Best miles credit cards

Have you ever wondered how your colleague affords all those fancy business-class flights? Unless they have a secret trust fund and rich parents, the answer is probably credit card miles. Yes, you can use your credit card to earn miles that you can then redeem for flights, making each cent of yours work double time. Here’s how to unlock the world of free flights and which miles credit cards you should be looking at.

Disclaimer: Please spend wisely and within your means, and do not take on debt just to redeem free flights.

Table of Contents

- Best miles credit cards

- The best air miles credit cards in Singapore

- 1. UOB PRVI Miles Credit Card

- 2. DBS Altitude Visa Signature Credit Card

- 3. Citi PremierMiles Credit Card

- 4. HSBC TravelOne Credit Card

- 5. Standard Chartered Journey Credit Card

- 6. UOB KrisFlyer Credit Card

- 7. American Express Singapore Airlines KrisFlyer Credit Card

- Pro tips & hacks to maximise your miles

- Which miles credit card is the best for you?

- Choosing the best miles credit card to get free flights

What are miles credit cards & how do they work?

When using credit cards, you’re usually rewarded with cash back or airline miles; the latter is what we’ll be focusing on in this guide. Essentially, for each dollar spent on a miles credit card, you’ll be given points or airline miles that you can transfer to certain airlines to redeem flights on. And tada, you’re flying on a “free” flight.

We put free in quotation marks because you’d still have to pay airport taxes and conversion fees, but these are minimal costs when booking a flight that would otherwise cost you a few thousand dollars.

In Singapore, the most common miles conversion partners include Singapore Airlines and Cathay Pacific; some credit cards have even more conversion partners like Air Canada, EVA Air, and United Airlines.

What to look out for in a miles credit card

To really stretch your dollar, choosing a miles credit card isn’t as simple as picking one that works with your bank. There are many factors to consider.

- Miles earn rate: How much you get for spending locally and spending in foreign currency

- Miles conversion flexibility: How many airlines do the credit card companies partner with, and if they are the ones you fly with often

- Annual fees: Can they be waived? If not, do you get miles for paying the annual dues?

- Bonus spending categories: Do you get more miles per dollar for buying groceries or spending on transport?

- Sign-up bonuses: Does the credit card you’re eyeing have a sign-up bonus, and do you have a big purchase coming up to hit the minimum spend?

The best air miles credit cards in Singapore

| Credit Card | Local spend earn rate (mpd) | Foreign spend earn rate (mpd) | Sign-up bonus | Annual fee | Transfer partners |

| UOB PRVI Miles | 1.4 | 2.4-3 | – | $261.60 | 2 |

| DBS Altitude Visa Signature | 1.3 | 2.2 | 38,000 miles | $196.20 | 4 |

| Citi Premiermiles | 1.2 | 2.2 | 30,000 | $196.20 | 11 |

| HSBC TravelOne | 1.2 | 2.4 | 36,000 | $196.20 | 20 |

| Standard Chartered Journey | Up to 3 | 2 | 30,000 | $196.20 | 2 |

| UOB KrisFlyer | Up to 3 | 1.2 | 15,000 | $196.20 | 1 |

| AMEX Singapore Airlines KrisFlyer | Up to 2 | 1.1 | 17,000 | $179.85 | 1 |

1. UOB PRVI Miles Credit Card

Earn up to 3 miles per dollar when spending overseas with no cap

Image credit: Unsplash/UOB

Avid travellers who want to make the most out of every dollar they spend overseas will love the UOB PRVI Miles Credit Card. It has one of the highest earn rates at 3 miles per dollar (mpd) when spending overseas in Malaysia, Thailand, Vietnam, and Indonesia. The card also has no cap on the miles you can earn at this accelerated rate, so you don’t have to worry about calculating down to the cent on how best to maximise the miles earned.

For the rest of the countries, the earn rate is 2.4 mpd, which is still one of the better rates available for overseas spend. With the earn rate for local spend being 1.4 mpd, avid travellers can chalk up miles when they spend both ways.

Booking your hotels or flights via the UOB PRVI Miles exclusive website with Agoda and Expedia will get you 8 mpd as well. However, bookings for your accommodation in Japan via Agoda will not count towards this bonus, so just take note of this when planning your trip.

Cardholders of the UOB PRVI Miles Card will also get a complimentary Priority Pass membership along with 4 free airport lounge passes for principal cardmembers annually, so you have a comfortable place to chill at before boarding.

Earn rate: 1.4 mpd on local spend, 2.4 mpd on foreign spend, 3 mpd on spend in Malaysia, Indonesia, Thailand and Vietnam

Sign-up bonus: No sign-up bonus as of now.

