Invest with a robo-advisor

You’ve landed your first steady job – well done! While you’re not exactly rolling in dough, you’re making enough to keep food on the table and then some. Unfortunately, for us non-finance folks, the steps to becoming a savvy investor aren’t all that clear. ETFs? Government bonds? Unit trusts? For all we know, all that mumbo-jumbo could very well be in Greek.

But with robo-advisor AutoWealth, they’ve got the core pillars of our lives all planned out for us. Robo-advisors offer financial advice that’s tailored to your risk tolerance and life goals by using sophisticated algorithms.

Compared to a human financial advisor, AutoWealth charges lower fees, is less biased, and offers higher investment accuracy. They also digitally monitor the market 24/7 – all very useful in helping maximise your potential returns – along with helping you buy and sell investments. So far, they’ve continuously outperformed most active fund managers.

Here’s how you can use AutoWealth to help achieve your life goals:

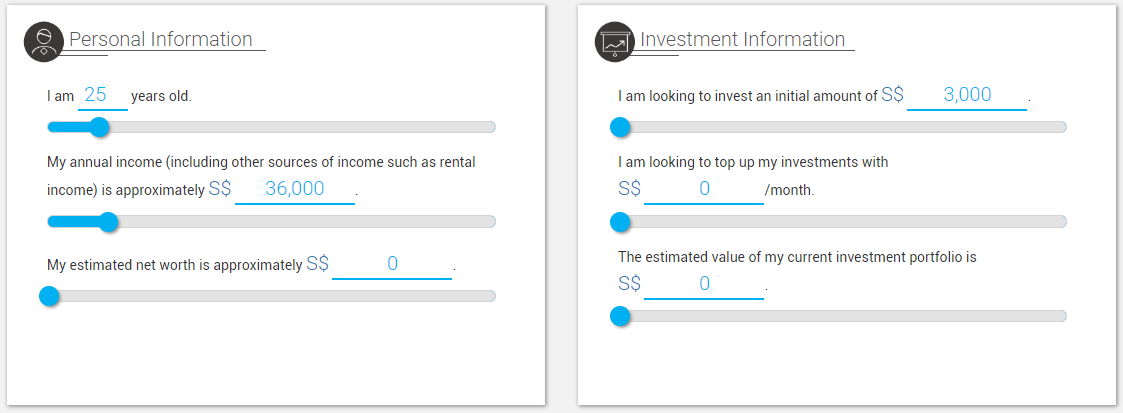

We set it to an annual income of $36k ($3,000/month). There’s a minimum investment sum of $3k, but beyond that, you just need to save $500 every month!

AutoWealth uses a complex algorithm – which considers factors like income level, age, and risk appetite – to build a recommended financial portfolio. You can also decrease or increase your risk level accordingly.

Get started by filling out personal and investment data, and you’ve got your very own customised investment plans to start saving up for a home, car, or even children’s education.

1. House

$30,000 is roughly the cost of downpayment for a BTO flat in a non-mature estate.

Saving up enough money to buy your own house should always be of first priority: a house isn’t merely your home, but a solid long-term investment plan. With AutoWealth, you can set a timeframe that works for you – we tweaked ours to 5 Years, which gives us ample time to start saving up for an approximate downpayment of $30,000.

Following AutoWealth’s recommendations, the Projected Annual Returns are roughly 4.9% – bringing your portfolio value to approximately $37k in 5 years. Thanks to robo-investing, you can hit your downpayment target and still have $7k extra for renovation!

2. Car

While many will vehemently insist that a car isn’t an investment – surely you’ve heard that the value drops tenfold as soon as you drive away – you can’t deny that it’s on many of our wishlists. And with the help of AutoWealth, that lofty goal becomes a whole lot more achievable.

Similar to saving up for a house, taking 5 years to save up for the downpayment of a car will get you a rough total of $37k. That means being able to afford a spacious car with a price tag of up to $100k and still have spare cash!

3. Wedding

Weddings are pricey business: once you’ve got an inkling of when you’re getting married, you’ll need to start saving ASAP. Use AutoWealth’s General Investing option for this so you can set a specific timeframe. If you’re getting married in 2020, that leaves you about 2 years to grow your savings. The Projected Portfolio Value in 2 years? Roughly $15k.

Between you and your partner’s savings, that’s more than enough for an average wedding in Singapore.

4. Children’s education

There’s no denying that children are our future, and as melodramatic as it sounds, the fate of our universe rests into their tiny hands. Depending on what you’re saving up for, preschool and university fees can be vastly different – not to mention all the tuition fees you’ll be forking up.

According to a HSBC survey, we spend an average of US$70,939 (~S$98k) on our children’s education, all the way from primary school to university level.

Sounds like a lot? Let’s say you’re currently in your mid-20s – your kids will probably be of schooling age in about 15 years. Using AutoWealth’s investment strategies, you can aim to save the full $98k in 15 years and maybe even get an extra $35k or so.

That’s plenty: you can use the remainder to put your kid through an overseas exchange during uni.

