How to start financial planning as a student

My life as a student could be summarised in just one phrase: “Champagne taste on a beer budget.” These atas dispositions of mine like frequent Uber rides to school and iced coffee from Starbucks resulted in an almost empty bank account most of the time.

It wasn’t until my uni days with adulthood on the horizon that I realised it was high time to get my act together. And after getting a bit more educated on the dos-and-don’ts of money, I’m proud to say that I’ve finally achieved financial stability with enough emergency savings to tide me through any rainy day. Here’s my story:

Not thinking about having any savings as a young, naive student

For most of my schooling life, “financial planning” were two words that didn’t exist in my dictionary. My spending was frivolous, and I probably championed the “YOLO” spirit way before the acronym even became a thing. Think grabbing fondue from Haagen Dazs after school with my clique and spending way too much on my instant photography hobby.

While my family wasn’t in the veritable top 1%, we were living pretty comfortably and I didn’t feel that there were any necessary obligations to have any emergency savings. “Mummy and Daddy can take care of it,” was the excuse I used whenever the thought of starting a savings account crossed my mind.

If there is a student equivalent of “living paycheck to paycheck,” you can find 15-year-old me there, living allowance to allowance

Only realising the need for proper financial planning during university

I first started thinking about having savings when I was headed off to university in Australia. But I played the uno reverso card on myself. Instead of using those savings for emergencies, it went to road trips, dining out, shopping, and other recreational spending. Oops.

My wake-up call came when I had to co-pay some medical bills that my insurance did not fully cover. And even though Mummy and Daddy could have wired me some money, it would have taken a few days too long to reach my bank account.

My bank balance was already running low, and to settle the bill I had to ask one of my best friends for a loan of $200. Can you imagine not even having $200 for a simple medical bill? I couldn’t even afford to pay for my health, and that feeling of helplessness absolutely sucked.

Achieving financial stability in just 2 years

After graduating and coming back to Singapore, I started looking at a couple of solutions to my savings. “Just don’t get a credit card, ah,” my mum cheekily warned me. And as attractive as accruing miles and cashback sounded, I knew I wasn’t ready to get my first C in the coveted “Five C’s of Singapore.” I wasn’t even eligible to apply since I wasn’t drawing a salary either.

I also used to hear my parents throw around jargon like “passive income” and “financial stability” when I was growing up, so I sat my dad down and asked him to give me a crash course on how to better manage my finances. Once he got over his nagging as all parents do, here’s what he shared:

- Think first, buy later

- Have at least three to six months’ worth of savings for living expenses

- Make your money work for you

That last tip he shared piqued my curiosity. How exactly can I make my money work for me? It was tricky starting with zero capital, but thankfully I lucked out and found a job soon enough which meant a steady income stream.

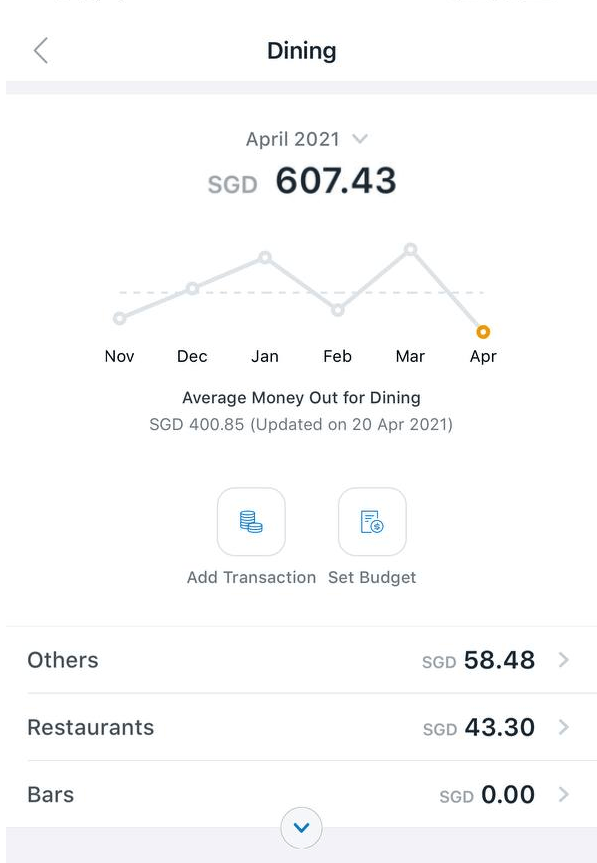

I decided to follow my dad’s advice and be more conscientious about my spending. I used DBS’ NAV Planner to track my finances with its Money In Money Out feature and set a strict monthly budget, especially for my dining out which was my Achilles heel.