Minimum annual income: $30,000 for Singaporeans

Annual fee: $261.60

Mile conversion fee: $25 per conversion

Transfer partners: 2 airlines

Find out more about the UOB PRVI Miles Credit Card.

2. DBS Altitude Visa Signature Credit Card

Good starter miles credit card

Image adapted from: DBS/Unsplash

If you want to dip your toes into the world of miles redemptions, the DBS Altitude Visa Signature Credit Card is your best bet. With the best local earn rate of 1.3 miles per dollar (mpd), this miles credit card is great for those who find themselves spending a lot locally, with the occasional travel once or twice a year.

The DBS Altitude Visa Signature Credit Card also comes with a complimentary Priority Pass membership and 2 free lounge passes. You can kick off your travels in comfort at the lounge, even if you’re only flying in coach.

If you are new to DBS, you can also get an additional 38,000 miles by spending $800 or more in 60 days and paying the $196.20 annual fee for the first year. This sign-up bonus is enough for you to redeem a one-way business class flight on Singapore Airlines to Bali, or an economy class ticket from Singapore to Perth.

Earn rate: 1.3 mpd on local spend, 2.2 mpd on foreign spend

Sign-up bonus: 28,000 miles by spending $800 or more in 60 days; an additional 10,000 miles by paying the first year’s annual fee.

Minimum annual income: $30,000 for Singaporeans

Annual fee: $196.20

Mile conversion fee: $27.25 per conversion; $43.60 to enrol in KrisFlyer auto conversion

Transfer partners: 4 airlines

Find out more about the DBS Altitude Visa Signature Credit Card.

3. Citi PremierMiles Credit Card

Transfer miles to 11 airlines, including Eva Air & British Airways

Image adapted from: Citi/Unsplash

Another miles credit card that plenty of savvy travellers have signed up for is the Citi PremierMiles Credit Card. While it has a very average earn rate of 1.2 miles per dollar on local spend, this card lets you transfer your miles to even more airline partners, including Eva Air, Qantas Frequent Flyer, Etihad Guest, Flying Blue, and Qatar Airways.

Citi also lets you transfer your miles to IHG Rewards Club to redeem free hotel nights. This could work to your advantage if your dream destination is served by one of those airlines. Citi PremierMiles Credit Cardholders also get a complimentary Priority Pass membership and 2 free lounge visits per year.

Earn rate: 1.2 mpd on local spend, 2.2 mpd on foreign spend

Sign-up bonus: 20,000 by spending $800 or more in 2 calendar months; an additional 10,000 miles by paying the annual fee

Minimum annual income: $30,000 for Singaporeans

Annual fee: $196.20

Mile conversion fee: $27.25 per conversion

Transfer partners: 10 airlines and 1 hotel

Find out more about the Citi PremierMiles Credit Card.

4. HSBC TravelOne Credit Card

Has one of the most conversion partners, with no mileage conversion fee

Image adapted from: HSBC/Unsplash

With most miles credit cards – save for the co-branded ones with Singapore Airlines – there are pesky conversion fees you’d have to pay to transfer your credit card miles to the partner airlines. With the HSBC TravelOne Credit Card, those conversion fees are waived; you’ll also get to transfer these miles to over 16 airlines and over 4 hotel programs.

The HSBC TravelOne Credit Card also offers one of the better foreign spending earn rates, at 2.4 miles per dollar. Cardholders also get 4 complimentary lounge visits thanks to the Mastercard Travel Pass that comes with the credit card.

Earn rate: 1.2 mpd on local spend, 2.4 mpd on foreign spend

Sign-up bonus: 26,200 miles after spending $500, spend another $500 and get another 9,800 miles for a total of 36,000 miles. The annual fee of $196.20 has to be paid to get the sign-up bonus.

Minimum annual income: $30,000 for Singaporeans

Annual fee: $196.20

Mile conversion fee: No redemption fees

Transfer partners: 16 airlines and 4 hotels

Find out more about the HSBC TravelOne Credit Card.

5. Standard Chartered Journey Credit Card

Earn 3 miles per dollar on transport, groceries, & food deliveries

Image adapted from: Standard Chartered/Unsplash

Even with the SG60 Supermarket Vouchers, shopping for groceries is not getting any cheaper. To get the most out of each dollar that you’re spending at NTUC or Sheng Siong, use the Standard Chartered Journey Credit Card to earn 3 miles per dollar. This miles credit card also gets you 3 mpd on transport and food deliveries.

