Uni Exchange Hacks

During my three year stint in university, getting the chance to live abroad was undoubtedly the best part of it all. But a student exchange programme is more than just joining societies and becoming the social butterfly you’re destined to be – because really, what do you do when living in a new country?

We’ve sussed out the 10 best tips and tricks that’ll have you cruisin’ your way abroad:

1. Enjoy a 2-day school week through smart timetabling

Two words: Weekend getaways. The sound of a mini vacation during the school week might seem like a myth, and we’re here to tell you it’s not.

I managed to enjoy this snowy getaway to Copenhagen by packing my winter-sem classes together. Image Credit: @rachormee

Many universities abroad allow you to customise your schedule, which means you’d be able to arrange your classes according to your preference – whether it’s cramming lessons into two days or enjoying just an hour of school everyday.

Pro tip: Pick modules that require less class-time, or have lectures and tutorials falling on the same day. Trust me, the 5-day weekends are worth it.

2. Score lobangs worldwide with an international student card

Image Credits: @isicglobal

If there’s anything more important than your passport, it’s your International Student Identity Card (ISIC). There’s no need to worry about scrimping your cash just to save a buck – this card enables full-time students to enjoy discounts for practically everything: we’re talking 50% off musicals, restaurants and even travel accommodation.

Sign up for an ISIC here. You can also follow @isicglobal on Instagram to keep tabs on the hottest deals from major cities all over the world.

3. Download student promo apps and get up to 50% discounts on big brands

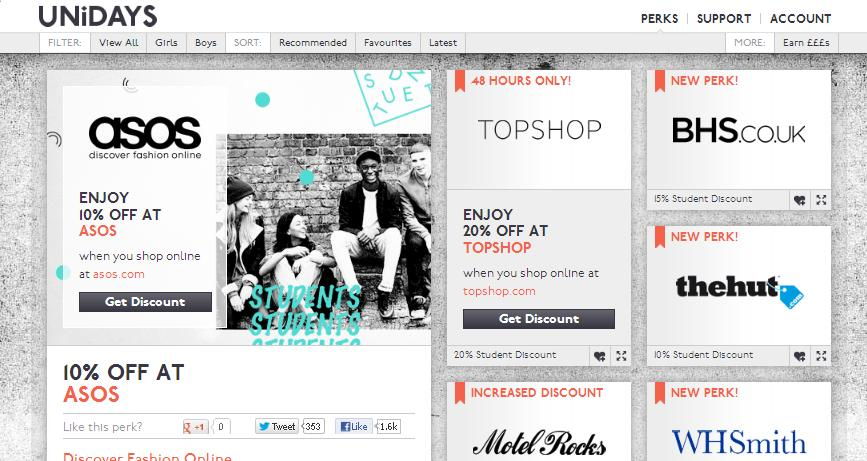

Aah, student life – the gift that keeps on giving. Keep the discounts rolling in by signing up for student-saver apps and websites such as UNiDAYS, which gives out promo codes for various stores like ASOS, Topshop and more.

Those living in the US can also download Shopkick, where users can earn points for every purchase, which can be converted into gift vouchers.

Pro-tip: Lots of shopping sites usually have big sales of up to 70% off during the off-peak mid-year season, so get the necessary clothes you’ll need for your exchange during this time.

4. Save money on groceries by cooking with your flatmates

Eating out all the time or tanking the cost of weekly groceries can – and will – cost you a bomb, so avoid this by sharing groceries amongst your roomies and splitting the cost. Not only would you be saving money, but cooking together is a great way to bond over some scrumptious grub.

A homely meal – with a little help from my housemates. Image Credit: @rachormee

Pro-tip: Earn yourself the Best Roomie Ever badge by initiating activities like “Cultural Night”, where everyone takes turns to cook a dish from their home country each week.

Bonus: Get coupons when you sign up as a supermarket member

If you’re flying off to the Land of Fish n’ Chips, be sure to sign up for the free memberships offered at British supermarkets like the Sainsbury’s Nectar card and Tesco Clubcard. Shoppers can collect points after every grocery run, and convert them into gift vouchers and discount coupons.

Know of supermarket perks in other countries? Let us know in the comments!

5. Keep a lookout for crazy sales and discount day

Time to up your auntie/uncle game my friends. Farmers’ markets are ideal for getting fresh groceries – and many universities host them on-campus on certain days of the week. Prices are cheaper too, as they’re catered towards students.

