Retirement planning in Singapore

Ever since dining out’s back on the menu, the coffee-sipping uncles have returned to their regular kopitiam haunts. I used to think about what a life like that would be. No 9-to-5 responsibilities, no worries about hitting a KPI, and certainly no stress on whether they’re eligible for a year-end bonus.

I plucked up the courage to strike up a conversation with one of these uncles, just to see if he had any advice to dole out. Enter Mr. Lai See Ka, a 69-year-old retiree who now lives off a very comfortable passive income of $7,000/month. Here are three things I learnt in our chat about proper retirement planning so that one day I can lim kopi like him too.

1. Make saving a part of your salary & bonus your habit

Having savings is a no-brainer. But despite being one of the most commonly dished out “life pro tips”, it can be easier said than done. One thing Mr. Lai did to make sure he stayed disciplined with his savings was to automatically deduct a percentage of his salary each month.

He didn’t start accumulating his savings until he got married at 30. “That was when I realised I had to think far ahead to have a stable family,” he said. Hearing this gave me a bit of solace knowing that it’s not too late for me as I’m only 26 this year.

To ensure he stayed on track, Mr. Lai used GIRO to automate his monthly contributions to his savings account. “You won’t even realise it,” he nonchalantly said.

He started off small at just $100/month, and he gradually increased that number with each promotion, before capping it at $500/month. It was always 10%-15% of his monthly income, while his year-end bonus would call for a bigger savings ratio of 30%-40%.

2. Only invest with your spare cash

Like many of us, Mr. Lai also dabbled in the stock market when he was younger. “I used to buy shares without any idea what it was or what I was buying,” he openly shared. “I went into it because my friends were into it.” This peer pressure initially backfired on him as he had to deal with losses, but he quickly realised this and adapted his investment strategy to avoid more losses.

Image credit: Maxim Hopman

“You shouldn’t play with the stock market unless it’s with money you’re prepared to lose and it won’t impact your daily needs,” he advised. And he’s not wrong – I’ve seen a few friends succumb to the FOMO mindset especially with day trading and the recent cryptocurrency boom, only to lose everything because of a bad decision.

By limiting yourself to only investing with disposable income, you don’t run the risk of having to scramble and dip into your savings if and when a crash occurs. Mr. Lai’s portfolio is also well-diversified with property holdings alongside his shares.

He’s adamant about not touching the volatile cryptocurrency market though. “It’s too high risk,” he said with a laugh. “At this age I’d rather enjoy a regular income.”

3. Have sufficient medical & life insurance coverage

Let’s be honest here: How many of us know exactly what insurance coverage we have? All I’m familiar with is the one I signed up for during my NS days, and I only know the ones my parents got for me in bits and pieces. Mr. Lai stresses that it’s not just about having insurance. Having sufficient coverage will protect you and your loved ones from the uncertainties of life.

“The two main ones I have are medical and life insurance,” he said. The first is meant to cover him in the event he has any accidents or comes down with certain illnesses. We’re lucky enough that some hospital bills are subsidised in Singapore, but there are always added costs that come with it. What if you need mobility assistance devices or have to install guardrails at home?

Mr. Lai also has life insurance to ensure his family is well taken care of in the event of – touch wood – an emergency. “I got it for my children, and you never know what’s going to happen.”

Reflecting on how he has prepared for his retirement, Mr Lai reiterated the importance of starting early and staying disciplined with savings and planning. He also added that I am luckier than him because I have a broader range of options that includes insurance plans to diversify my retirement planning and returns.

With so many policies, it can be quite hard to keep track of them all. Rather than remembering which provider covers you for medical situations or general investment needs, you can stay on top of your insurance with DBS NAV Planner.

Start planning for retirement in Singapore

Retirement might still be quite a long way away for me, but after my conversation with Mr. Lai, I realised that it’s never too early to start planning for it. After all, there are customisable retirement insurance plans like RetireSavvy by DBS and Manulife Singapore that can help you get ready to live out your golden years. You won’t be impeding on any shorter-term life goals like owning a BTO or buying the latest smartphone, too.

