Best investment app in Singapore for beginners

We all know that it’s good financial sense to start investing early on in life. However, getting started can be difficult when there are so many cheem terms to learn and your hard-earned money is on the line. If you’ve been itching to get started on your investment journey, these 11 best investment app and platform options in Singapore can help you kick-start your financial journey.

Table of Contents

- Best investment app in Singapore for beginners

- 1. Endowus

- 2. StashAway Simple

- 3. Kristal.AI

- 4. Syfe

- Free comprehensive risk assessment

- 5. DBS digiPortfolio

- 6. FSM Mobile

- 7. OCBC Bank

- 8. PhillipCapital

- 9. MoneyOwl

- 10. AutoWealth

- 11. SquirrelSave

- Bonus: investment apps in Singapore to best familiarise yourself with investing

- Beginner-friendly investment apps in Singapore to start investing

1. Endowus

Flat, all-in access fee of 0.4%/year for CPF investments

Image credit: eleken via Dribbble

When it comes to important purchases like housing, education and hospital bills, CPF can come in mighty handy. But for those looking for other ways to grow your SRS funds for a comfier retirement, Endowus offers a flat 0.4% fee per year for full access to the service. It’s the best investment app option in Singapore for those with more funds, with a minimum required deposit of $1,000.

Management fees: From 0.25% to 0.60% p.a. for cash, 0.4% p.a. for CPF/SRS

Minimum deposit: $1,000

Ease of use: Advanced

Learn more about Endowus.

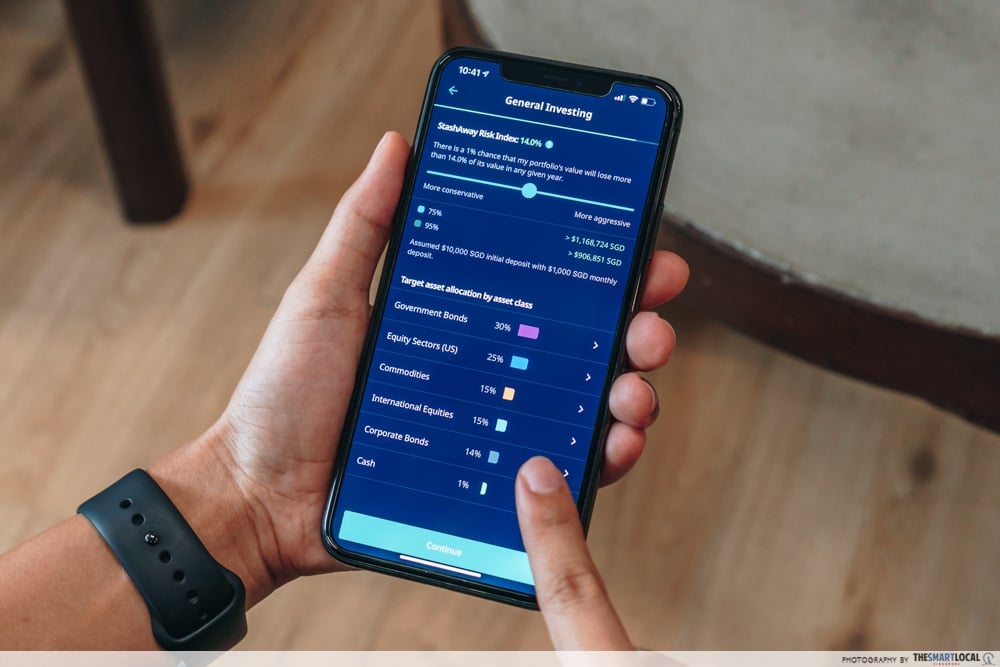

2. StashAway Simple

Best beginner-friendly investment app in Singapore with super-low fees

StashAway is one of the most intuitive and easy-to-use platforms available in Singapore

StashAway is one of the most highly-rated investment apps in Singapore, and for good reason. For beginners, their StashAway Simple cash management portfolio is ideal with no minimum deposit amount, and you can withdraw your investment whenever you want.

You simply have to fill in a questionnaire and the robo-advisor puts together a portfolio that suits your specific needs. Even with low returns of 2.4% per annum, Stashaway Simple will beat leaving your cash in a bank – although it is an investment and has risk. With low management fees of 0.15%, you pay $1.50 but gain up to $24 per year on a $1000 dollar investment.

