Saving habits of working adults in their 20s

Adulting in Singapore is tough. The cost of living is continually on the rise, and we have a 9% GST hike to ‘look forward to’ in the not-too-far-off horizon. Now more than ever, it’s imperative to sort out your finances and see how much you’ve saved thus far.

There’s no magic number to determine how much savings you should have in your 20s; after all, comparison is the thief to joy, and everyone’s circumstances are different. But as a general rule of thumb, you want to have at least 6 months’ worth of salary stowed for a rainy day. Plus, you want to be saving at least 20% of your paycheck.

So, how do you go about achieving that? We asked our colleagues and friends to give us some of their top saving tips that you can adopt to fast-track your financial goals.

1. Get 10% off when you pay with dedicated apps at food courts

Even hawker and food court prices are on the rise, but you can still enjoy some savings on your meals. If you frequent Kopitiam, Koufu, and Food Junction, listen up: you can get 10% off all your meals at these food courts simply by paying with their respective apps. Here’s a quick rundown of the apps you’ll need to enjoy the discounts:

- Kopitiam: FairPrice Group app

- Koufu: Koufu Eat app

- Food Junction: BreadTalk Group Rewards app

The best part is that there’s no minimum spend to enjoy the discount. All you have to do is get your in-app QR code scanned at the stall for the discount to be automatically applied to your order.

2. Use an expense tracker to track monthly spending

![]()

We all know that one friend who whips out their phone and says, “Wait ah, I need to record this” after making a purchase. Chances are this friend is using an expense tracker app or their banking app to keep tabs on their spending. And it’s a fantastic way to help you visualise where your money goes every month.

By building a clear picture of how you spend your monthly salary, you can identify the unnecessary purchases and tighten your purse strings accordingly. Personally, I discovered I was paying for subscriptions like HBO Max and obscure gaming services that I don’t use – needless to say, I’ve axed them and put my moolah to better use.