Australian convenience stores located near schools often have discount days on snacks when during exam period too, so stock up on those Tim Tams for as low as $2! Coles supermarket also has fresh produce every Tuesday, and perishables going on sale the day before.

6. Avoid overspending by keeping an expense tracker

Being in a country for a definite amount of time might lead you to focus less on saving money. This makes it really easy to overspend while on exchange, as you’re less likely to keep an eye on your daily expenditure.

![]()

Mint’s got budget planning down to a science. Image Credit

But with expense-tracking apps such as Mint or YouNeedABudget, you can create a customised budget based on your spending habits – you know, like going a little overboard on that latest kegger. Bill tracking apps are also nifty for keeping all your transactions in one place – they’ll even notify users of upcoming rent payments when O$P$ time comes around.

7. Travel cross-country for ⅓ the price with a youth coach/railcard

Travel from Paris to London by bus. Image Credit

Flights may be the quickest and most convenient way to travel, but they’re often the priciest too. But fret not, because the same destinations can be reached via the bus or train too.

PSA for the UK crew: Signing up for National Express and National Rail youth passes – which make inter-city travelling a breeze – is a must. And for those wanderlusters itching to get out of the country, you can explore cities like Paris and Brussels for just £12 with Eurolines, or Megabus – where you can travel for as low as just £1!

Note: Megabus is also available in the US and Canada.

Keep a look-out for youth travel passes that most major travel companies offer students – like South Korea’s Korail Youth Pass and transport concessions when travelling around Australia.

Bonus: Make new friends by going on road trips

There’s no better way to explore a country than going on a good ol’ road trip. Websites like Travel Buddies lets you find other travellers going in the same direction – which allows a group to share travelling costs.

8. Escape exorbitant Uni dorms by living in private accommodations

Living the dorm life might sound fancy – and cost just as much. Instead, opt for private-rented accommodations instead. Websites such as Couchsurfing and Gumtree are perfect for those looking for single apartments. Plus, they’re more likely to come fully furnished too.

9. Get a car for as cheap as $1,000 in Australia

This one’s for those going Down Under: getting a second-hand vehicle in Oz is a good investment, as cars here are considerably inexpensive. Not only would this save you public transport cost on the daily, but also a ton of time – just make sure your car doesn’t need excessive repair work.

Pro-tip: Woolworths supermarket has a handy app that notifies drivers of petrol prices at nearby stations that are within a certain radius.

10. Stay insured despite how healthy you are

Nothing could possibly happen to you within a span of a few months, right? Well, despite how healthy or safe you think you may be, it’s always better to get yourself insured during your time abroad. I once had a friend who had appendicitis while abroad; fortunately her medical bills were covered by the insurance policy she took up before leaving for her exchange programme.

Pro-tip: Always keep a hardcopy version of your insurance documents with you when travelling – you never know when you’ll need it.

Take on the world with Liberty Insurance

The thought of leaving home for the first time is enough to send some of us into a state of frenzy, but there’s no need for mindless worrying. Liberty Insurance makes preparing yourself for a successful overseas experience a whole lot easier.

With their Overseas StudentCare plan, young Singaporeans have a comprehensive cover for all their needs while abroad – no matter where in the world you might be. Benefits include:

● Accident & Health: Personal Accident (up to S$200,000) and Medical Expenses (up to S$15,000)

● Travel and Baggage Delay (up to S$500)

● Worldwide Security Alerts: You may sign up for alerts on events that could pose a threat to your safety whilst overseas. This feature comes in handy during times of emergency too – if you ever find yourself in a compromising or dangerous situation abroad, login to their worldwide security platform to get tips on how to stay safe.

● Student Assistance: Study Loan Repayment (up to S$5,000)

With these extensive benefits and more, there’s no reason for you to let practical concerns such as security or health get in the way of your plans. Be it just for the summer or a whole year, an exchange programme is an opportunity not to be missed.

So go forth, youngins – your great worldly adventure awaits.

Find out more about Overseas StudentCare here!

Note: Singaporeans aged between 15 – 45 years, and those registered as students with overseas educational institutes (full-time or exchange) are eligible to apply for this policy.

This post was brought to you by Liberty Insurance.