Image for illustration purposes only

Screenshot from DBS NAV Planner

It didn’t take me long to get used to this adjustment in my lifestyle. Kopi from the kopitiam downstairs perked me up as good as Starbucks did, and ordering less from food delivery apps in the afternoon also meant I wasn’t packing in as many calories. The small savings over time meant my bank balance gradually grew and seeing that number increase was a dopamine rush.

After a year of mindful spending and saving, the tables have turned. I was no longer living life on a paycheck’s edge, and I could afford to loosen up a little now that I had around four months worth of expenses saved up – more than enough for the inevitable rainy day.

But keeping my savings stagnant in a bank was not going to make it magically double itself. Like Dad said, I had to find a way to make it work for me.

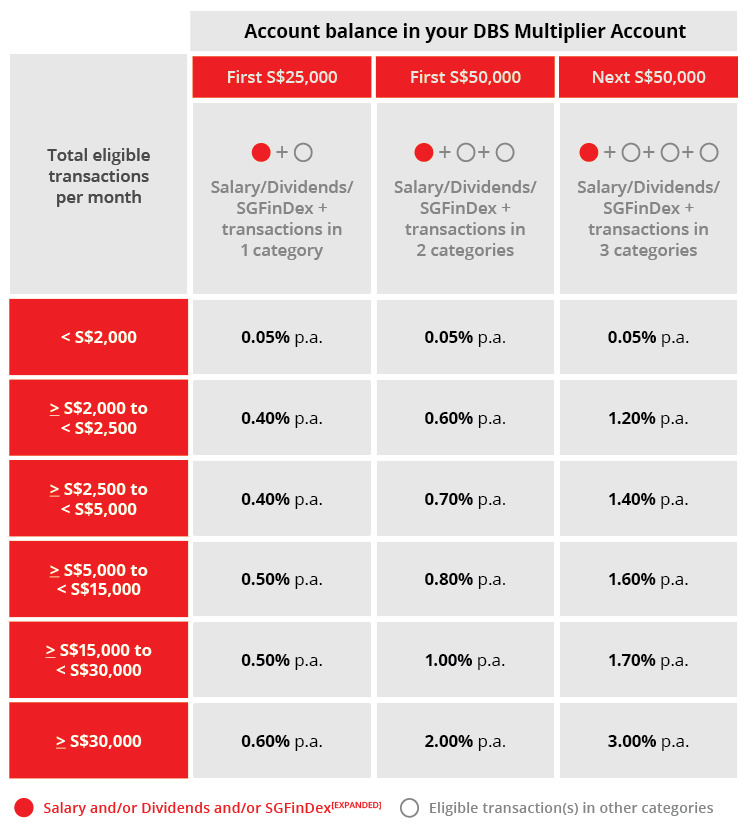

Enter DBS Multiplier. The personal deposit account checked all my boxes as someone in their 20s in a first job: No minimum amount was required and there were good interest rates that can scale from a base of 0.4% p.a. up to 3% p.a. by taking into account my salary, dividends, and transactions with DBS/POSB’s credit cards, investments, and insurance.

Image credit: DBS

My income and transactions per month made me eligible to earn at least 0.40% interest p.a. The concept of getting rewarded for everyday expenses that I’m already spending was definitely something up my alley, and I couldn’t pass up the opportunity to gain some passive income. It’ll also go back into my emergency savings, a win-win for me.

If you’re below 30 years old and aren’t drawing an income yet, you can also take advantage of Multiplier by spending with PayLah! to get at least 0.3% p.a. on your first $10,000 balance. You can also bump this up to 0.4% p.a. by connecting SGFinDex to NAV Planner and spending at least $500 per month with PayLah!