Bonus: Once you’ve gained enough investment EXP, you can upgrade to the main StashAway service, which in exchange for higher management fees, grants you access to more advanced features like:

- More investment products to choose from

- Higher returns of up to 8.8%

- Accepts Supplementary Retirement Scheme investments via CPF

Management fees: 0% + 0.15% external ETF management fee

Minimum deposit: $0

Ease of use: Beginner

Learn more about StashAway Simple.

3. Kristal.AI

0 fees for investments under US$10,000

Another best investment app for beginners in Singapore is Kristal, which charges 0 fees for investments under US$10,000 (~S$12,971.05). It’s a unique service that uses artificial intelligence to allocate investors based on their financial goals and risk appetite to individual plans, also known as “Kristals”.

However, unlike most other robo advisories, the AI doesn’t perform rebalancing. Rebalancing involves small adjustments to the composition of your portfolio to ensure alignment with your financial goals.

Management fees: From 0%

Minimum deposit: US$100 (~S$129.71)

Ease of use: Beginner

Learn more about Kristal.

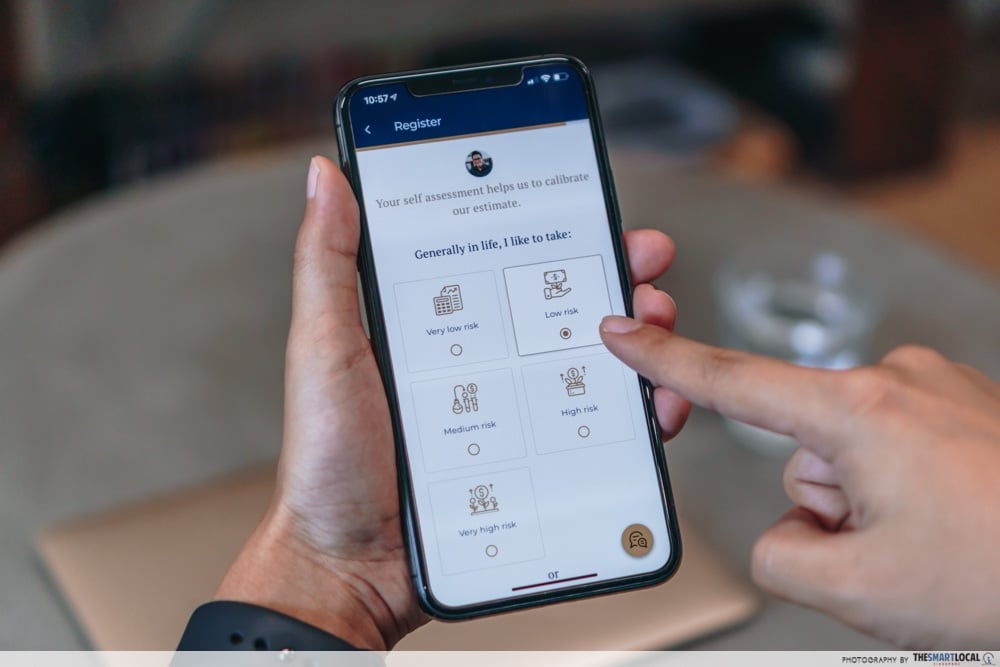

4. Syfe

Free comprehensive risk assessment

Syfe lets you personalise your investment portfolio according to a comprehensive and free risk assessment.

Syfe is the ideal beginner-friendly investment app in Singapore for those who want expert advice on their finances, by offering a free over-the-phone assessment even before you begin. The platform offers REIT and bonds in addition to ETFs, delivering up to a 3.9% return per year.

Like other robo advisors, Syfe provides unlimited and free withdrawals and does not charge trading and brokerage fees.

Management fees: 0.65% + 0.15% ETF management fee

Minimum deposit: $0

Ease of use: Beginner

Rebalancing available: Yes

Learn more about Syfe.

5. DBS digiPortfolio

Easiest option for Singaporeans with DBS accounts

Image credit: DBS

If you’re born and bred in Singapore, there’s a very high chance you have a DBS bank account. This means that if you’re looking to get your feet wet investment-wise, you’re just steps away from getting access to the DBS digiPortfolio robo-advisor service.

With a minimum deposit of $1,000, DBS digiPortfolio gives you a choice of Asian and global portfolios of ETFs with quarterly rebalancing. Apart from ease of registration for DBS bank account holders, DBS digiPortfolio can be seen to be more stable as it is run by a large, reputable local bank.

Management fees: From 0.25% to 0.75%

Minimum deposit: $1,000

Ease of use: Beginner

Learn more about DBS digiPortfolio.

