Deciding on your first insurance policy

Though turning 21 is the mark of becoming an adult, ask any Singaporean in their early to mid-20s about insurance coverage and they’d likely reply with “I don’t know leh my parents handle one”. Realistically speaking, the only time most of us feel like real adults is when we start paying our own bills – insurance policies included.

If you’re one of those clueless millennials – don’t worry, we’ve all been there – looking to get your own policy for the first time, here are some questions that will help you decide on an appropriate insurance policy – as shared by professionals in the field.

1. What are the first types of policies I should get?

The first thing to note about insurance is that there are many different kinds, suited to different needs. Protection-type policies protect you from unforeseen circumstances, endowment policies focus on savings, and investment-linked policies (ILP) are customisable schemes that help you grow your money, subject to market risk.

Jumping into ILPs may seem enticing, but for beginners like you and I who are a little more conservative, the pros recommend starting off with a hospitalisation plan first. As Y.S., a manager at a local financial advisory firm puts it, having to get hospitalised without a policy to cover you renders all other plans useless, as your funds will all go towards paying your bills.

Once you’ve got your basic hospitalisation plan covered, you can move on to exploring other protection-type insurance plans such as disability insurance, critical illness coverage and life insurance. This’ll ensure that you’ve got all your healthcare bases covered. After all, what good is wealth accumulation if you’re not alive and kicking to spend all that moolah?

2. How much should I be insured for?

As much as you may wear your kiasu–ism like a badge of honour, you don’t want to apply this logic when it comes to insurance. Over-insuring is an actual thing, which means that you’ll be spending unnecessary money on higher premiums than needed.The amount of money that you’re insured for affects the price of your premiums, so it’s important that you’re insured for just the right amount.

Based on guidelines from the Life Insurance Association, Lorna Tan, Head of Financial Planning Literacy at DBS Bank, suggests that you get insured for about nine times your annual income in case of death. As for critical illness insurance, get about five years of your expenses covered, as that is typically the amount of time the average person needs to recuperate from a critical illness.

Even if you’re new to the insurance game, you’re likely to have some sort of existing insurance policies under your parents, CPF Savings and deposit savings. It’s important to take them into account when working out your insurance gaps.

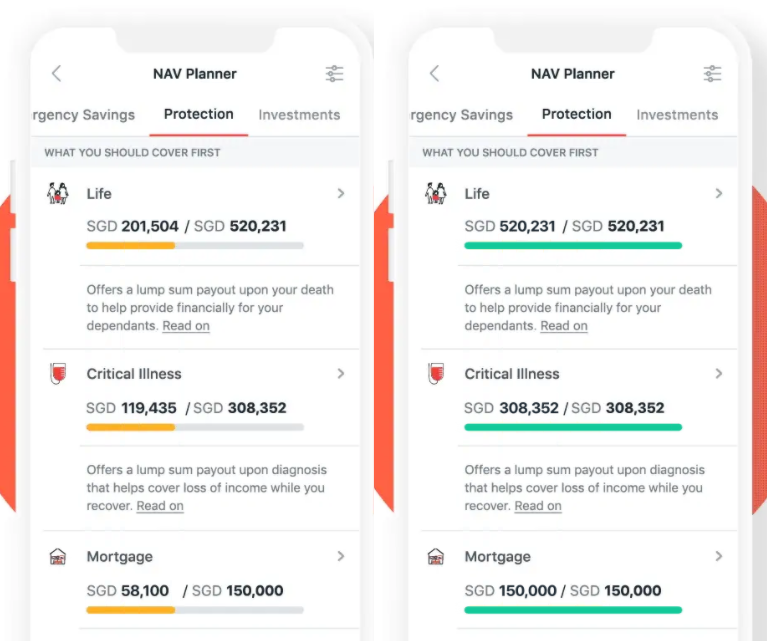

To prevent yourself from over- or under-insuring, you can also check out the DBS NAV Planner to help you keep track of your insurance needs. It’ll give you precise, personalised calculations on how much insurance you’ll need depending on your dependants, life stage and income. You’ll even get suggestions on how your insurance cover might change over time.

3. What percentage of my savings should be set aside for insurance?

As with the amount of money you set aside for insurance, this depends on your dependants, income and expenditure. If you’ve not built up an emergency fund yet, Lorna urges that you settle this before anything else. For most people, that would be three to six months of your expenses. But if you’re self-employed, it would be better to save up to 12 months instead.

It’s more important to have all your bases covered at least a little, rather than stretch yourself too thin trying to pay unnecessarily hefty premiums, or put too many eggs in one basket while leaving other areas uninsured.

