How to invest in Exchange-Traded Funds (ETFs)

In an ideal world, your investment income will be more than your monthly paycheck – not the other way around. It sounds like a dream, and the idea of investing becomes all the more exciting. But getting started often comes across as a tricky process. Too many options that are far too mind-boggling – we’d give up and let our hard-earned dollars languish in a low-interest account.

But there are ways to get your head into the investing game without agonising over the little details. One of the easiest ways to get started is to invest in Exchange-Traded Funds (ETFs).

What are ETFs?

ETFs, track an index which contains securities like stocks or bonds, and they are traded on the stock exchange. This allows you to diversify your portfolio from the get-go, by investing in a variety of companies (as in the case of stocks) with a single trade.

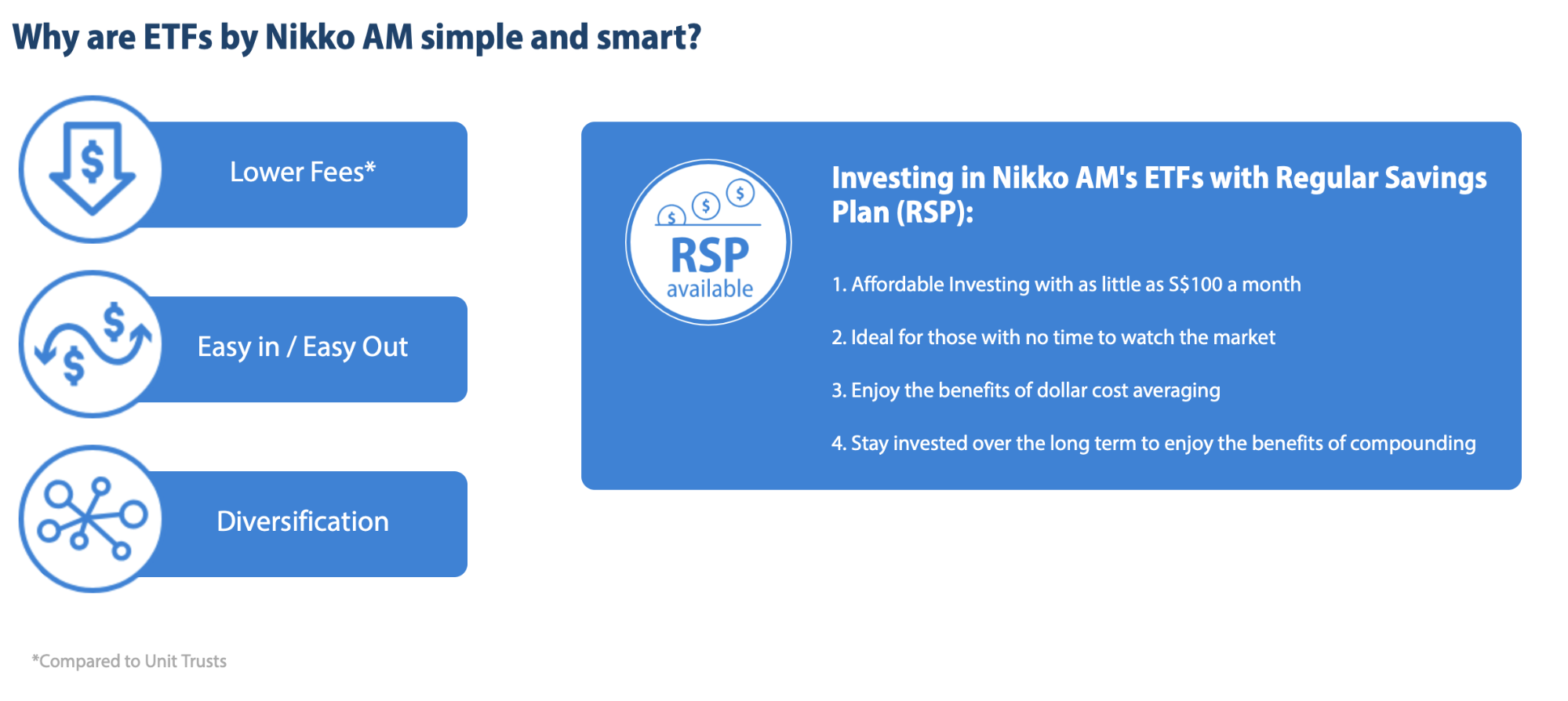

One way you can invest in ETFs is through an asset management company such as Nikko Asset Management (Nikko AM), who’s been providing ETFs in the Singapore market since 2005.

Here’s how you can start investing:

1. Think about your life needs

Fancy a dream holiday to Korea? Investing in ETFs may help you get started.