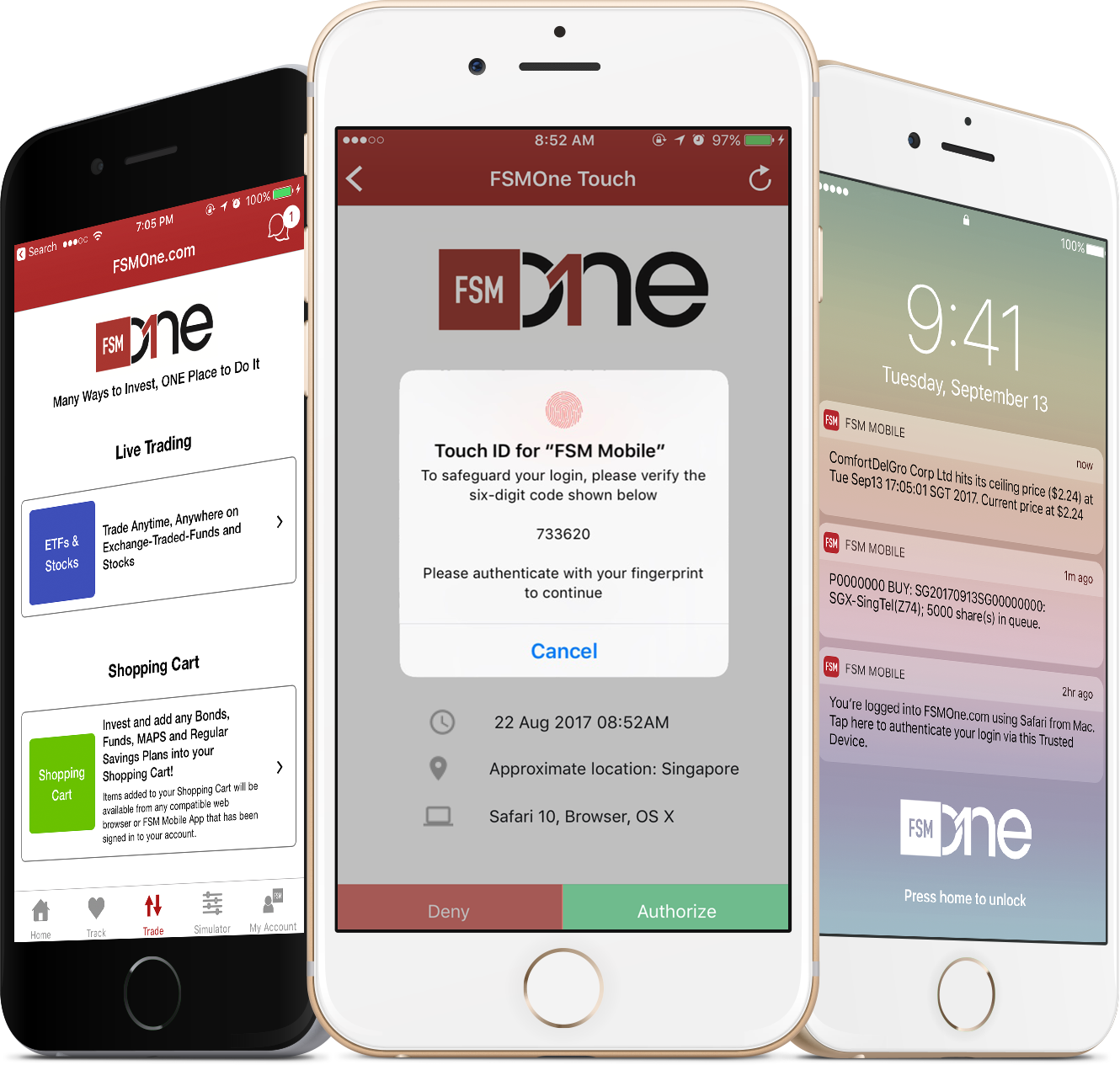

6. FSM Mobile

Lowest fees for regular savings plans amongst investment apps in Singapore

Image credit: Fundsupermart.com

If saving money is a constant struggle for you, a regular savings plan like FSM Mobile might be the best investment platform in Singapore to fit your financial goals. Just like an insurance policy that requires monthly premium payments, a regular savings plan will make it easy for you to invest regularly and develop better financial discipline.

With regular savings plans like these, cost is the deciding factor and with transaction fees starting from just $3.80, it’s amongst the lowest of the investment apps in this list, especially when dealing with larger transactions.

Management fees: From $3.80/transaction

Minimum deposit: $50

Ease of use: Intermediate

Learn more about FSM Mobile.