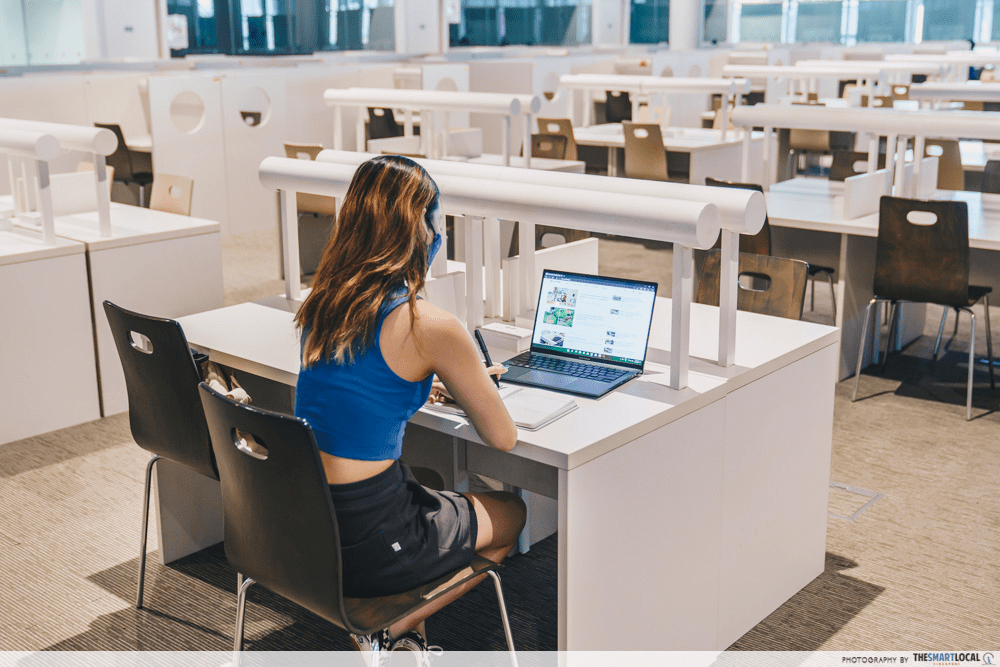

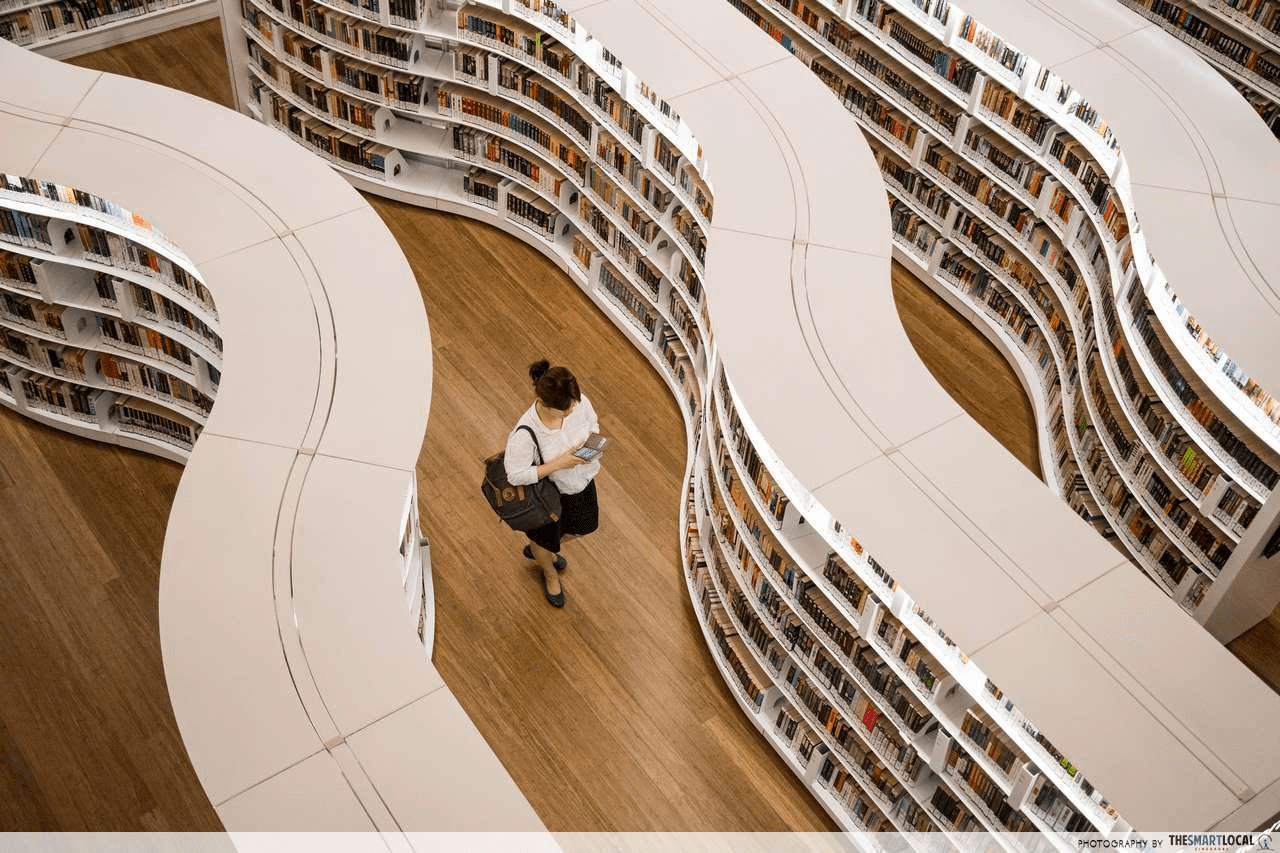

3. Work from community centres & libraries instead of cafes

Gone are your halcyon days as a student, living large on your folks’ dime. If you’re looking for spaces to work, forgo those overpriced cafes and expensive co-working space memberships. Instead, save up your dimes and head over to your nearest community centre or library to work.

Library @ Orchard.

As a plus, some libraries have gorgeous study spots that make for a pleasant working experience away from the office. Make sure you swing by before peak hours to chope a seat. And to be considerate to others, don’t leave your seat unattended for long periods of time.

4. Buy house brands instead of name brand products

Think twice before you reach for a bottle of branded dishwashing liquid or that well-known sack of rice. Branded products tend to be more expensive than the supermarket’s house brands. And it’s not just limited to your groceries, but also includes your everyday items like toiletries and other household goods.

Not to mention the quality is often exactly the same, as some house brand items are even manufactured in the same factories as the name brands. By choosing house brands over name brands, you’ll be able to save big on your grocery bill.

5. Buy pre-loved items such as clothes, furniture & appliances

When things break or stop working as intended at home, resist the urge to rush out and buy brand new replacements. Hunt down second-hand items instead – places like Carousell and Facebook are your best friends for your search.

Don’t be quick to snub second-hand too. There are usually items listed that are almost as good as new, but people may need to sell them quickly for various reasons. For example, expats leaving Singapore usually want to sell their furniture for cheap or simply give them away for free.

