Financial planning with the DBS app

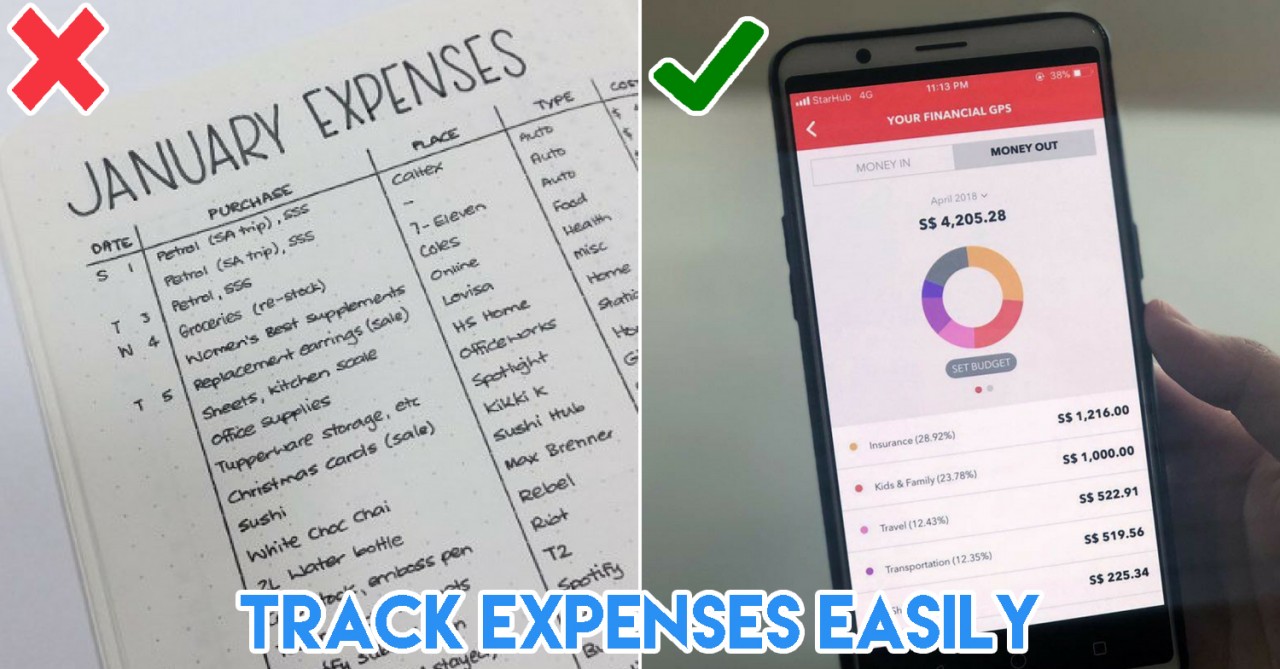

Image adapted from: @thatbujokid

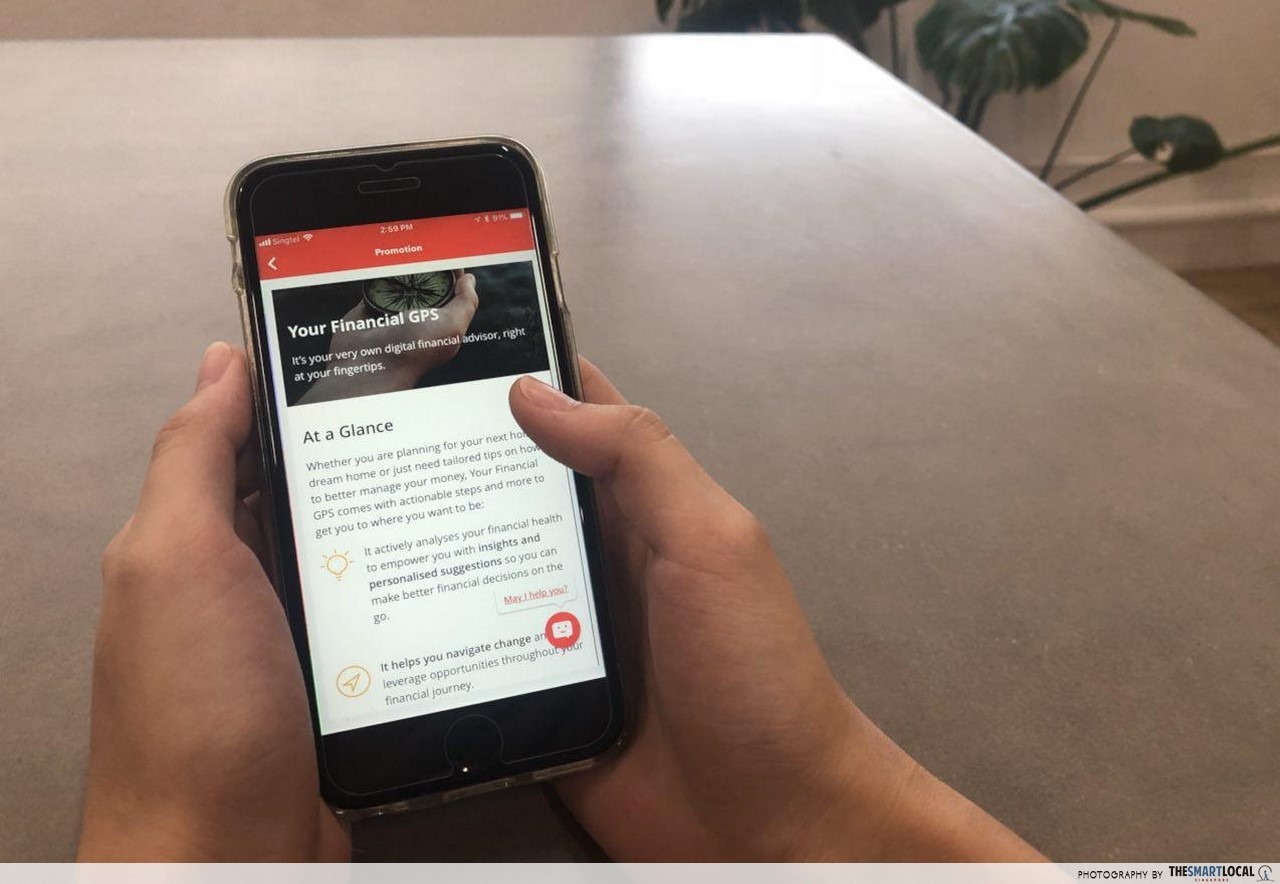

Taking your first step into financial independence is never easy. You’re armed with a jumble of messy receipts and not much else, but now you’re making your own money, you’ve got a newfound determination to save and spend wisely. You can do just that with DBS Bank’s Financial GPS which makes financial planning a whole lot easier.

This new DBS feature isn’t like any other free money tracker you download from the app store. In fact, this feature single-handedly knows so much about your personal life that it can give useful advice on how you should spend, save, or invest.

Track spending and set budgets

We’ve all faced our fair share of money woes. How much to spend, how to save, when to start investing? All valid questions, and no simple answer to any of this. Tracking down our expenses is a start but meticulously plotting out each and every purchase isn’t anyone’s idea of fun.

Let the DBS app do that for you.

