Healthcare in Singapore

The only healthcare most of us know is fever medicine, but we’ll all grow old one day. Lately, MediShield has been in the news: the government has announced that Medishield will be replaced by MediShield Life come November 2015.

In a way, MediShield Life is similar to its predecessor MediShield – it is basic health insurance administered by the CPF Board which reimburses expensive hospital bills and outpatient treatment. MediShield coverage is tailored towards treatment in the government subsidised B2 or C wards. But there’s so much more to MediShield Life than that.

Here are 8 things you should know about the new and upcoming MediShield Life:

1. ALL Singaporeans and PRs are covered

Regardless of your name or age, as long as you’re a Singaporean or a Permanent Resident, you will be covered under MediShield Life, and are entitled to some healthcare subsidies from the government.

2. You don’t need to fill up any forms

The hassle to fill up forms is real, but MediShield Life offers automatic inclusion to benefit everyone – especially those who are unfamiliar with tedious forms, such as the elderly or people with special needs.

3. You are covered for life

For better or worse, regardless of what you’re working as, MediShield Life protects you for life – from the moment you’re born to the moment you die. This is especially helpful as you age and your need for healthcare increases.

4. It doesn’t matter if you have pre-existing medical conditions

As a universal health insurance policy, MediShield Life covers any pre-existing medical conditions. For patients with serious pre-existing conditions such as heart failure, stroke or cancer, given the higher risks, they will have to pay additional premiums to co-share a portion of the cost.

Generally, patients will pay an additional premium of 30% for 10 years, but these additional premiums will only form a small portion of the full cost of their coverage, with the rest coming from the government and other policyholders.

5. Co-insurance and deductibles still exist

Although MediShield Life so far sounds logical, most of us, being Singaporean, try to “game the system”, hoping to get as much bang for our buck as possible. This means asking for the best hospital wards, or for specialist treatments that aren’t necessary “just in case lah… you know”.

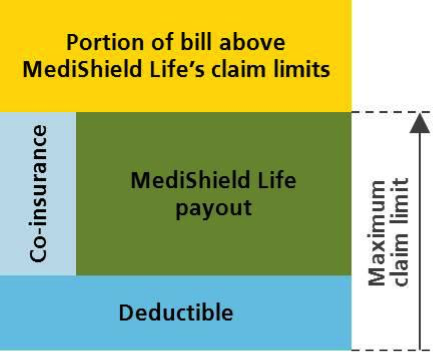

To prevent this, as well as creating a sustainable healthcare system, there are a few costs that patients will have to bear: co-insurance and deductibles. Deductibles are the minimum sum that must come out of your own pocket when paying for your hospital bills, before insurance takes over. Co-insurance is the percentage you have to foot to “top up” the amount your insurance pays for your bills.

6. Enhanced benefits

After paying the deductible and co-insurance out of your pocket, MediShield Life covers the rest of the eligible bill, up to the claim limits. With the higher claim limits and reduced co-insurance, MediShield Life gives you a higher payout, and you’ll pay less.

MediShield Life offers greater benefits than the existing MediShield in terms of higher payouts, higher claim limits and lower co-insurance. This means that when you seek medical treatment, you’ll get more reimbursement for your medical bill as compared to MediShield. It’s possible to get even more reimbursement – even for the full hospital bill amount – if you have an Integrated Shield Plan (IP), but find out more about IPs below.

7. You can’t opt out of MediShield Life

MediShield Life, being a universal policy, means that as much as every Singaporean will benefit from it, everyone also has the responsibility of contributing to it. This is the government’s way of creating a kampung spirit, knowing that when you fall ill, your neighbour will help you to foot your bill and doing his part to ensure your swift return to health.

8. You can top up your MediShield Life coverage further

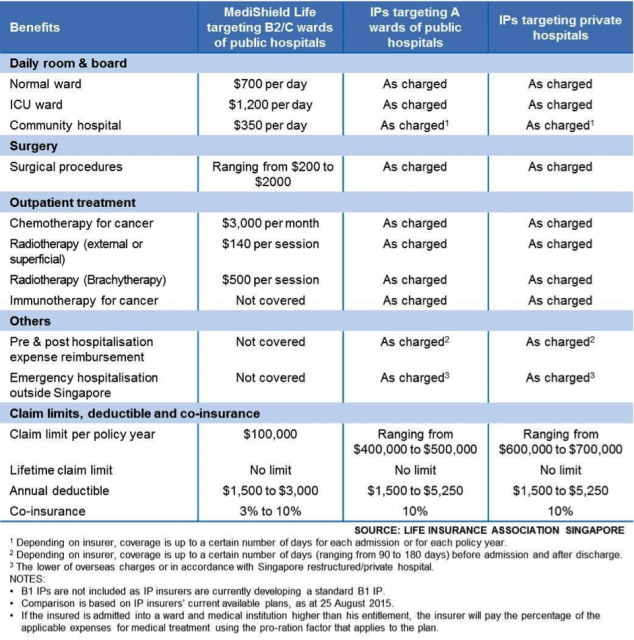

There are limits to MediShield Life though – pre and post hospitalisation costs aren’t covered. This includes A&E charges and post-hospitalisation treatments. Also, not only are there annual claim limits of $100,000 per year, there are claim limits of $200 to $2,000 per surgery, depending on the scope and complexity of the operation.

In order to have more comprehensive coverage, you can choose to purchase an Integrated Shield Plan (IPs) from a private insurer such as Aviva, where there are no claim limits for most benefits. Furthermore, IPs are designed to work seamlessly with MediShield Life, so there is no duplication of coverage.

Better safe than sorry

Singapore has an amazing healthcare system with some of the best doctors in the world. And with the implementation of MediShield Life, our healthcare financing system is about to get better.

The Life Insurance Association of Singapore compared MediShield Life vs IPs recently.

With an IP, you can choose to purchase add-ons that cover the deductible and/or co-insurance components of the hospital bill. And some IPs also offer additional value-added features – for example, Aviva’s MyShield covers four of your children for free until they are 20 years old, if both you and your spouse are customers!

MediShield Life is designed to be a basic scheme to cater to all Singaporeans, and IPs augment MediShield Life, giving Singaporeans greater choice. Learn more about various types of IPs and how they can help you here. Stay healthy, stay safe!

For more information about Aviva’s MyShield plan and its terms and conditions, please visit www.aviva.com.sg/myshield.

This post was brought to you by Aviva.