Mastercard® security features

You’re at the supermarket doing your weekly grocery run. Fresh fruits, cereal, and not forgetting your favourite bag of chips. You’re headed to the cashier but unlike the rest of us, you don’t have to scrounge for change at the bottom of your wallet.

Instead, you pull out your shiny Mastercard contactless card and with a simple tap, payment is made and you’re on your merry way.

Such cards make everyday payments hassle-free, saving you precious time in your busy lives. But fret not if you’re wary of potential fraud or ghost charges, contactless payments are actually one of the most secure payment methods to date. Here are 5 security features your card has that’ll give you peace of mind while you shop.

1. EMV chips to protect your card details

Image credit: NerdWallet

Image credit: NerdWallet

Like a burly bouncer that guards the entrances of the hippest clubs along Clarke Quay, the EMV chip on your card serves as a safeguard to your info.

Instead of giving out your card’s personal information, this little chip replaces sensitive data with an undecipherable code-named[b] token that retains all essential information about the data without compromising its security. You could say it’s like a super-secret password every time you tap and go.

2. You will be notified when your card is used

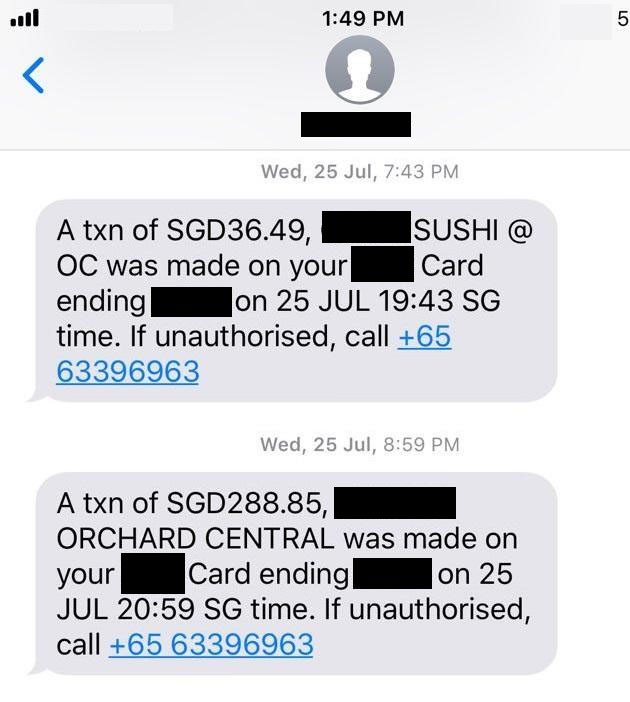

Sign up for the FREE SMS Alert service provided by banks, which ensures you get an immediate text notification when you make a purchase on your contactless card.

Transaction details like the retail shop and amount charged are at your fingertips.

Transaction details like the retail shop and amount charged are at your fingertips.

This makes it real easy to spot fraudulent transactions, especially if you’re watching Halloween at the theatres and get a notification for a random charge at Starbucks for a Grande Pumpkin Spice Latte, extra shot. – Spooky no more!

3. There’s additional verification for high-value purchases

For added peace of mind, transactions over $200 made with contactless cards will require an extra step of verification, such as signing off on your purchase.

4. You only get charged once even if you “double tap”

Just imagine you’re at the cashier with your very “itchy-fingers” child. But in a sudden sneak attack, your kid swipes your card right outta your hands, tapping it everywhere like Ringo Starr on drums.

Well, fret not because even if they tap the card on the reader again and again, the reader won’t beep – your transactions only go through once. So double taps ≠ double charges.

5. You’re covered with Liability Protection

On the off chance you do get billed for something dodgy, the Liability Protection protects you from fraudulent transactions. If you spot any charge you didn’t make, contact your bank and ask for information about how you are covered against this.

So thank goodness that that mysterious charge for a $500 bottle of snake oil won’t go through!

Tap and go with Mastercard contactless cards

Whether you’re shopping for groceries, tapping in on MRT gantries or settling a dinner bill, you can rest easy knowing you are safe with these security measures. In fact, the contactless nature of the cards means the card never has to leave your hands – how’s that for peace of mind.

It goes beyond credit and debit cards or physical payments, too. Mobile devices and wearables are also enabled for contactless payments, and you can even whip out your mobile phone or sport wristband to pay if you’ve added your Mastercard to your digital wallet – it’s easy and safe to tap & go. That means making payment only takes seconds, so you don’t have to hog up the entire line while digging for coins.

Find out more about Mastercard Contactless here!

This post was brought to you by Mastercard.