Financial lessons learnt from my single mother

Growing up, it has always been ingrained in us that having a nuclear family is the societal norm, where every child goes home to both a father and a mother. Otherwise, a single-parent situation is seen as less than ideal, with many people regarding anything else to be a “broken” or “incomplete” family – as harsh as it sounds.

In the case of Kylie*, a 25-year-old Content Strategist, she’s only had her mum ever since she was 2 years old. She shares that while life wasn’t always fine and dandy, she’s since learnt a great deal from her mum, including the know-how on managing her money.

Here’s a look at how her experiences growing up helped to shape her money mindset, and the gems of knowledge she gained along the way.

*Names have been changed to maintain confidentiality, all images for illustration purposes only.

Growing up in a single-parent household

Cards on the table: it’s not easy growing up in a single-parent household. From a financial perspective, you have 1 less person to contribute monetarily, meaning there’s less cash coming in. And of course, there’s the whole aspect of growing up with a missing parental figure.

Kylie’s primary school allowance was $1/day.

Image credit: Pexels

Kylie’s parents divorced when she was just 2 years old, and Kylie and her mum were left with no place to stay. This resulted in the duo bouncing between 2 of her mum’s sisters’ places for the next 4 years. They were living off Kylie’s mum’s savings, and her mum was unemployed as she was taking care of Kylie.

When Kylie turned 6, her mum decided it was time to go back into the workforce. She was soon employed at an average-paying office job and subsequently managed to afford a home of their own when Kylie was 13 years old.

It was in primary school when Kylie realised that it was difficult to ask for money from her mum. Money was tight, so her mum would limit their spending to only the necessities. It dawned on her that while her friends could go to the other parent for allowance, she could only request from her mum.

There were also instances where Kylie had to choose between either going on school trips or family holidays – they could not afford to go on both since travel expenses were hefty.

When Kylie started secondary school, she started to understand the value of money, and the difficulties of earning it. She could feel the difference between herself and her peers, especially when it came to mealtimes. For example, they’d suggest having lunch at McDonald’s but a Maccas meal was the cost of Kylie’s $5/day allowance.

Image credit: Pexels

All throughout her childhood, Kylie’s mother would actively remind her to weigh each expenditure carefully, and save up for essentials instead of spending on the “wants”. In order to afford even everyday luxuries like a fast food meal, Kylie’s mum had to diligently scour for coupons and deals – a good savings habit which Kylie adheres to to this day.

Their frugal way of life could be seen even in their living conditions. The peeling paint on the walls were only treated to a fresh coat after 15 years, and beds and tables that needed replacing had to be put on hold because big-ticket purchases on furniture just weren’t feasible.

Since Kylie’s mum was her sole caretaker, Kylie would follow her mum on meetings with her friends to seek financial advice. This later helped Kylie understand the importance of having active conversations with others regarding money matters.

Her mum also recognised that the value of cash would soon deplete over time, so she made the smart move to invest in stocks and gold bars to help generate more revenue after ensuring that she had enough savings. She also conscientiously followed the news, kept up to date with the latest global affairs, and listened to finance podcasts for money-management advice.

That being said, Kylie’s mother did not skimp on necessary health insurance for both herself and Kylie. This came in handy when Kylie was younger and had respiratory issues. Her insurance fully covered the costs of paediatric visits and renting of the nebuliser, which are both costly expenses.

It was a priority for Kylie’s mum to get vital health and savings insurance for both herself and Kylie. She made sure to be able to cover as much of the premiums as possible, so when Kylie took over, she didn’t have to spend as much on insurance.

Learning to manage personal finances

Having been in the working industry for over a year now, Kylie has since started to manage her own income and expenses. She’s adapted her mother’s method of setting aside a budget at the start of every month for her spending, and will give a portion of it to her mum. With whatever’s left, she will then save it.

She also makes sure to stay on top of her insurance needs. The good thing is, despite the rocky finances at home, Kylie had a solid insurance foundation to start off with. When she started overseeing her own insurance plans, she found out that her mum had actually obtained the bare minimum for herself, in order to be able to afford more comprehensive coverage for Kylie.

Such is a mother’s love and sacrifice, a tale as old as time. Kylie realises that her mother’s scant insurance coverage was no doubt the result of their financial limitations, although her mother was, in fact, aware of how crucial adequate insurance is.

Similarly, Kylie laments that unlike other households who didn’t have to worry about tight cashflows as much, she and her mum were unfortunately not able to get a head start on growing their wealth through investments.

In an ideal scenario, Kylie would’ve loved the financial freedom to ensure that her mum is also well-insured on all fronts, and still have funds leftover to start building healthy investment returns over time.

Her mum even put in the work to research extensively on investment opportunities which came about throughout the years, but it ended up being more of a priority for the family to always have emergency cash available, rather than to put it aside for investments.

Because she’s conscious of the need to save up for future expenses such as additional insurance or investments, Kylie tends not to spend as much on pricier items such as tech gadgets. Case in point: she’s been using the same laptop for over 6 years, and only upgraded her phone after 4 years – despite the constant social hype around each new phone launch.

Some may say that they’ve been bitten by the travel bug, and that’s the case for Kylie. Whenever she has a trip coming up, she’ll be diligent in spending less on things like clothes and food so she can allocate more money towards her trip.

Kylie is always on the lookout for sales and promotions. Like her mother, she prefers making her purchases only when they are on offer, and she’ll tally all her expenses at the end of the month to track her cash flow.

When it comes to insurance and investments, Kylie says, “There is no one size fits all for policies. You have to find out what suits you best, by yourself.” This is a tip she learnt from her mum. If Kylie’s mum had left the money management to her then-husband, she would have been left with zilch post-divorce.

