Insurance For Young Adults

I’ve been in my twenties for about four years already and I’ll be the first to admit that there are many things about being an adult that still go over my head. Some things come more naturally – like deciding what you like and don’t – while others require greater due diligence – one such being insurance.

If you’re lucky, insurance is something your parents have been handling for you since young. But now that you’re a twentysomething, it’s time to take charge of your own life. Here’s how you can get started – we’ve laid out 7 of the most important insurance tips that you should know before getting your first policy.

1. What should you look for in an insurance agent?

Your ideal agent:

- Has a reasonable amount of experience. Younger or newer agents have a higher tendency to leave the industry due to high competition.

- Has a congenial personality. You’ll want someone that you can be open with.

- Is the real deal. Check the Monetary Authority of Singapore’s Financial Directory to confirm that your agent’s legit.

FYI: Don’t feel paiseh to ask if they receive commission from the sale of a particular company’s product – this helps establish any vested interests. The idea here isn’t to be wary of all insurance agents, rather, to be prudent with your search so that you can build what will hopefully be a lifelong relationship.

2. What insurance policy do you already have?

You may already have insurance thanks to your kiasu parents. If this is true, go through with them specifics of the coverage. A common one that parents get for their children is term insurance. This provides coverage only over a fixed period of time, e.g. up to when you complete your tertiary education, or when you’re financially self-reliant.

It’s okay if your parents don’t remember the specifics of the policy that they bought for you. Just contact the insurance company directly and they’ll assist you accordingly.

Did you know: When you make your first CPF contribution (i.e. you officially start working), you’re automatically covered by the Dependants’ Protection Scheme (DPS) – a term insurance plan that provides coverage of up to $46,000, until you’re 60 years old. Learn more about it here.

3. What are the different types of insurance available?

Adapted from Source

While your agent will be the one deducing what kind of insurance you need, it’s useful to know what types of insurance are available and how they can meet your needs.

- Life – Typically pays out in the event of critical illnesses, death or permanent disability. It’s especially important if you have dependants, but also worth considering even if you don’t. You’re more likely to breeze through medical underwriting when you’re still in the pink of health, and you’ll also pay lower premiums if you start your life insurance policy at an early age.

- General – This is the umbrella term for insurance involving things like travel, vehicles and personal property. It covers a wide range of things including loss and damage so it’s usually only applicable when the situation demands it.

- Health – This covers hospitalization in the event of unexpected health scenarios like accidents, illnesses or disabilities. This is one of the most important insurances that you should first secure, since such scenarios can happen to anyone – even if you’re a gym buff who leads an active lifestyle.

4. What type of insurance do you need?

If you’re a standard young adult looking to get your first policy, you’ll probably not have to worry about something as long-term as whole life insurance or specific as home insurance yet.

Nevertheless, there is no one-size-fits-all approach to getting insurance. All you need to do is communicate all of your general life needs and concerns to your insurance agent. This is when it’s OK to be TMI – tell them if you’re likely to travel a lot, your health worries, any plans of furthering your studies etc. – these will be matched to relevant policies

FYI: Let’s say this isn’t your first time getting an insurance policy – you’re either thinking of getting investment-linked insurance or even approaching life milestones like starting a family and buying a house. There are online portals like DIYInsurance and compareFIRST to help you assess and compare quotes.

5. What are the necessary payments that you have to make?

- Premium – This is a regular payment that you make to maintain your insurance. Your choice of payment frequency depends on your means – this can be monthly, quarterly, half-yearly, annually or whatever is agreed with your agent.

- Deductible – For health insurance, this is the amount that you’ll first have to pay within a policy year (i.e. 12-month period attached to your policy) before the insurance company pays their share.

Example: Let’s say your deductible is set at $3,000. Within a year, you’ll have to pay $3,000 worth of medical bills out of your own pocket before your insurance plan kicks in.

- Coinsurance – This is the percentage that you’ll have to pay for every medical claim after you’ve paid off your deductible. The remaining percentage will be covered by the company.

