Advancements in Singapore

Image credit: HDB

We’ve seen QR code payment methods taking over our neighbourhood coffee shops and police drones zipping over our heads, but that’s only just the tip of the iceberg. Our city is barrelling towards a future of change and there aren’t any brakes in sight.

From suspended play areas in Jewel Changi Airport to a new mandatory long-term care insurance plan that kicks into effect once you hit 30, this list details what’s coming your way in the next 5 years.

1. Underground passageway link for future Thomson-East Coast Line (TEL) and North-South Line (NSL)

Image credit: LTA

The arduous wait for the Thomson-East Coast Line (TEL) is finally coming to an end. And while that in itself should be a cause for celebration, there’s more good news. Not only does the line take you directly to all the hot spots in the city, its Orchard Station interchange will sport a 60m-long pedestrian underpass, seamlessly connecting the TEL line to the North-South Line (NSL) and our existing Orchard underpass system..

And if you’re wondering why there haven’t encountered any major noise disruptions, all credit goes to this ingenious pipe-roofing method. Used for the first time ever in Singapore, this method bores interlocking steel pipes into the ground one at a time to create a durable roof before a retractable micro-tunnel boring machine tunnels through to create the passageway.

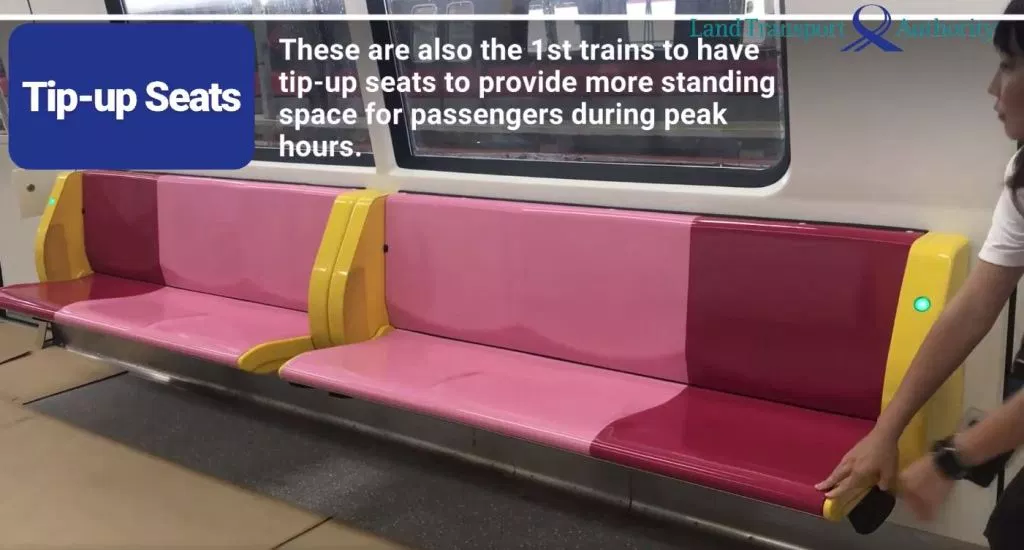

BONUS: More tip-up seats to make space during rush hour

Image credit: LTA

Love them or hate them – expect to see more tip-up seats coming your way with 60 of the new fleet of 91 trains sporting 10 rows per train.

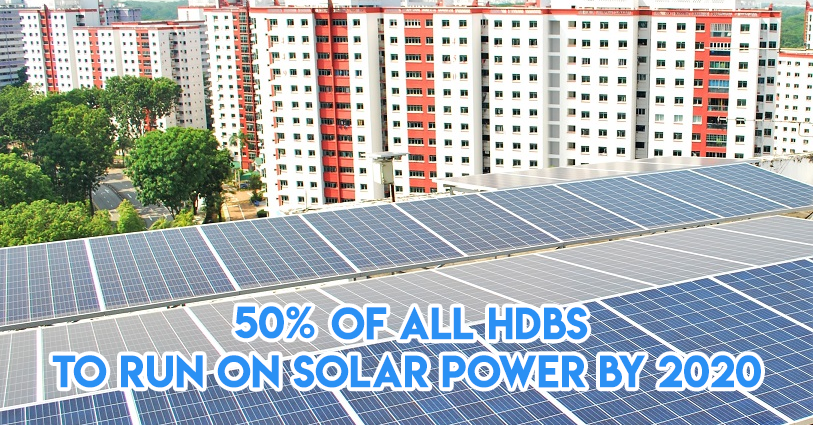

2. Half of all HDB blocks in SG to run on solar power by 2020

Image credit: HDB

Taking a leaf out of the book of solar-powered cities, another 848 HDB blocks in West Coast and Choa Chu Kang along with some ITE campuses, and government sites will receive the gift of solar energy by 2020.