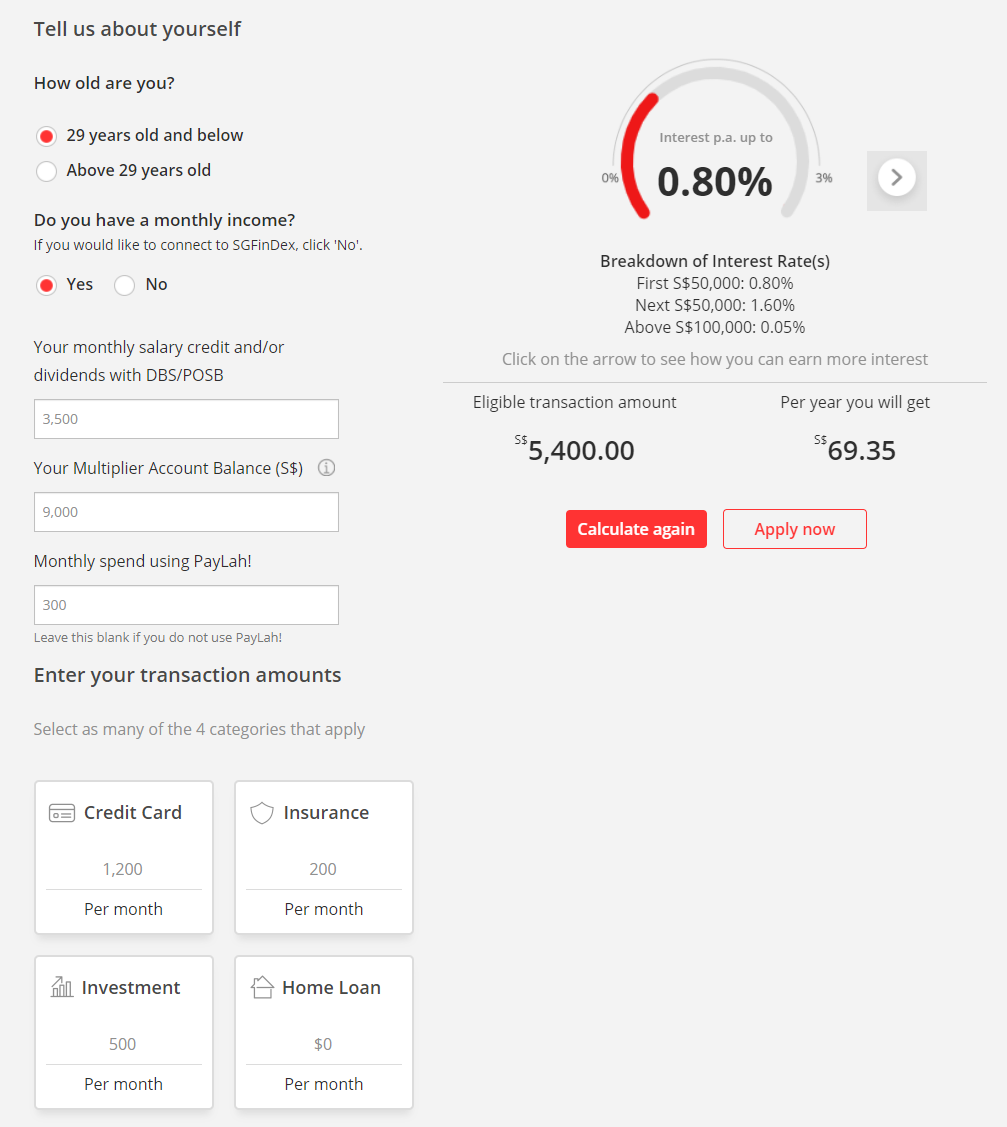

You can calculate how much interest you’ll earn with a nifty tool. Image for illustration purposes only.

Image adapted from: DBS

Now, Multiplier also recognises life insurance policies, investments like Invest-Saver and digiPortfolio, and connecting to SGFinDex on DBS NAV Planner, the last of which would come in handy for those who have yet to start drawing a salary.

How to start growing your money even as a student

Hindsight is 20/20, and if I could turn back time to tell my younger self to start taking financial planning more seriously, I’d do it in a heartbeat. Unfortunately, I don’t have ready access to a time machine just yet, so the next best thing I can do is to advise my younger peers to be more mindful of their pocket expenses.

It might be daunting to start, especially since anything involving money for those who haven’t even started working is intimidating. But those still in school or young adults who are not earning an income yet can qualify for DBS Multiplier’s interest rates by linking their finances with SGFinDex each month.

Those 29 years old and under also have the option to earn this bonus interest by simply spending on eligible PayLah! transactions with no minimum spend required. It’s pretty easy to get started – definitely more than building a time machine – and you can thank us later when you look back and see how your monies have multiplied.

Find out more about DBS Multiplier

This post was brought to you by DBS.

Illustrations by Charlotte Lee.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Drop us your email so you won't miss the latest news.