How to start trading in Singapore

We’ve all heard the investment talk before. Whether it’s from your financial advisor or the “adult” of your friend group, most Singaporeans are familiar with the concept of investments, where you pump money into stocks to build wealth in the long-run.

The idea? Hopefully, to beat inflation instead of leaving your cash in banks or stashed under your bed gathering dust.

What is trading?

Trading, on the other hand, is a whole new ball game. Think of it as investing’s more risky sibling. Simply put, it’s the buying and selling of financial assets, generally in a more short-run timeframe. In pop culture, an example of this is when stock brokers in movies buy assets at lower prices to sell them at a profit when their value climbs.

Potentially, that means you can gain income even in the short-run – if you get on the right side of the market. If you’re itching to explore the world of trading in financial markets, you must understand the basics well before taking the plunge. Here are some trading tips:

1. Choose assets that match the amount of risk you’re willing to take

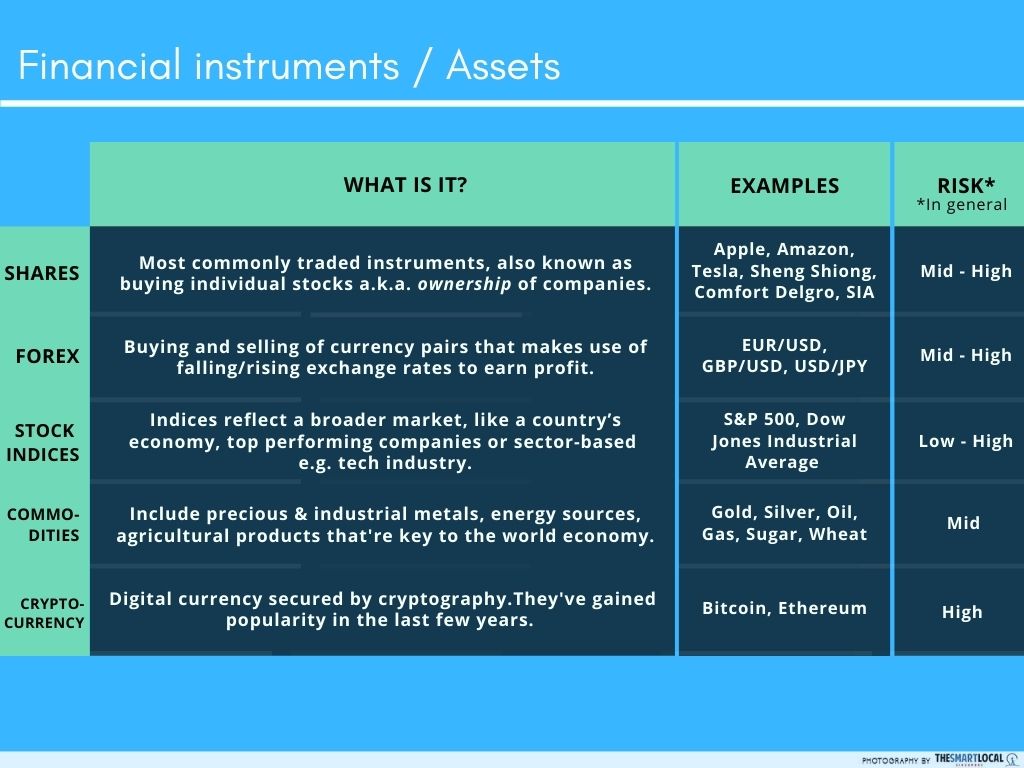

Trading, like people, comes in many forms. And you, aspiring Warren Buffet, can take your pick from the types of financial instruments (or assets) you’d want to trade in.

Each instrument comes with its own level of risks, for example, bonds are usually perceived as low-risk, low-return affairs while equities and Forex trading are usually for those with higher risk appetites due to its generally higher level of volatility.

In general, a higher possible return corresponds with a higher risk. These are just some of the instruments you could explore:

- Shares

- Forex

- Stock indexes/ indices

- Commodities

- Cryptocurrencies

Always do your research on the instrument instead of picking it due to popularity. Instead, look at the factors that affect its prices, past trends as well as financial reports.

Bonus: Besides trading the above assets directly, you could consider CFD (Contracts For Difference) trading. Instead of buying to own the financial instrument, CFD trading is based on a contract made between 2 parties – usually the trader and the CFD provider.

For example, in CFD trading, I sign a contract that has a set price for gold (A) at the time of signing. After the stipulated time on the contract or when I choose to leave the market, my gains and losses are based on the difference of the asset’s closing price (B) and A. You’ll also need to minus any costs such as commissions and holding costs to your trade.