Image credit: DBS

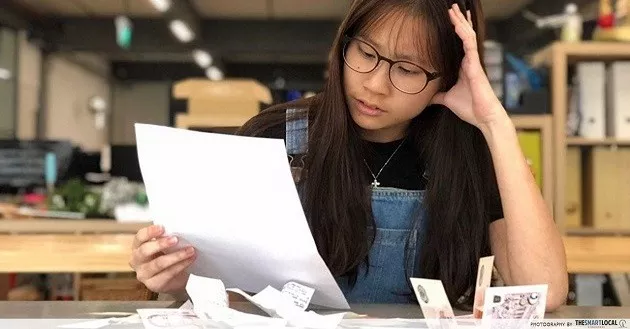

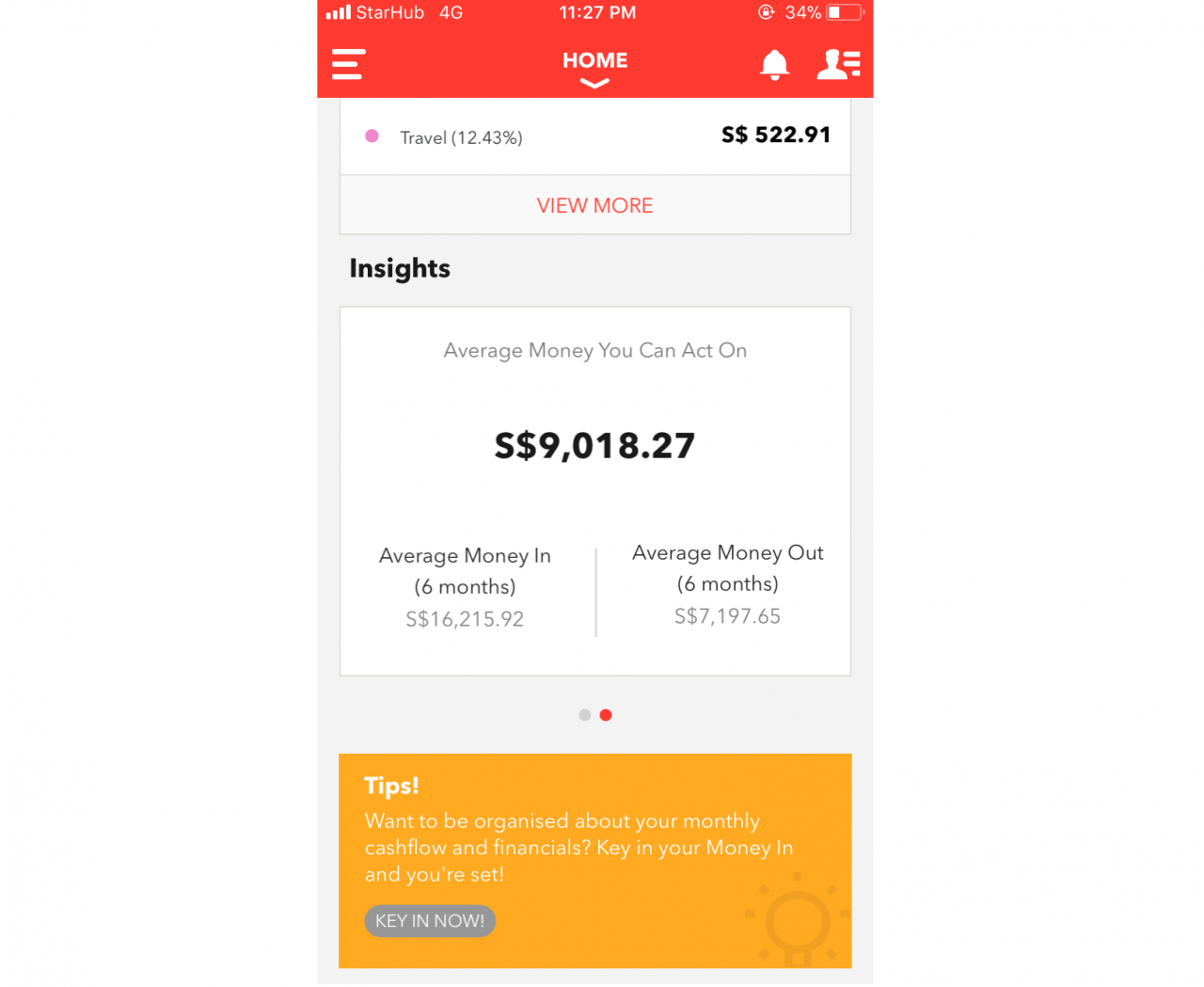

Your Financial GPS is a new tab in your regular DBS app. What I like most about it is that it comes with customisable budgets, so you know how much money you’re spending on the different areas of your life. Personally, I have a tendency to overspend on food so this app will be super useful when it comes to planning what to eat everyday.

Image credit: DBS

The DBS app is constantly monitoring your money in and money out, so it’s almost reached Google-like status by knowing your every spend. It tracks spending. It sets budgets. It even consolidates all your expenses into categories like ‘Transport’ or ‘Grocery Shopping’. But most of all, it gives clever insights into how you’re handling money.

No more confusion over things like “savings plan” and “life insurance”.

Using their analogy of a sailboat, here’s everything you need for solid financial planning:

- Saving: emergency funds to keep the boat stable when you need to weather out a storm

- Assurance: life and health insurance for that much-needed lifebuoy on board

- Invest: investments to get you faster to your goal, like a mainsail

- Life goals: things to work towards to, like a wedding or holiday

Best thing is, you can check out your SAIL status to see if you’re on the right track. If not, the app will offer up sound advice on how to save wiser or best use your money for investments and insurance plans.

Planning for a home, wedding, or holiday

Everyone’s got a long-term goal, whether it’s buying your first house or saving up for a much-needed holiday around the world. And that’s all made easier with proper financial planning. Since Your Financial GPS collects data and identifies trends, it’ll help you keep track of all your monies.

Image credit: DBS

