Parenting tips to safeguard your child’s future

Nothing sends our personal kiasu meters crashing through the roof quite like impending parenthood. And with only 9 months to give yourself a crash course on all there is to know about caring for your new baby, you’re now tasked with the full responsibility of ensuring that your child’s future is well planned for.

If baby countdown timer is ticking away and you’re still not 100% on top of your list of things to do, this guide to safeguarding your child’s future will lighten your new load.

1. Consider a Maternity Insurance plan if you haven’t yet given birth

Image credit: @elliesheanigans

Image credit: @elliesheanigans

The road to your little one’s arrival is paved with obstetrician check-ups, ultrasounds and tests. And even if you’ve worked all the forecasted costs into your budget, hiccups can still happen. It only takes one serious complication to blow your budget right out of the water.

Protecting yourself from the worst-case-scenario can protect your funds for it to be better channelled to planning for your child’s future and a maternity insurance plan will do just that.

Most plans take effect from the second trimester onwards and cover hospitalisation fees, pregnancy complications and the costs of treatment in the event of your baby develops a congenital disease.

2. Newborn insurance has the lowest premiums and the highest coverage

Image credit: Fabius Oo

Image credit: Fabius Oo

If you’ve dodged your way through pregnancy complications and find yourself cradling a perfectly healthy newborn, then the next most kiasu – and smart – thing you can do is to arm yourself with some newborn insurance. As with most policies, the premise is pretty straightforward: the healthier and younger you are, the cheaper your premium.

With that said, there’s no better time to lock in those ultra-low premiums than when your baby is fresh out of the oven with a perfect bill of health. Hypochondriacs and extra kiasu parents can also opt for additional Hospitalisation and Surgery or Personal Accident coverage. After all, it’s better to be safe than sorry.

3. Consider storing your child’s umbilical cord stem cells in case of medical emergencies

Image credit: @elliesheananigans

Image credit: @elliesheananigans

Most of us are well aware that our umbilical cords are responsible for our baby’s growth in utero. But the real reason why it’s the body’s MVP is that it is a rich source of life-saving stem cells that can be beneficial for your child and family.

Fun fact: Cord blood has as many as 10 times the amount of stem cells your bone marrow has. (Gunning J., 2007)

Cord blood contains highly adaptable Haematopoietic Stem Cells (HSCs) which have the unique ability to take on the form of red blood cells, white blood cells and platelets. They come in particularly handy should a need for a transplant in a time-critical situation ever arise.

Cord blood can be stored indefinitely and can be your baby’s second lease of life if one of the named diseases does rear its ugly head. What’s more, cord blood doesn’t lose its value when your child gets older – studies have also shown that cord blood stem cells have been effectively used to treat conditions like Type 1 Diabetes and even stroke later on in life.

4. Multiply your savings with a Child Development Account

Image credit: Hey Baby

Image credit: Hey Baby

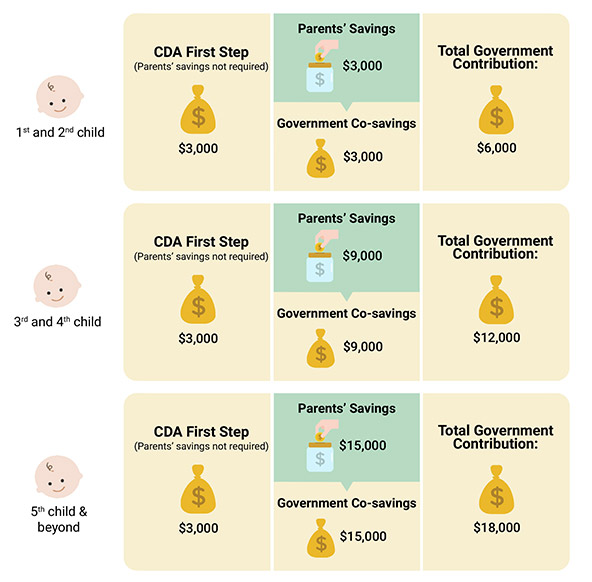

Probably the second most exciting thing apart from your newborn baby is getting access to the $8,000 baby bonus cash gift and the $3,000 Child Development Account (CDA) First Step Grant.