Follow in the footsteps of Gen Z and head over to thrift stores to find preloved items like clothes and bags for cheap. Online sites and retail stores like Née Vintage are great options for pre-loved luxury bags, which are priced lower than brand new.

If you simply need something for one-time use, you can use apps like GoodHood to see if your neighbours or people in your community have the item you need so you can just borrow and return it. For example, an appliance for a one-off baking session or a toolbox for DIY projects.

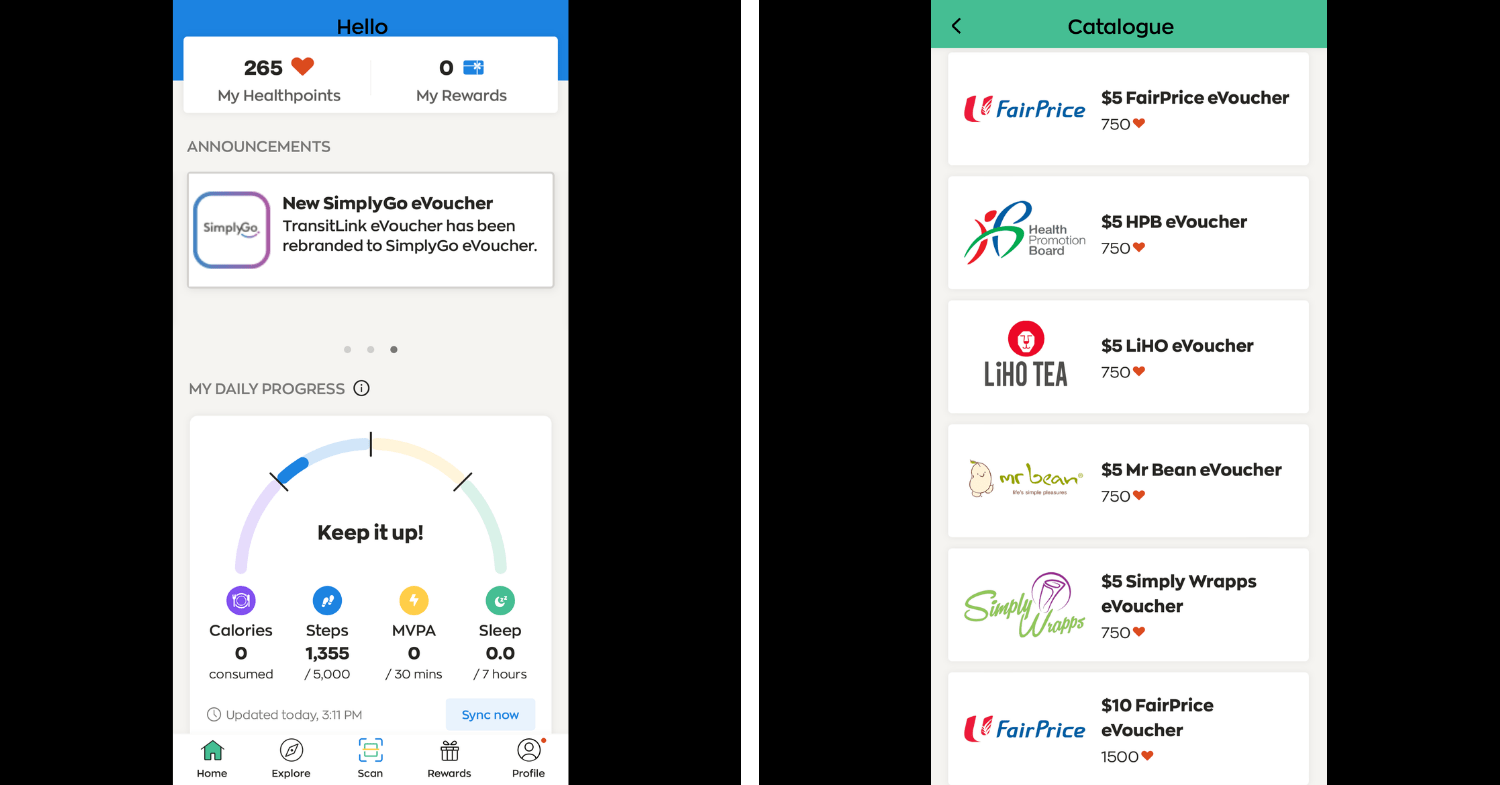

6. Use the Healthy365 app to snag points for vouchers

Remember the Healthy365 app (App Store | Google Play)? It’s alive and well, and it’s still rewarding you with points for clocking in steps and choosing healthier food options. Accumulate enough of these points, and you can exchange them for these rewards:

- HPB Credit$: Can be used to offset your NETS QR purchases at selected merchants.