If you’re trying to figure out how to make the down payment for a BTO or take a holiday to Japan at the end of the year, this app will help figure it all out – and even calculate how much you need to be saving per month. It also shows your average money in and out over a 6-month period, as well as how much disposable income you’re working with.

Plus, it offers plenty of money-saving tips and gives you strategies on investing spare cash – just so your pile of cash isn’t just festering away in a dead-end account that’s close to 0% interest.

NAV Hub at DBS Bank

If you want to take it one step further, NAV Hub will help you with their free resources with no strings attached. This means that they’re not allowed to sell you any products so no need to worry about the pressure to sign up. If terms like unit trusts and dividends aren’t in your regular vocab but you’re curious, then head straight down to NAV Hub – it’s a great place to learn how to manage your personal finances.

They also regularly hold free classes and workshops where industry experts will get us adulting, with topics like buying a HDB and budgeting tips for weddings. You can also join their online forum called YourNav Community, so if you’ve got any financial-related questions, you can simply pop in to start a convo with other curious people.

Make financial decisions with the DBS app

With DBS’ new app feature, dinnertime conversations with real life adults will no longer be a snoozefest – you’ll be joining in hearty discussions over the latest financial product. But really, this new feature is a godsend for those who can’t quite keep track of their money or save as much money as they need.

Your Financial GPS not only keeps track of expenses and savings, but is filled with money-related data that’s customisable to your life. Coupled with useful insights, this feature lets you take full control of every cent as you navigate your way through adulthood. Buying your first home, getting married, and having kids? Tough, but manageable with Your Financial GPS.

Find out more about Your Financial GPS here!

This post was brought to you by DBS.