5. Spare cash

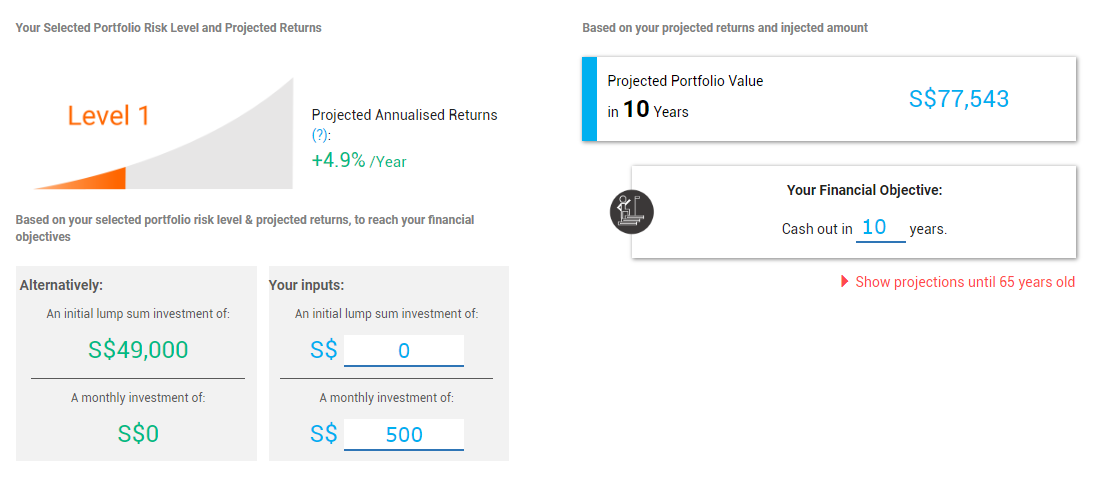

Fiddle around with AutoWealth to see how much you could save at the end of 10 years.

If you’re not saving up for anything in particular, it’s always recommended to have some cash on hand. Whether it’s 6 months or 10 years, AutoWealth offers projected portfolio returns of between 4.9% and 6.9% on your investments.

Grow your money with AutoWealth

When finance jargon leaves you scratching your head, try AutoWealth for easy-to-understand financial advice.

Now that you’re making the big bucks, there’s no point in hoarding your savings in the bank: it’ll all just wither away at a subpar interest rate that barely beats inflation. And while you want to be smart with your money – it’s okay to admit that you have no idea how to start.

Whether it’s saving for a house or planning ahead for your children’s education, using an investment platform like AutoWealth makes things a whole lot easier. Every single step comes with sound advice, from the recommended amount of monthly investments to the diversification of your financial portfolio.

Image credit: AutoWealth

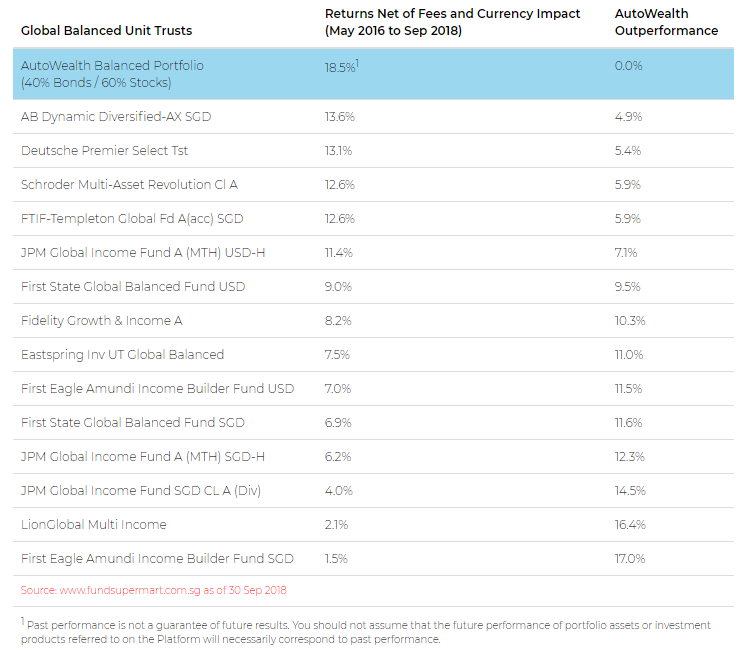

Although robo-advisors are relatively new to Singapore, they provide hassle-free investments that consistently outperform active fund managers. In the last 2 and a half years, AutoWealth’s track record has proven exactly that. You can also be sure that your money is yours – unlike unit trusts or many insurance policies, they set up separate custody accounts for their customers.

You’ll even get your very own wealth manager that’s just a WhatsApp message away.

Image credit: AutoWealth

Another plus point: AutoWealth screens over 6,000 Exchange-Traded Funds (ETFs) and only selects from those listed on the world’s largest stock exchanges. Once you sign up for AutoWealth for a low fee of 0.5% of the amount you invest and US$18 (~S$25) a year, simply sit back and watch your savings grow.

Find out more about AutoWealth here!

This post was brought to you by AutoWealth.

Drop us your email so you won't miss the latest news.