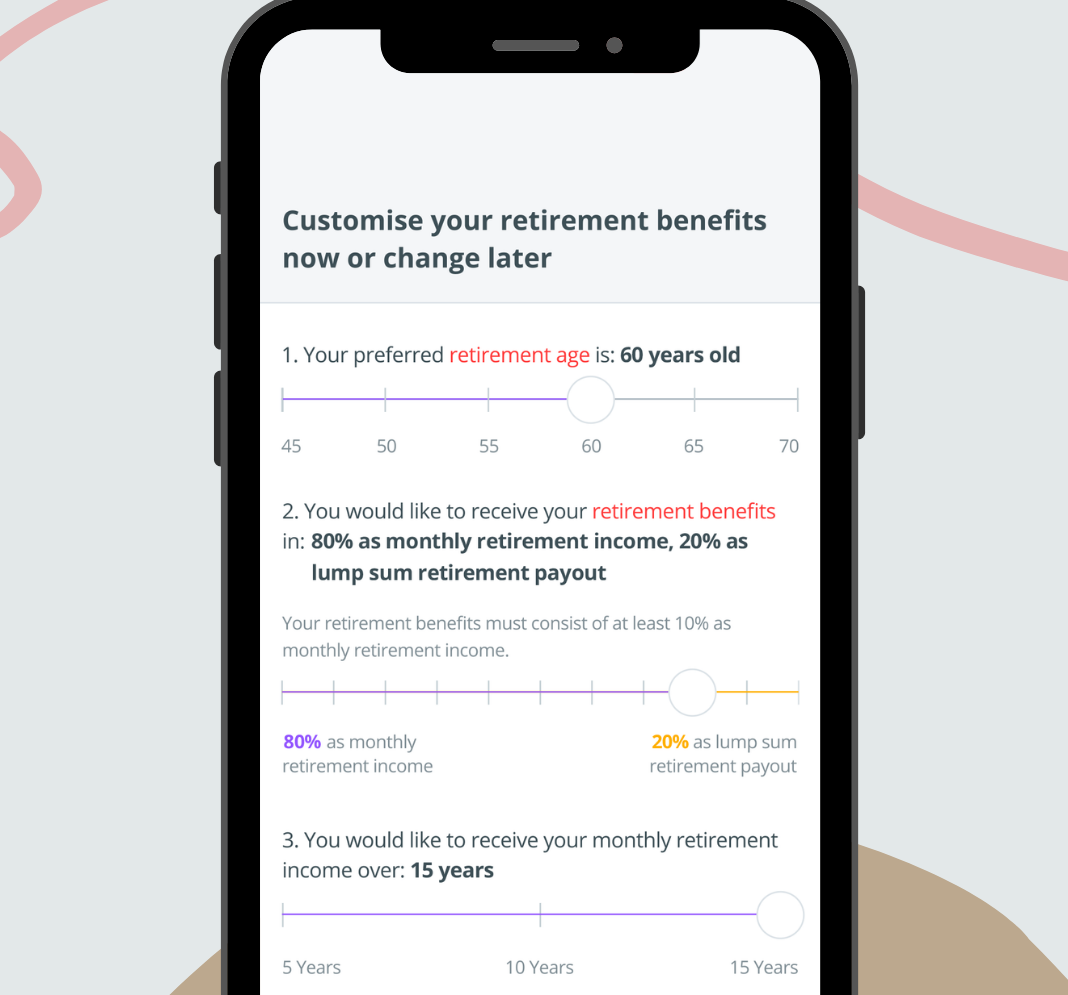

RetireSavvy is Singapore’s first truly flexible digital retirement product of its kind with multiple options that can be tailored to suit your lifestyle. This way, you can live your youthful days without fussing about the future.

Image adapted from: DBS

You can start your retirement fund with RetireSavvy at just a premium of $128.74/month*. With extra income from your bonuses and ang pao, you can top-up your premiums** one year after the policy’s effective date until five years before your selected retirement age.

If for any reason you meet an emergency, you can also put your premium payment on hold^ without compromising on your long-term goals. When an unfortunate retrenchment occurs, RetireSavvy will also give you a lump sum payout** as financial protection so that your eventual retirement plan stays on track.

And when it’s near the time for you to finally retire, you can either defer your selected retirement age – with adequate notice – and adjust your retirement income rate#. For example, I can keep working till I’m 70 instead of saying sayonara to my boss at 65, and receive 20% of my insurance benefits as a lump sum while getting the balance 80% as my monthly retirement income.

Image credit: DBS

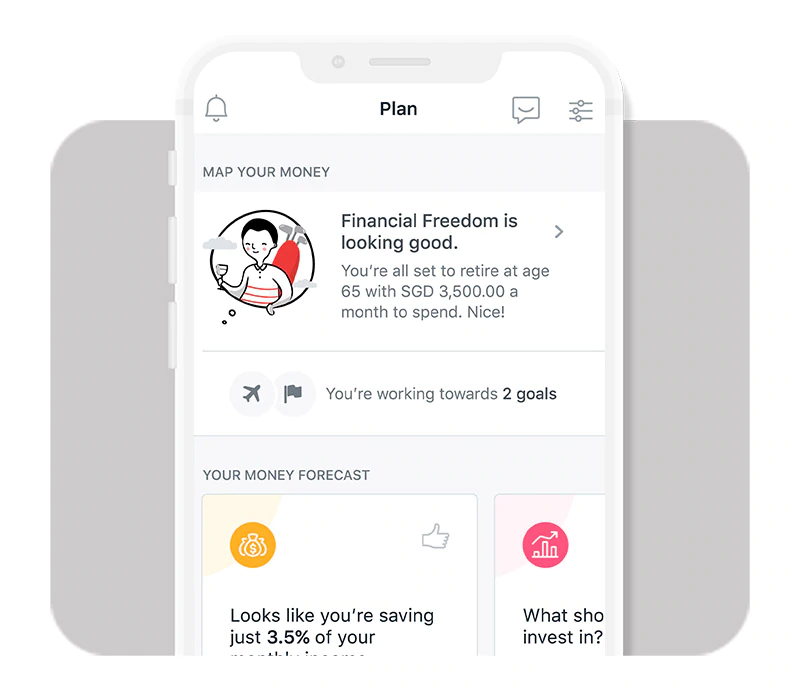

While all the numbers might seem daunting at first glance, you can also take advantage of DBS NAV Planner to forecast your finances and get some insight on your wealth to make planning easier. From cash flow projection to expenditure calculation, the free feature on the digibank app lets you see all you need to know about your money at an easy glance.

Think of it as a one-stop-shop for all your financial planning needs. Not only can it link up with other insurance providers so you can see all your coverage at a glance, it can also recommend you investment options based on your risk appetite and even get you connected with an advisor for more in-depth knowledge.

Find out more about RetireSavvy here

This post was brought to you by DBS and Manulife.

Cover image adapted from: TheSmartLocal, Fatboo

Responses have been edited for grammar and clarity.