But before you flex your new financial spending ability on all the frivolous baby stuff you don’t need, deposit that money into your child’s CDA account to double your savings in lightning speed. On top of that initial lump sum, the government will match whatever you deposit into that CDA dollar-for-dollar up to $3,000.

The cash gift is released in batches, so if you don’t find yourself needing to use the cash urgently, it’s much wiser to put it where it belongs – in that CDA account! You’ll be able to use these savings to offset future payments like your child’s preschool education and healthcare expenses.

5. Start scouting for preschools and nurseries min. 6 months in advance

We’ve seen just how kiasu parents can be when it comes to enrolling their kids into Primary school, and sadly, preschool is no different.

If you’ve got your sights set on private preschool education for your little one, don’t wait until your child is just a couple months shy of 18 months before you start your search for a suitable school. Parents usually enrol their children at least 6-12 months in advance to secure a slot.

Planning when you want to enrol your child in school will give you a clear timeline to follow when it comes to shortlisting and contacting the schools you want.

6.Set aside funds for your retirement early

When you’re in the thick of squirrelling away cash for your child’s university fund, saving for yourself might take a back seat, but it really shouldn’t!

Saving for your retirement – as far off in the distance as it is – is always important. After all, nobody wants to be a financial burden on their children when they’re well on the road to starting their own families. An early retirement plan and ample savings will give you buoyancy and independence in your golden years or if your health deteriorates.

7.Write your will

Image credit: The Globe and Mail Inc.

Image credit: The Globe and Mail Inc.

Death is never an easy topic to broach – especially when it’s your own, but a will is something you shouldn’t put off until you’re well past 60 years old. If you’re not sure what will happen if you pass on unexpectedly without a will in place, here’s a teaser:

The government will freeze your assets – and a long and tedious process with lots of paperwork awaits your next of kin. This process takes months, if not years to even complete!

Writing a will save your loved ones the hassle and let you clearly state how much of your assets you want your child/children to inherit and when. If you need a little help with crafting one, WillMaker can help you do one up in 20 minutes or less at a flat fee of only $89.

Planning for your child’s future with Cordlife

Parenthood brings along with it a whole barrage of new information, new skills to equip yourself, and most of all, a list of things to do to ready yourself for a life with children! And just as our parents planned for our future, it’s now our turn to do the same for our little ones.

If you’re still preparing for your baby’s grand arrival into this world, it’s not too late to make arrangements to store your baby’s precious umbilical cord stem cells with Cordlife – a Singaporean family cord blood bank that has been established since 2001.

TL;DR – cord blood stem cells act as a medical safety net should your child develop a life-threatening disease or condition that may potentially alter his/her life for good. Think of it as a form of biological insurance which is a 100% match for your child.

Image credit: @cordlifesg

Image credit: @cordlifesg

From blood cancers and solid tumours to immune and metabolic disorders, cord blood can be used to treat a gamut of over 80 diseases such as leukaemia, lymphoma and thalassemia, just to name a few. Unlike the conventional bone marrow extraction, storing your baby’s cord blood is a painless process that’s completely safe for both mother and child.

On top of storing your child’s cord blood, you can also add an extra level of protection by storing your baby’s umbilical cord lining, also known as the skin of the umbilical cord. Similar to cord blood, the umbilical cord lining also contains 2 types of progenitor stem cells – Mesenchymal stem cells (MSCs) and Epithelial stem cells (EpSCs).

These are also known as the “muscle-forming” and “skin-forming” building blocks that make up our body. They can work to speed up the repair of damaged organs and tissues. And while clinical trials are still underway to access the full potential of cord lining stem cells, they could potentially hold the key to treating Alzheimer’s and Parkinson’s disease, spinal cord injury, stroke, heart failure and more.

And your only chance to harvest these highly-potent and life-saving stem cells in your baby’s cord blood and cord lining is at birth!

Find out more about cord blood banking with Cordlife here

This post was brought to you by Cordlife Singapore.