Before you jump head-first into investing, it’s important to think about what you want to get out of it. Are you growing your savings for a dream holiday? Do you want to diversify your stock portfolio? Or are you just giving investing a try?

Depending on what you want to achieve, there are many ways to go about investing. ETFs should be viewed as mid to long-term investments, as it may take time for you to see a possible return on your investment. They’re affordable and uncomplicated, and there’s little need for you to track the stock or bond markets closely.

2. Figure out how much risk you want to take

Go with fuss-free investments if you’re new to investing!

For most first-time investors, you probably want to pick something as affordable as possible. ETFs are a good option here and they provide diversified portfolios too. You can buy and sell them easily so you can exit the market if you feel things aren’t working out with minimal fuss.

The ABF Singapore Bond Index Fund, one of the ETFs managed by Nikko AM, is one to consider if you’re looking for a lower risk option. This ETF invests mostly in Singapore government bonds, which are some of the highest-yielding AAA-rated government bonds in the world.

These bonds are resilient, and are less affected by adverse market conditions, which is great for folks who prefer to live life on the safer side.

Read more about the ABF Singapore Bond Index Fund here.

3. Set up a Regular Savings Plan

There are a few ways to invest in ETFs. They are traded on the Singapore Exchange and can be bought through a stockbroker or an online trading platform. Some stockbrokers may also offer a direct subscription to the ETF but that would typically require a minimum amount of 50,000 units. An easy and fuss-free way is to set up a Regular Savings Plan (RSP).

RSPs work by investing a fixed sum monthly to buy units of the ETF. This ensures that no matter what, you’ll never invest more than what you’re comfortable with.

RSPs are great for the first-time investor, because you can just set aside a fixed amount to invest every month, and you can get started with as little as $100 a month! Plus, it provides the benefit of dollar cost averaging so that you have little to worry about market timing and volatility.

There are a number of RSPs out there – pick one that works best for you. Consider factors like what you’re investing in and how much the investment fee is.

Fun fact: You can invest in Nikko AM’s ETFs via RSP.

Invest in ETFs with Nikko AM

Image credit: Nikko AM

Getting started on investing doesn’t seem so scary anymore, with these simple and smart ETFs available. They’re a good way to enter the investment game with minimal fuss and may help kick start growing your savings for the future.

Here are 4 ETFs you should consider:

1. ABF Singapore Bond Index Fund

As Singapore’s first ETF bond fund, the ABF Singapore Bond Index Fund invests mainly in Singapore government bonds – one of the world’s highest yielding AAA-rated government bonds.

Find out more here.

2. Nikko AM Singapore STI ETF

This ETF has the investment objective of replicating as closely as possible the performance of the Straits Times Index, which comprises of the top 30 companies in Singapore.

Find out more here.

3. NikkoAM–StraitsTrading Asia ex Japan REIT ETF

Covering well-known Real Estate Investment Trusts (REITs) like CapitaLand Mall Trust, Mapletree Commercial Trust and Suntec REIT* across several Asian countries such as Singapore, Hong Kong, Malaysia, China, and Indonesia, this is a good choice if you want exposure to Asia’s property market in a single trade.

*Note: These names are among the top 10 REITs that the ETF invested into as of 31 August 2019. They are provided for illustration purposes only and are not securities recommendations.

Find out more here.

4. Nikko AM SGD Investment Grade Corporate Bond ETF

With bonds from the likes of Temasek, DBS, UOB, and Standard Chartered*, this ETF is an affordable way to invest in Singaporean and foreign corporate bonds from investment grade issuers.

Note: These names are among the top 10 bond issuers whose bonds that the ETF invested into as of 31 August 2019. They are provided for illustration purposes only and are not securities recommendations.

Find out more here.

With Nikko AM, investing in ETFs has never been easier. Set up your RSP today, and let the deductions happen automatically every month – it’s a relatively low-risk, fuss-free way to earn some passive income while living your life to the fullest.

Find out more about Nikko AM’s ETFs

This post is brought to you by Nikko Asset Management.

Photography by Clement Sim.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The performance of the ETF’s price on the Singapore Exchange (“SGX”) may be different from the net asset value per unit of the ETF. The ETF may also be delisted from the SGX. Transaction in units of the ETF will result in brokerage commissions. Listing of the units does not guarantee a liquid market for the units. Units of the ETF may be bought or sold throughout trading hours of the SGX through any brokerage account. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units. Investors may only redeem the units with Nikko AM Asia under certain specified conditions.

This document is for information only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in unit trusts or ETFs are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The funds may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the funds are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including risk warnings) and product highlights sheet which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.