Unfortunately, Standard Chartered only has 2 airline partners in Singapore Airlines and Cathay Pacific. However, they also include complimentary priority pass membership and 2 free lounge visits per year.

Earn rate: 1.2 mpd on local spend, 2 mpd on foreign spend, 3 mpd when spending on transport, food deliveries, and online merchants

Sign-up bonus: 20,000 when spending $800 in 60 days; an additional 10,000 when paying the annual fee

Minimum annual income: $30,000

Annual fee: $196.20

Mile conversion fee: $27.25

Transfer partners: 2 airlines

Find out more about the Standard Chartered Journey Card.

6. UOB KrisFlyer Credit Card

Best miles credit card for those who fly with Singapore Airlines & Scoot

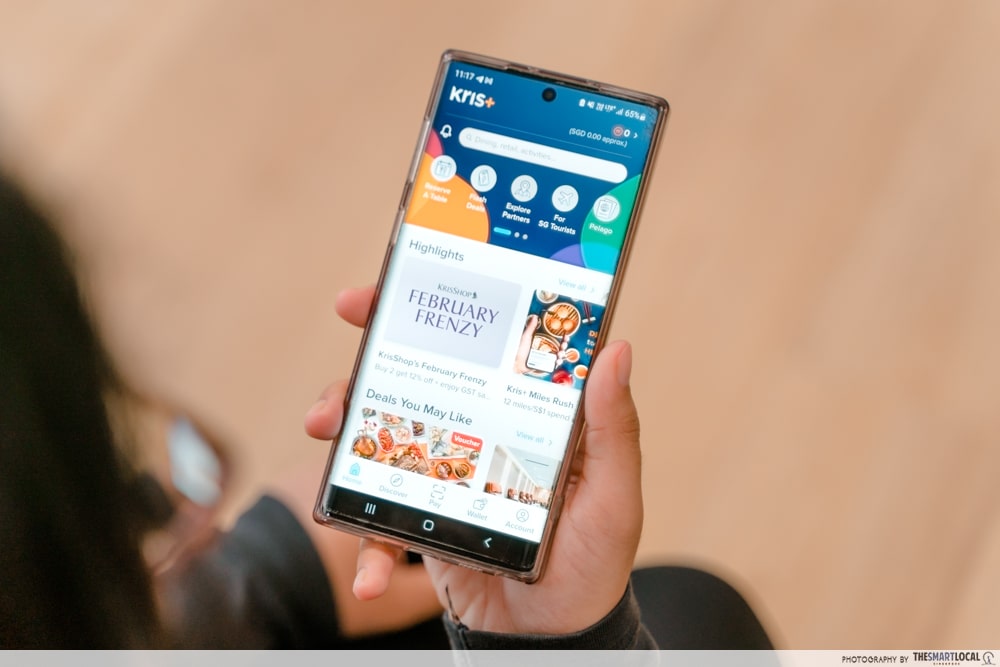

Singapore Airlines loyalists can count on the UOB KrisFlyer Credit Card to rack up miles. With a whopping 3 miles per dollar earn rate when spending on Singapore Airlines, Scoot, and other Singapore Airlines-related businesses like Kris+, this lets you potentially earn thousands of miles when charging your flights to the card.

The UOB KrisFlyer Credit Card also has an accelerated earn rate of 2.4 miles per dollar when spending on dining, food delivery, online shopping, online travel, and transport. So if you were to apply for this card, make sure you use it to pay for the right transactions so as to maximise your rewards for each dollar spent. This perk is activated once you make at least $1,000 in transactions with Singapore Airlines Group.

Beyond the earn rate for SQ-related purchases, cardholders also get a fast track to KrisFlyer Elite Silver Status after spending a minimum of $5,000 with Singapore Airlines Group-related transactions. The card also gets you $15 off Grab rides to and from Changi Airport, along with priority check-in, boarding, and additional baggage allowance when flying with Scoot.

Earn rate: 3 mpd when spending on Singapore Airlines, Scoot, KrisShop, Kris+, Pelago; 2.4 mpd when spending on dining, food delivery, online shopping, online travel, transport; 1.2 mpd for all other spending

Sign-up bonus: 5,000 miles after spending $5; an additional 10,000 miles after prepaying the second year’s annual fee.

Minimum annual income: $30,000 for Singaporeans

Annual fee: $196.20, waived the first year

Mile conversion fee: None, all miles earned are automatically credited to your KrisFlyer account

Transfer partners: Only Singapore Airlines

Find out more about the UOB KrisFlyer Credit Card.