As you don’t own the underlying asset, whether it’s a physical commodity or company stock, you can “buy” more than the money you deposited and gain revenue based on price change movements.

CFDs can be used across different assets. It also has a magnifying glass effect, where both earnings and losses are amplified. Image credit: The Smart Local

CFDs can be used across different assets. It also has a magnifying glass effect, where both earnings and losses are amplified. Image credit: The Smart Local

Note: CFD trading carries a high level of risk to your capital compared to other kinds of investments, as prices may move rapidly against you. So, you might lose more than your deposit and have to make further payments.

Because you don’t own the physical asset, CFDs also enable you to “short” the market, taking a selling position if you believe its value will decline in the short term. If you’re still confused (it’s normal), watch this “What are CFDs?” video.

2. Compare the fees & security of trading platforms

Before you start trading, you need to open an account on your chosen platform. Yes, there’re a million trading account providers out there, so narrow down options by comparing transaction cost, ease of use and most importantly, the security of your funds.

Be aware of transaction fees – most platforms charge a fee every time you buy or sell that ranges from $10-$25. Some also charge a commission based on the amount you earn, thus eating into your overall profits. Consider how safe your money truly is, too, as you wouldn’t want to lose your hard-earned cash through unlicensed providers.

Pro tip: Look for providers with a good reputation that are regulated by the Monetary Authority of Singapore (MAS) and comply with Singapore’s Securities and Futures Act. This means client money (aka your money) is held in a segregated bank account different from the providers’ own. If the provider becomes insolvent, at least you get your cash back.

Also, suss out if your choice of platform trades in the financial assets you’re interested in (see point #1). Some platforms specialise in US stocks, while others focus on CFD trading. Some, like CMC Markets, also include a diverse array of asset classes, so you can have it bao ka liao and trade on just one platform.

Many use trading apps on-the-go, so look out for mobile-friendly platforms.

Many use trading apps on-the-go, so look out for mobile-friendly platforms.

Lastly, for us millennials who’re wary of looking at pages of incomprehensible data and charts, an easy-to-use interface is a definite plus. Look out for platforms with noob-friendly online sites or mobile apps, and which offer extra features like watchlists or automated trading.

It’ll make your trading life that much easier, and help you to see patterns more clearly. Now, that translates into possible earnings – kaching.

3. Go for free courses and webinars on-site

Let’s be real, trading is not something that you can learn in a day. And the more you know, the more you realise how vast the financial landscape is. Even the biggest pro traders will say they still haven’t mastered the markets!

Ramp up your knowledge by using free online resources that are hosted on the very site of your online trading platform. For instance, established providers like CMC Markets offer introductory trading guides, full-fledged podcasts and complimentary webinars and virtual events you can sign up for.

Pro tip: There’s nothing like hands-on practice to get in the swing of things, so look out for demo account options on your online platform. Think of demos like your game “tutorial”, where you can familiarise yourself and practise trading strategies in a risk-free environment.

4. Diversify your portfolio across country and industry

Most people enter the world of trading with their eyes on the prize, but do spare a thought on how to mitigate losses, too.

To avoid being that person in the news who has lost thousands in a market crash, many experts suggest diversifying your risk – aka not putting all your eggs in one basket – by choosing different types of assets when trading. This isn’t just a strategy for long-run investment.

For example, some traders consider a 50-50 ratio: half of their money go to perceived lower risk assets like bonds or ETFs, while the other half to more volatile, but potentially more profitable shares.

Other ways to diversify include by country and industry. Take for instance if I had traded heavily in just the travel sector alone, I would have taken a heavy hit with COVID-19’s travel lockdown.

Airline and hotel stocks might not look so good right now, while Medtecs and Netflix are flourishing. Image credit: @singaporeair, Kendal

Airline and hotel stocks might not look so good right now, while Medtecs and Netflix are flourishing. Image credit: @singaporeair, Kendal

But, if I had also traded in other rising sectors such as medical technology or video streaming, my losses may have potentially balanced out.

5. Trade within your means – use stop-loss orders to limit losses

Some questions that cross the minds of every single trader: How much money should I trade with? When should I cut my losses? While there is no hard-and-fast rule in trading, professionals suggest you abide by these 2 strategies for risk management:

- Think of the maximum amount of loss that you can stomach, then set aside that money for trading. Let’s call this your account, and theoretically put it at $10k.

- Some traders apply the 1% risk rule. That means if your account is $10k, only risk up to 1% of it – $100 – on one single trade. The math goes like this:

If your asset price rises with 1.5%-3% gains, you could get a $300 profit off your original $100. If you lose up to 10 times: 10 x $100 = $1,000 lost.