Example: Continued from above, your deductible is $3,000 and coincidentally your first medical claim of the year is also $3,000. This effectively means that you’ve settled your deductible by your first medical claim. Your second claim happens to cost you $1,000. Let’s say your coinsurance is set at 10%, you’ll still have to pay $100 and the company will cover the remaining $900, provided that the plan is “as-charged” (i.e. you’ll be reimbursed for eligible hospitalisation expenses, subject to terms and conditions).

- Rider – An add-on policy to your main one as a means to provide supplementary coverage.

Example: A type of rider for health insurance can be one that helps pay for your deductibles and coinsurance. This means that you’ll pay a higher premium but you don’t have to worry about additional payments when being treated.

6. What if you can’t pay your premiums on time?

Before even committing to an insurance plan, make sure that you can afford maintain your premium payments. But let’s say you do find yourself unable to keep up the payments, don’t worry – there are a few ways that this can be handled.

Depending on your policy, there’s usually a grace period which allows you to pay off any outstanding payments. Beyond that, the company may decide to terminate your policy. Alternatively, you can consult with your agent who may recommend that you convert your policy with cash value to a paid-up policy. This basically means that whatever sum assured will be reduced and you will not have to pay any further premiums.

7. What should you not do as a first-timer?

Things not to do by the end of your first meeting with your agent – make any sort of final decision, sign blank or incomplete forms or disclose personal data without first knowing what any of it’s for. Just like deciding on the love of your life, do not settle – even if you’re having doubts on your second or third meeting.

Take comfort in knowing that there’s a 14-day free look period for you to look through your policy. It takes effect the moment you officially get your policy document – so don’t rush.

Be sure about your insurance

If you don’t understand specific clauses, terms and conditions, get your agent to clarify. Ask the tough questions. You need to make sure that you understand what you’re signing up for so you’ll have to do your homework as well. Otherwise, you’ll find yourself not knowing what to ask.

Also remember that it’s okay if your agent doesn’t know everything on the spot. If they offer to check and get back to you, it means that they’re taking the extra effort to get you a more informed answer.

Get your health insurance covered with Enhanced IncomeShield

Source: Income

There are many insurance plans offered these days so sometimes it’s hard to sieve out the one that best fits you. Enhanced IncomeShield is an Integrated Shield Plan (IP) that provides you with holistic coverage consisting of two parts – MediShield Life and an additional private insurance coverage portion provided by Income.

Among other things, the additional coverage includes pre- and post- hospitalisation treatments and even emergency overseas treatments so you’ll have a peace of mind when you’re off jet-setting. The enhanced benefits provided are plenty too – you’ll get an unlimited lifetime coverage and one that is considered “as-charged”.

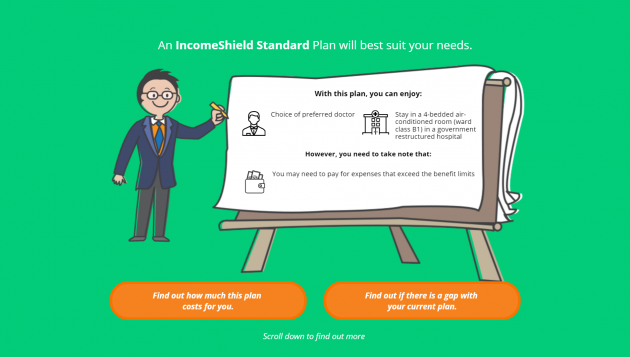

Source: Income

They’ve set up an interactive website called Know Your Shield which serves as a step-by-step guide to help you understand which plan is right for you. It’ll also highlight gaps in your preferred coverage and compare it to what you currently have.

Source: Income

It’s an easy-to-follow website which provides useful pop-ups explaining what specific terms mean. You’ll be asked questions to determine your needs but don’t worry – no typing is involved. All it takes is a few clicks and scrolls before you arrive at your recommended insurance plan. Costs are broken down for you as well so you’ll get a clearer idea of what you can expect.

Source: Income

Adult-ing isn’t actually as profound and daunting as it’s often made out to be. You just have to put in the work to make sure that you don’t fall behind the rest of your peers. Sure, even the best laid plans fall through sometimes, but it pays to be safe. And when you have insurance, it literally pays. You’ll thank yourself later so get yourself covered now.

Find out more about your potential first policy!

This post was brought to you by Income.