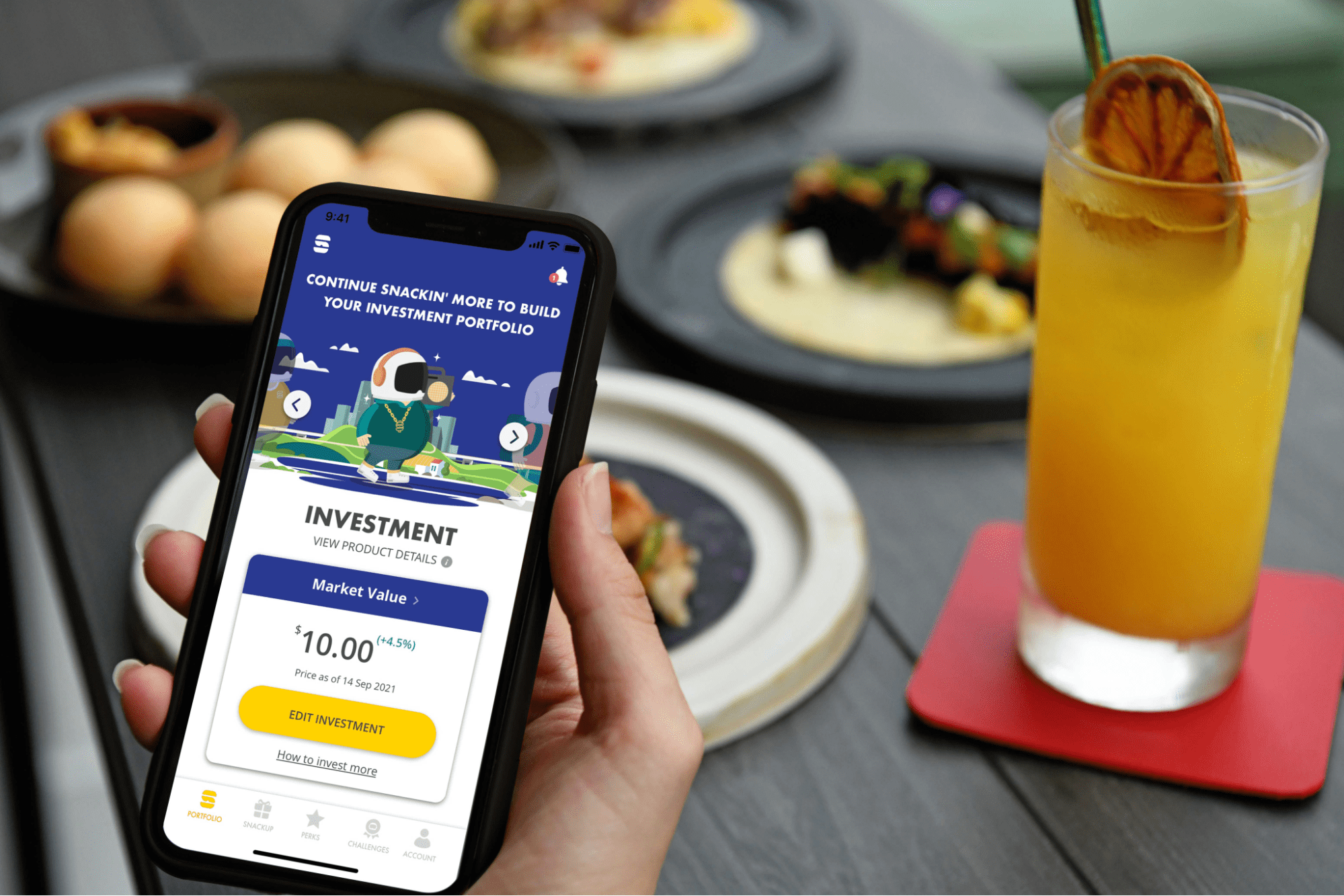

As beginner investors, it’s understandable if flexibility and making regular contributions are concerns. But with SNACK by Income, you will have more control over your investments at all times.

We know what it’s like to feel a little cash strapped, especially after dropping green on countless year-end sales. When that happens, you may choose to pause your investments then restart them again once you’re financially comfortable.

And if you need some extra cash, withdraw your investments at any time without any fees.

You can even make adjustments to your premiums. Whenever you’re ready, boost your investment contributions by a dollar or two more per activity to hit your financial goals faster.

Start investing easily with SNACK by Income

With cashless transactions so widespread these days, we barely think twice about tapping our cards onto terminals to pay for our stuff. And with SNACK by Income, these taps can be turned into investment contributions.

Apart from making micro-investments through daily activities, you can also opt to do so automatically. Say you’ve committed to setting aside $10 a week for investing, but because of WFH, you haven’t been able to use your linked card as much to make your contributions. SNACK will then charge the balance of your weekly cap so that you’re still meeting your financial goals.

Image credit: SNACK by Income

Whether you’re just getting started on investing or looking for a way to make more of an effort to regularly build your portfolio, SNACK by Income can help you achieve these goals with a dollar at a time.

And as a TSL reader, you’re in for a great deal. Get up to $118 credits when you invest with SNACK. You’ll get $30 just by setting up SNACK Investment – no promo code needed – and 1-for-1 for every dollar you invest in January and February 2022, up to $88. This promotion is valid from now till 27 February 2022*.

Sign up for SNACK by Income here

This post was brought to you by SNACK by Income.

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

This advertisement has not been reviewed by the Monetary Authority of Singapore.