Adulting challenges in Singapore

As we trudge on to our 20s, 30s, and even 40s, it always seems not too long ago that we were wee kids – yearning with great fervour to finally grow up and become adults.

Besides gaining all that delicious freedom, we also got to unlock grownup milestones that we spent our childhoods counting down to. But somewhere along the way, that excitement might’ve been dimmed by the woes of adulting. What our young and naive selves weren’t prepared for were the bills, deadlines, and responsibilities of being grownups.

While it certainly isn’t all doom and gloom, here are some things I find myself wishing there were manuals and cheat codes for, as someone in their early 30s who is still trying to get the hang of adulting challenges in Singapore. Because as much as I’m glad that the examination phase of my life is done and dusted, at least the Ten Year Series had answer sheets at the back!

Note: All images are for illustrative purposes only.

Table of Contents

1. How do I split my time with just 24 hours in a day?

Gone are the days of whiling away watching Kids Central and playing Neopets. Save for the hour or so every night I spend engaging in revenge bedtime procrastination, I feel like the entire day is spent at work, commuting, settling chores, and slotting in quality time with my partner, friends, and family – depending on the day of the week.

It seems Herculean, if not impossible, to strive for ample time split between all these slices of the pie. And at the end of it all, we still have to carve out time to take care of our own physical health and mental well-being.

Petition for mega productive folks – y’know, the kind who get cracking at 5am in the morning, squeeze in a run, slay the day at work, and still have the energy in the evening for some wholesome hobbies like crocheting or playing an instrument? – to spill the beans, please. That’s a manual I’d love to get my hands on.

In the meantime, I’ve made it a point to be more mindful about how I divvy up my time, and be very clear on which tasks deserve higher priority. It’s been helpful to tackle each day with a proper to-do list, so I don’t get sidetracked by the million and one tiny distractions along the way.

And at the end of each day, I set aside some time to go through the tasks I have completed. This allows me to take ownership of my own productivity instead of feeling like just another day has slipped away, and puts me in a more confident and less frazzled state of mind to await tomorrow’s arrival.

2. How to make & maintain friendships in adulthood?

Making friends throughout our youth felt easy-peasy. Cliques naturally formed amongst classmates and CCA mates, and thereafter, co-workers who we can vibe with. Now in my 30s, I’m sandwiched in the awkward in-between of being too old and cringey for Gen Z folk, and unable to relate to older folks who have already settled comfortably into the “house, car, and kids” stage of life.

It’s also tough to maintain existing friendships from earlier stages of life, as everyone upholds their own hectic schedules and are navigating different chapters and hence, have vastly different priorities. You definitely can’t doomzi doomzi with pals who have kids or furkids to rush home to, and even scheduling a post-work dinner with the gang can face months of postponing. The difficulty level is certainly cranked up when you’re an introvert.

So far, I’ve dabbled in friendship-making apps, going for fitness classes to meet fellow busy folks who at least share one thread of similarity with me, and even going out on a limb to hit distant acquaintances up in their IG DMs when I feel that we could vibe well over a meal and perhaps become proper friends. Next step: Perhaps joining a bead craft or Zumba class in my neighbourhood CC?

What I’ve found makes the most difference is simply putting myself out there and daring to face rejection. After all, the worst they can say is no. This has helped me strike up conversations when I’m at workout classes, and I’ve recently been added to a community group chat where like-minded people are planning to check out new classes together.

3. How should I use my adult money?

The rising cost of living is a reality that we can’t ignore, intensifying the sting of everyday expenses from train fares to kopi and cappuccinos. In decades prior, the extent of my financial worry was how many times a month I could afford to have after-school fast food meals and movie outings with my friends, and perhaps saving up for the occasional CD or new threads from fashion retailers.

Dollars and cents became hundreds and thousands as I levelled up in the game of adulting. Having checked off my wedding last year, which meant a major dip in my and my partner’s funds, I’m now staring down the barrel of the next big-ticket purchase: a house.

Thankfully, us Singaporeans are able to get some much-needed help on that front with our CPF contributions. But even then, there are aspects of becoming a homeowner that CPF can’t be used for, such as renovations. So in this process, while we are able to use our CPF savings for home purchase, it’s still important to weigh the wants versus needs instead of chiong-ing towards our dream home with reckless abandon finances-wise.

Don’t even get me started on setting aside enough in case of any medical emergencies. The low-key hypochondriac in me can’t imagine how much my bank account will haemorrhage money should I or my loved ones ever – touch wood – meet with a disease or accident. Once again, the fact that we have MediShield Life and MediSave savings to cushion these expenses makes me feel thankful.