The amount of potential energy generated is said to be able to power over 55,000 four-room flats and will be used to power lifts, pumps and lighting in common areas, reducing carbon emissions by 132,500 tonnes each year.

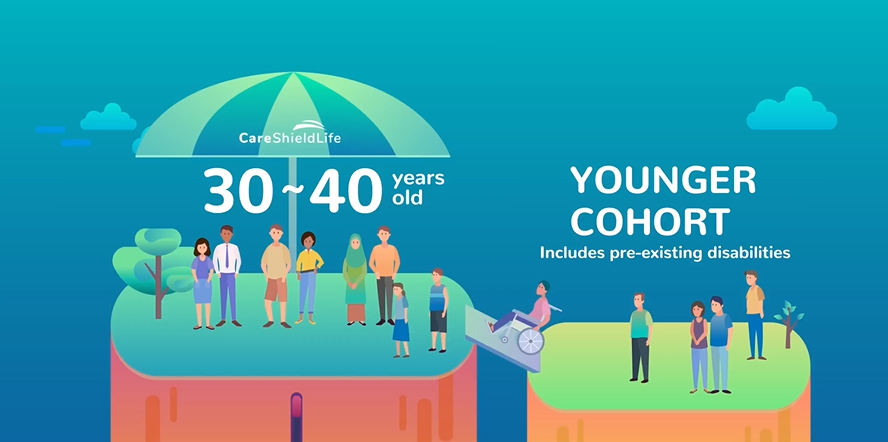

3. Automatic CareShield Life coverage for those above 30

Image credit: MOH

Medical insurance is all part and parcel of taking care of yourself as you transition into adulthood, and by 2020, you’ll automatically be covered by CareShield Life, a mandatory long-term care insurance the minute you hit the big 3-0.

Offered by the Ministry of Health to safeguard more Singaporeans in their golden years, CareShield Life’s premiums stand at $206/year for men and $253/year for women and are fully payable by Medisave so you won’t feel the pinch.

Those who require financial assistance can also apply for government subsidies and additional support. In a worst-case scenario of life-long disability, no-cap monthly payouts start at $600 and will increase over time to give you better coverage against the uncertainty of long-term care costs. Read to the bottom to find out how to get more comprehensive coverage over disabilities.

4. SG’s first Forest Town with an artificial intelligence core system

Image credit: HDB

We should’ve seen it coming with Punggol. They take an undesired, ulu plot of land and completely transform it into a sought-after residential area with eco-friendly amenities. Modelled as the country’s first “Forest Town“, Tengah is HDB’s current work-in-progress that boasts a lush, scenic neighbourhood, a car-free town centre and a Smart Energy Concierge powered by AI (artificial intelligence).

From a centralised cooling system for flats and an energy grid powered by solar energy to smart traffic lights to clear congestion, the Smart Energy Concierge will feature a host of functions to help the town run in a cost and energy efficient way with minimal disruptions.

Tengah looks close to godforsaken on the map right now, but it’ll be up there on the list of “Best areas to live in SG” in the foreseeable future – you just don’t know it yet.

5. Jewel Changi Airport with 10 floors of retail and dining options

Image credit: Jewel Changi Airport

If you’ve travelled in the direction of Changi Airport recently, you would’ve seen a glass dome rising on the horizon. That’s the noise-insulating facade of Jewel Changi Airport that’s made up of 9,000 pieces of specially manufactured glass and also the soon-to-be tallest indoor waterfall in the world.

Set to take over MBS as our next iconic landmark and tourist attraction, Jewel Changi Airport will house 10 floors (5 above the ground and 5 basement floors) of retail, dining and play attractions along with its airport facilities. How’s that for spoiling the market?

Sky Nets

Image credit: Changi Airport

We might’ve been wowed by T3’s Butterfly Garden, but Jewel is pulling out the big guns with its Forest Valley – a 22,000 sqm tropical nirvana showcasing the largest indoor collection of plants in Singapore. It also puts play areas around the city to shame with installations like their Discovery Slides, Canopy Mazes and Sky Nets – a 250m-long suspended bouncing net.

Preparing for the future with Tokio Marine

In the wise words of the Greek philosopher, Heraclitus – “Change is the only constant”. If we’re closing in on AI home systems in the next couple of years, just imagine what the future has in store for us. And for those zooming in on personal protection for the future, here’s another scheme by Tokio Marine that will complement any existing scheme you have in place and provide you with more comprehensive coverage.

TM Protect 1 – A disability income plan

Image credit: Tokio Marine Life Insurance

When you’re young and agile, it’s tough to picture a future with any kind of disability or sickness. No one plans to fall ill, but sometimes life throws you a curveball. And when – and if – that time ever comes, don’t let yourself be caught off-guard, neck deep in hospital bills.