- HPB & Merchant branded eVouchers: Available in denominations of $5 and $10 to offset your purchases from merchants like FairPrice.

- SimplyGo eVouchers: Can be used to top up your EZ-Link card for use on public transport.

Combining the Healthy365 app with your meal prepping will go a long way in helping you save money for the long haul. Then, you won’t feel so guilty about splurging on a fancy meal once in a while.

7. Set a cap on how much to spend for lunch

Image credit: Eatbook

As working adults, lunch almost always means having to eat out – especially if you’re WFO. That doesn’t mean you can’t cut down on your lunch budget, and one way you can do it is by getting caifan or economical rice. Just make sure you avoid seafood and pork chops, as these are often charged at a premium.

Knowing how much to spend on lunch will also help stem the splurges you’re not always aware of that add up like that bubble tea craving. Budget well so you still get a fulfilling meal, and save the treats only when you really want it. With a little discipline, you might be positively surprised to see your savings at the end of the month.

Alternatively, if you want to add a personal touch to your nutrition, try your hand at meal prepping. Apart from saving money, meal prepping has the added benefit of ensuring you eat healthy and wholesome meals.

And it isn’t difficult – you can start small by packing your leftovers from dinner for lunch the next day. Ingredients can be pretty cheap too; for example, a full head of broccoli starts from just $2.25 at NTUC, which is good for several meals and gets you your daily veggie requirement too.

8. Earn interest on your savings, even if starting small

The cost of living in Singapore is undeniably high, but by making small changes in your lifestyle with all these tips, you’ll be able to set aside a tidy sum for your savings. Having said that, you don’t want your savings to be sitting idle in your bank account when they could be helping you earn even more money.

Enter insurance savings account – a product that basically grows your money by earning interest on the principal amount and protects you against life’s unexpected mishaps.

You don’t need to accumulate a tidy sum to start growing your money. For instance, you can start small with the Singlife Account. By just funding a minimum of $100 to kickstart, you can snag up to 3.5% p.a.* on your first $10,000, plus the added benefit of life insurance that covers you for up to 105% of your account value.

If you are worried this plan has a mandatory lock-in period, it doesn’t. The Singlife Account has no lock-in period, so you can withdraw your cash any time without any penalties.

Protect your hard-earned savings with Singlife

If you haven’t already gotten your medical insurance needs sorted, check out the Singlife Shield Starter plan. This plan gives you an annual hospitalisation coverage of up to $20,000 with the flexibility to opt for private hospital treatment at only $300 annually. This is payable via MediSave, so no need to dig into your hard-earned stash to get yourself insured.

For just $1 more in cash, you can add on Singlife Health Plus Starter, a rider that reduces the amount you have to pay out of pocket to just 5% of your hospital bill.

With our saving tips and Singlife’s medical plan, you’re well on your way to hitting your saving goals and achieving financial independence.

Learn more about Singlife’s medical plans

*Up to 3.5% p.a. = 2% p.a. (promotional base return on first S$10,000 of Account Value) + Cash Bonus from the Singlife Account Special Incentive Campaign + 0.5% p.a. bonus return from the Singlife Sure Invest Bonus Return Campaign + 0.5% p.a. bonus return from the Singlife Account Top-up Campaign. All campaigns are available from now until such time as updated by Singlife.

This post was brought to you by Singlife.

Premiums quoted above are before GST.

These policies are underwritten by Singapore Life Ltd (“Singlife”). The Smart Local is not an insurance agent/intermediary and cannot solicit any insurance business, give advice, recommend any product or arrange any insurance contract. Please direct all enquiries to Singlife.

The content on this page is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person. You may get a copy of the Product Summary from Singapore Life Ltd and the participating distributors’ offices. You should read the Product Summary before deciding whether to purchase the product. You may wish to seek advice from a financial adviser representative before making a commitment to purchase the product. If you choose not to seek advice from a financial adviser representative, you should consider whether the product in question is suitable for you.

As Singlife Shield Starter has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. Buying a health insurance policy that is not suitable for you may impact your ability to finance your future healthcare needs.

The Singlife Account is an insurance savings plan. It is neither a bank savings account nor a fixed deposit. For disclosures under the Payment Services Regulation 2019 for the Singlife Account, please refer here.

This material is not an insurance contract. Full details of the standard terms and conditions of these policies can be found in the relevant policy contracts.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Singlife or visit the Life Insurance Association Singapore or SDIC websites (www.lia.org.sg or www.sdic.org.sg).