To instil however much financial calm I can muster, I’ve started being more diligent in tracking my expenses, and am on a journey to educate myself on beginner-friendly finance concepts. It could be watching finance-related videos instead of entertainment before bedtime, or tuning into a podcast while on my commute. Baby steps!

4. What is CPF actually for & how do I use it?

Speaking of CPF, I’ll be the first to admit that throughout my youth, I didn’t have a clue what it was and what it was for. I just knew that I contributed a portion of my first big girl salary every month to my CPF savings, which of course was a downer because it meant less moolah for shopping and cafe dates.

Now that I’m in my older and wiser era, I realise that my CPF account is like a reliable bestie that’s quietly growing in the corner, getting ready to give me a boost in the upcoming hurdles of adulting life in Singapore.

What I once felt disdain for, I now find so much comfort and assurance in. And seeing those growing numbers in my 3 CPF accounts and knowing they’ll come in clutch to pay off my home, bolster my medical expenses, and provide a steady stream of income upon retirement, I can’t imagine being without it.

I’m no finance girlie, so it definitely took me a while to get acquainted with what CPF is about and all the jargon attached to it. For those in the same boat, here’s a handy breakdown answering the age-old question: what is CPF? Hey, I guess that’s at least one adulting thing we do have a manual for!

5. How will I know when I’m ready for the next step?

Then we have the age-old question of knowing when to advance to the next level. When it comes to job-hopping versus staying in the same company, taking the plunge for a big-ticket purchase, and making the ultimate life-altering decision to have a baby: how does one know when the right time is?

On days where all these considerations get a bit overwhelming and I’m about to freak the freak out à la Victorious, I find great solace in 2 things:

- Tonnes of people have achieved it, and so will tonnes more.

- I am not alone in this, and I have a plethora of support from those around me and resources at my disposal – from mental health support organisations to a good ol’ self-help book – should I choose to reach out and receive the help I need.

In order to make well-informed decisions instead of waiting around for some kind of big-brain moment to point out the “right” path, I’ve decided to sit down and properly set some tangible goals.

These will serve as indicators of whether it’s time to advance to the next stage – for instance, have I accumulated enough skills and knowledge to take the plunge and vie for career advancement? – instead of taking a shot in the dark and simply hoping for the best.

Unlocking clarity in the journey of adulting, one step at a time

Amidst my pursuit of more clarity and wanting to become an adult who is better at … well, adulting, I’ve learnt that it’s important to develop a hands-on approach. We’re old and wise enough to know that wallowing too long in pity and helplessness will serve no good.

In video game terms, you can only gain XP and level up when you journey through the various stages, collecting vital tools in your inventory. While we may not have clear-cut manuals and the keys to solve all our adulting problems, leaning on actionable resources can help eliminate burdens and uncertainties one at a time, lessening our load.

Money woes are always at the forefront of our minds as grownups. Not only do we have our CPF accounts to steadily work towards a sizeable nest egg so long as we leverage it, you can now gain clarity and feel more prepared for the chapters ahead with the CPF Retirement Payout Planner tool. It’s a handy online tool that can help you estimate the CPF retirement savings goal you should work towards based on your desired payouts and lifestyle in retirement.

If you are unsure about what payout goal to set, given that retirement can be decades away, the planner has a simple guide that will provide a rough estimate based on your answers to some prompting questions.