4. What common mistakes should I avoid when buying my first policy?

Rushing into buying insurance policies

One common mistake pointed out by the professionals is that people tend to rush into buying their first policy. As ‘M.N.’, a Financial Services Consultant points out, different insurance policies can get very confusing with many overlapping features.

A good tip provided by Danielle Chia and Joe Liao, both Wealth Planning Managers at DBS, is to assess your financial situation and understand your insurance needs before shopping around for a suitable cover. This way, you won’t end up blindly purchasing a policy that you’ll struggle to pay premiums for.

They added that you should not focus only on the premiums to pay, but also look at the guaranteed vs non-guaranteed parts of the policy illustration, so that you’ll have a bigger picture of how the policy will benefit you.

To help you decide on a policy, here’s a checklist provided by Lorna, Head of Financial Planning Literacy at DBS:

- What are your financial objectives and needs?

- Have you set aside at least three to six months of emergency cash?

- What are your existing insurance plans (types of cover, sums assured, potential benefits) and investments?

- Who are your dependants and how long will they be dependent on you?

- How much do you need to support them during this period of dependency?

- How much can you set aside to pay insurance premiums?

Not finding a suitable advisor

With all the different and admittedly confusing policies out there, you’ll probably not even know where to start – which is where your financial advisor (FA) comes in. A good advisor will give you customised solutions that cater only to your needs and wants, nothing more.

‘K.F.’, a certified Life Planner, recommends that you ask your FA any question that pops in your mind, until you’ve got zero doubt that they’ll be the right one for you. Else, there are many other agents and advisors in the market you can approach, so take your time to find someone that you truly resonate with.

Here’s a neat tip for those of us who are still living with our parents – since most of us still have some sort of coverage provided by our mum and dad, financial advisor ‘Y.S’ shares that a good financial advisor will propose solutions to enhance existing coverage, instead of asking you to surrender your old policy completely instead.

‘A.L’, a financial consultant, also shares that most professionals in the business agree that hospitalisation policies are the basic plan that you should have first. A trustworthy insurance agent will be unlikely to suggest savings or investment policies if you don’t already have the basic hospitalisation plans purchased, a good indicator of which agents are sus.

5. How do I file an insurance claim and how long does it take?

Filing an insurance claim varies from agency to agency, but most of them will have a company portal that’ll guide you through submitting your claims. Besides ensuring that you’ve got the proper documentation, do a double check to make sure that all the information is accurate – else the process of claiming your payout may take longer.

Most insurance claims take up to two weeks to process – the fastest being a few working days, according to ‘A.L.’, a Financial Consultant. However, serious and complicated claims can take longer, and factors like third-party involvement and waiting periods may delay the process.

Filing claims can get stressful, so don’t be afraid to approach your financial planner for help instead of trying to tackle that mountain of paperwork alone. As certified Life Planner, ‘K.F.’, aptly puts, it’s always good to have a trusted agent settle your claims for you, especially when you have a hundred and one other more important things to settle in life.

6. Do I need to pay more when I make a claim?

Although insurance plans do help to cover most of your expensive hospital bills, you’ll also be expected to foot some of the bill yourself in the form of deductibles and copayments.

Deductibles are the minimum amount you’ll have to pay for your insurance before you can get a payout from your insurance. Copayments are the amount that you split with the insurer after paying your deductibles.

Depending on your insurance provider, some policies may not cover certain illnesses or accidents. For example, most health insurance policies will not pay for cosmetic surgeries or new medical technologies. To get payouts from your insurance, most will also require proof such as medical reports, which can cost anywhere from $10 to $480.

7. How often should I update my insurance policy over the years?

Our needs and goals change as we grow older – which is why it’s important for us to review our insurance policies. As advised by financial advisory manager, ‘Y.S.’, annual reviews with your advisor will help you decide which policies are the best to meet your present and future needs.

As your passive income increases, you can also delve into savings and investment plans based on your current needs, as shared by ‘A.L.’, a Financial Consultant.

However, ‘K.F.’ also mentions that, from his knowledge as a Life Planner, it’s important to gradually increase your insurance coverage in preparation of unexpected health problems that might come as you age. Building up bit by bit will give you more peace of mind, without forking out too much early on when you’ve just ventured into the working world.

Buying insurance in Singapore for the first time

Most of us in our 20s are in the pink of health – we’re probably more focused on saving up for that post-COVID-19 holiday than paying insurance premiums. That said, starting young not only saves you money in the long run, but gives you the peace of mind too.