7. OCBC Bank

Lowest fees on small investments for those under 30

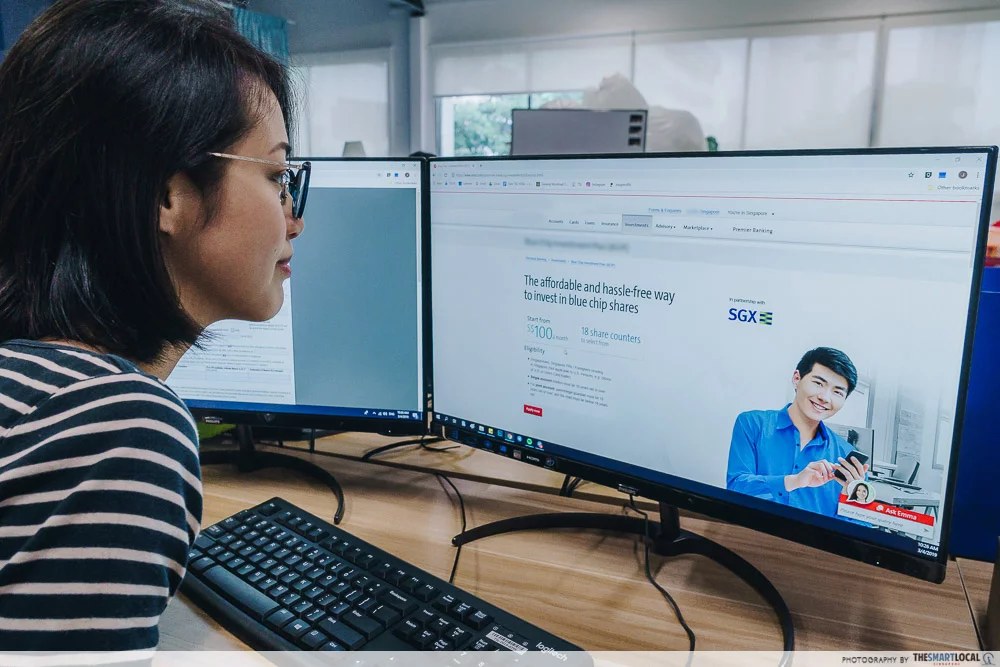

Another regular savings plan is OCBC’s Blue Chip Investment Plan, which is especially attractive if you’re under the age of 30 and planning to invest small monthly amounts or in specific stocks.

The OCBC BCIP offers a decent range of options of 7 ETFs and 14 individual blue-chip stocks, along with free Young Investor Programme youth seminars to get educated.

Management fees: 0.88% under 30 years old, from $5 per trade

Minimum deposit: $100/month

Ease of use: Intermediate

Learn more about OCBC Blue Chip Investment Plan.

8. PhillipCapital

Automatic dividend reinvestment, most investment options

With their $25,000 minimum investment amount, PhilipCapital has the highest barrier to entry when it comes to starting your trading journey, but offers the widest range of investment options with over 3,000 ETFs across 24 global exchanges. It also allows you to automatically reinvest dividends to increase your overall yield without fuss.

Management fees: 1.5%

Minimum deposit: $25,000 initial investment, subsequently minimum $500/month

Ease of use: Advanced

Learn more about PhillipCapital.

9. MoneyOwl

Pay only if you need advice

As Singaporeans, a sizeable amount of our salaries are allotted into our mandatory CPF accounts. If you’re earning a considerable sum, you might want to consider voluntarily contributing salary to your Supplementary Retirement Scheme (SRS) account for tax rebates.

With platforms like MoneyOwl, you will then be able to invest your SRS for additional returns. MoneyOwl customers can enjoy a free 2-hour comprehensive financial planning session to better understand their options, or top up 0.65% per annum for personalised advisory service.

Management fees: 0.4%

Minimum deposit: $50/month

Ease of use: Beginner

Learn more about MoneyOwl.

10. AutoWealth

Best investment app in Singapore for larger investments

With a unique fee structure comprising a yearly subscription fee of US$18 (~S$23.36) on top of a 0.5% annual commission, AutoWealth makes for one of the best investment app options in Singapore for those intending to invest large sums.

The service differentiates itself with highly-personalised service, with a financial advisor allocated to each investor that can be contacted easily over WhatsApp or in person. Each investor’s money is also held in separate custodian accounts on the exchange, which means that your money is technically safer.