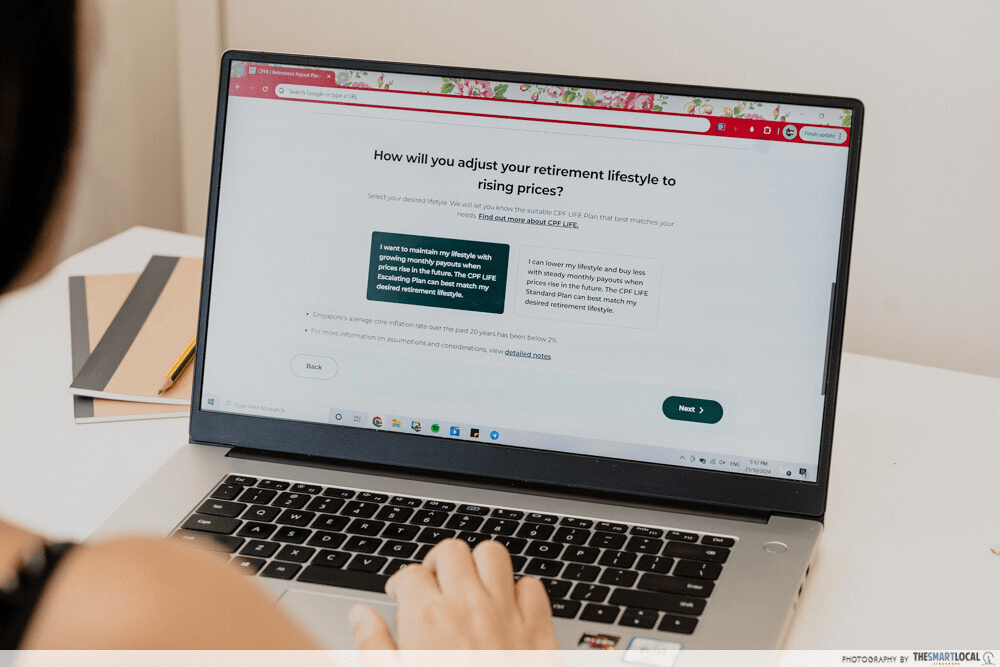

You will also need to consider your desired lifestyle in retirement. For instance, would you choose to maintain your lifestyle upon retirement with a CPF LIFE Escalating Plan that grows your payout over time to help address rising prices, or would you prefer a steady income stream with the CPF LIFE Standard Plan?

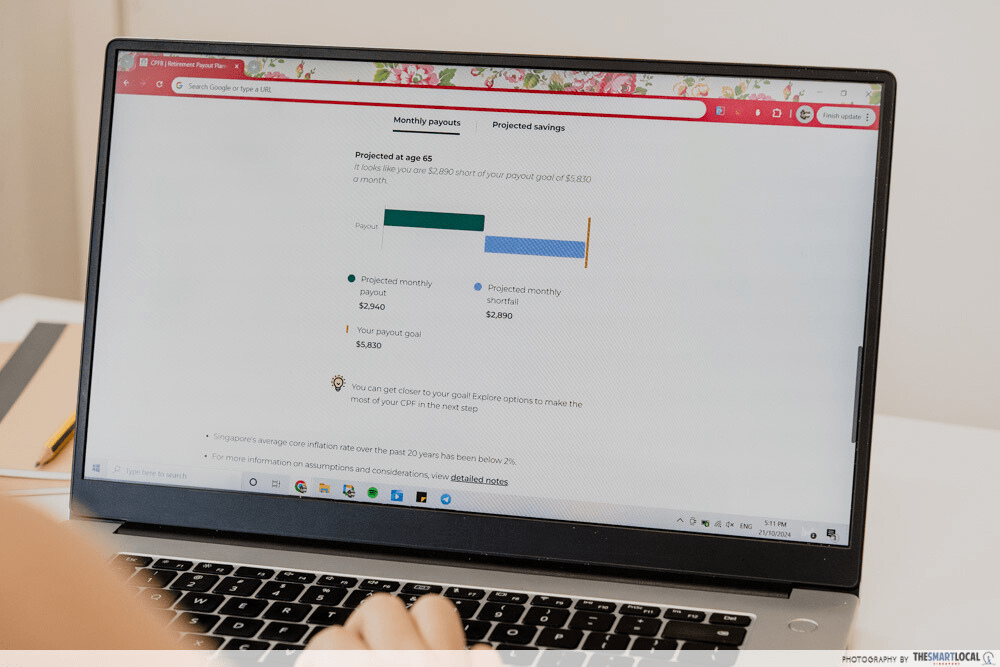

Based on your existing CPF account balances and by providing details on your monthly income, the numbers will be churned to provide a solid forecast of whether you’re on track to meet your retirement income goal when you hit 65 years of age.

We all daydream about living our best life upon retirement, no longer having to stress about work and instead, doing leisurely activities all day err day like chilling at the beach or going for high tea. That said, it’s important to be realistic about whether your income and savings will keep pace with what your retirement requires, and plan accordingly for your desired lifestyle.

Knowledge is power, and you’ll feel much more at ease knowing whether you’re on track to building your dream retirement in the decades to come. And if not, having that awareness allows you to kick into action and see what tweaks need to be made. The CPF Retirement Payout Planner even allows you to simulate making a top-up or transfer, to see how that’ll help you close any gap to your goal.

Make use of all the tips, tricks, and life hacks you can get – and being able to suss out whether you’re on the right track to your dream retirement is this pretty nifty tool to cross one major stressor off your plate. This helps you to achieve a sense of financial calm, where you feel secure about and in control of your finances, reducing a tonne of stress and anxiety. In order to focus on the things that truly matter, and live your best life right now, grant yourself the favour of being in the know.

Find out how you can leverage CPF Board’s tools to plan your future

This post was brought to you by the Central Provident Fund Board.