This means just a few winning trades – where asset prices move up by a small percentage – can make up for losing trades! This rule can also prevent newbie traders from wiping out their account in one shot, and gain experience over time to refine strategies.

Pro tip: Most online platforms offer an automated stop-loss feature. Think of it as the well-meaning friend who stops you from buying bubble tea everyday for the sake of your health.

A stop-loss automatically stops your participation in the market when the price hits a specified point*.

A stop-loss automatically stops your participation in the market when the price hits a specified point*.

For example, if I buy a stock at $20 and set a stop-loss order to kick in at $19.80, I’ll be pulled out of the market when it drops by 1% to $19.80, thus limiting my losses.

*Not always guaranteed, as market conditions may cause the trade to be exited at a slightly different price due to market slippage or gapping.

6. Don’t blindly copy trades or listen to recommendations and news

If you weren’t already a daily news reader, stepping into trading in Singapore or overseas means your ears will prick up at current affairs or financial news. However, as beginners, it’s easy to take news or advice as gospel, and blindly follow the recommendations of your favourite sites, Whatsapp/Telegram groups, or even brokers.

Word of advice: Don’t blindly copy the trades of famous investors as they have different risk appetites, capital and knowledge compared to you.

Map out how much you’re willing to spend, plus your investment goals and strategies before entering the market.

Map out how much you’re willing to spend, plus your investment goals and strategies before entering the market.

Take rumours with a pinch of salt – maybe XYZ company has been tapped by finance gurus to grow, but insider moves like a CEO resigning, the cyclical nature of the economy and unpredictable events like COVID-19 can reveal little market movements (or worse, fake news).

Pro tip: There’s no shortcut – do your homework. Follow the market in your spare time to observe trends, plus read and cross-check reputable sites like Google Finance, The Wall Street Journal and Bloomberg. If you can, pick up technical analysis skills, the art of looking at past market data to predict future trends.

7. Match your style of trading to the time you have

Not everyone has the time to trade full time, and that’s okay. But different lifestyles and levels of commitment will translate into roughly 4 main styles of trading.

Position trading requires the least amount of commitment. Here, traders generally hold trades from months to years, with less regard to short-term market fluctuations and can spend just a few hours a week checking up on their assets.

A little higher up the scale is swing trading, where you hold assets for several days or weeks and try to figure out the best time to buy or sell them.

Image credit: Visual Capitalist

Image credit: Visual Capitalist

The glued-to-your-computer-monitor folks are the day traders or scalp traders. Day traders clock in like a 9-5 job, entering and exiting positions on the same day, while scalp traders monitor trades by seconds and minutes and profit off many, many small price changes.

How to start trading in Singapore?

Now that you’re equipped with the basics, take your first baby steps of setting up a trading account. If you’re keen to explore and learn faster, swim in the ocean instead of a swimming pool – dive into a platform that offers a wide range of financial products.

This is just a screenshot of the platform, the numbers might have jumped since then!

This is just a screenshot of the platform, the numbers might have jumped since then!

In this respect, I checked out trading platform CMC Markets, which has a mind-boggling array of up to 10k financial products. They offer everything from commodities to shares and indices via CFD trading, and reviews have rated them as “Best Overall Forex Broker” and “Best For Range Of Offerings”. That’s some peace of mind for my award-centric Singaporean brain.

They’re also legit – with over 30 years in the market, MAS regulation, as well as being listed on the London Stock Exchange.

Level 1 traders like me should take advantage of the platform’s extensive educational side, with e-books, webinars, their own podcast series, and glossaries. All the better to look up cheem terms like “bid-spread yield” and “bear market” instead of being embarrassed in front of your finance friend. You can also call upon customer help if you’re really stuck.

CMC Markets mobile app

What about mobile use? I tested the app myself, and you can easily see your profits, accounts and shortlisted assets at a glance. You can also sort by products, read news and analysis, set price alerts and more – all without leaving the app.

Other plus points for beginners: no minimum deposit and demo accounts with free virtual money. So you can start small, get the hang of it risk-free first and then…take over the financial world.

Whether you’re a newbie who wants to know more about trading in Singapore or overseas, or a pro refining your strategy, CMC Markets is a credible platform well worth your time and phone’s storage space.

Find out more about trading with CMC Markets

This post was brought to you by CMC Markets.

This advertisement is for information only, not an investment recommendation or financial advice. Losses can exceed your initial deposit. See risk warning/disclosure & other important information on our website: www.cmcmarkets.com.sg. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS). CMC Markets is regulated by MAS.