Management fees: 0.5% commission, US$18 (~S$23.36) subscription per annum

Minimum deposit: $3,000

Ease of use: Intermediate

11. SquirrelSave

Gamified questionnaire to determine risk appetite

Image adapted from: SquirrelSave

For those unsure of the kind of investor they are, Squirrelsave outdoes the other robo-advisors with a fun and engaging activity to determine your financial goals and risk appetite.

A user-friendly UI, no lock-in and no minimum deposit make it easy for beginners to get the hang of the platform. In return, SquirrelSave charges a 0.5% annual fee, and only charges 10% commission on the difference in records whenever it hits a new all-time high.

Management fees: 0.5% per annum, 10% high-watermark commission

Minimum deposit: $0

Ease of use: Beginner

Learn more about SquirrelSave.

Bonus: investment apps in Singapore to best familiarise yourself with investing

SGX Mobile – the best source of information for local portfolios

Keep updated with local market trends with SGX Mobile

SGX Mobile (App Store | Google Play) is a great source of real-time information on local stocks and shares. If your portfolio has many Singaporean stocks or if you are keen on familiarising yourself with local market conditions, this app would be an indispensable tool in your arsenal.

Learn more about Singapore Exchange.

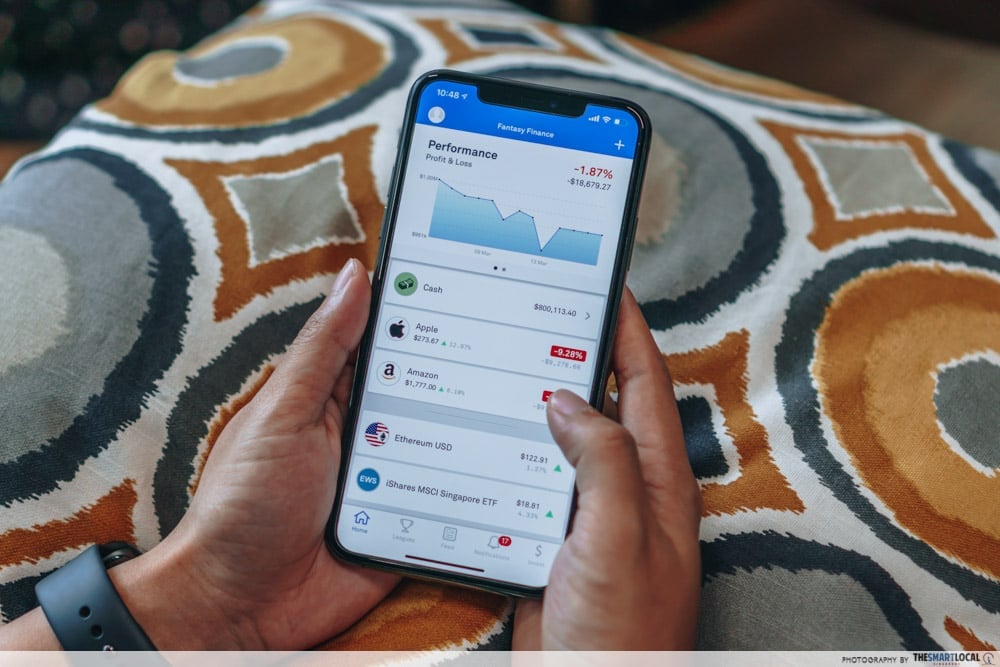

Invstr – learn to invest by playing

Invstr is a stock market simulator that allows you to invest real money if want

Learning about investing can mean sacrificing your valuable time or even making mistakes with your hard-earned money. Invstr solves this by gamifying investing, making it fun and easy to take your first step in this weird and wonderful world.

In-game share prices reflect real-world conditions, and players can compete to build the most robust portfolios and generate the most returns.

Management fees: $3.99/month for premium

Minimum deposit: $0

Ease of use: Beginner

Learn more about Invstr.

Beginner-friendly investment apps in Singapore to start investing

With so many beginner-friendly investment apps in Singapore, it has never been easier to get started investing. Whether you choose to start with an investment simulator, opt for low-risk investment strategies like StashAway Simple, or plan for your retirement by investing funds in your CPF account, they’re all baby steps in the right direction.

Disclaimer: This article is not intended as financial advice, and readers are encouraged to seek qualified professionals when making financial and investment decisions.

Photography by Kenneth Chan.

Cover image adapted from: Unsplash

The apps have been ranked in terms of features and price from sources and reviews online.

This article contains partial partnership content. However, all opinions are ours.

Originally published on 13th July 2021. Last updated by Khoo Yong Hao on 10th December 2025.