No matter if you’re a student or part of a young couple starting your family, these tips are sure to help you make the best decision when it comes to getting your own insurance policy for the first time.

No more panicking when the conversation switches to “adulting” topics like how much you’re setting aside for insurance premiums, or stressing about hospital fees should you be warded.

Get yourself covered with ease using the DBS NAV Planner

We all know how tricky managing our finances can be, which is why the DBS NAV Planner is a handy tool, especially for rookies. There’s no “one-size-fits-all” approach to insurance, which is why this advisory tool helps to prioritise and calculate the coverage you need, letting you know if gaps to bridge, and ensuring that you don’t overspend on insurance.

For those who already have insurance coverage, DBS NAV Planner provides an overall view of all their insurance plans, so that there’s more clarity when it’s time for them to make decisions in terms of upgrades or new policy purchases.

Image adapted from: DBS

It even works out your total coverage from all your life insurance policies, and measures exactly what you’ll need for these financial obligations in the event of your death – taking into account your current assets, personal loans, how much your dependants need, and even including funeral expenses.

You can also check how much you’ll need to cover your expenses while recovering from critical illness. They include how much you’ll need for your medical bills, how much your dependants need, and funds for part-time help too.

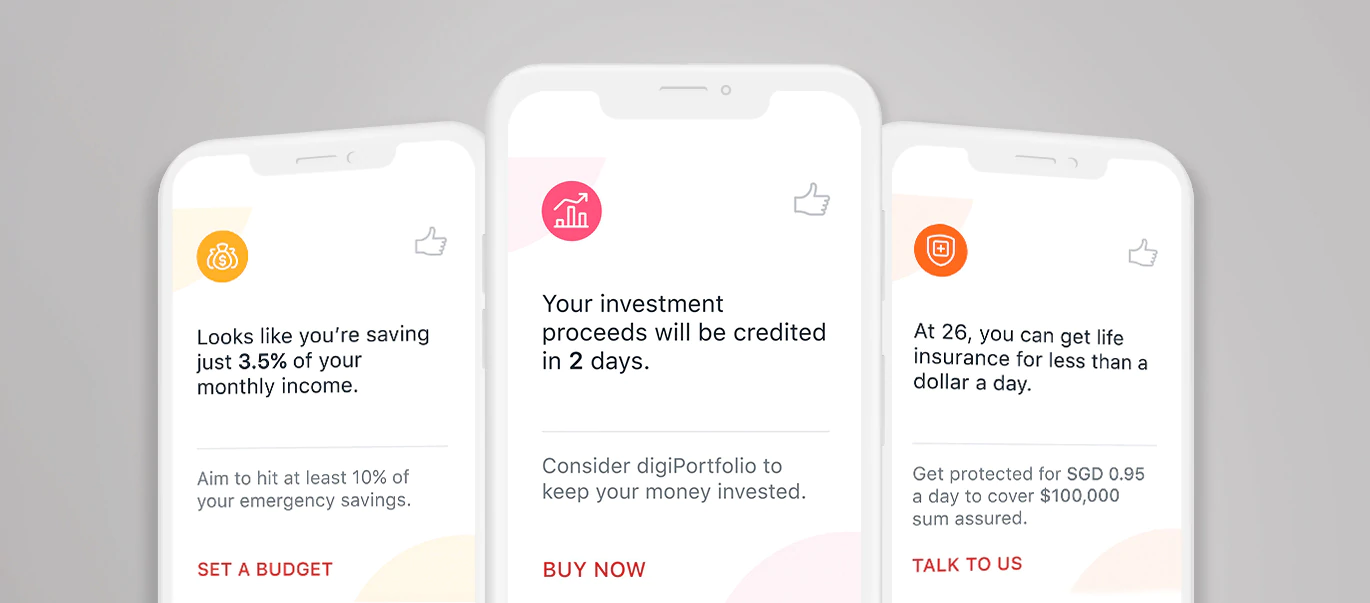

Image credit: DBS

Image credit: DBS

The intuitive layout of the DBS NAV Planner gives you a holistic view of all your finances, allowing you to check in on your assets and liabilities at a glance. You won’t have to fuss around with different banking, insurance and finance tracking apps – it’s all here whenever you need it.

Especially for those of us who find it hard to get an upper hand on our finances, the DBS NAV Planner will not only be a good way to track your insurance plans, but all other finances as well.

Find out more about the DBS NAV Planner here

This post was brought to you by DBS.

Disclaimer: This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

This advertisement has not been reviewed by the Monetary Authority of Singapore.