Since Kylie is still new to the working world and just starting to save her own pool of money, she has yet to make any investments. That’s not to say she doesn’t see the priority in investing though; she’s actively learning and planning her finances so she can start making investments when she’s got the financial capabilities to.

Celebrating friends’ birthdays are fun affairs, yet oftentimes expensive.

Of course, the biggest difference between Kylie and her mum is that, at this stage of her life, Kylie doesn’t have an extra mouth to feed. She shares that she’s aware of this blessing, allowing her the wiggle room to spend more on social activities like eating out with friends or splurging on travelling. That being said, her subconscious would remind her to always, always, save for a rainy day.

Managing money matters with Citi Plus

It’s no doubt that life can be a tad different – and difficult – when you only have 1 parent by your side. But listening to Kylie’s sharing has also made me reflect on my own financial planning. No matter your family background, it’s vital to not only save, but invest and insure so you can rest easy knowing you’re covered on all grounds.

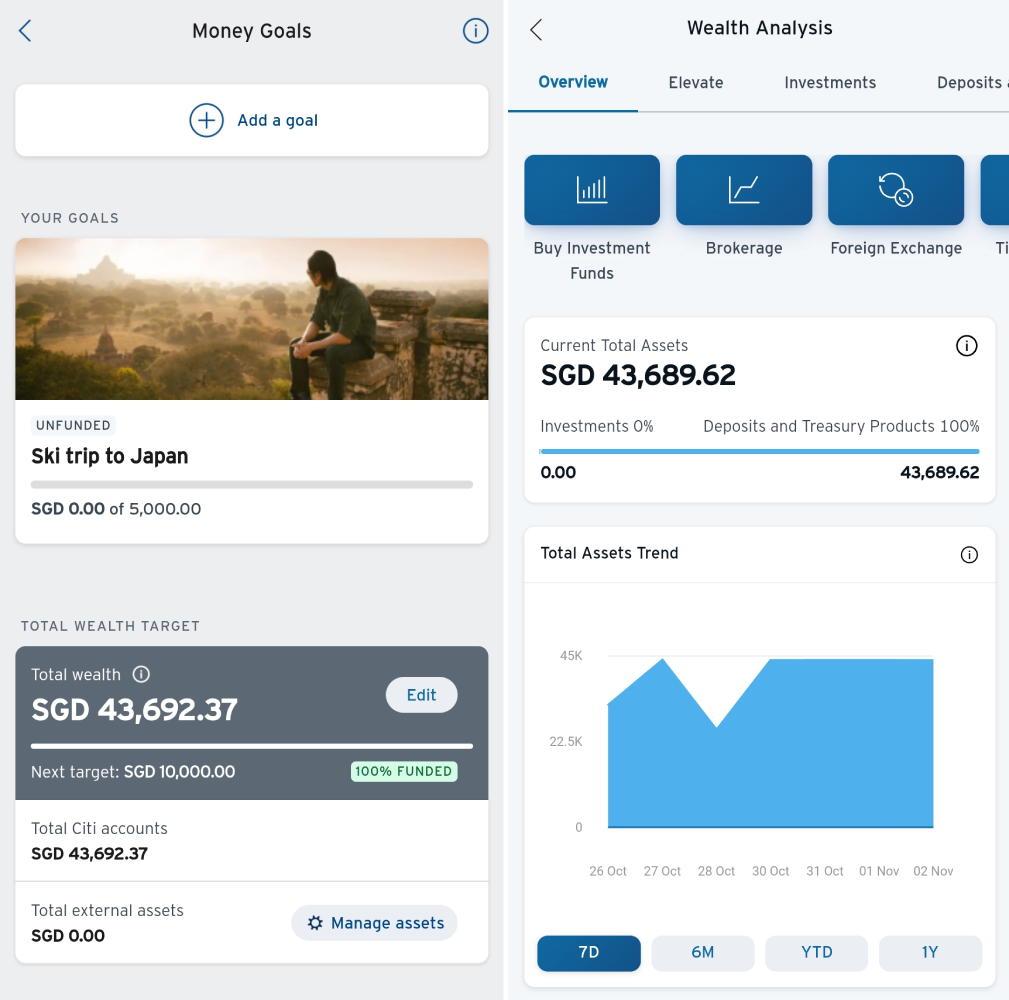

For lost birds who aren’t sure where to start, check out Citi Plus. Through the Citi Mobile App (Google Play | App Store), the platform helps you update and manage your finances and investments, with the ability to access your stocks and funds conveniently.

Image adapted from: Citi Plus

They also act as your finance teacher – financial insights and digestible pieces of content that address everything you need to know about managing your moolah. It’s basically your one-stop shop for all things finance.

The perks don’t stop there. You get to enjoy up to 4% p.a.* interest on a Citi Interest Booster Account when you save, spend, invest, and insure. There’s also an upsized 2% cashback when you use the Citi Cash Back+ Mastercard – perfect if you love shopping.

Hong Kong’s cityscape from the Victoria Peak Circle Walk.

Take advantage of their birthday celebration and join the Citi Plus gang if you haven’t already. New joiners can score up to $150 worth of welcome rewards, and up to 4% p.a.* interest. You can also take part in the lucky draw that’s happening from now till 30th November 2023 – 1 winner will take home a pair of Singapore Airlines flight tickets to Hong Kong.

Let’s be honest – money can be a sensitive subject amongst friends and family. But that doesn’t mean that your wealth planning should be swept to the back of your mind. Consider Citi Plus as your personal planner and guide, so you can make the most out of your finances.

*Terms and conditions apply. Insured up to $75,000 by SDIC.

Find out more about Citi Plus

This post was brought to you by Citi.

Cover image adapted from: MOE via Facebook

Find out more about the Citi Plus interest rates.

Originally published on 2nd December 2023.