7. American Express Singapore Airlines KrisFlyer Credit Card

Earn 2 miles per dollar on Singapore Airlines & Grab transactions

Image adapted from: American Express/Unsplash

Another miles credit card that Singapore Airlines frequent flyers can apply for is the American Express Singapore Airlines KrisFlyer Credit Card. While its earn rate is poorer than the UOB KrisFlyer Credit Card, the AMEX card has a sign-up bonus that could net you a total of 17,000 miles by just spending $1,000 in the first 2 months.

Other perks include a $150 cashback to be used on Singapore Airlines if you spend at least $800 in a single transaction, or a total of $12,000 from 1st July 2025 to 30th June 2026.

Earn rate: 1.1 mpd on local and foreign spend, 2 mpd when spending with Grab, Singapore Airlines, Scoot, and KrisShop

Sign-up bonus: 5,000 miles when charging to the card for the first time; an additional 10,900 miles after spending $1,000 or more in the first 2 months, for a total of 17,000 miles (including the 1,100 base miles earned after spending the $1,000)

Minimum annual income: At the discretion of American Express

Annual fee: $179.85, waived the first year

Mile conversion fee: None, all miles earned are automatically credited to your KrisFlyer account

Transfer partners: Only Singapore Airlines

Find out more about the American Express Singapore Airlines KrisFlyer Credit Card.

Pro tips & hacks to maximise your miles

To make the most out of your miles credit card, follow these tips and tricks:

Use the right card for the right spend category

If you have a credit card that rewards you with extra miles for buying groceries or taking a taxi, remember to use that one instead of your default credit card. Otherwise, you’d be losing out on an extra mile or two for each dollar you spend; for those who spend an average of $300 per month on groceries, you could be earning at least 8,640 miles a year, rather than 3,960 if you charged it to another credit card.

One way to never forget to use the right credit card is to make it the default payment method on apps like Grab or Shopee.

Stack miles by using online portals like Kris+

For the uninitiated, Kris+ is a lifestyle rewards app (App Store | Google Play) that lets you earn KrisFlyer miles by spending at over 450 merchants in Singapore and Australia. And some credit cards, like the UOB KrisFlyer Credit Card, let you double-dip on the miles rewards by awarding you more miles when you charge your Kris+ purchases to the said card.

For example, if you’re buying some Krispy Kreme doughnuts, you can earn 6 miles per dollar through the Kris+ app. Couple that with the UOB KrisFlyer Credit Card, and you’ll earn an extra 3 mpd for a total of 9 mpd.

Time your applications to get the sign-up bonuses

To lure you in like a moth to a flame, credit card companies always offer sign-up bonuses, with the best deals going to new-to-bank applicants. These bonuses, however, require a minimum spend that’s usually around $800 in 2 months.

Rather than applying for all the credit cards on this list and having to spend thousands of dollars within 2 months, you should time your applications and stagger them to make the most out of the sign-up bonuses. Have a flight you need to book soon? Sign up for the AMEX Singapore Airlines Credit Card and get an extra 15,900 miles, as long as your tickets are at least $1,000, and that’s not including the bonus miles you get if you’re booking with Singapore Airlines.

Do note that these sign-up bonuses are mostly one-time deals, and any attempts to game the system by refunding your purchases would result in your mile rewards getting clawed back.

Which miles credit card is the best for you?

If you are always travelling around Southeast Asia: The UOB PRVI Miles Credit Card with its 3 mpd earn rate in Malaysia, Thailand, Indonesia, and Vietnam will come in handy.

If you fly Singapore Airlines often: The UOB KrisFlyer and AMEX Singapore Airlines KrisFlyer Credit Cards will transfer your miles automatically and for free for added convenience, plus you get accelerated earn rates when spending on any Singapore Airlines Group-related purchases.

If you are an online shopaholic: The Standard Chartered Journey Credit Card gets you 3 mpd with online merchants.

If you love trying new airlines: The HSBC TravelOne and Citi PremierMiles Credit Cards have multiple airline partners to transfer your miles to.

If you only go on one big trip a year: The DBS Altitude Visa Credit Card has one of the better local spending earn rates at 1.3 mpd and 2 free lounge passes.

Choosing the best miles credit card to get free flights

While the prospect of redeeming free flights might sound attractive, remember to use your credit cards responsibly and within your means. Strategically choosing the right card for your spending habits, and not opening all of them at once will unlock a world of travel opportunities without breaking the bank and landing you in debt.

Discover more travel hacks:

- Money-saving tips when travelling in Europe

- How to stay safe when travelling overseas

- The only travel guide to China you need to bookmark

This article contains partial partnership content. However, all opinions are ours.

Originally published on 14th August 2025. Last updated on 29th August 2025.