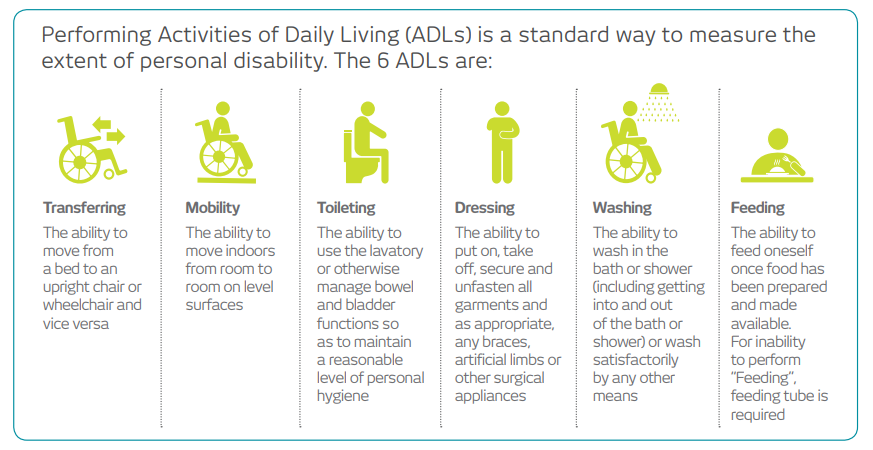

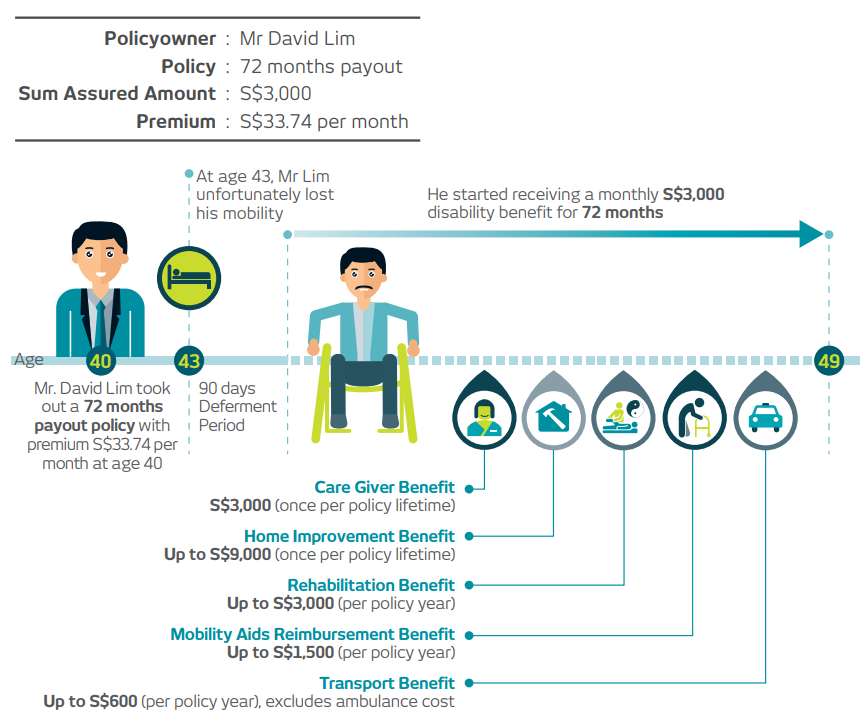

TM Protect 1 is Singapore’s first disability income plan that works to cover you in the event that you’re disabled and unable to care for yourself with premiums as low as 22 cents/day. Caring for yourself is classified into 6 Activities of Daily Living (ADLs) – Transferring, Mobility, Toileting, Dressing, Washing and Feeding. Failure to perform at least 1 of the 6 ADLs will commence a monthly payout for the entire duration of your chosen period of coverage.

Image credit: Tokio Marine Life Insurance

And unlike other protection plans that require you to go for lengthy full-fledged health screenings, TM Protect 1’s easy sign up only requires that you answer 5 health questions. In addition to the basic monthly payout, the scheme also gives you added benefits to help defray any other cost that might arise:

- Care Giver Benefit

- Disability Due to Heart Attack or Stroke Benefit

- Rehabilitation Benefit

- Mobility Aids Reimbursement Benefit

- Home Improvement Benefit

- Transport Benefit

Here’s an illustration to explain just how it all works:

Image credit: Tokio Marine Life Insurance

There is even a Get Well Benefit of 3 times the monthly benefit upon full recovery from an ADL disability. You can also choose between 3 or 6 year benefit payout periods – and plan renewal is guaranteed.

From now till the 31st of December 2018, in celebration of Tokio Marine Life Insurance’s 70th birthday, you can get 10% Premium Discount off the TM Protect 1 Disability Plan.

Get 10% off Tokio Marine’s TM Protect 1 Disability Plan today

This post was brought to you by Tokio Marine Life Insurance Singapore.